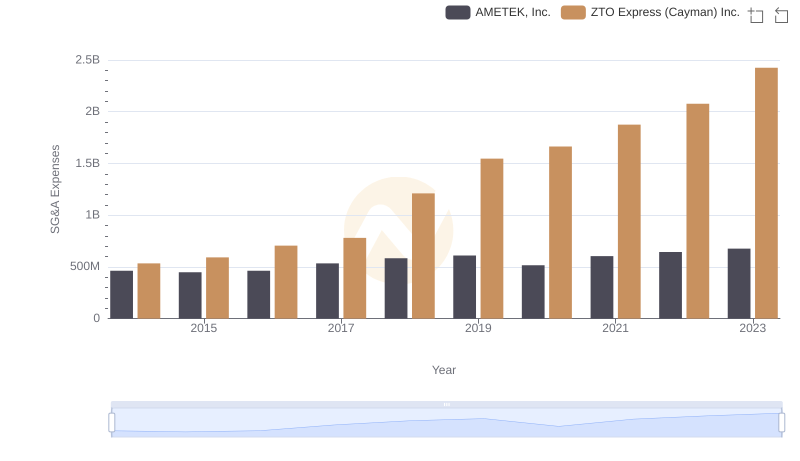

| __timestamp | AMETEK, Inc. | CNH Industrial N.V. |

|---|---|---|

| Wednesday, January 1, 2014 | 462637000 | 2925000000 |

| Thursday, January 1, 2015 | 448592000 | 2317000000 |

| Friday, January 1, 2016 | 462970000 | 2262000000 |

| Sunday, January 1, 2017 | 533645000 | 2330000000 |

| Monday, January 1, 2018 | 584022000 | 2351000000 |

| Tuesday, January 1, 2019 | 610280000 | 2216000000 |

| Wednesday, January 1, 2020 | 515630000 | 2155000000 |

| Friday, January 1, 2021 | 603944000 | 2443000000 |

| Saturday, January 1, 2022 | 644577000 | 1752000000 |

| Sunday, January 1, 2023 | 677006000 | 1863000000 |

| Monday, January 1, 2024 | 696905000 |

Data in motion

In the competitive landscape of industrial giants, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. AMETEK, Inc. and CNH Industrial N.V. have been at the forefront of this financial discipline since 2014. Over the past decade, AMETEK has demonstrated a steady increase in SG&A expenses, peaking at approximately $677 million in 2023, reflecting a 46% rise from 2014. In contrast, CNH Industrial N.V. has shown a more volatile trend, with a significant reduction of 36% in SG&A costs, from $2.925 billion in 2014 to $1.863 billion in 2023.

This divergence highlights AMETEK's consistent growth strategy, while CNH Industrial's cost-cutting measures suggest a focus on efficiency. As businesses navigate economic uncertainties, these insights offer valuable lessons in strategic financial management.

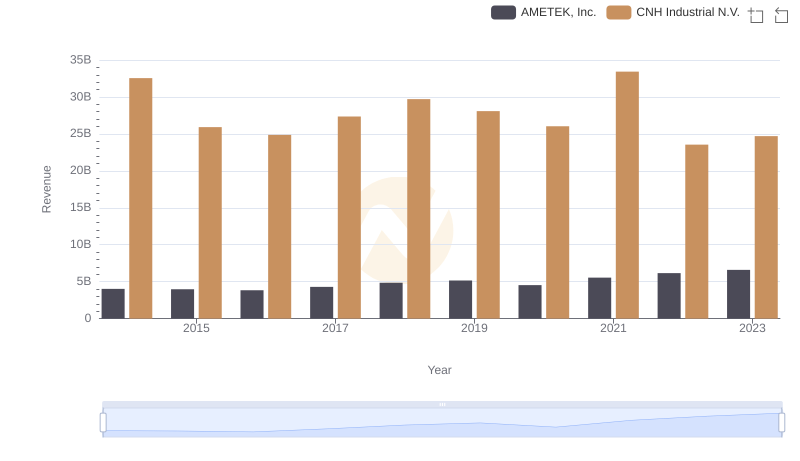

AMETEK, Inc. and CNH Industrial N.V.: A Comprehensive Revenue Analysis

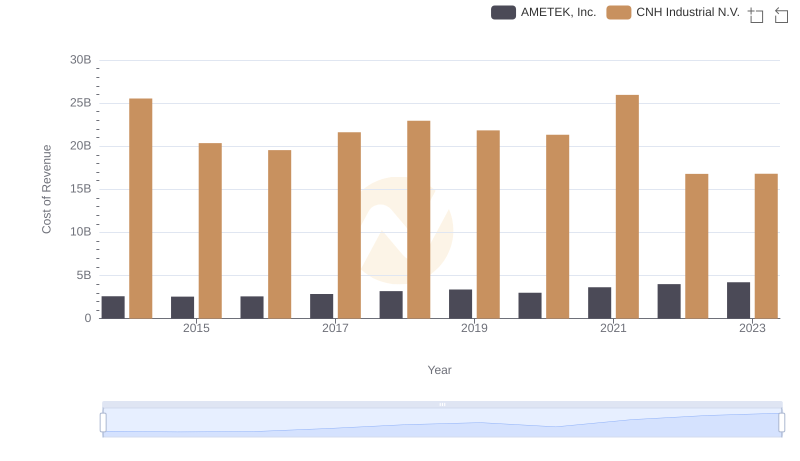

Cost Insights: Breaking Down AMETEK, Inc. and CNH Industrial N.V.'s Expenses

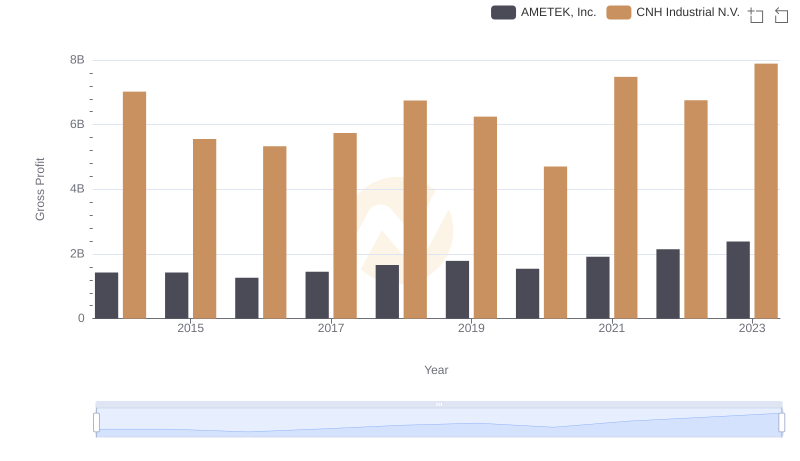

Gross Profit Trends Compared: AMETEK, Inc. vs CNH Industrial N.V.

AMETEK, Inc. or ZTO Express (Cayman) Inc.: Who Manages SG&A Costs Better?

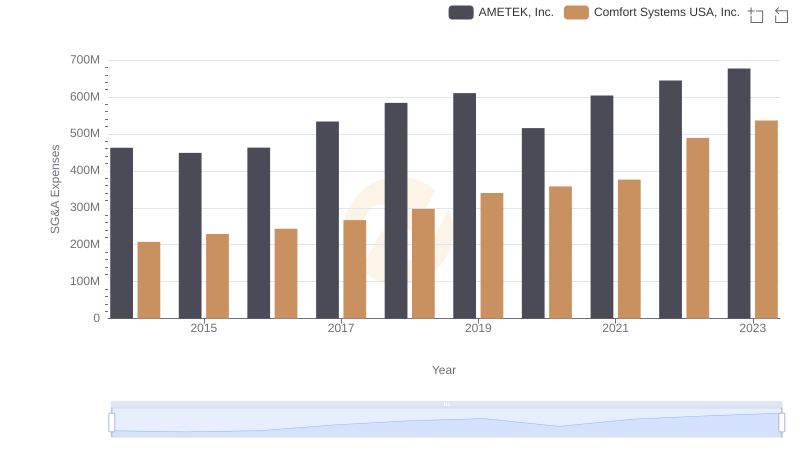

Who Optimizes SG&A Costs Better? AMETEK, Inc. or Comfort Systems USA, Inc.

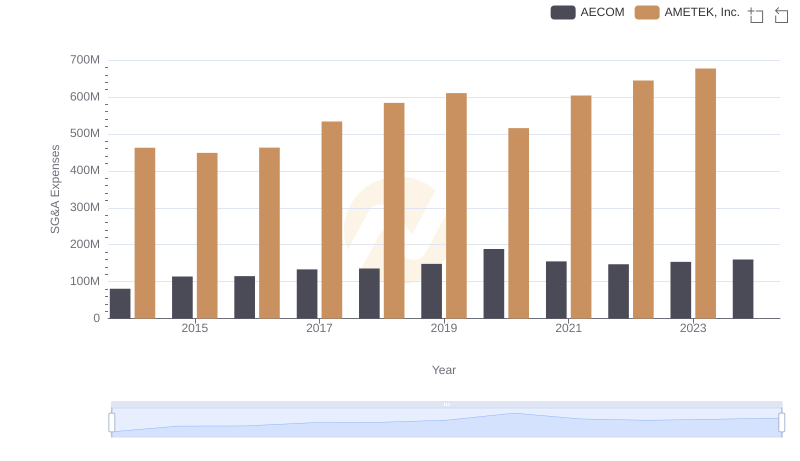

SG&A Efficiency Analysis: Comparing AMETEK, Inc. and AECOM

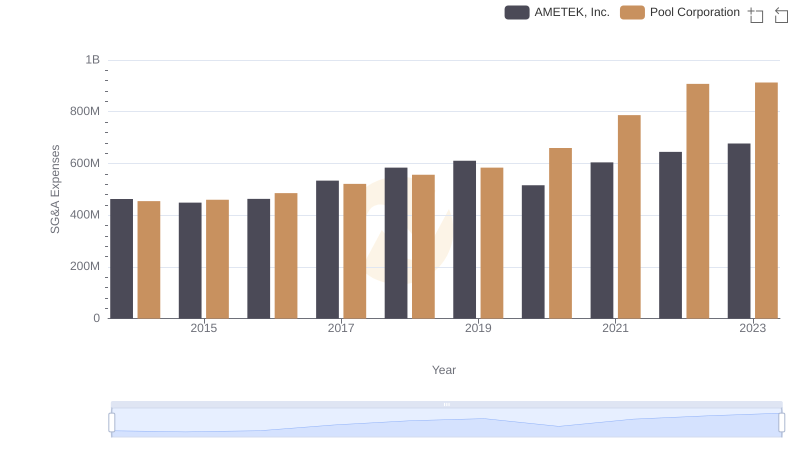

Cost Management Insights: SG&A Expenses for AMETEK, Inc. and Pool Corporation

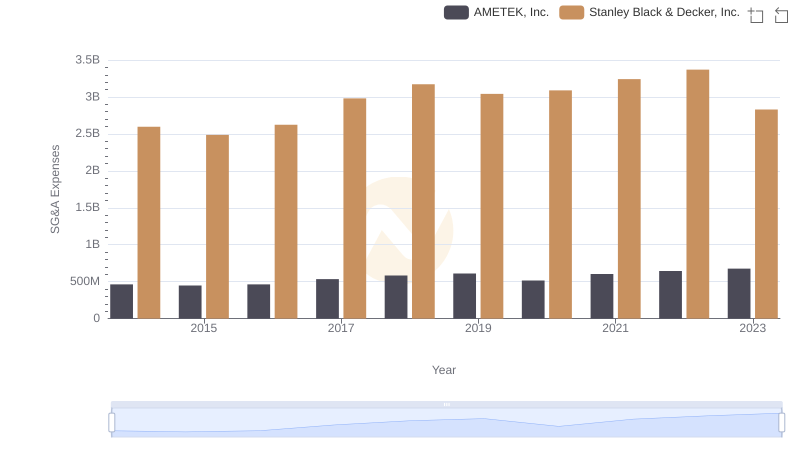

AMETEK, Inc. and Stanley Black & Decker, Inc.: SG&A Spending Patterns Compared

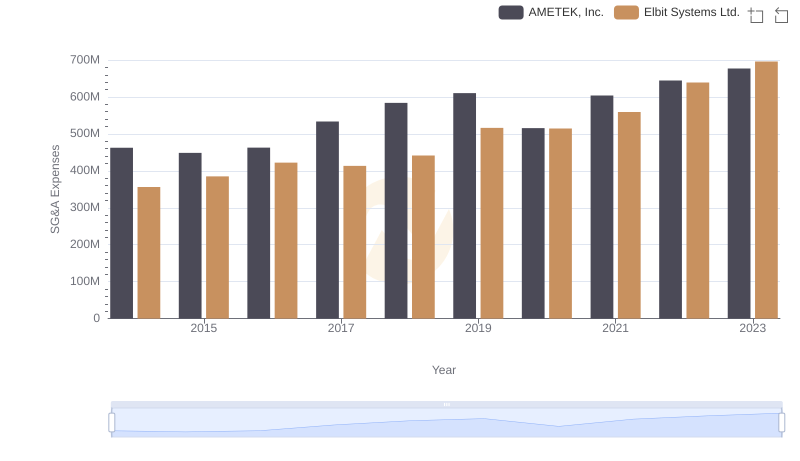

AMETEK, Inc. and Elbit Systems Ltd.: SG&A Spending Patterns Compared