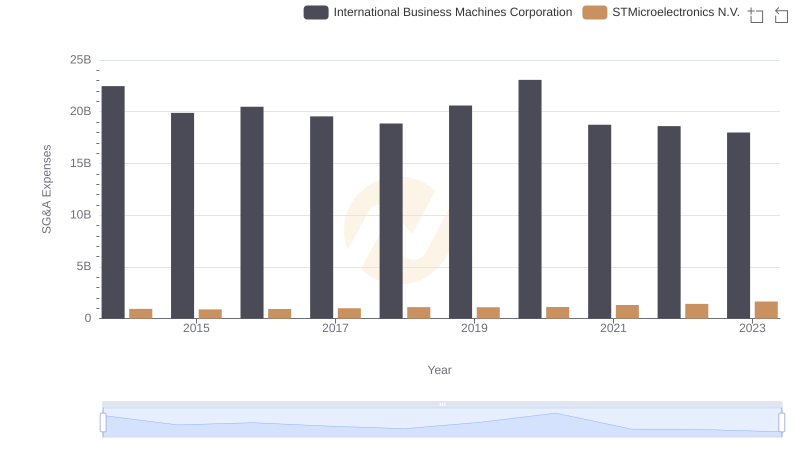

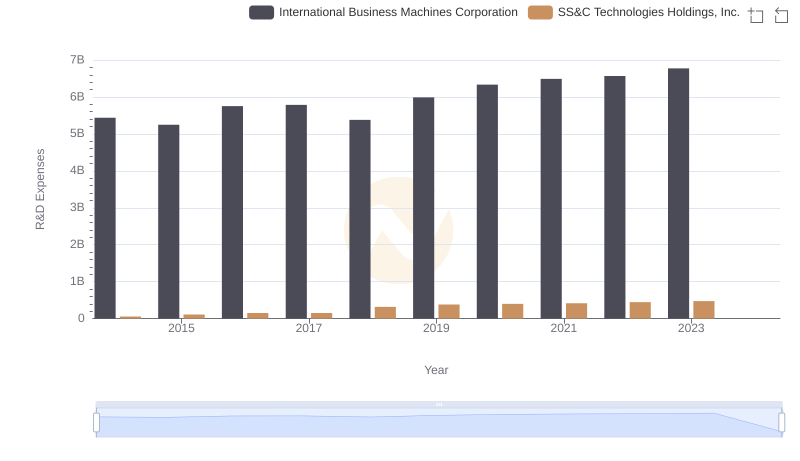

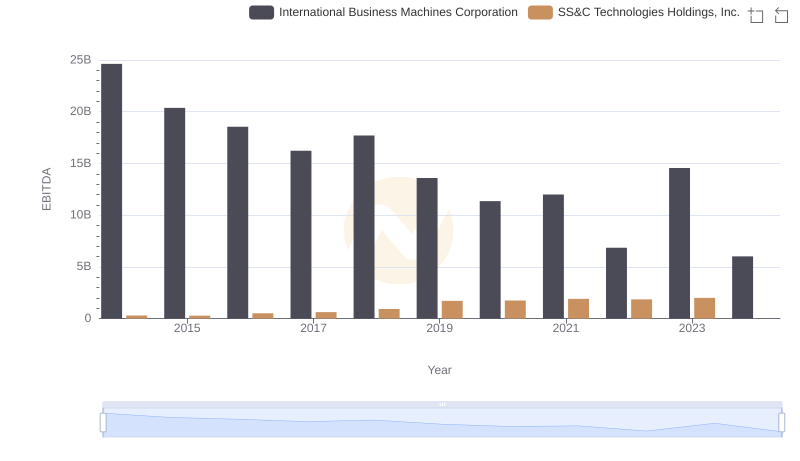

| __timestamp | International Business Machines Corporation | SS&C Technologies Holdings, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 22472000000 | 99471000 |

| Thursday, January 1, 2015 | 19894000000 | 192782000 |

| Friday, January 1, 2016 | 20279000000 | 239563000 |

| Sunday, January 1, 2017 | 19680000000 | 238623000 |

| Monday, January 1, 2018 | 19366000000 | 524900000 |

| Tuesday, January 1, 2019 | 18724000000 | 723100000 |

| Wednesday, January 1, 2020 | 20561000000 | 708600000 |

| Friday, January 1, 2021 | 18745000000 | 752100000 |

| Saturday, January 1, 2022 | 17483000000 | 925100000 |

| Sunday, January 1, 2023 | 17997000000 | 959700000 |

| Monday, January 1, 2024 | 29536000000 | 1002400000 |

Igniting the spark of knowledge

In the ever-evolving landscape of corporate finance, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. This analysis juxtaposes two industry titans: International Business Machines Corporation (IBM) and SS&C Technologies Holdings, Inc., over a decade from 2014 to 2023.

IBM, a stalwart in the tech industry, has seen its SG&A expenses fluctuate, peaking in 2020 with a 15% increase from 2019, before declining by 22% by 2023. This trend reflects IBM's strategic cost management amidst technological shifts. Conversely, SS&C Technologies, a leader in financial services software, has consistently increased its SG&A spending, growing nearly tenfold from 2014 to 2023. This growth underscores SS&C's aggressive expansion strategy.

These contrasting trajectories highlight the diverse approaches to SG&A efficiency, offering valuable insights into corporate strategy and financial health.

International Business Machines Corporation or SS&C Technologies Holdings, Inc.: Who Leads in Yearly Revenue?

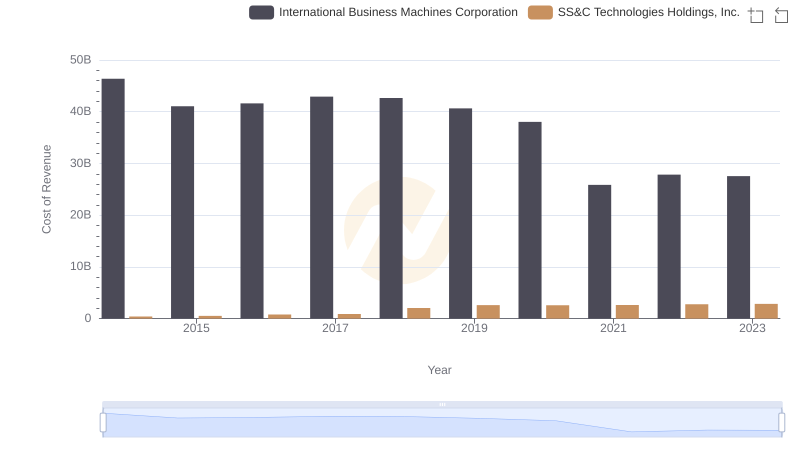

Analyzing Cost of Revenue: International Business Machines Corporation and SS&C Technologies Holdings, Inc.

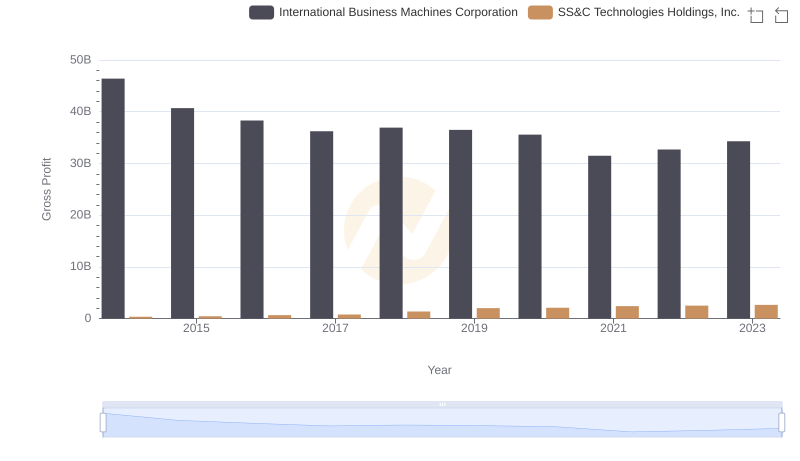

Who Generates Higher Gross Profit? International Business Machines Corporation or SS&C Technologies Holdings, Inc.

International Business Machines Corporation or STMicroelectronics N.V.: Who Manages SG&A Costs Better?

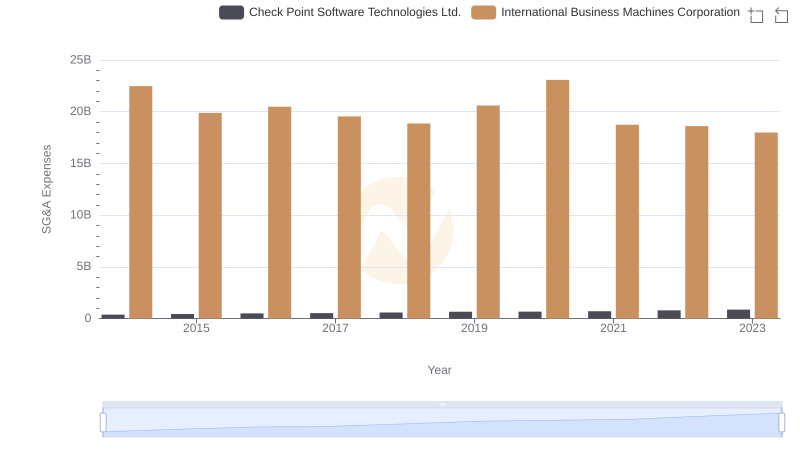

Operational Costs Compared: SG&A Analysis of International Business Machines Corporation and Check Point Software Technologies Ltd.

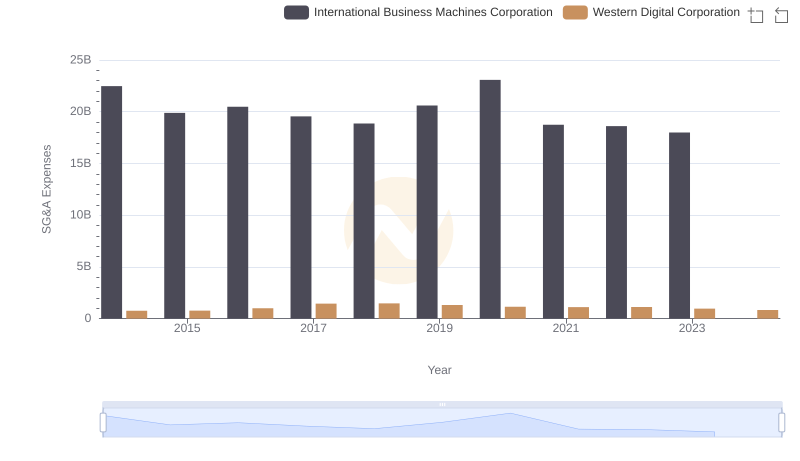

Selling, General, and Administrative Costs: International Business Machines Corporation vs Western Digital Corporation

Comparing Innovation Spending: International Business Machines Corporation and SS&C Technologies Holdings, Inc.

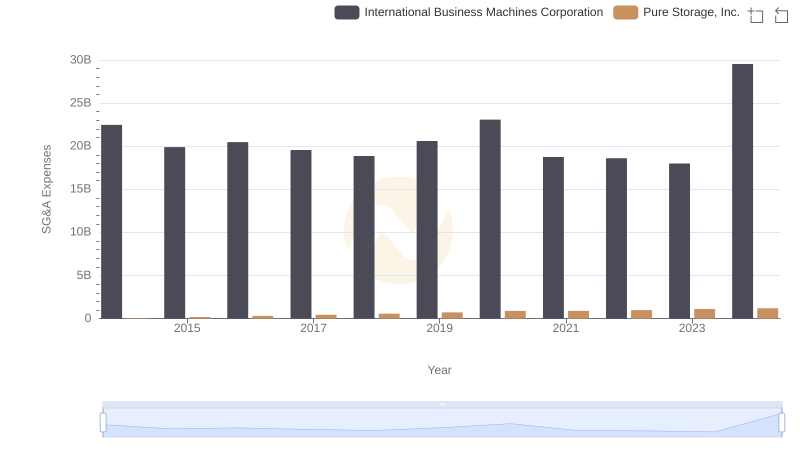

International Business Machines Corporation or Pure Storage, Inc.: Who Manages SG&A Costs Better?

Comparing SG&A Expenses: International Business Machines Corporation vs ASE Technology Holding Co., Ltd. Trends and Insights

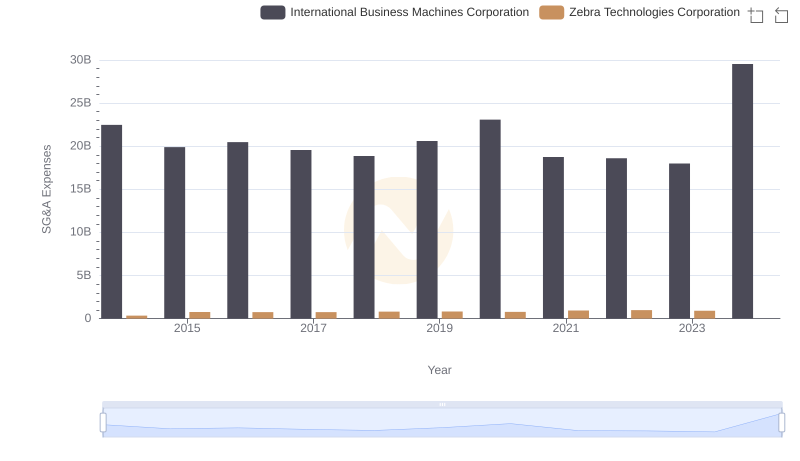

Who Optimizes SG&A Costs Better? International Business Machines Corporation or Zebra Technologies Corporation

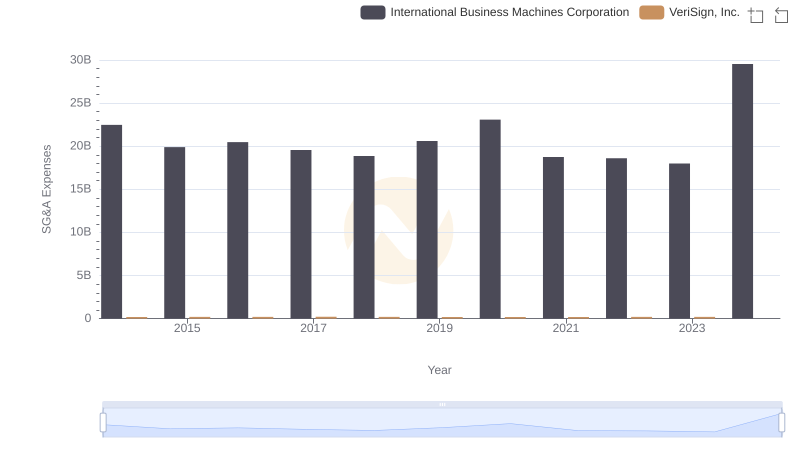

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and VeriSign, Inc.

Comprehensive EBITDA Comparison: International Business Machines Corporation vs SS&C Technologies Holdings, Inc.