| __timestamp | AMETEK, Inc. | IDEX Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 462637000 | 504419000 |

| Thursday, January 1, 2015 | 448592000 | 479408000 |

| Friday, January 1, 2016 | 462970000 | 498994000 |

| Sunday, January 1, 2017 | 533645000 | 524940000 |

| Monday, January 1, 2018 | 584022000 | 536724000 |

| Tuesday, January 1, 2019 | 610280000 | 524987000 |

| Wednesday, January 1, 2020 | 515630000 | 494935000 |

| Friday, January 1, 2021 | 603944000 | 578200000 |

| Saturday, January 1, 2022 | 644577000 | 652700000 |

| Sunday, January 1, 2023 | 677006000 | 703500000 |

| Monday, January 1, 2024 | 696905000 | 758700000 |

Igniting the spark of knowledge

In the competitive landscape of industrial manufacturing, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, AMETEK, Inc. and IDEX Corporation have demonstrated distinct strategies in handling these costs. From 2014 to 2023, AMETEK's SG&A expenses grew by approximately 46%, while IDEX saw a 40% increase. Notably, AMETEK's expenses peaked in 2023, reaching a 10-year high, whereas IDEX consistently maintained a slightly higher SG&A cost throughout the period.

Despite AMETEK's higher growth rate in expenses, both companies have shown resilience and adaptability in a fluctuating market. The data suggests that while IDEX has managed to keep its expenses relatively stable, AMETEK's strategic investments might be driving its higher cost trajectory. This analysis provides a fascinating glimpse into how two industry leaders navigate financial management in a dynamic economic environment.

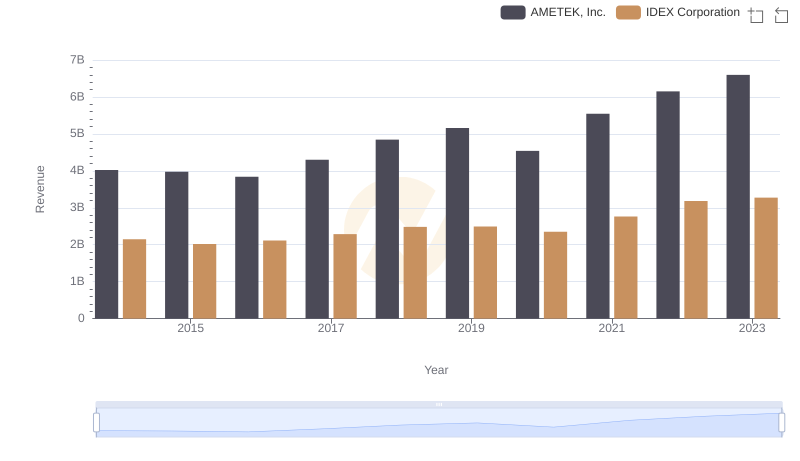

Who Generates More Revenue? AMETEK, Inc. or IDEX Corporation

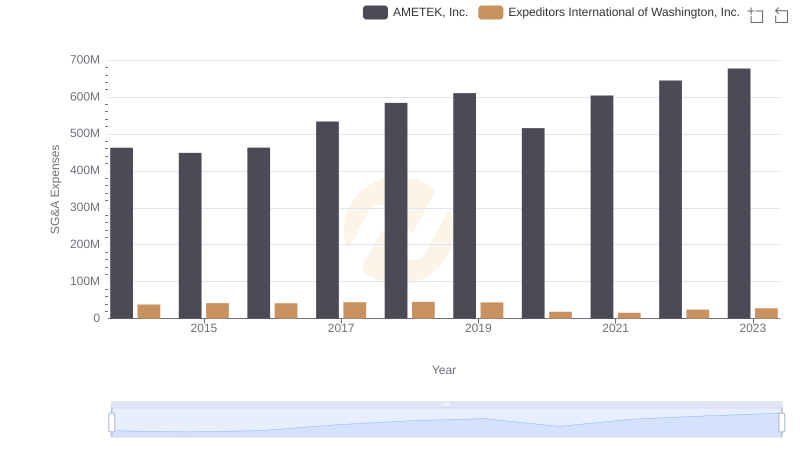

Operational Costs Compared: SG&A Analysis of AMETEK, Inc. and Expeditors International of Washington, Inc.

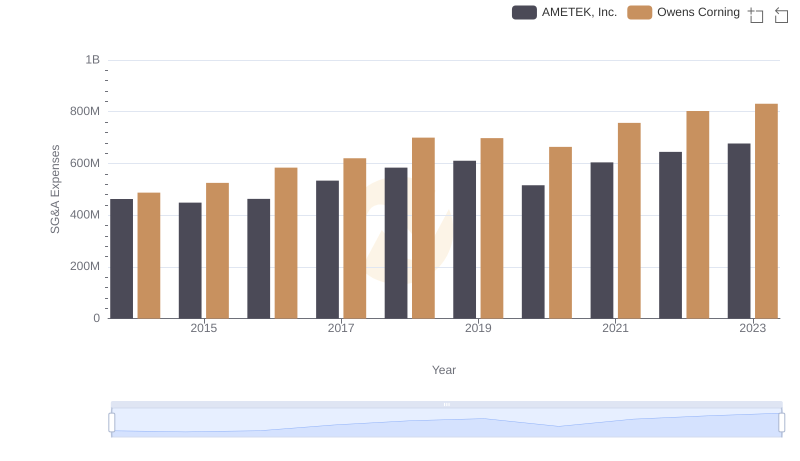

Comparing SG&A Expenses: AMETEK, Inc. vs Owens Corning Trends and Insights

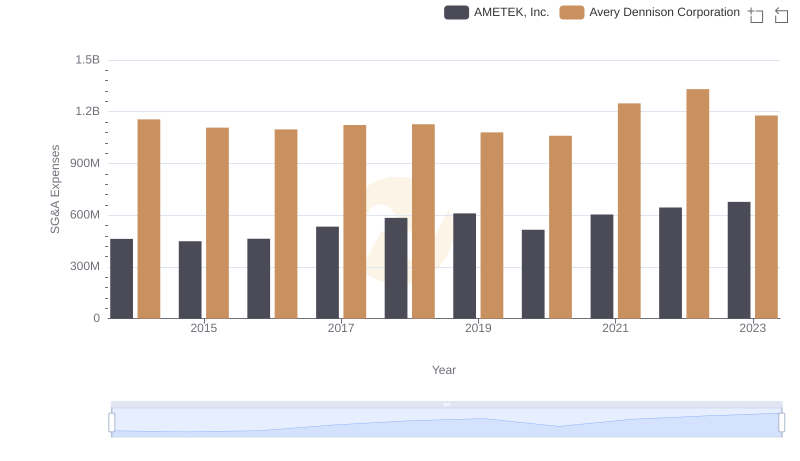

Cost Management Insights: SG&A Expenses for AMETEK, Inc. and Avery Dennison Corporation

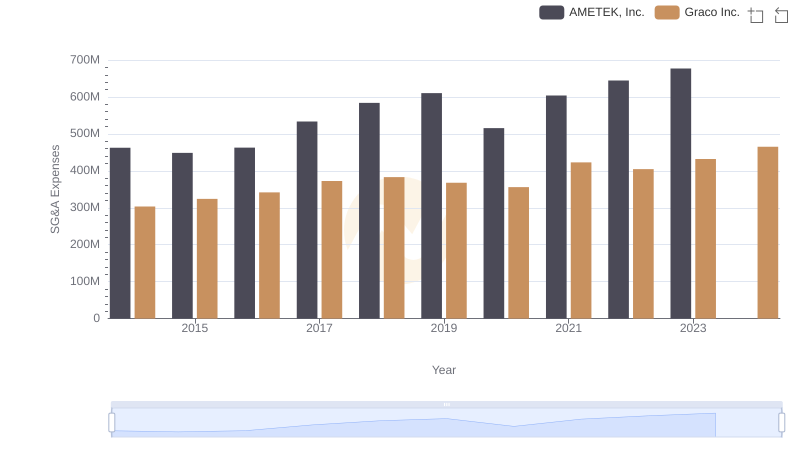

AMETEK, Inc. or Graco Inc.: Who Manages SG&A Costs Better?

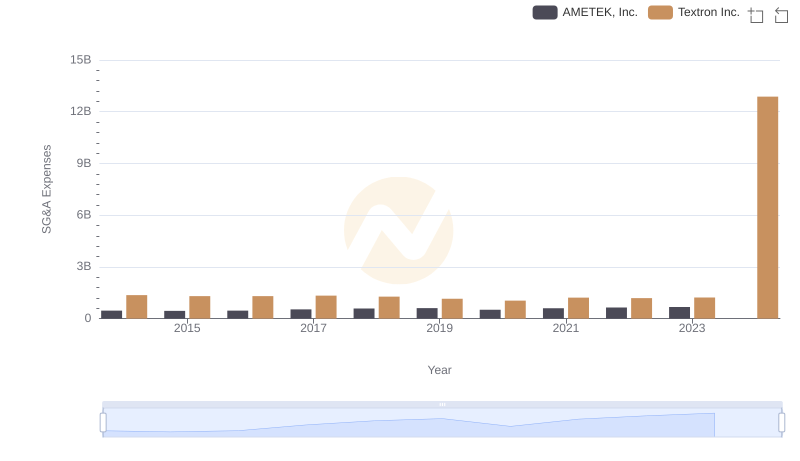

SG&A Efficiency Analysis: Comparing AMETEK, Inc. and Textron Inc.

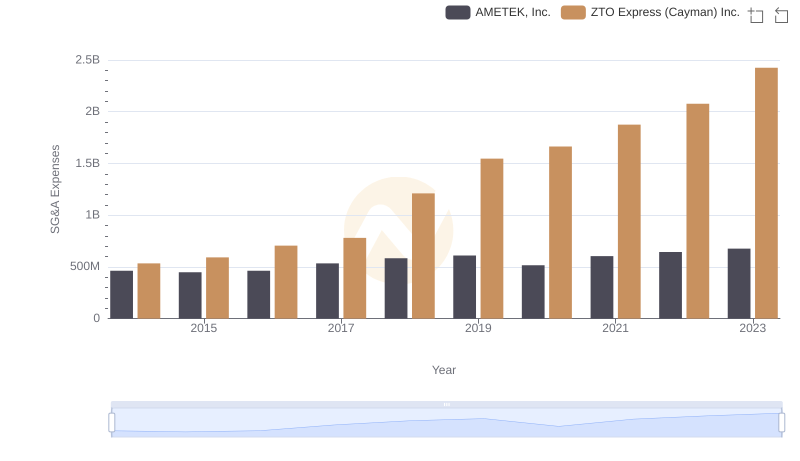

AMETEK, Inc. or ZTO Express (Cayman) Inc.: Who Manages SG&A Costs Better?