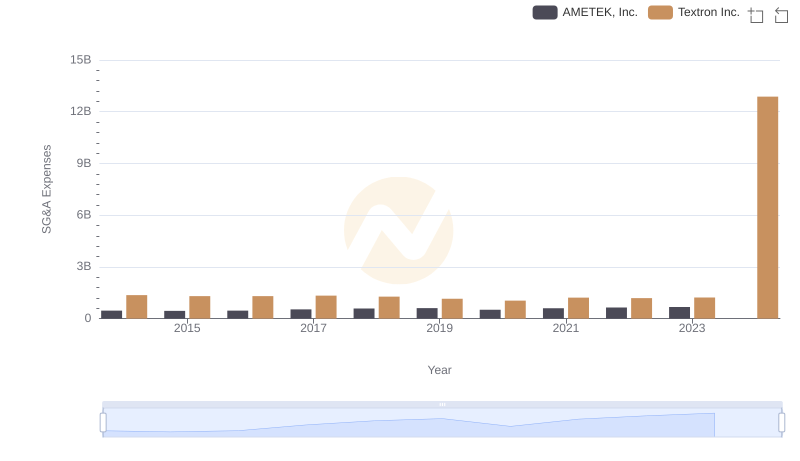

| __timestamp | AMETEK, Inc. | Owens Corning |

|---|---|---|

| Wednesday, January 1, 2014 | 462637000 | 487000000 |

| Thursday, January 1, 2015 | 448592000 | 525000000 |

| Friday, January 1, 2016 | 462970000 | 584000000 |

| Sunday, January 1, 2017 | 533645000 | 620000000 |

| Monday, January 1, 2018 | 584022000 | 700000000 |

| Tuesday, January 1, 2019 | 610280000 | 698000000 |

| Wednesday, January 1, 2020 | 515630000 | 664000000 |

| Friday, January 1, 2021 | 603944000 | 757000000 |

| Saturday, January 1, 2022 | 644577000 | 803000000 |

| Sunday, January 1, 2023 | 677006000 | 831000000 |

| Monday, January 1, 2024 | 696905000 |

Unleashing the power of data

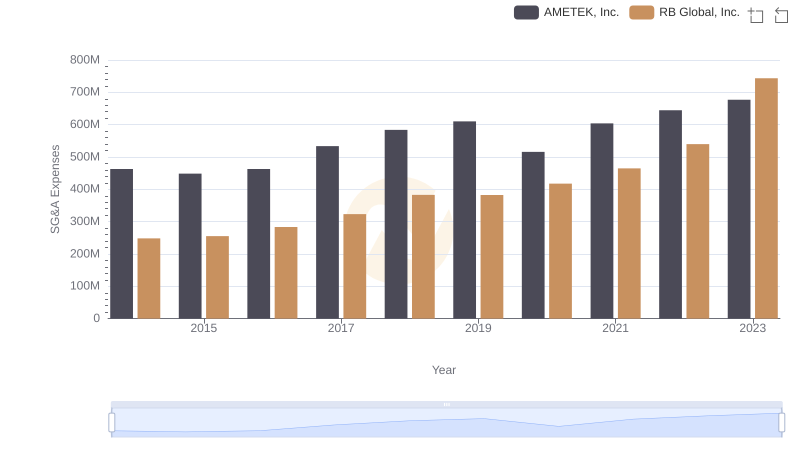

In the ever-evolving landscape of industrial manufacturing, AMETEK, Inc. and Owens Corning stand as titans, each with a unique trajectory in managing their Selling, General, and Administrative (SG&A) expenses. Over the past decade, from 2014 to 2023, these two companies have showcased distinct financial strategies.

AMETEK, Inc. has seen a steady increase in SG&A expenses, rising approximately 46% from 2014 to 2023. This growth reflects their strategic investments in operational efficiency and market expansion. In contrast, Owens Corning's SG&A expenses surged by about 71% during the same period, indicating a robust focus on scaling operations and enhancing market presence.

The data reveals a fascinating insight: while both companies have increased their SG&A expenses, Owens Corning's growth rate outpaces AMETEK, Inc., suggesting a more aggressive approach to capturing market share. This comparison offers a window into the strategic priorities of these industrial leaders.

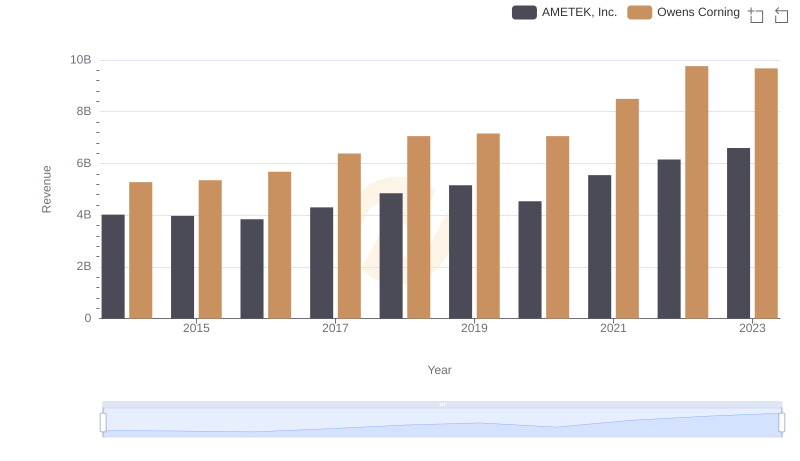

AMETEK, Inc. or Owens Corning: Who Leads in Yearly Revenue?

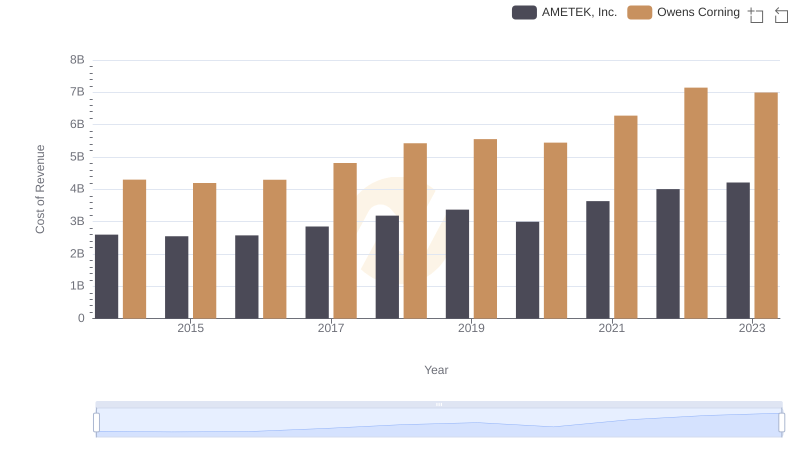

Cost of Revenue Trends: AMETEK, Inc. vs Owens Corning

AMETEK, Inc. and RB Global, Inc.: SG&A Spending Patterns Compared

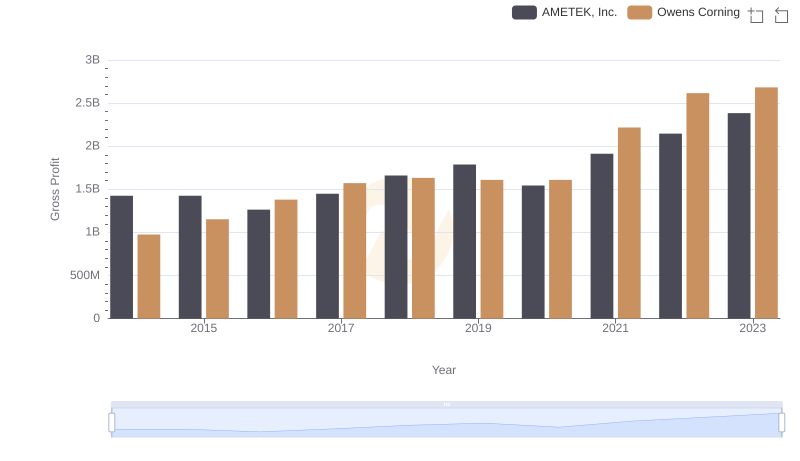

Who Generates Higher Gross Profit? AMETEK, Inc. or Owens Corning

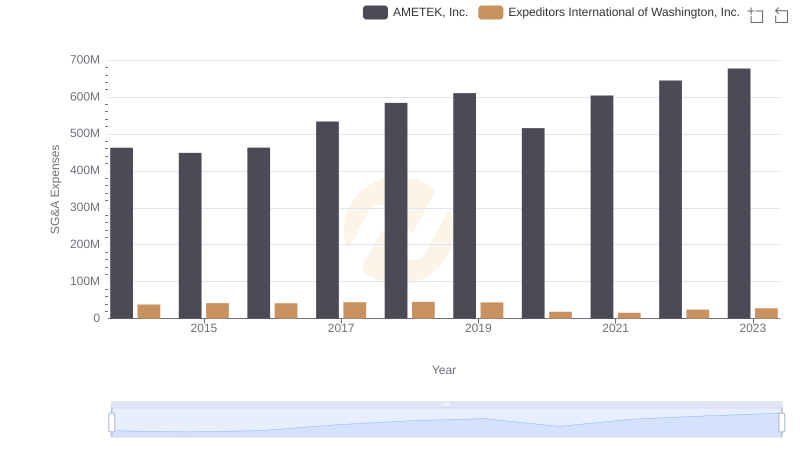

Operational Costs Compared: SG&A Analysis of AMETEK, Inc. and Expeditors International of Washington, Inc.

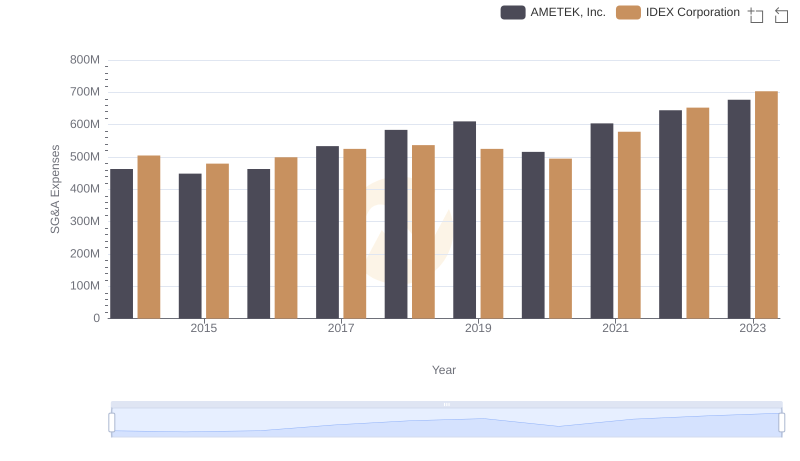

AMETEK, Inc. or IDEX Corporation: Who Manages SG&A Costs Better?

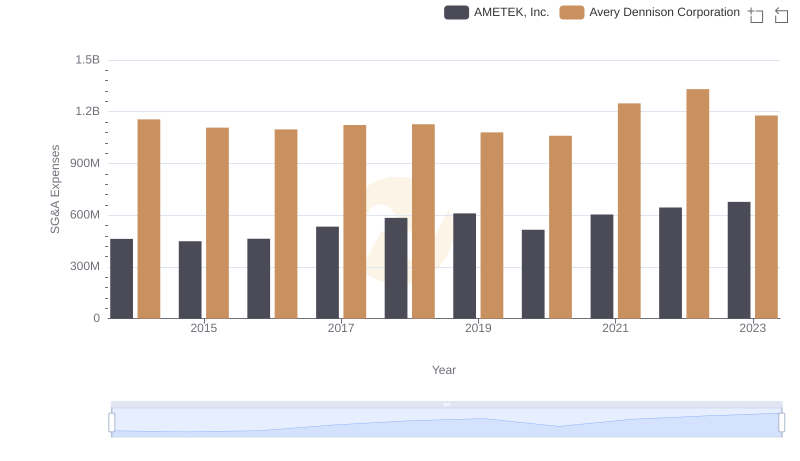

Cost Management Insights: SG&A Expenses for AMETEK, Inc. and Avery Dennison Corporation

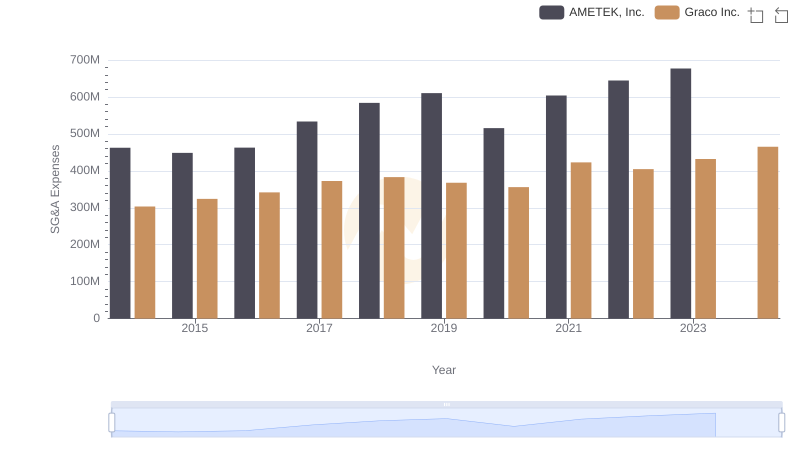

AMETEK, Inc. or Graco Inc.: Who Manages SG&A Costs Better?

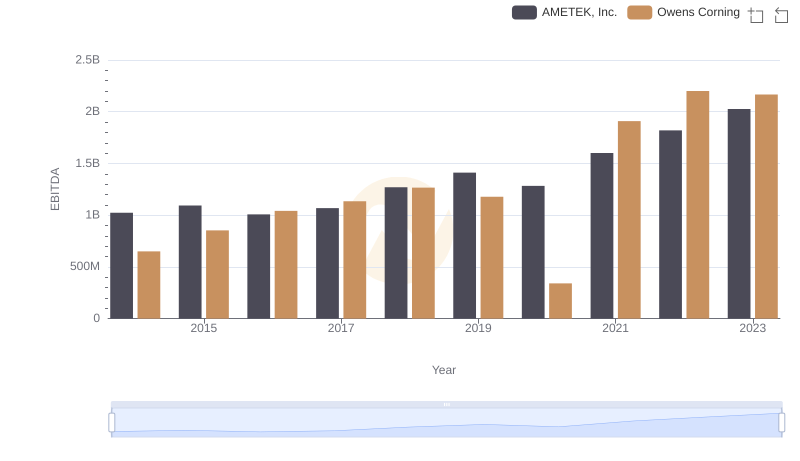

EBITDA Performance Review: AMETEK, Inc. vs Owens Corning

SG&A Efficiency Analysis: Comparing AMETEK, Inc. and Textron Inc.