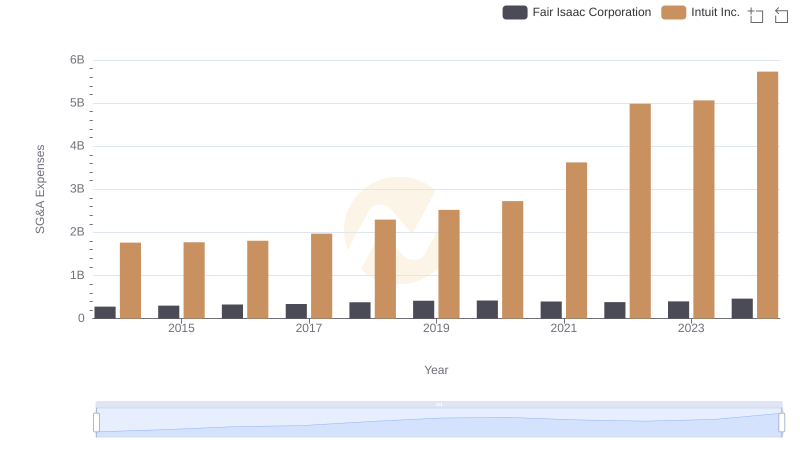

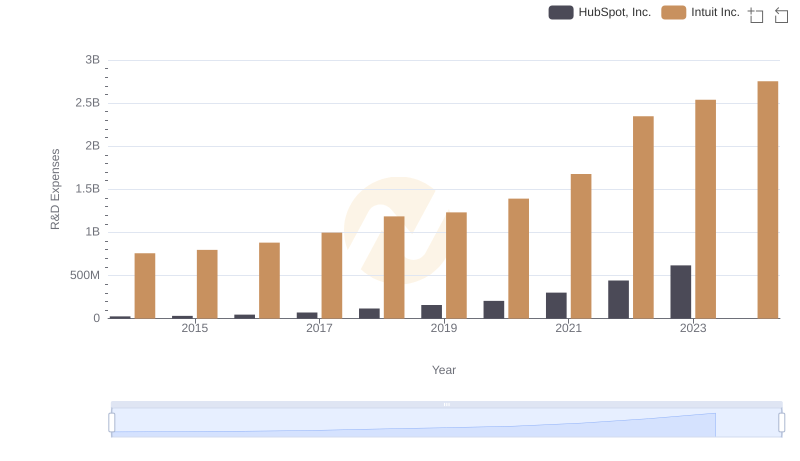

| __timestamp | HubSpot, Inc. | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 101767000 | 1762000000 |

| Thursday, January 1, 2015 | 148037000 | 1771000000 |

| Friday, January 1, 2016 | 207767000 | 1807000000 |

| Sunday, January 1, 2017 | 269646000 | 1973000000 |

| Monday, January 1, 2018 | 343278000 | 2298000000 |

| Tuesday, January 1, 2019 | 433656000 | 2524000000 |

| Wednesday, January 1, 2020 | 561306000 | 2727000000 |

| Friday, January 1, 2021 | 794630000 | 3626000000 |

| Saturday, January 1, 2022 | 1083789000 | 4986000000 |

| Sunday, January 1, 2023 | 1318209000 | 5062000000 |

| Monday, January 1, 2024 | 1519176000 | 5730000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of technology companies, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability and growth. Over the past decade, Intuit Inc. and HubSpot, Inc. have demonstrated contrasting approaches to handling these costs. From 2014 to 2023, Intuit's SG&A expenses have consistently been higher, peaking at approximately $5.1 billion in 2023, reflecting its expansive operations and market reach. In contrast, HubSpot's expenses have grown from $102 million in 2014 to $1.3 billion in 2023, marking a significant increase of over 1,200%. This rapid growth underscores HubSpot's aggressive expansion strategy. However, the absence of 2024 data for HubSpot suggests a potential gap in reporting or a strategic shift. As these companies continue to innovate, their ability to manage SG&A costs will remain a key indicator of their financial health and competitive edge.

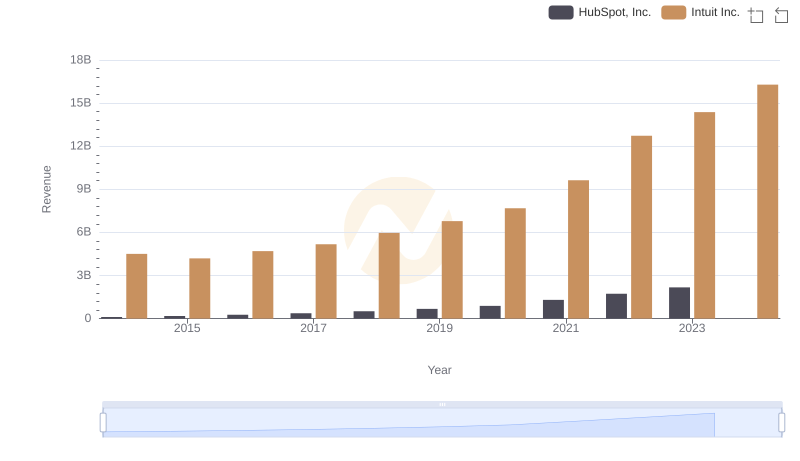

Comparing Revenue Performance: Intuit Inc. or HubSpot, Inc.?

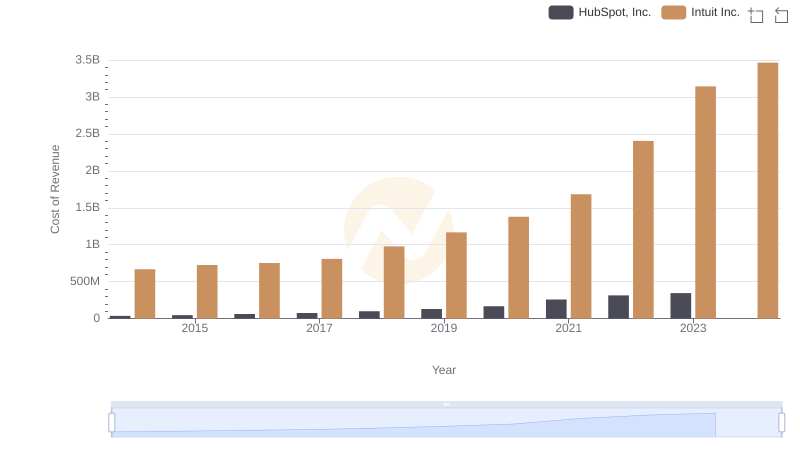

Comparing Cost of Revenue Efficiency: Intuit Inc. vs HubSpot, Inc.

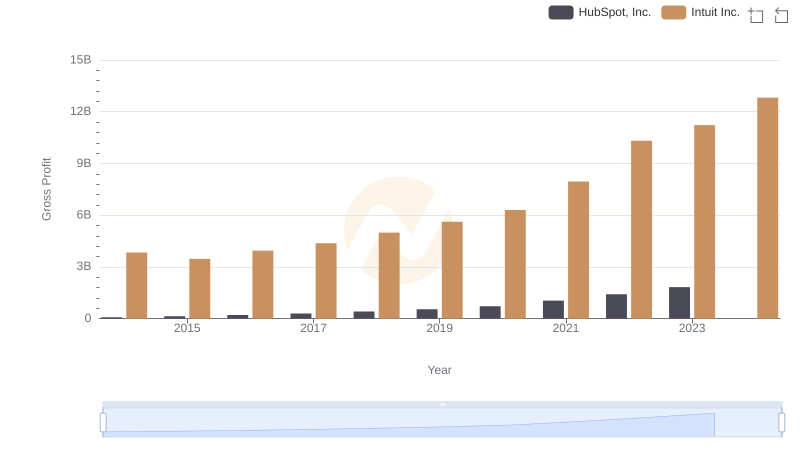

Gross Profit Analysis: Comparing Intuit Inc. and HubSpot, Inc.

Comparing SG&A Expenses: Intuit Inc. vs Fair Isaac Corporation Trends and Insights

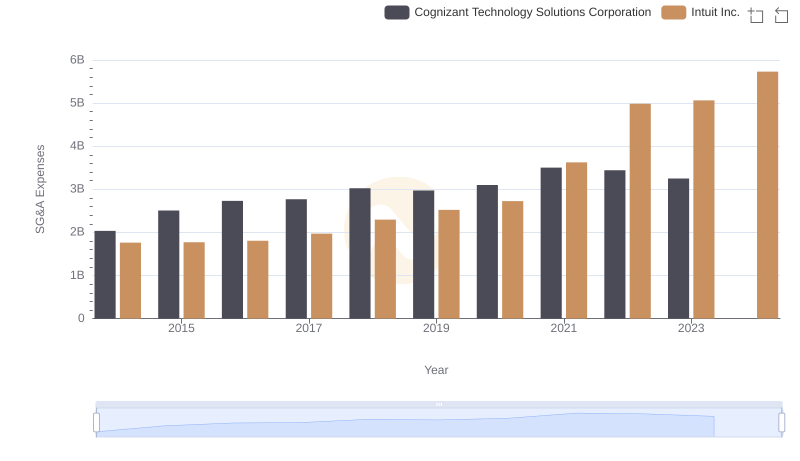

Cost Management Insights: SG&A Expenses for Intuit Inc. and Cognizant Technology Solutions Corporation

Research and Development Expenses Breakdown: Intuit Inc. vs HubSpot, Inc.

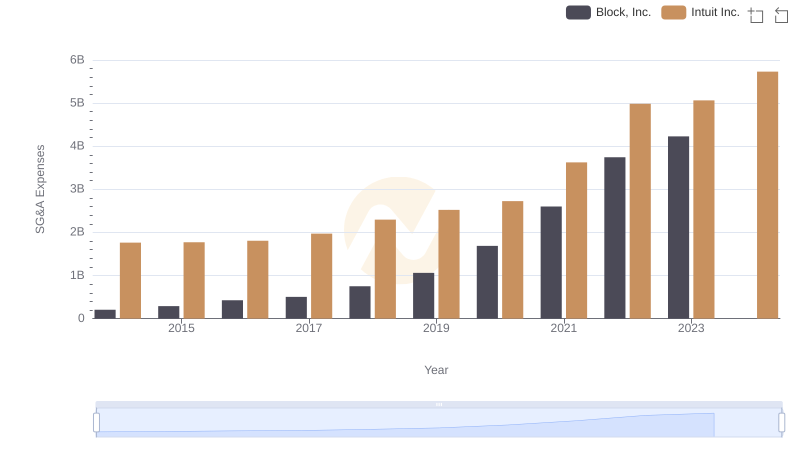

Intuit Inc. vs Block, Inc.: SG&A Expense Trends

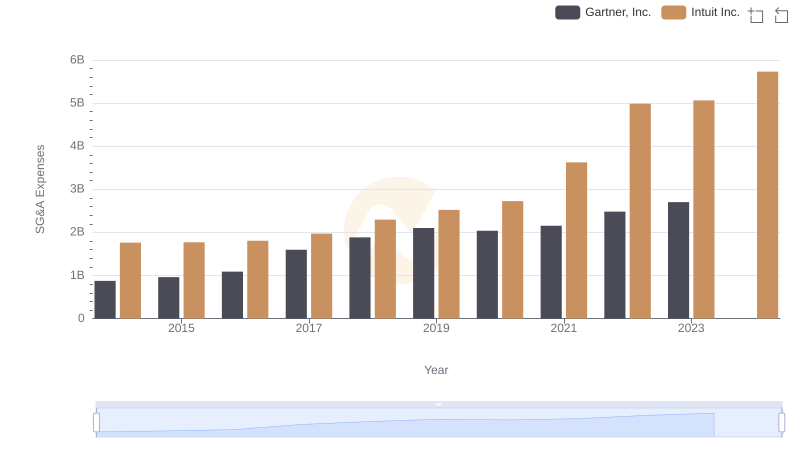

Intuit Inc. vs Gartner, Inc.: SG&A Expense Trends

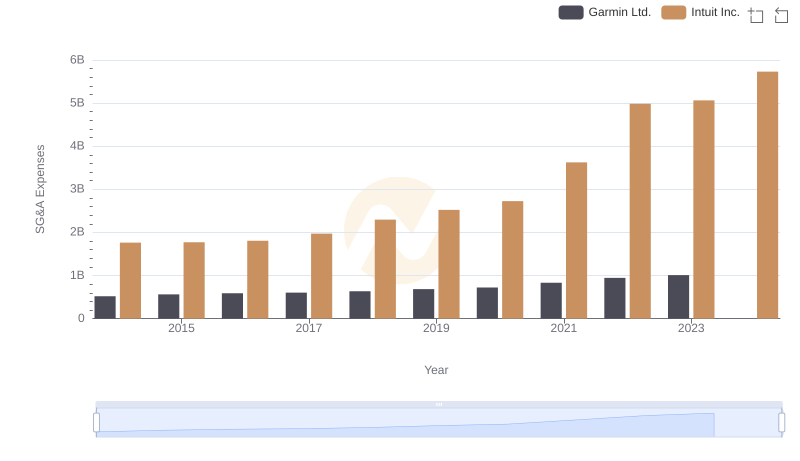

Who Optimizes SG&A Costs Better? Intuit Inc. or Garmin Ltd.

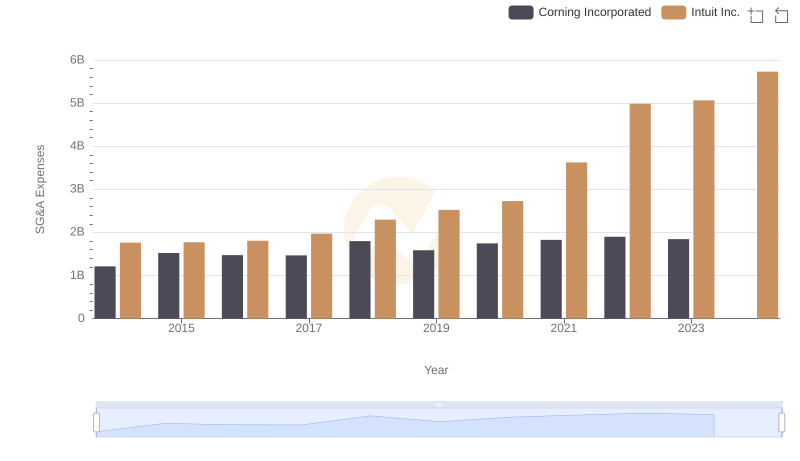

Selling, General, and Administrative Costs: Intuit Inc. vs Corning Incorporated

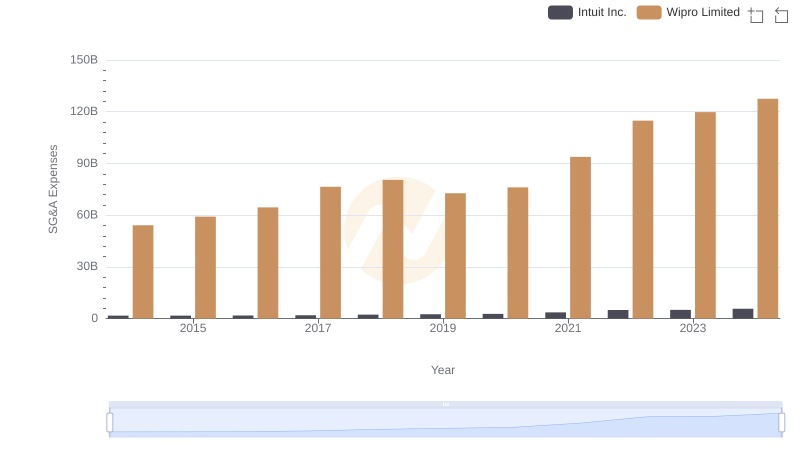

Breaking Down SG&A Expenses: Intuit Inc. vs Wipro Limited

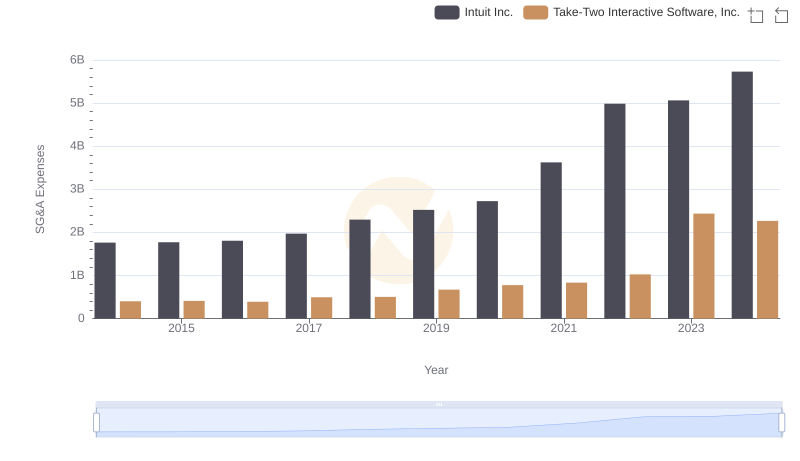

Comparing SG&A Expenses: Intuit Inc. vs Take-Two Interactive Software, Inc. Trends and Insights