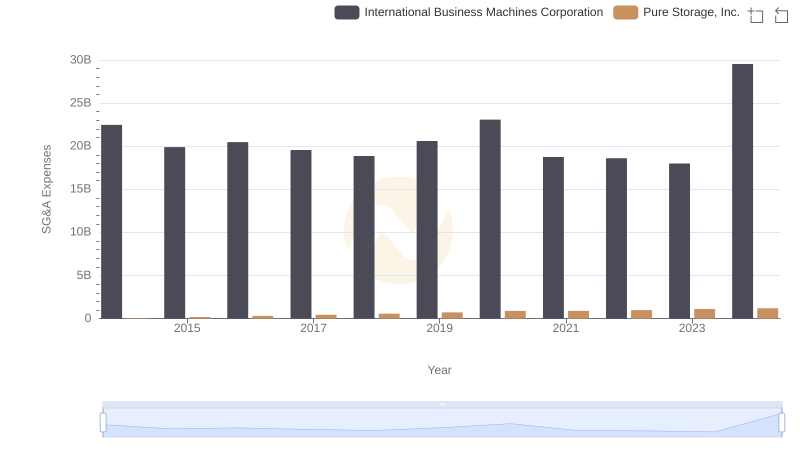

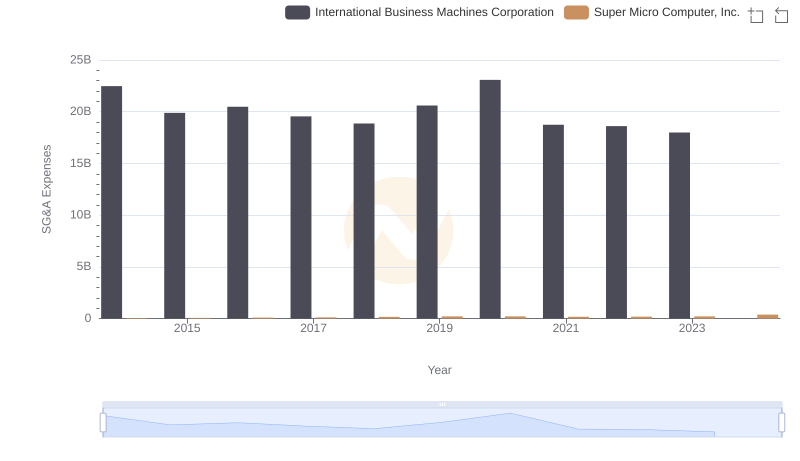

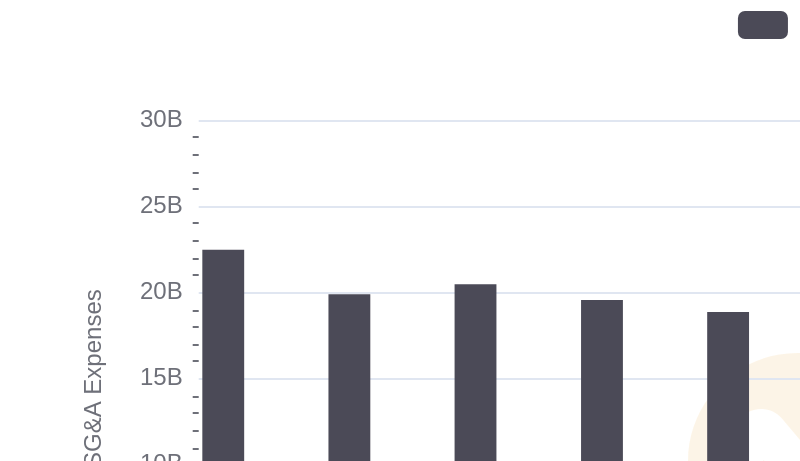

| __timestamp | International Business Machines Corporation | Leidos Holdings, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 22472000000 | 310000000 |

| Thursday, January 1, 2015 | 19894000000 | 232000000 |

| Friday, January 1, 2016 | 20279000000 | 334000000 |

| Sunday, January 1, 2017 | 19680000000 | 552000000 |

| Monday, January 1, 2018 | 19366000000 | 729000000 |

| Tuesday, January 1, 2019 | 18724000000 | 689000000 |

| Wednesday, January 1, 2020 | 20561000000 | 770000000 |

| Friday, January 1, 2021 | 18745000000 | 860000000 |

| Saturday, January 1, 2022 | 17483000000 | 950000000 |

| Sunday, January 1, 2023 | 17997000000 | 942000000 |

| Monday, January 1, 2024 | 29536000000 | 983000000 |

Unleashing the power of data

In the competitive world of technology and defense, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, International Business Machines Corporation (IBM) and Leidos Holdings, Inc. have taken different paths in optimizing these costs. IBM, a stalwart in the tech industry, has seen its SG&A expenses fluctuate, peaking in 2024 with a 30% increase from 2023. Meanwhile, Leidos, a key player in defense, has consistently kept its SG&A costs under control, with a steady rise from 2014 to 2023, reaching just under a billion dollars. This strategic management highlights Leidos' focus on efficiency, while IBM's larger scale operations reflect its expansive global reach. As businesses navigate economic challenges, these insights into SG&A optimization offer valuable lessons in balancing growth and cost management.

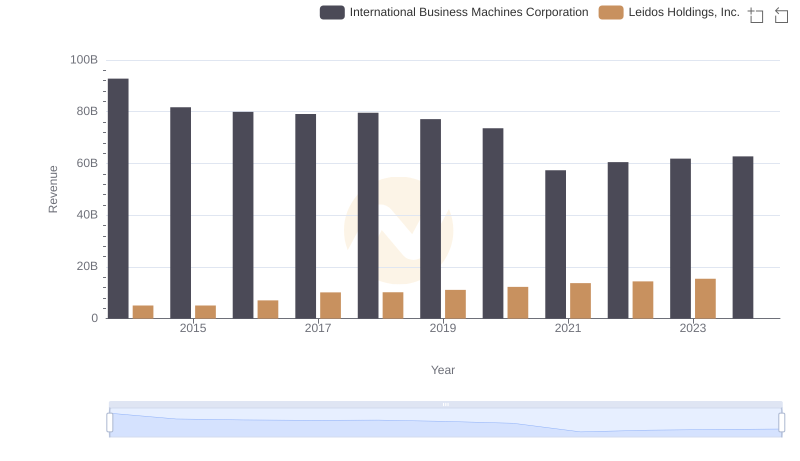

Comparing Revenue Performance: International Business Machines Corporation or Leidos Holdings, Inc.?

International Business Machines Corporation or Pure Storage, Inc.: Who Manages SG&A Costs Better?

Comparing SG&A Expenses: International Business Machines Corporation vs ASE Technology Holding Co., Ltd. Trends and Insights

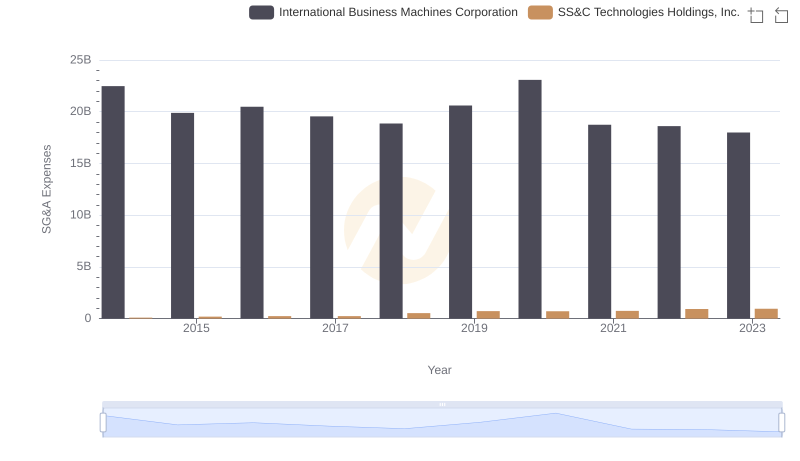

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and SS&C Technologies Holdings, Inc.

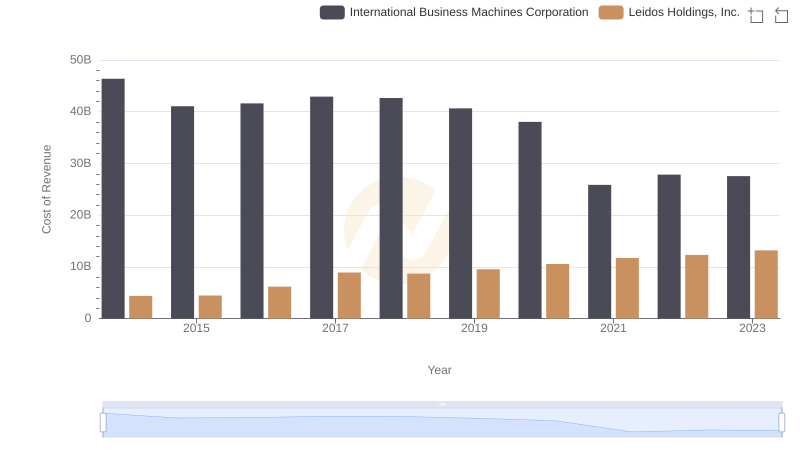

International Business Machines Corporation vs Leidos Holdings, Inc.: Efficiency in Cost of Revenue Explored

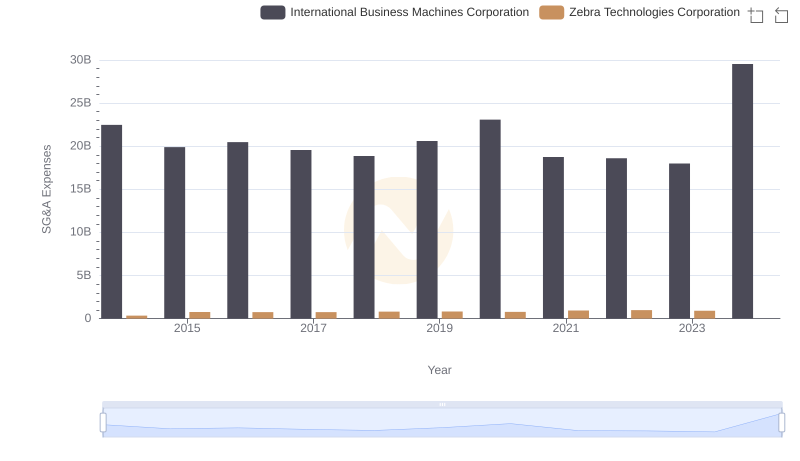

Who Optimizes SG&A Costs Better? International Business Machines Corporation or Zebra Technologies Corporation

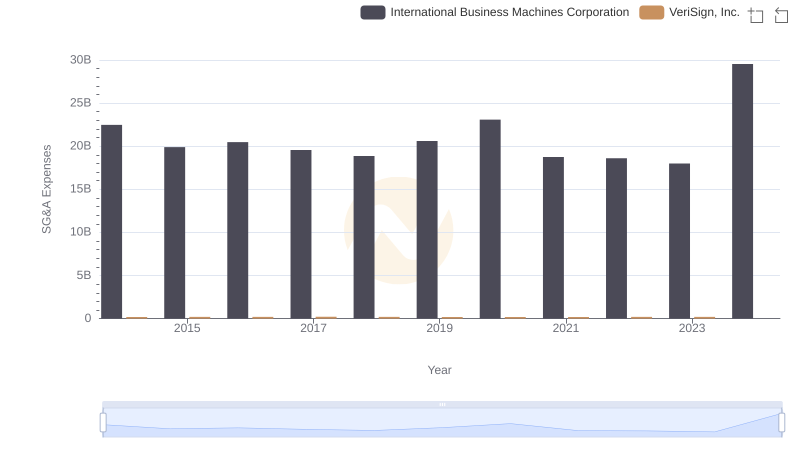

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and VeriSign, Inc.

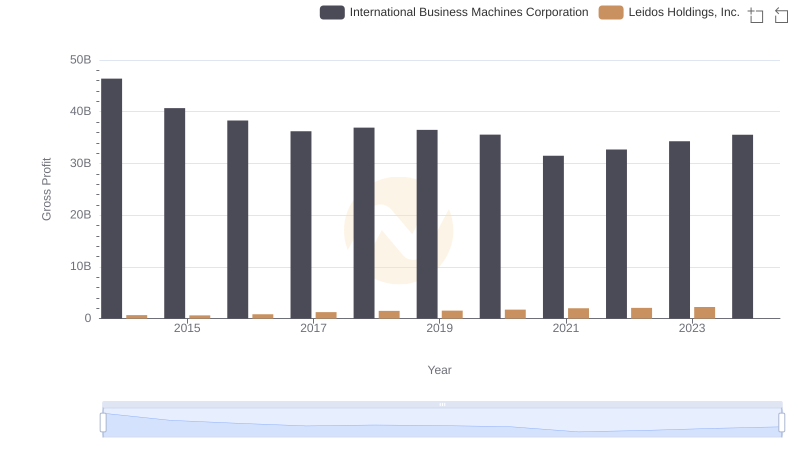

Gross Profit Analysis: Comparing International Business Machines Corporation and Leidos Holdings, Inc.

Selling, General, and Administrative Costs: International Business Machines Corporation vs Super Micro Computer, Inc.

Breaking Down SG&A Expenses: International Business Machines Corporation vs Trimble Inc.

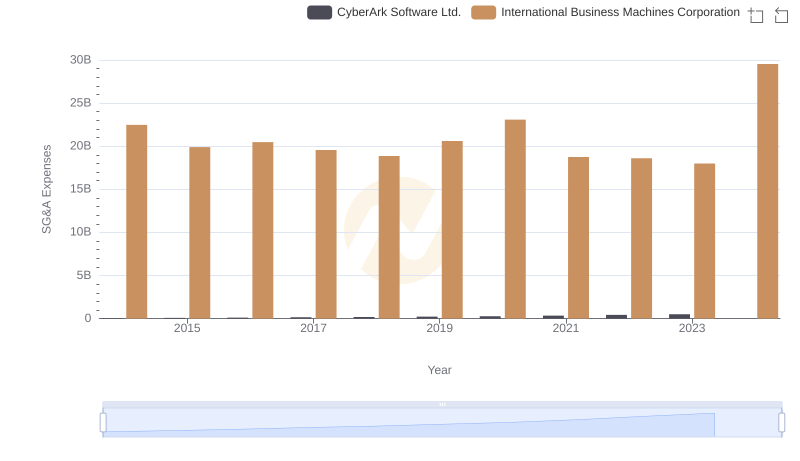

International Business Machines Corporation or CyberArk Software Ltd.: Who Manages SG&A Costs Better?

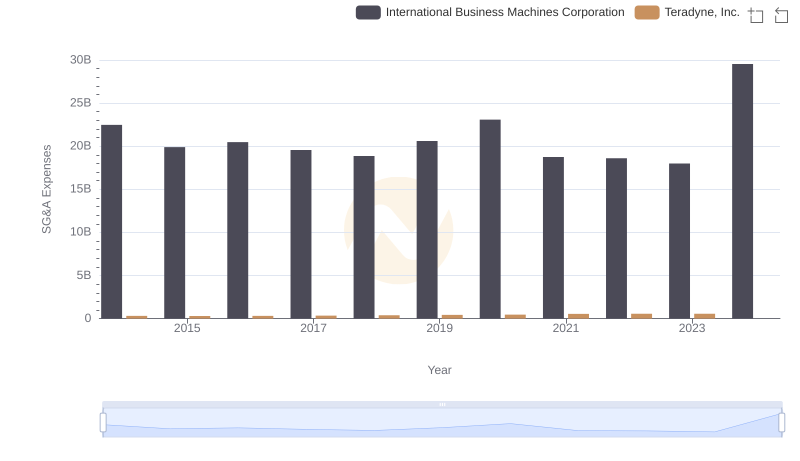

Selling, General, and Administrative Costs: International Business Machines Corporation vs Teradyne, Inc.