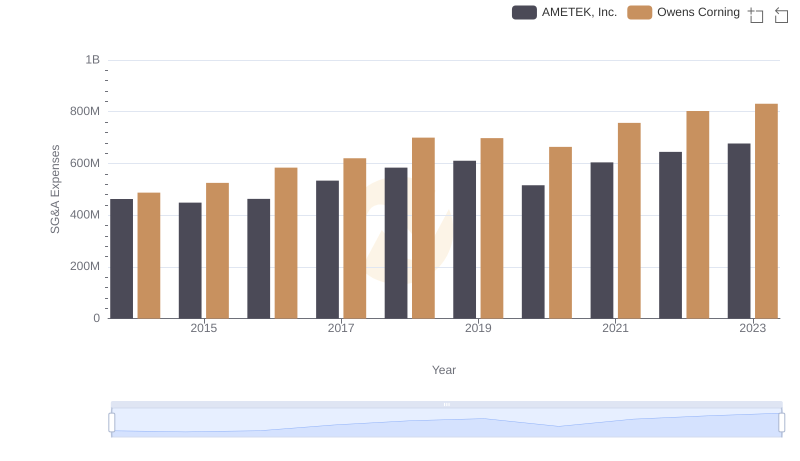

| __timestamp | AMETEK, Inc. | Avery Dennison Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 462637000 | 1155300000 |

| Thursday, January 1, 2015 | 448592000 | 1108100000 |

| Friday, January 1, 2016 | 462970000 | 1097500000 |

| Sunday, January 1, 2017 | 533645000 | 1123200000 |

| Monday, January 1, 2018 | 584022000 | 1127500000 |

| Tuesday, January 1, 2019 | 610280000 | 1080400000 |

| Wednesday, January 1, 2020 | 515630000 | 1060500000 |

| Friday, January 1, 2021 | 603944000 | 1248500000 |

| Saturday, January 1, 2022 | 644577000 | 1330800000 |

| Sunday, January 1, 2023 | 677006000 | 1177900000 |

| Monday, January 1, 2024 | 696905000 | 1415300000 |

Unleashing the power of data

In the ever-evolving landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, AMETEK, Inc. and Avery Dennison Corporation have demonstrated distinct strategies in this domain. From 2014 to 2023, Avery Dennison consistently reported higher SG&A expenses, peaking in 2022 with a 13% increase from 2014. Meanwhile, AMETEK's expenses grew by approximately 46% over the same period, reflecting a strategic expansion.

Despite fluctuations, both companies have shown resilience, with Avery Dennison's expenses stabilizing in 2023 and AMETEK achieving a steady upward trend. This data underscores the importance of strategic cost management in sustaining competitive advantage. As businesses navigate economic uncertainties, understanding these trends offers valuable insights into effective financial stewardship.

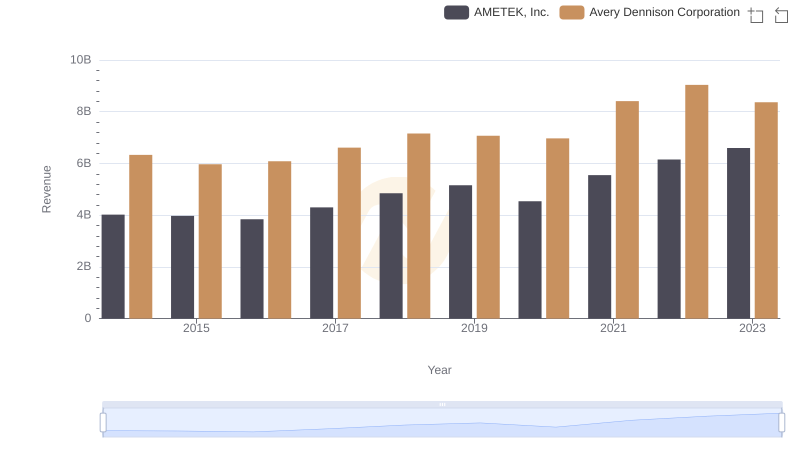

Breaking Down Revenue Trends: AMETEK, Inc. vs Avery Dennison Corporation

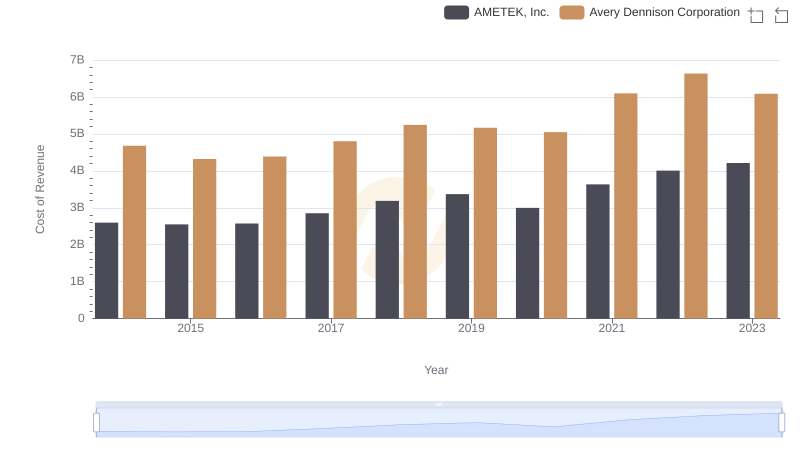

AMETEK, Inc. vs Avery Dennison Corporation: Efficiency in Cost of Revenue Explored

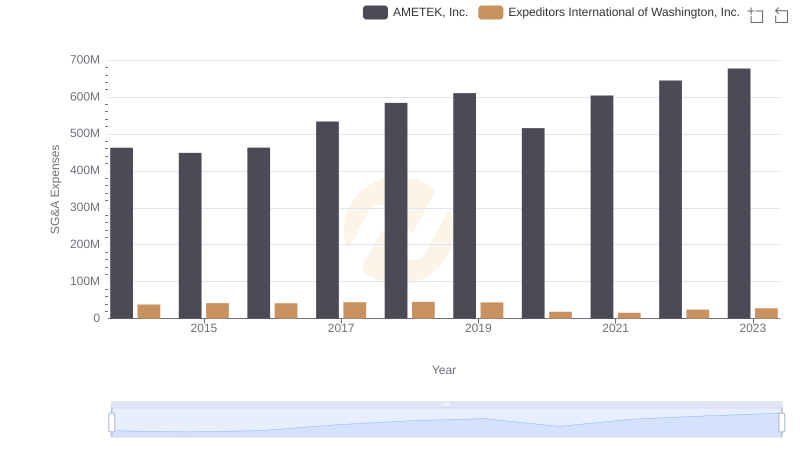

Operational Costs Compared: SG&A Analysis of AMETEK, Inc. and Expeditors International of Washington, Inc.

Comparing SG&A Expenses: AMETEK, Inc. vs Owens Corning Trends and Insights

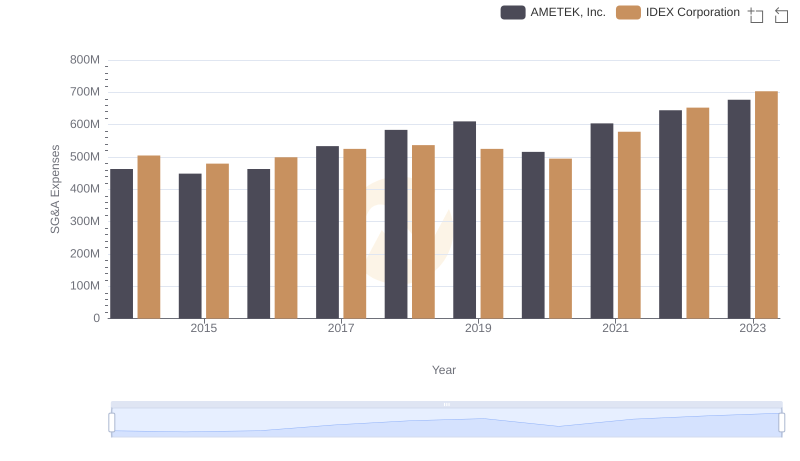

AMETEK, Inc. or IDEX Corporation: Who Manages SG&A Costs Better?

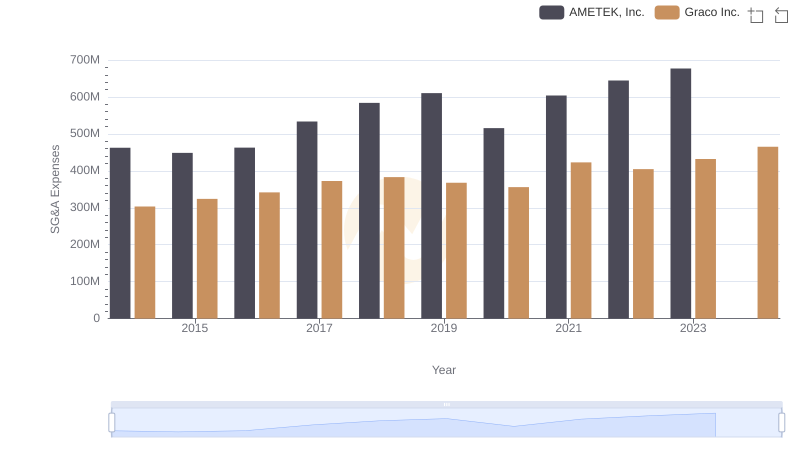

AMETEK, Inc. or Graco Inc.: Who Manages SG&A Costs Better?

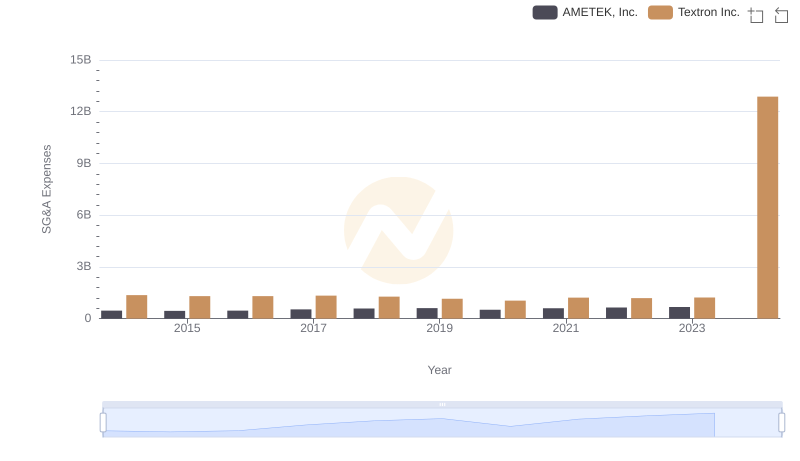

SG&A Efficiency Analysis: Comparing AMETEK, Inc. and Textron Inc.

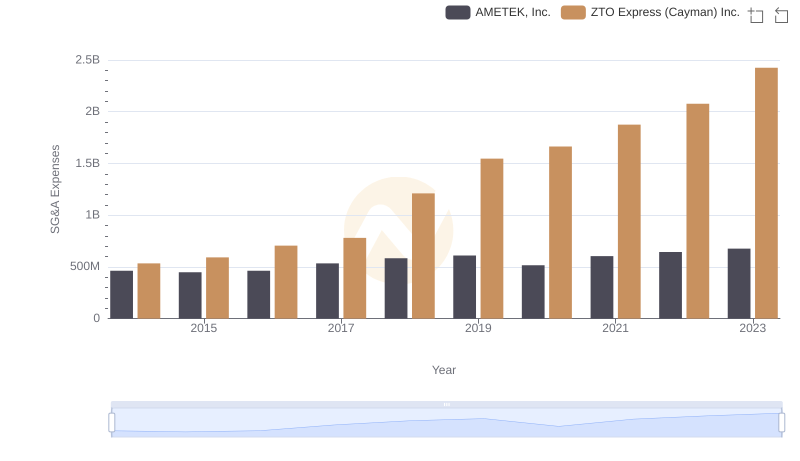

AMETEK, Inc. or ZTO Express (Cayman) Inc.: Who Manages SG&A Costs Better?