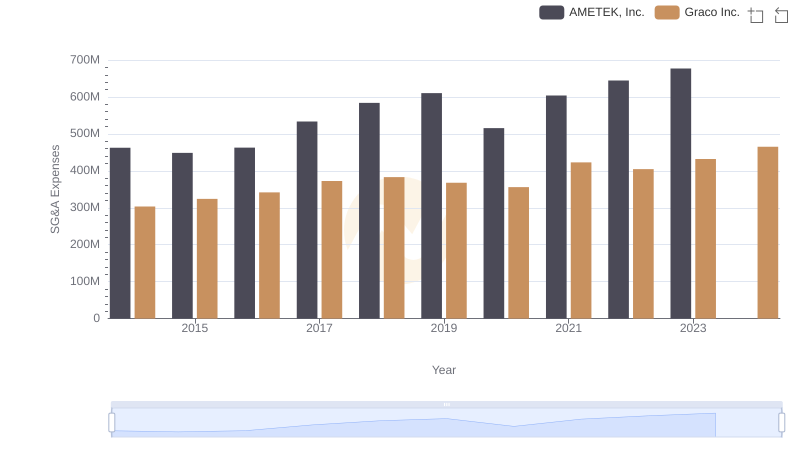

| __timestamp | AMETEK, Inc. | Comfort Systems USA, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 462637000 | 207652000 |

| Thursday, January 1, 2015 | 448592000 | 228965000 |

| Friday, January 1, 2016 | 462970000 | 243201000 |

| Sunday, January 1, 2017 | 533645000 | 266586000 |

| Monday, January 1, 2018 | 584022000 | 296986000 |

| Tuesday, January 1, 2019 | 610280000 | 340005000 |

| Wednesday, January 1, 2020 | 515630000 | 357777000 |

| Friday, January 1, 2021 | 603944000 | 376309000 |

| Saturday, January 1, 2022 | 644577000 | 489344000 |

| Sunday, January 1, 2023 | 677006000 | 536188999 |

| Monday, January 1, 2024 | 696905000 |

Unleashing the power of data

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. AMETEK, Inc. and Comfort Systems USA, Inc. have been navigating this financial terrain since 2014. Over the past decade, AMETEK has consistently maintained higher SG&A expenses, averaging around 554 million annually, compared to Comfort Systems' 334 million. However, the growth trajectory tells a different story. Comfort Systems has seen a remarkable 158% increase in SG&A expenses from 2014 to 2023, while AMETEK's expenses grew by 46% during the same period. This suggests Comfort Systems is expanding its operations more aggressively. As we look to the future, the ability to optimize these costs will be pivotal in determining which company can sustain its growth and profitability.

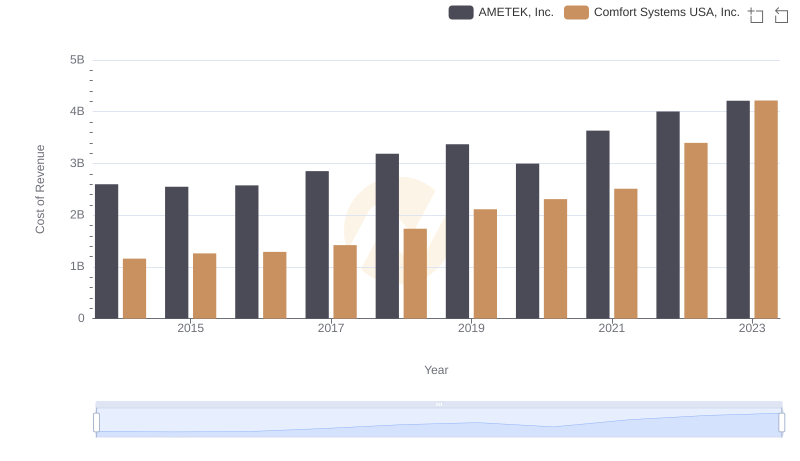

Cost of Revenue Comparison: AMETEK, Inc. vs Comfort Systems USA, Inc.

AMETEK, Inc. or Graco Inc.: Who Manages SG&A Costs Better?

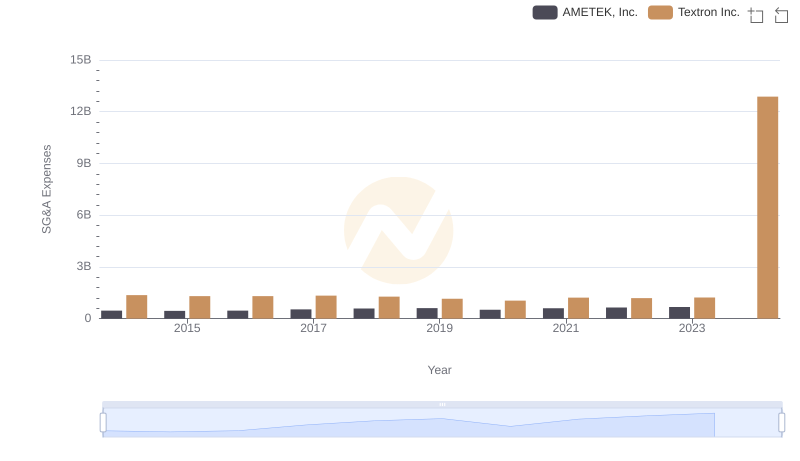

SG&A Efficiency Analysis: Comparing AMETEK, Inc. and Textron Inc.

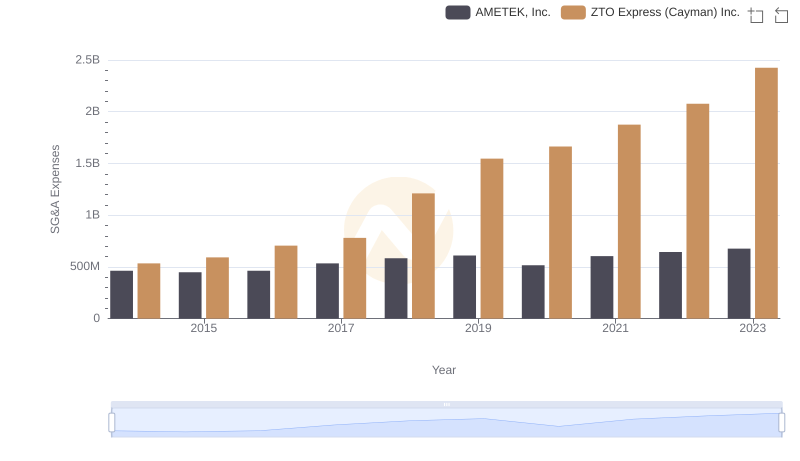

AMETEK, Inc. or ZTO Express (Cayman) Inc.: Who Manages SG&A Costs Better?

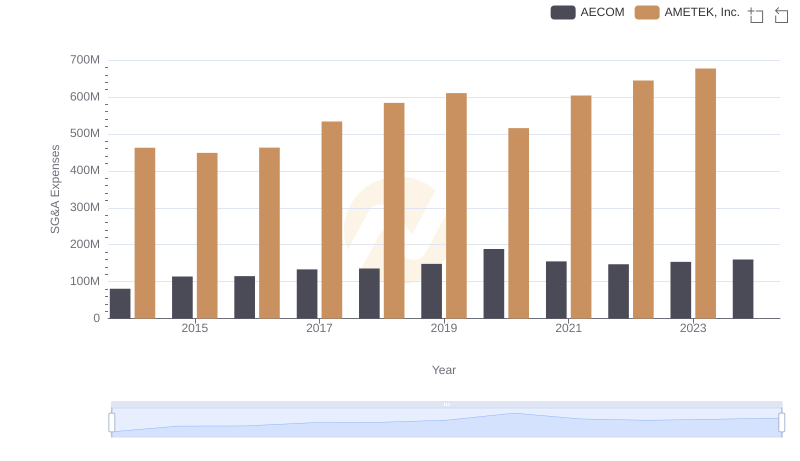

SG&A Efficiency Analysis: Comparing AMETEK, Inc. and AECOM

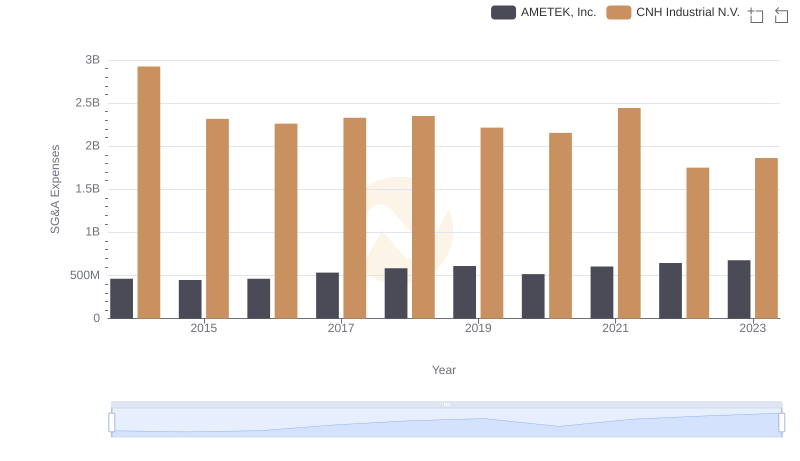

Who Optimizes SG&A Costs Better? AMETEK, Inc. or CNH Industrial N.V.

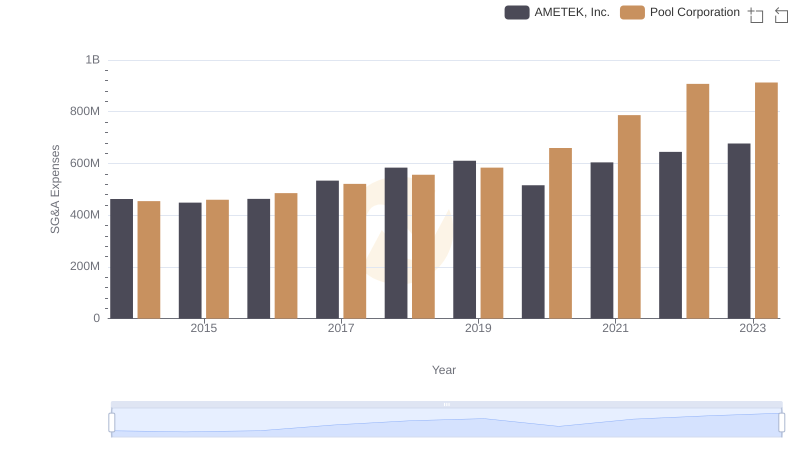

Cost Management Insights: SG&A Expenses for AMETEK, Inc. and Pool Corporation

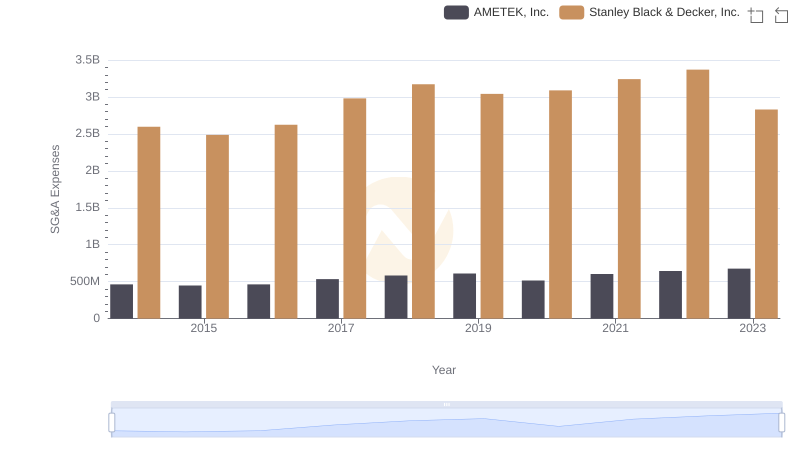

AMETEK, Inc. and Stanley Black & Decker, Inc.: SG&A Spending Patterns Compared

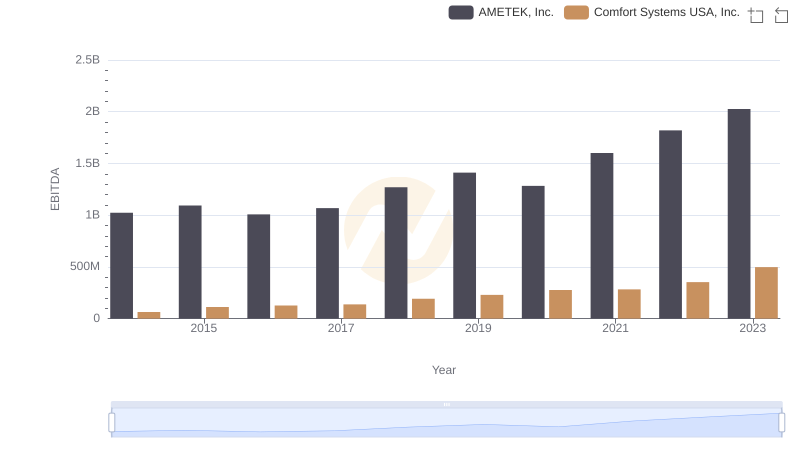

A Side-by-Side Analysis of EBITDA: AMETEK, Inc. and Comfort Systems USA, Inc.