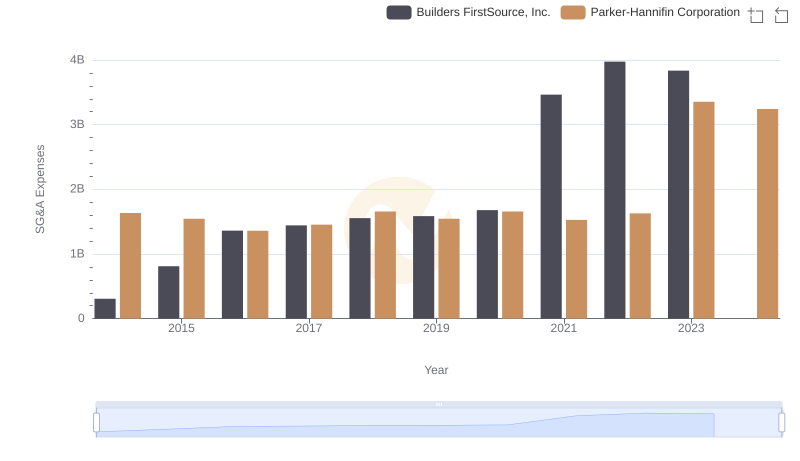

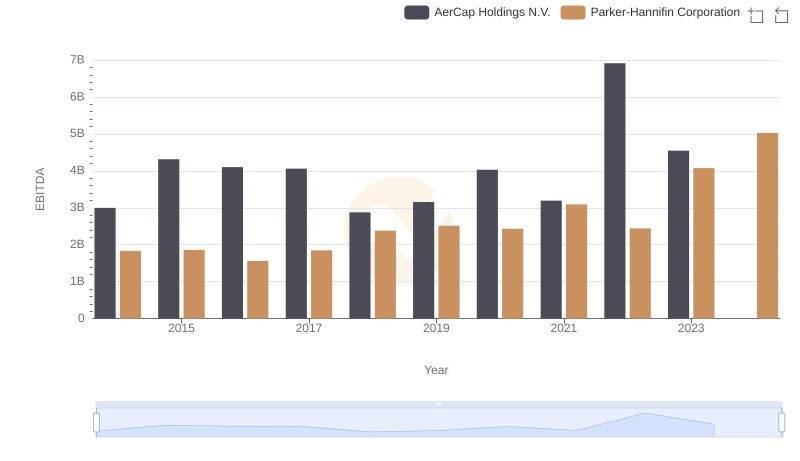

| __timestamp | AerCap Holdings N.V. | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 299900000 | 1633992000 |

| Thursday, January 1, 2015 | 381308000 | 1544746000 |

| Friday, January 1, 2016 | 351012000 | 1359360000 |

| Sunday, January 1, 2017 | 348291000 | 1453935000 |

| Monday, January 1, 2018 | 305226000 | 1657152000 |

| Tuesday, January 1, 2019 | 267458000 | 1543939000 |

| Wednesday, January 1, 2020 | 242161000 | 1656553000 |

| Friday, January 1, 2021 | 317888000 | 1527302000 |

| Saturday, January 1, 2022 | 399530000 | 1627116000 |

| Sunday, January 1, 2023 | 464128000 | 3354103000 |

| Monday, January 1, 2024 | 3315177000 |

Unveiling the hidden dimensions of data

In the competitive landscape of industrial and financial sectors, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Parker-Hannifin Corporation and AerCap Holdings N.V. have been at the forefront of this challenge since 2014. Parker-Hannifin, a leader in motion and control technologies, has consistently maintained higher SG&A expenses, peaking at approximately $3.35 billion in 2023. This reflects their expansive operations and strategic investments. In contrast, AerCap Holdings, a global leader in aircraft leasing, has shown a more conservative approach, with SG&A expenses reaching around $464 million in 2023, marking a 55% increase from 2014. The data reveals Parker-Hannifin's aggressive growth strategy, while AerCap's leaner model suggests a focus on efficiency. Missing data for AerCap in 2024 indicates potential reporting delays or strategic shifts. As these giants navigate economic challenges, their SG&A strategies will be pivotal in shaping their financial futures.

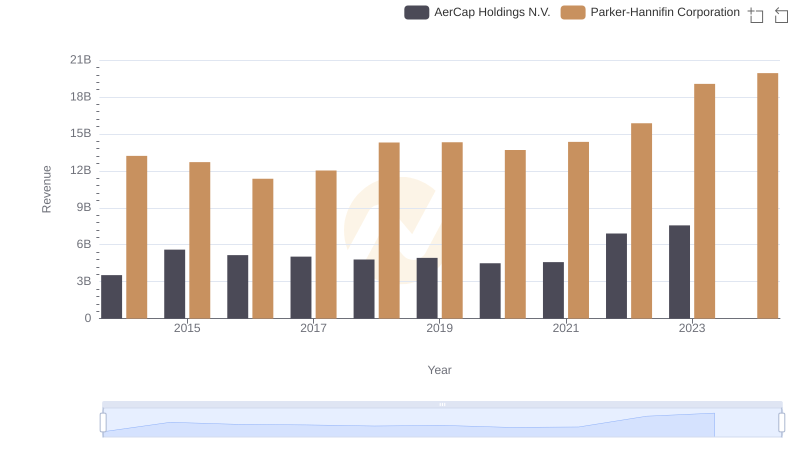

Annual Revenue Comparison: Parker-Hannifin Corporation vs AerCap Holdings N.V.

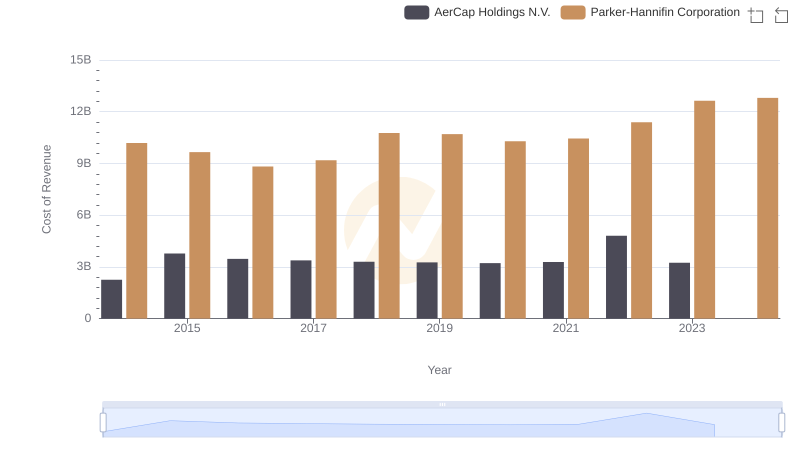

Cost of Revenue Trends: Parker-Hannifin Corporation vs AerCap Holdings N.V.

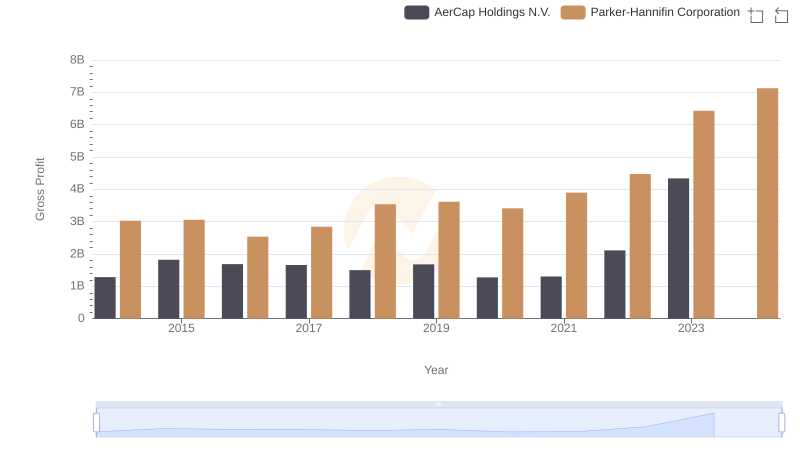

Gross Profit Trends Compared: Parker-Hannifin Corporation vs AerCap Holdings N.V.

Comparing SG&A Expenses: Parker-Hannifin Corporation vs Builders FirstSource, Inc. Trends and Insights

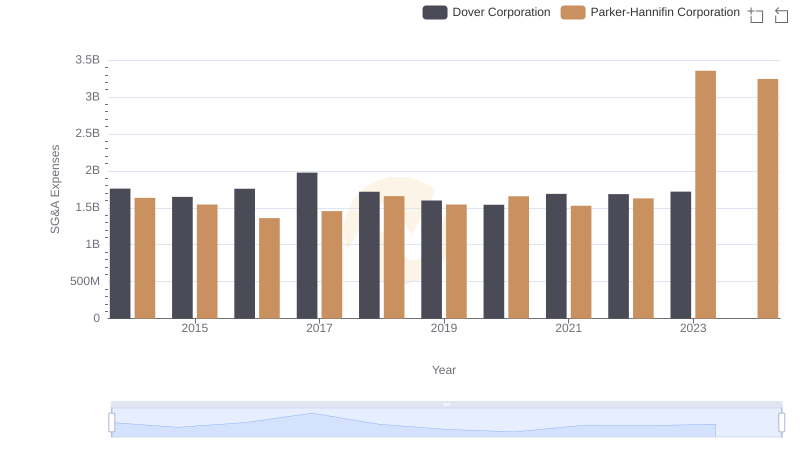

Parker-Hannifin Corporation and Dover Corporation: SG&A Spending Patterns Compared

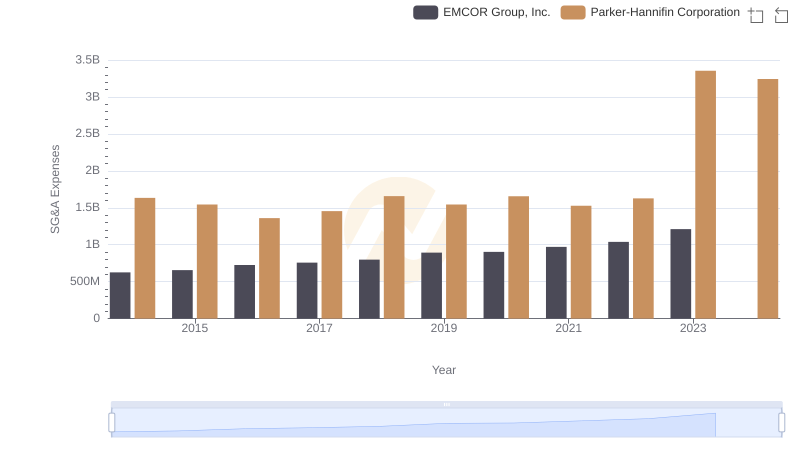

Who Optimizes SG&A Costs Better? Parker-Hannifin Corporation or EMCOR Group, Inc.

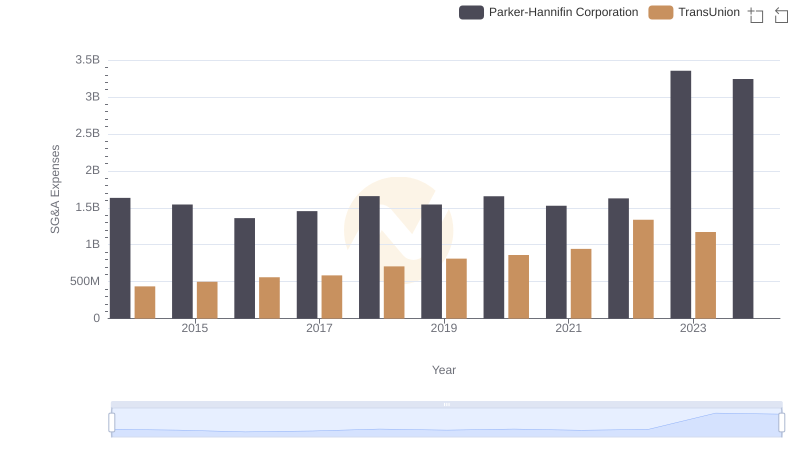

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs TransUnion

Parker-Hannifin Corporation and AerCap Holdings N.V.: A Detailed Examination of EBITDA Performance