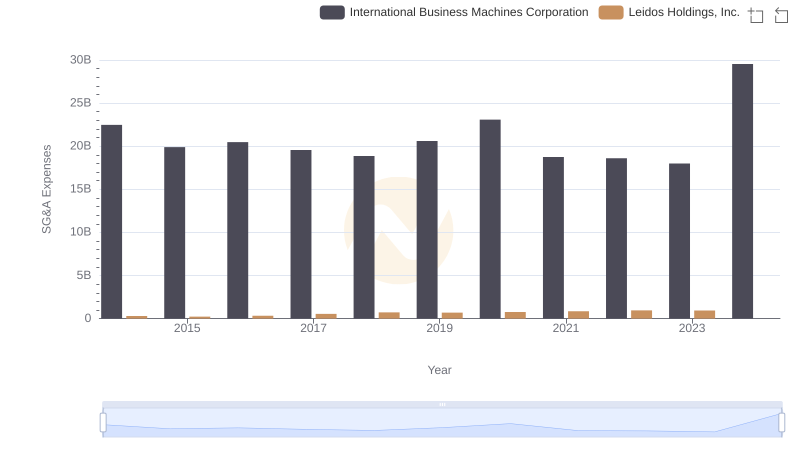

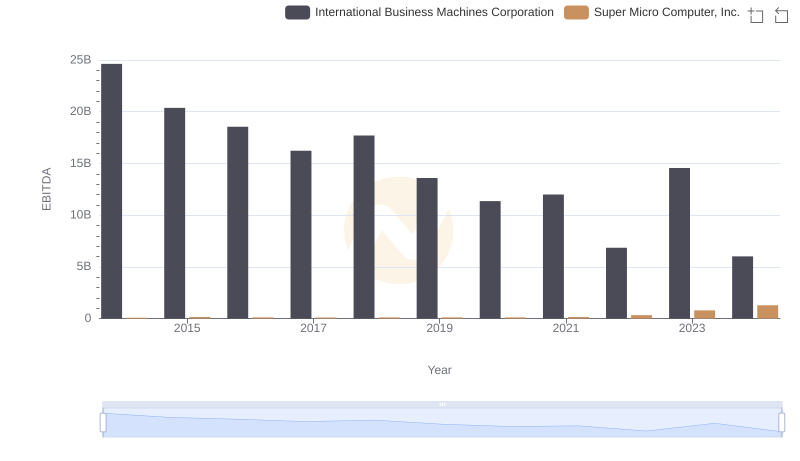

| __timestamp | International Business Machines Corporation | Super Micro Computer, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 22472000000 | 61029000 |

| Thursday, January 1, 2015 | 19894000000 | 73228000 |

| Friday, January 1, 2016 | 20279000000 | 100681000 |

| Sunday, January 1, 2017 | 19680000000 | 115331000 |

| Monday, January 1, 2018 | 19366000000 | 170176000 |

| Tuesday, January 1, 2019 | 18724000000 | 218382000 |

| Wednesday, January 1, 2020 | 20561000000 | 219078000 |

| Friday, January 1, 2021 | 18745000000 | 186222000 |

| Saturday, January 1, 2022 | 17483000000 | 192561000 |

| Sunday, January 1, 2023 | 17997000000 | 214610000 |

| Monday, January 1, 2024 | 29536000000 | 383111000 |

Unleashing the power of data

In the ever-evolving landscape of technology, the financial strategies of companies like International Business Machines Corporation (IBM) and Super Micro Computer, Inc. offer a fascinating glimpse into their operational priorities. Over the past decade, IBM's Selling, General, and Administrative (SG&A) expenses have shown a steady trend, peaking in 2024 with a 42% increase from 2023. This reflects IBM's strategic investments in innovation and market expansion. In contrast, Super Micro Computer, Inc. has demonstrated a more modest growth in SG&A expenses, with a notable 78% rise from 2014 to 2024. This suggests a focused approach on scaling operations efficiently. The data highlights the contrasting paths of these tech titans, with IBM's expansive strategy versus Super Micro's leaner, growth-oriented model. As the tech industry continues to evolve, these financial insights provide a window into the strategic decisions shaping the future of these companies.

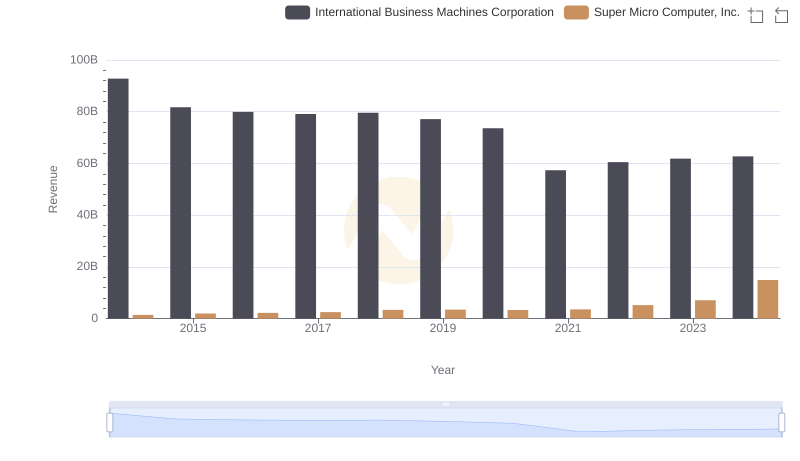

International Business Machines Corporation or Super Micro Computer, Inc.: Who Leads in Yearly Revenue?

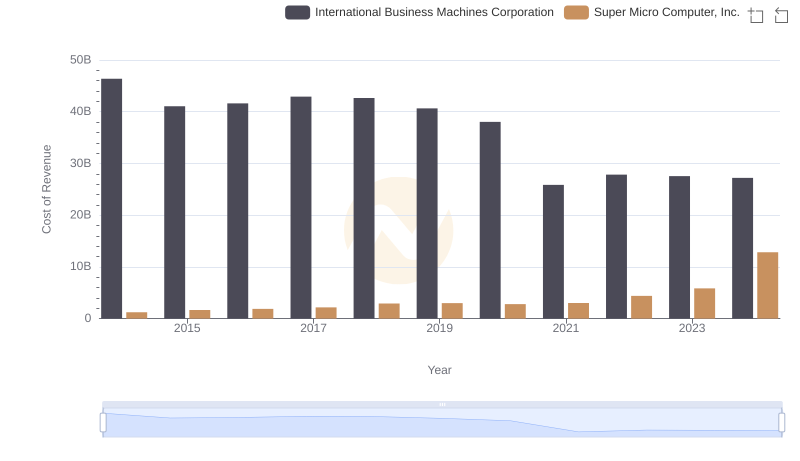

Cost of Revenue Trends: International Business Machines Corporation vs Super Micro Computer, Inc.

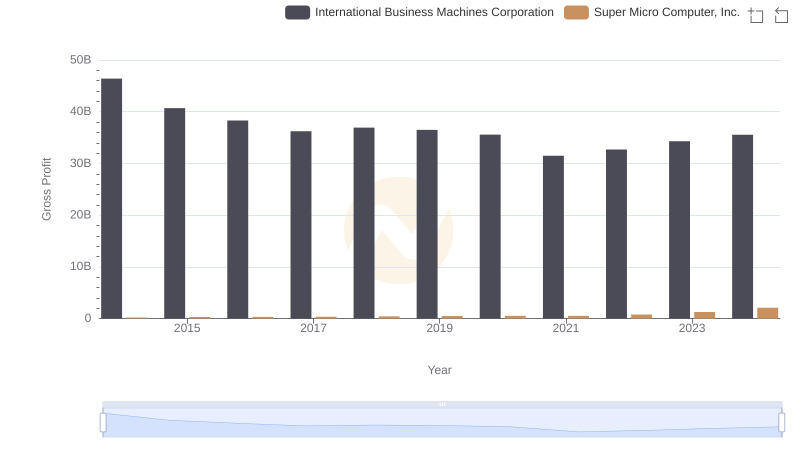

International Business Machines Corporation and Super Micro Computer, Inc.: A Detailed Gross Profit Analysis

Who Optimizes SG&A Costs Better? International Business Machines Corporation or Leidos Holdings, Inc.

R&D Spending Showdown: International Business Machines Corporation vs Super Micro Computer, Inc.

Breaking Down SG&A Expenses: International Business Machines Corporation vs Trimble Inc.

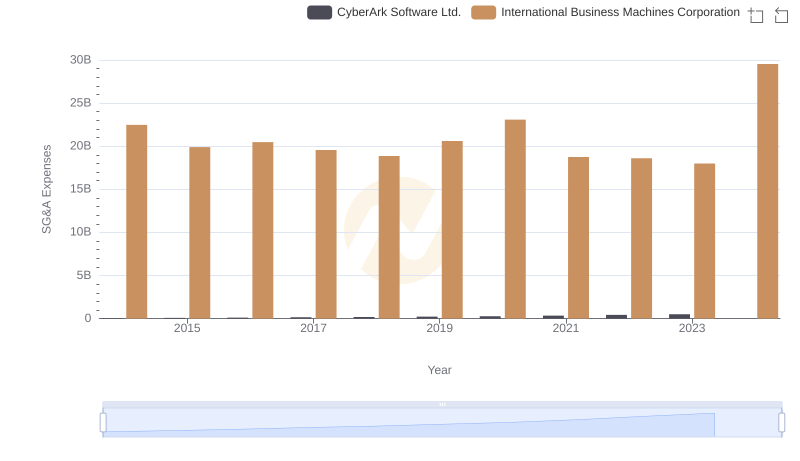

International Business Machines Corporation or CyberArk Software Ltd.: Who Manages SG&A Costs Better?

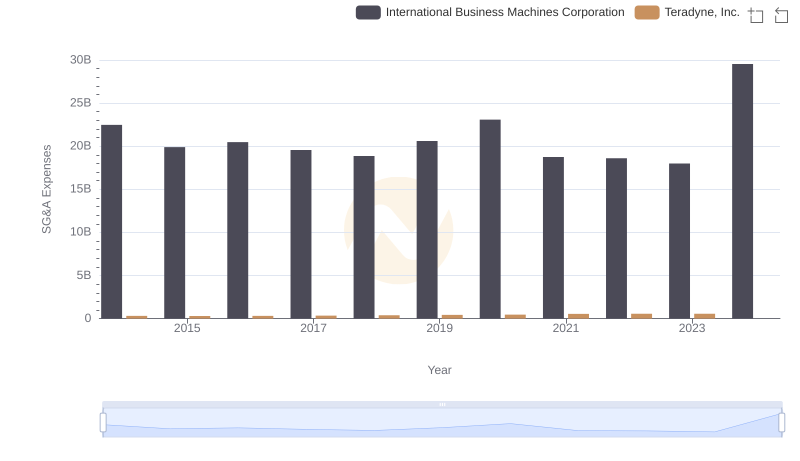

Selling, General, and Administrative Costs: International Business Machines Corporation vs Teradyne, Inc.

A Side-by-Side Analysis of EBITDA: International Business Machines Corporation and Super Micro Computer, Inc.

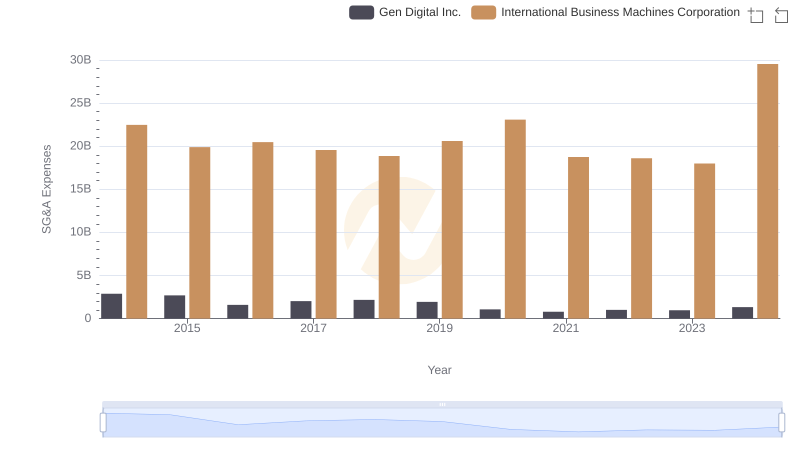

Selling, General, and Administrative Costs: International Business Machines Corporation vs Gen Digital Inc.

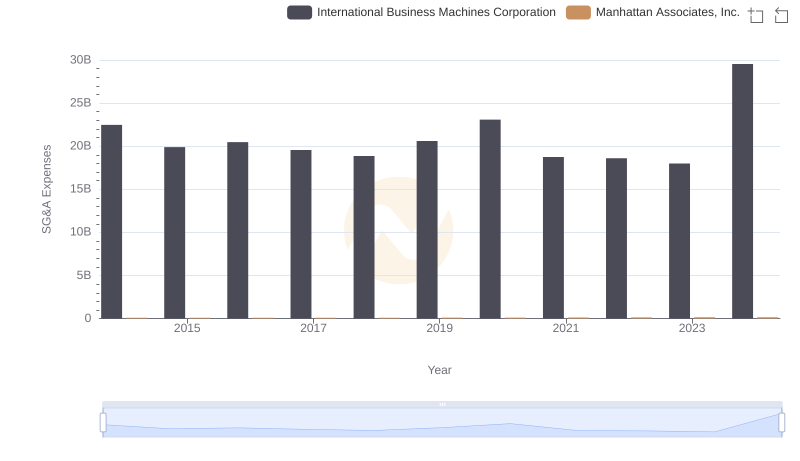

Selling, General, and Administrative Costs: International Business Machines Corporation vs Manhattan Associates, Inc.

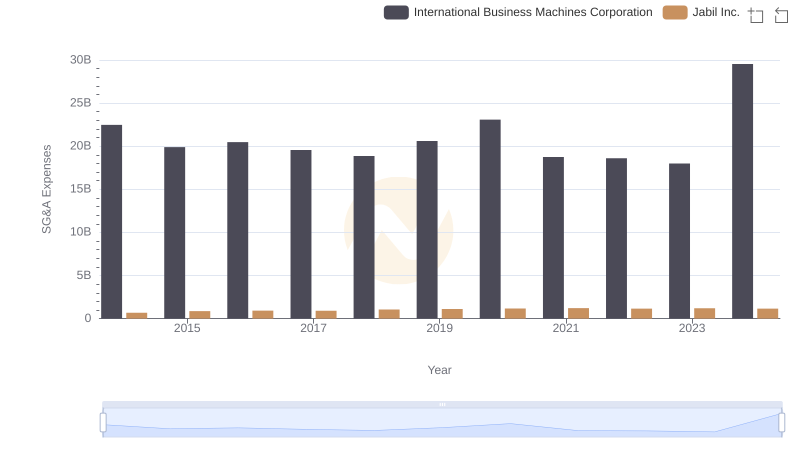

Selling, General, and Administrative Costs: International Business Machines Corporation vs Jabil Inc.