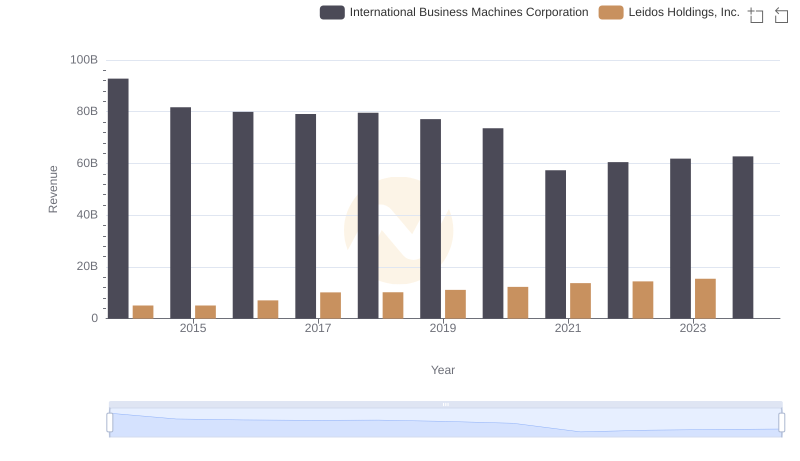

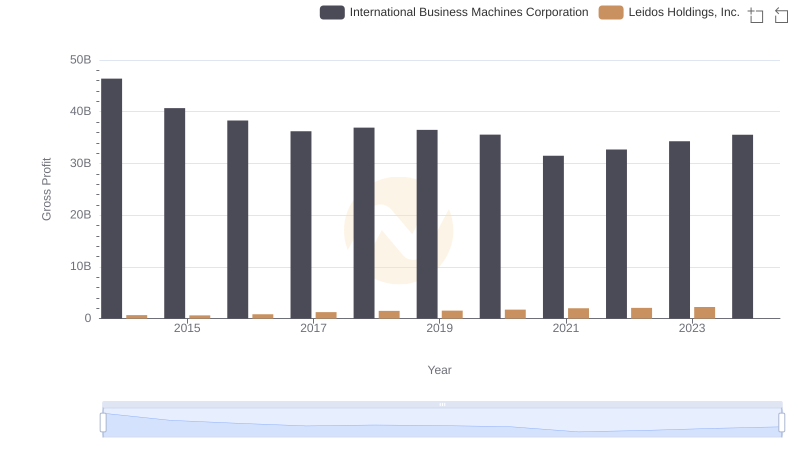

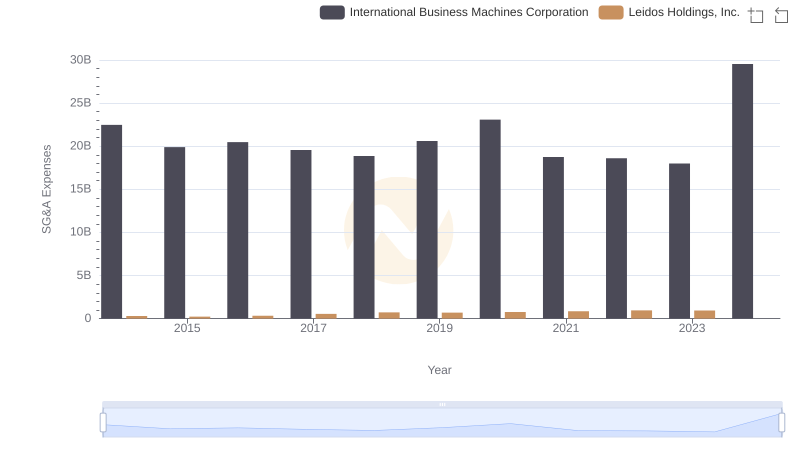

| __timestamp | International Business Machines Corporation | Leidos Holdings, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 46386000000 | 4392000000 |

| Thursday, January 1, 2015 | 41057000000 | 4468000000 |

| Friday, January 1, 2016 | 41403000000 | 6191000000 |

| Sunday, January 1, 2017 | 42196000000 | 8923000000 |

| Monday, January 1, 2018 | 42655000000 | 8690000000 |

| Tuesday, January 1, 2019 | 26181000000 | 9546000000 |

| Wednesday, January 1, 2020 | 24314000000 | 10560000000 |

| Friday, January 1, 2021 | 25865000000 | 11723000000 |

| Saturday, January 1, 2022 | 27842000000 | 12312000000 |

| Sunday, January 1, 2023 | 27560000000 | 13194000000 |

| Monday, January 1, 2024 | 27202000000 | 13864000000 |

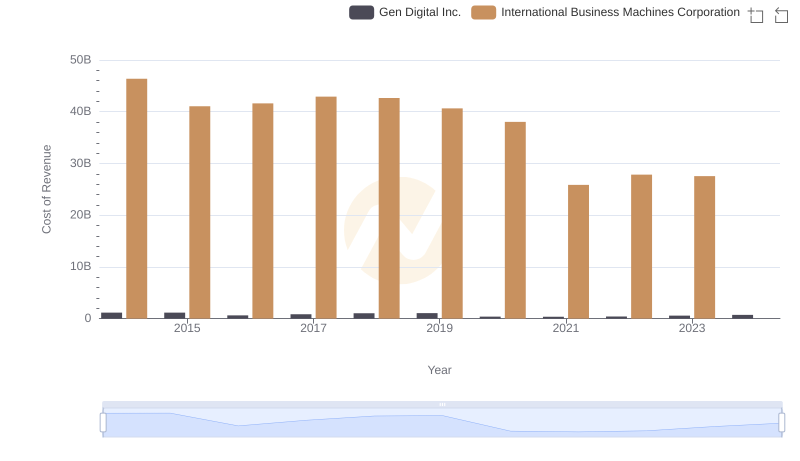

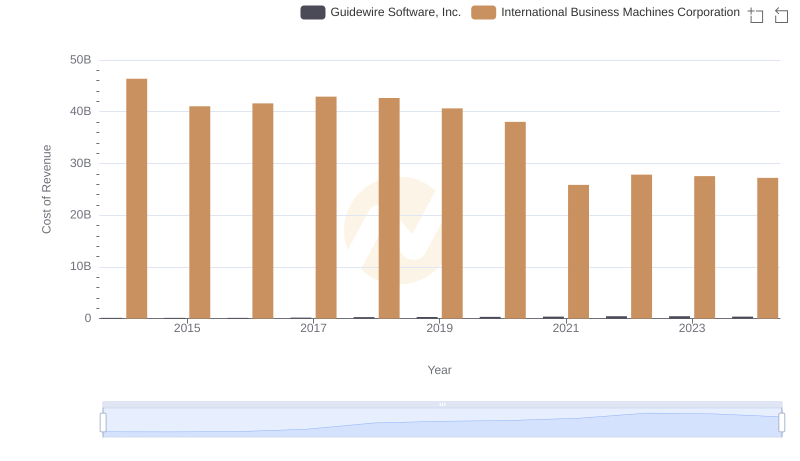

Unleashing insights

In the ever-evolving landscape of technology and defense, cost efficiency remains a pivotal factor for industry giants. This analysis delves into the cost of revenue trends for International Business Machines Corporation (IBM) and Leidos Holdings, Inc. from 2014 to 2023. Over this period, IBM's cost of revenue has seen a significant decline, dropping by approximately 41% from 2014 to 2023. In contrast, Leidos Holdings has experienced a remarkable increase of nearly 200% in the same timeframe.

IBM's strategic shift towards cloud computing and AI has contributed to its reduced cost of revenue, reflecting a leaner operational model. Meanwhile, Leidos Holdings' expansion in defense and technology sectors has driven its cost of revenue upwards, indicating robust growth. This juxtaposition highlights the diverse strategies employed by these corporations to navigate the competitive landscape.

Comparing Revenue Performance: International Business Machines Corporation or Leidos Holdings, Inc.?

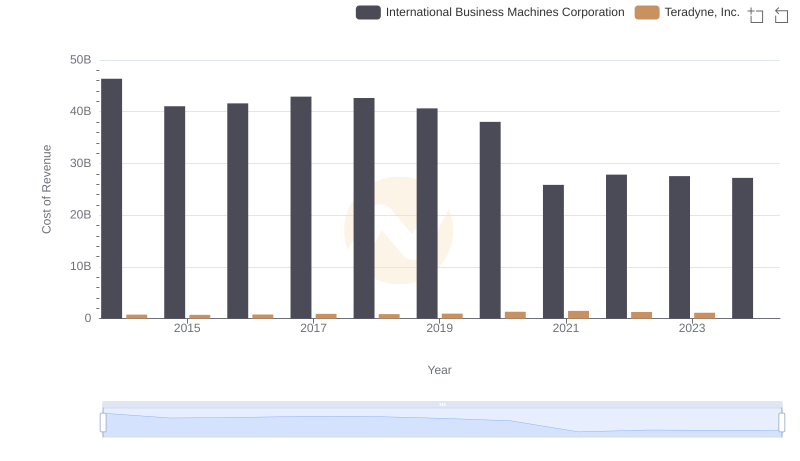

Cost of Revenue Trends: International Business Machines Corporation vs Teradyne, Inc.

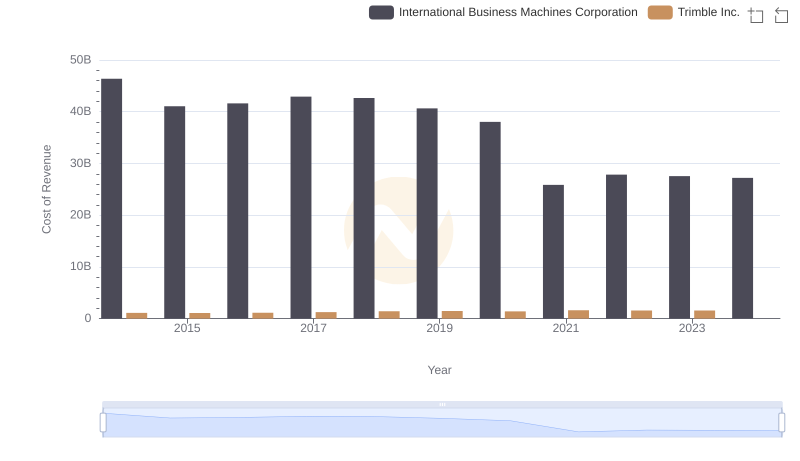

International Business Machines Corporation vs Trimble Inc.: Efficiency in Cost of Revenue Explored

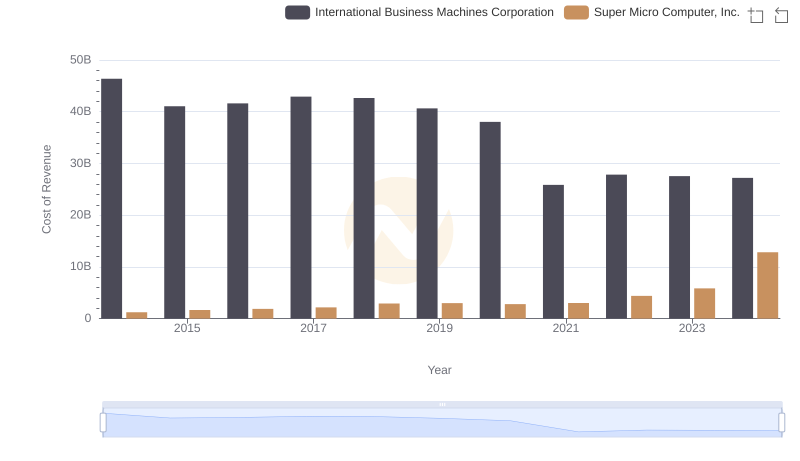

Cost of Revenue Trends: International Business Machines Corporation vs Super Micro Computer, Inc.

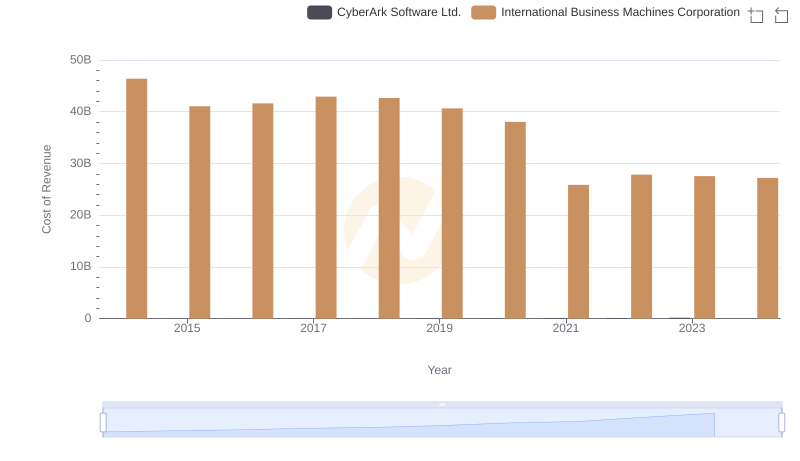

International Business Machines Corporation vs CyberArk Software Ltd.: Efficiency in Cost of Revenue Explored

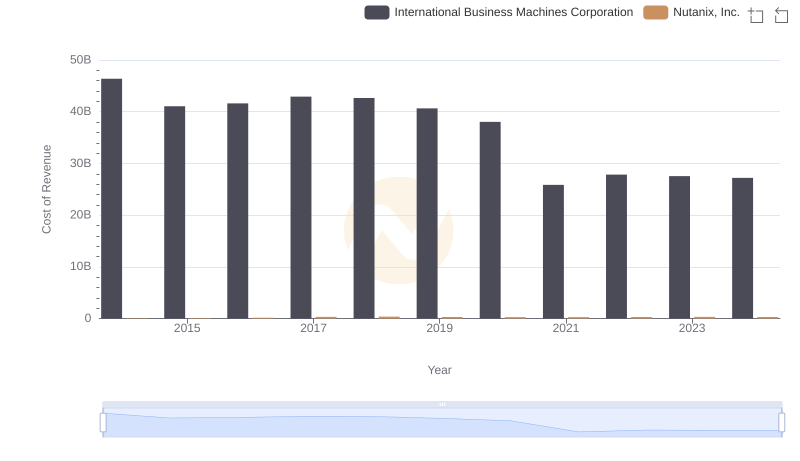

Analyzing Cost of Revenue: International Business Machines Corporation and Nutanix, Inc.

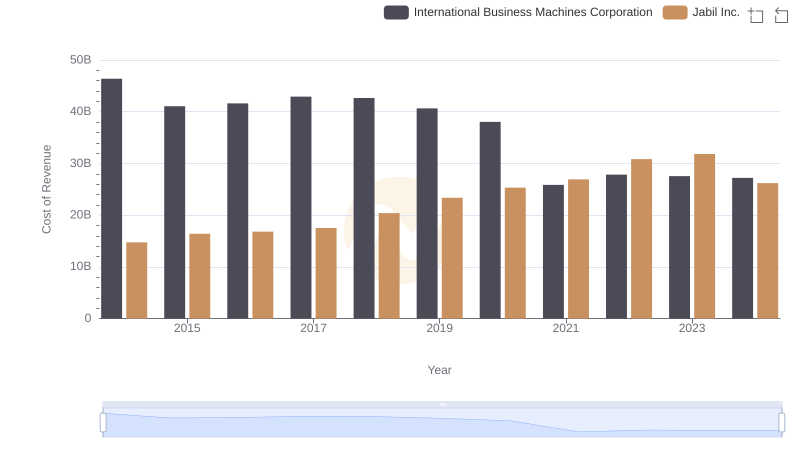

Analyzing Cost of Revenue: International Business Machines Corporation and Jabil Inc.

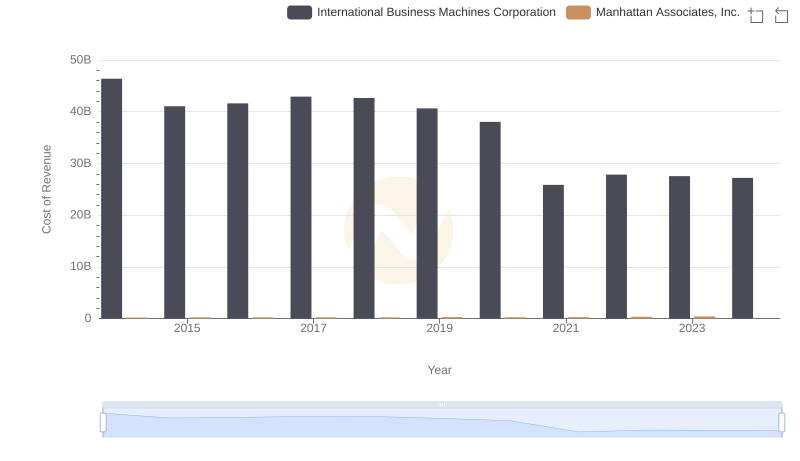

Comparing Cost of Revenue Efficiency: International Business Machines Corporation vs Manhattan Associates, Inc.

Gross Profit Analysis: Comparing International Business Machines Corporation and Leidos Holdings, Inc.

Cost of Revenue Trends: International Business Machines Corporation vs Gen Digital Inc.

International Business Machines Corporation vs Guidewire Software, Inc.: Efficiency in Cost of Revenue Explored

Who Optimizes SG&A Costs Better? International Business Machines Corporation or Leidos Holdings, Inc.