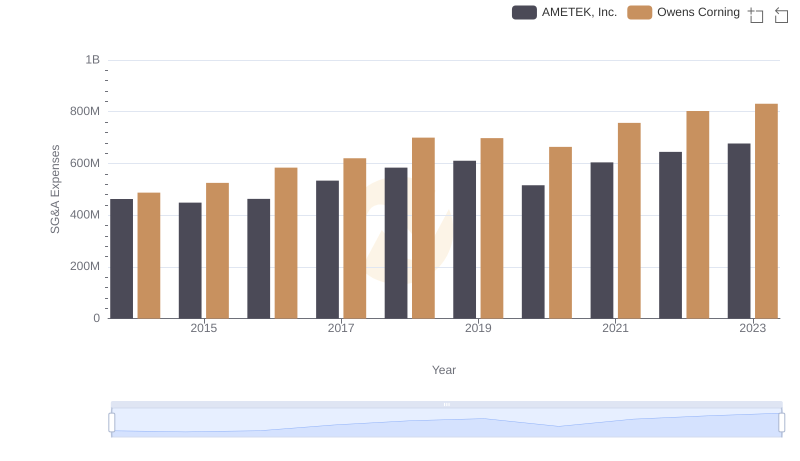

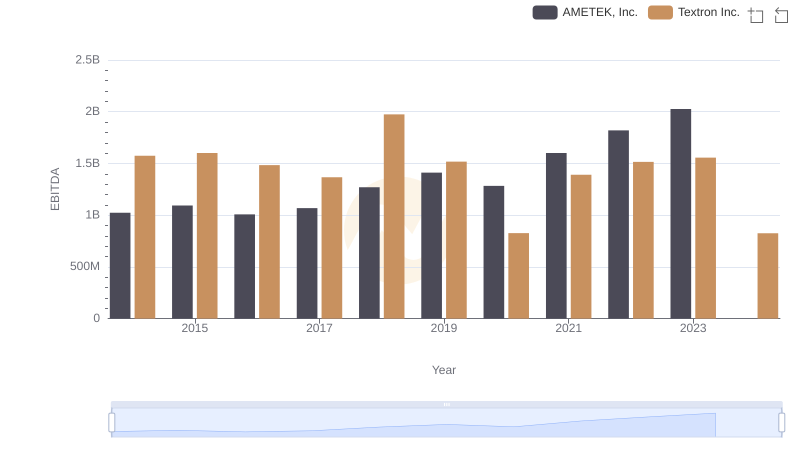

| __timestamp | AMETEK, Inc. | Textron Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 462637000 | 1361000000 |

| Thursday, January 1, 2015 | 448592000 | 1304000000 |

| Friday, January 1, 2016 | 462970000 | 1304000000 |

| Sunday, January 1, 2017 | 533645000 | 1337000000 |

| Monday, January 1, 2018 | 584022000 | 1275000000 |

| Tuesday, January 1, 2019 | 610280000 | 1152000000 |

| Wednesday, January 1, 2020 | 515630000 | 1045000000 |

| Friday, January 1, 2021 | 603944000 | 1221000000 |

| Saturday, January 1, 2022 | 644577000 | 1186000000 |

| Sunday, January 1, 2023 | 677006000 | 1225000000 |

| Monday, January 1, 2024 | 696905000 | 1156000000 |

Infusing magic into the data realm

In the competitive landscape of industrial manufacturing, AMETEK, Inc. and Textron Inc. have showcased distinct strategies in managing their Selling, General, and Administrative (SG&A) expenses over the past decade. From 2014 to 2023, AMETEK's SG&A expenses have grown by approximately 46%, reflecting a strategic investment in operational efficiency. In contrast, Textron's expenses have remained relatively stable, with a slight decrease of around 10% over the same period. This divergence highlights AMETEK's aggressive expansion and Textron's focus on cost containment. Notably, 2023 saw AMETEK reaching its highest SG&A efficiency, while Textron's data for 2024 remains incomplete, leaving room for speculation. As these industry leaders continue to evolve, their financial strategies offer valuable insights into the broader market dynamics.

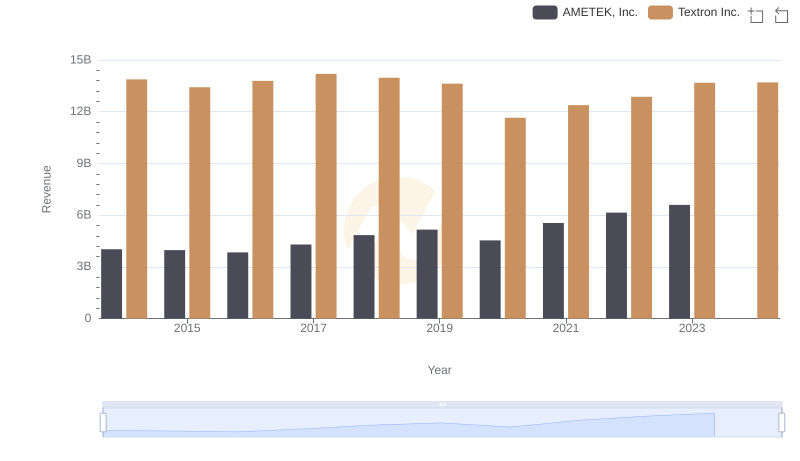

Breaking Down Revenue Trends: AMETEK, Inc. vs Textron Inc.

Comparing SG&A Expenses: AMETEK, Inc. vs Owens Corning Trends and Insights

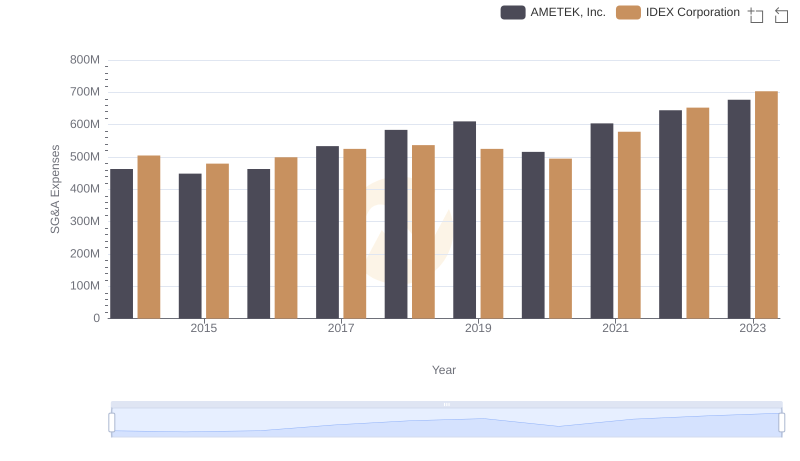

AMETEK, Inc. or IDEX Corporation: Who Manages SG&A Costs Better?

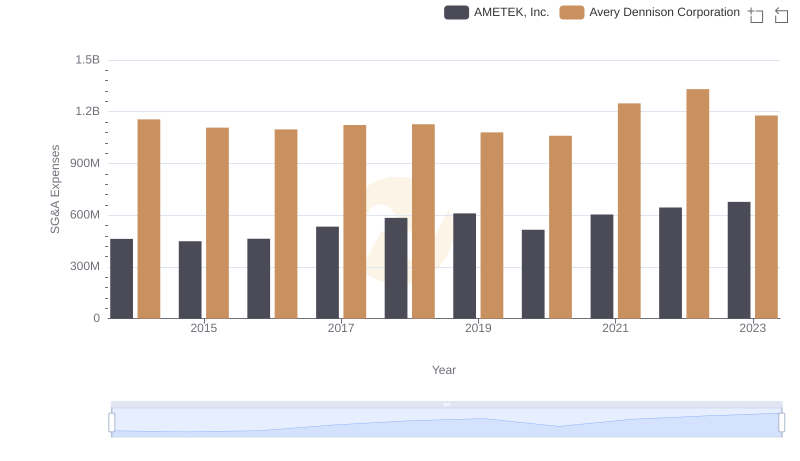

Cost Management Insights: SG&A Expenses for AMETEK, Inc. and Avery Dennison Corporation

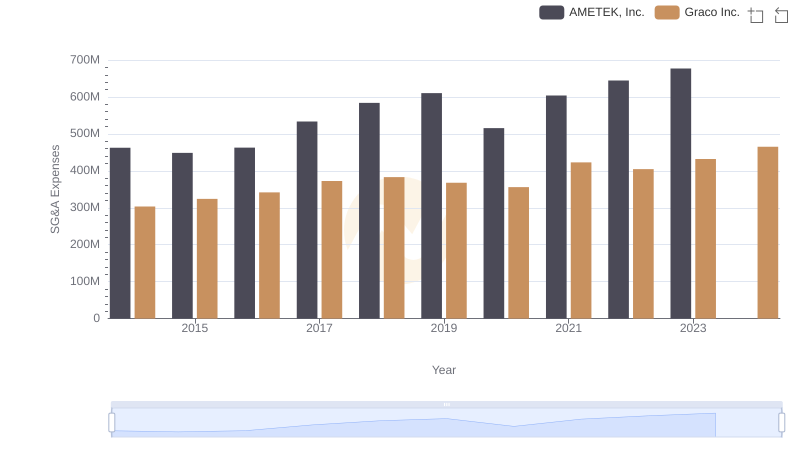

AMETEK, Inc. or Graco Inc.: Who Manages SG&A Costs Better?

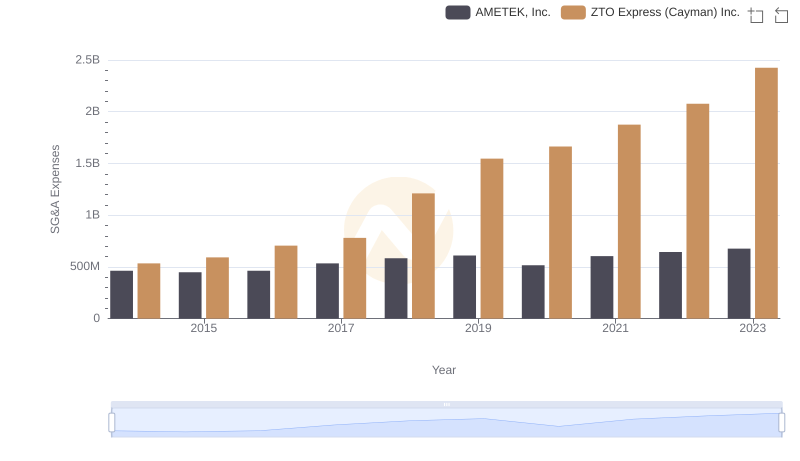

AMETEK, Inc. or ZTO Express (Cayman) Inc.: Who Manages SG&A Costs Better?

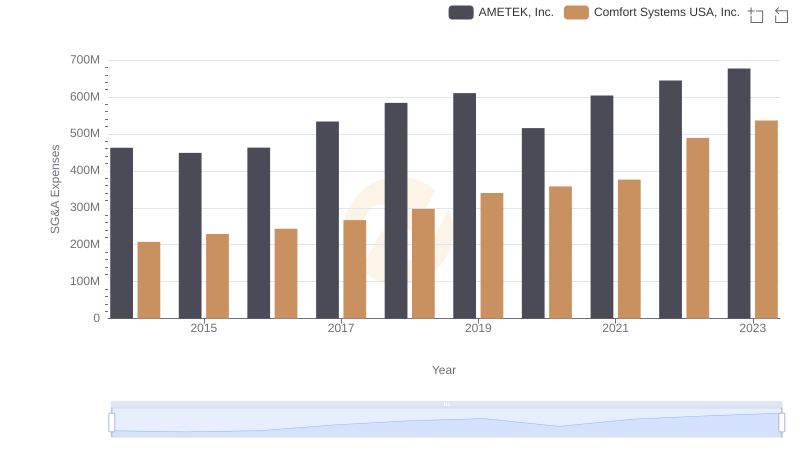

Who Optimizes SG&A Costs Better? AMETEK, Inc. or Comfort Systems USA, Inc.

A Professional Review of EBITDA: AMETEK, Inc. Compared to Textron Inc.

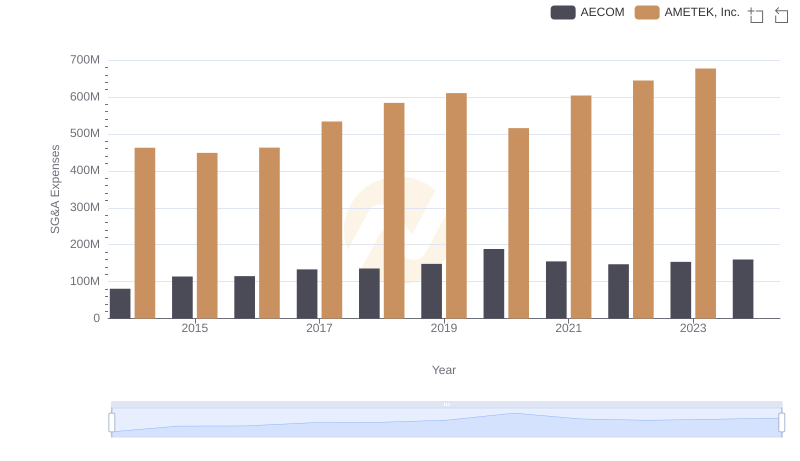

SG&A Efficiency Analysis: Comparing AMETEK, Inc. and AECOM