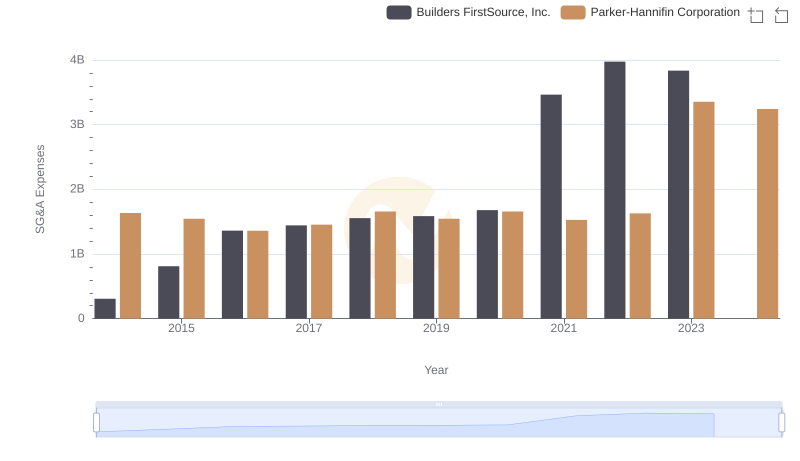

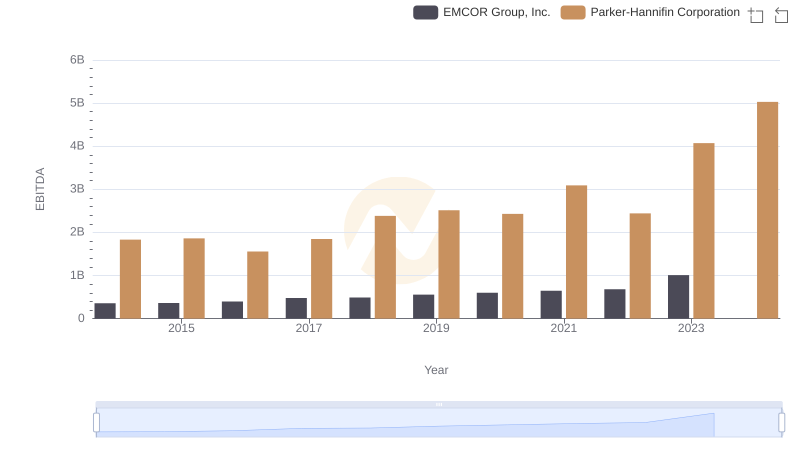

| __timestamp | EMCOR Group, Inc. | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 626478000 | 1633992000 |

| Thursday, January 1, 2015 | 656573000 | 1544746000 |

| Friday, January 1, 2016 | 725538000 | 1359360000 |

| Sunday, January 1, 2017 | 757062000 | 1453935000 |

| Monday, January 1, 2018 | 799157000 | 1657152000 |

| Tuesday, January 1, 2019 | 893453000 | 1543939000 |

| Wednesday, January 1, 2020 | 903584000 | 1656553000 |

| Friday, January 1, 2021 | 970937000 | 1527302000 |

| Saturday, January 1, 2022 | 1038717000 | 1627116000 |

| Sunday, January 1, 2023 | 1211233000 | 3354103000 |

| Monday, January 1, 2024 | 3315177000 |

In pursuit of knowledge

In the competitive landscape of industrial and construction services, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Parker-Hannifin Corporation and EMCOR Group, Inc. have been at the forefront of this challenge since 2014. Over the past decade, Parker-Hannifin has consistently reported higher SG&A expenses, peaking at approximately $3.35 billion in 2023, a significant 106% increase from 2014. In contrast, EMCOR Group's SG&A expenses have grown more modestly, with a 93% increase over the same period, reaching around $1.21 billion in 2023.

This data suggests that while both companies have seen rising costs, Parker-Hannifin's expenses have surged more dramatically. The absence of data for EMCOR in 2024 leaves room for speculation on future trends. As these industry leaders continue to navigate economic challenges, their ability to optimize SG&A costs will be pivotal in maintaining competitive advantage.

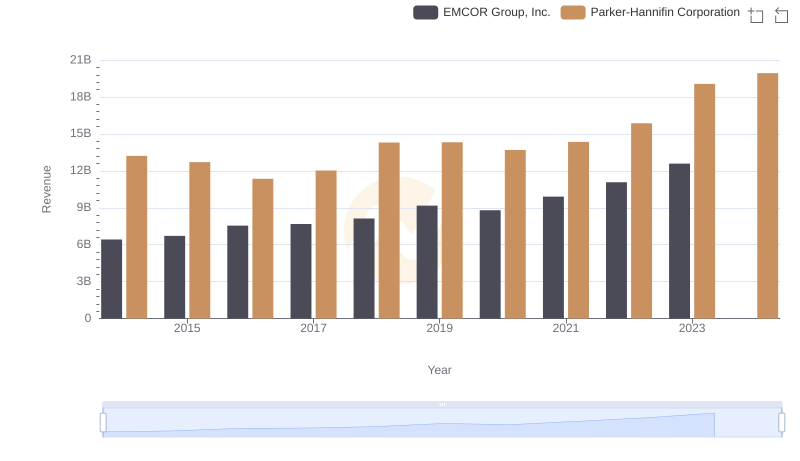

Who Generates More Revenue? Parker-Hannifin Corporation or EMCOR Group, Inc.

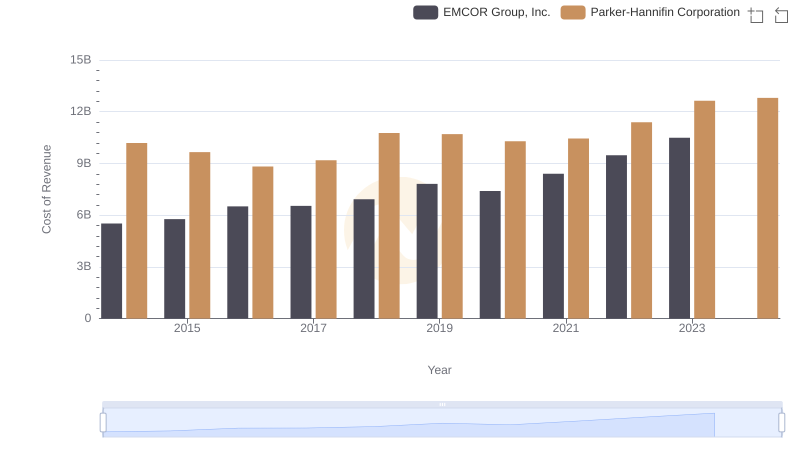

Cost Insights: Breaking Down Parker-Hannifin Corporation and EMCOR Group, Inc.'s Expenses

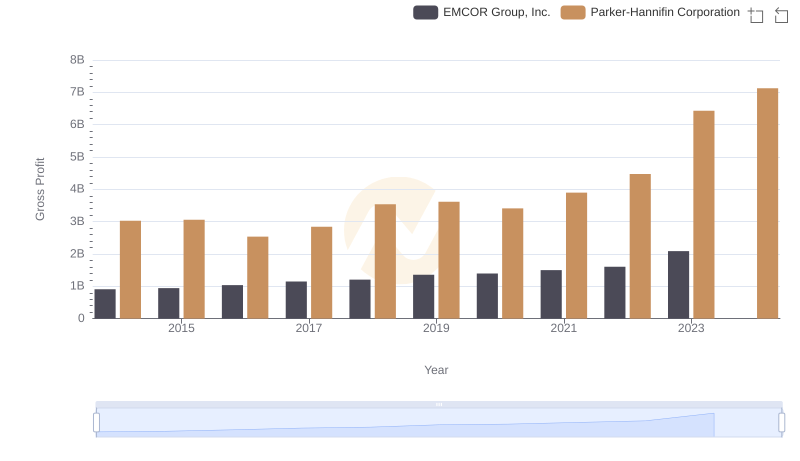

Who Generates Higher Gross Profit? Parker-Hannifin Corporation or EMCOR Group, Inc.

Comparing SG&A Expenses: Parker-Hannifin Corporation vs Builders FirstSource, Inc. Trends and Insights

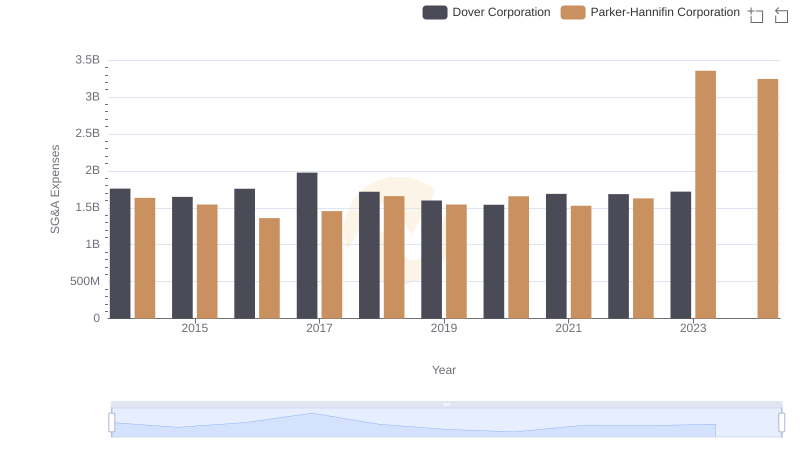

Parker-Hannifin Corporation and Dover Corporation: SG&A Spending Patterns Compared

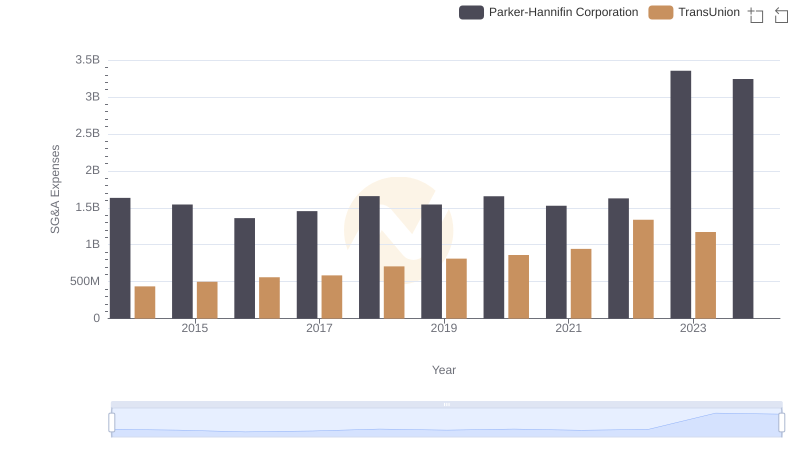

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs TransUnion

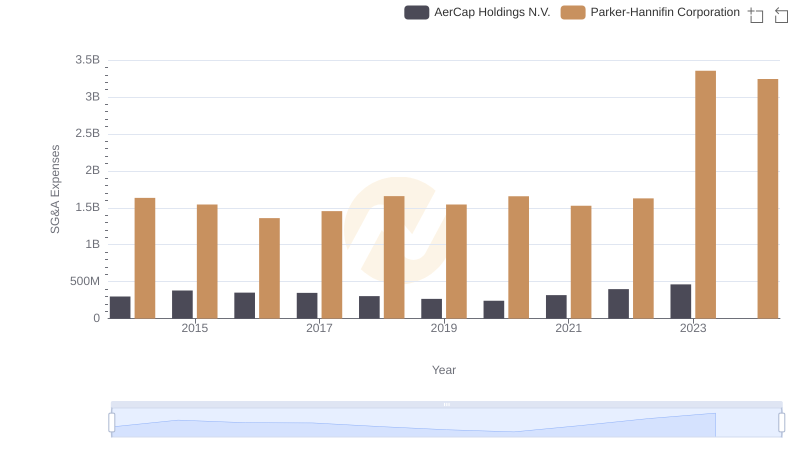

Who Optimizes SG&A Costs Better? Parker-Hannifin Corporation or AerCap Holdings N.V.

Comprehensive EBITDA Comparison: Parker-Hannifin Corporation vs EMCOR Group, Inc.