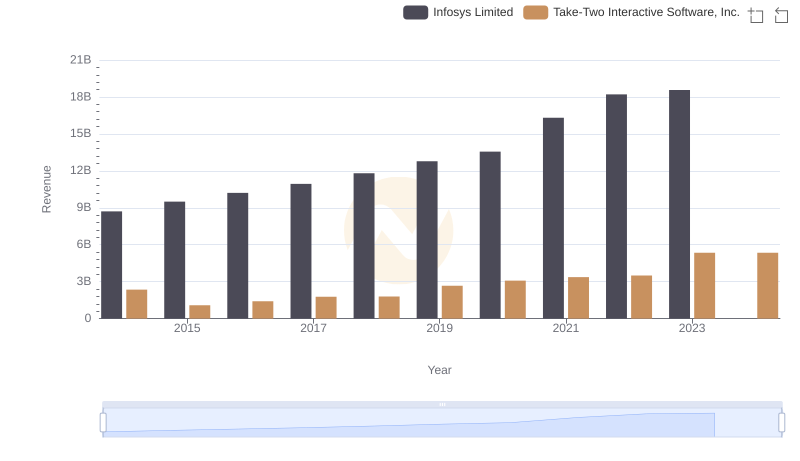

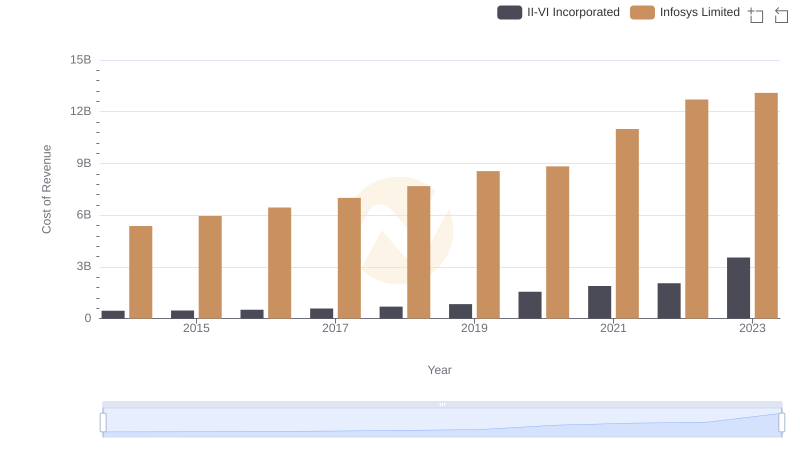

| __timestamp | Infosys Limited | Take-Two Interactive Software, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 5374000000 | 1414327000 |

| Thursday, January 1, 2015 | 5950000000 | 794867000 |

| Friday, January 1, 2016 | 6446000000 | 813873000 |

| Sunday, January 1, 2017 | 7001000000 | 1022959000 |

| Monday, January 1, 2018 | 7687000000 | 898311000 |

| Tuesday, January 1, 2019 | 8552000000 | 1523644000 |

| Wednesday, January 1, 2020 | 8828000000 | 1542450000 |

| Friday, January 1, 2021 | 10996000000 | 1535085000 |

| Saturday, January 1, 2022 | 12709000000 | 1535401000 |

| Sunday, January 1, 2023 | 13096000000 | 3064600000 |

| Monday, January 1, 2024 | 3107800000 |

Infusing magic into the data realm

In the ever-evolving landscape of global business, understanding the cost of revenue is crucial for evaluating a company's financial health. This analysis focuses on Infosys Limited, a titan in the IT services sector, and Take-Two Interactive Software, Inc., a leader in the gaming industry, from 2014 to 2023.

Infosys has shown a consistent upward trend in its cost of revenue, growing by approximately 144% over the decade. This increase reflects the company's expanding operations and investment in cutting-edge technologies.

Take-Two Interactive's cost of revenue has seen a more volatile journey, with a notable spike of nearly 100% in 2023. This surge aligns with the company's strategic acquisitions and blockbuster game releases.

Both companies illustrate the diverse strategies in managing costs, highlighting the dynamic nature of their respective industries.

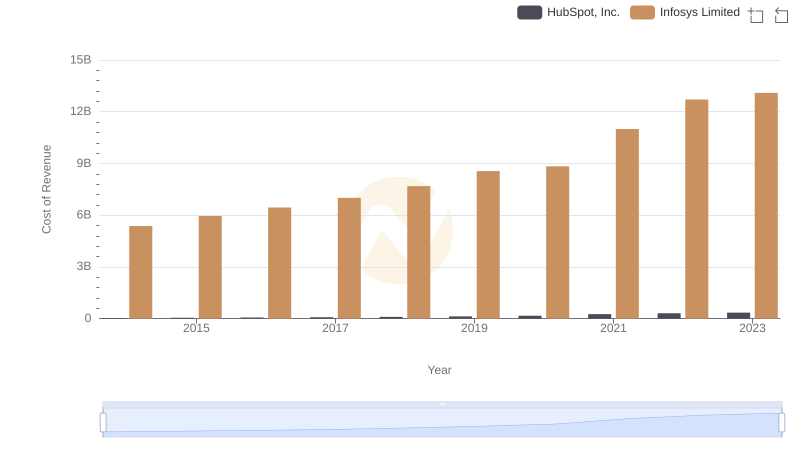

Comparing Cost of Revenue Efficiency: Infosys Limited vs HubSpot, Inc.

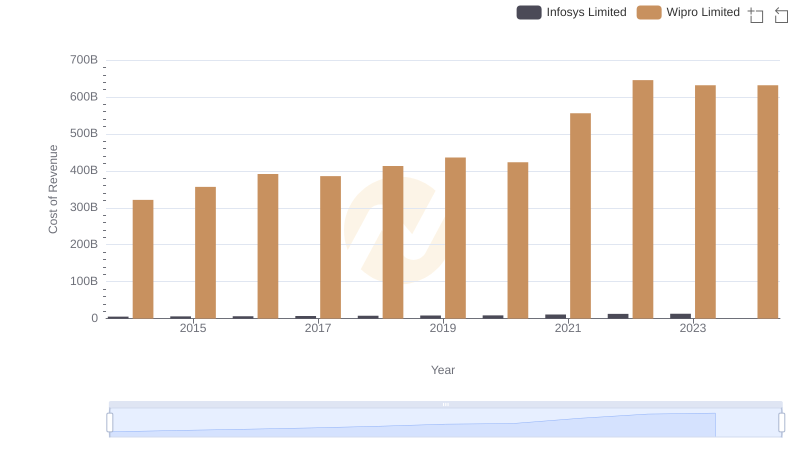

Comparing Cost of Revenue Efficiency: Infosys Limited vs Wipro Limited

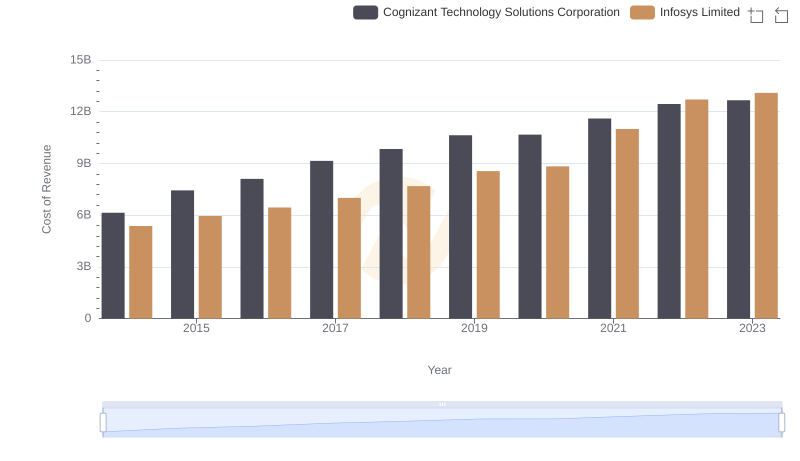

Comparing Cost of Revenue Efficiency: Infosys Limited vs Cognizant Technology Solutions Corporation

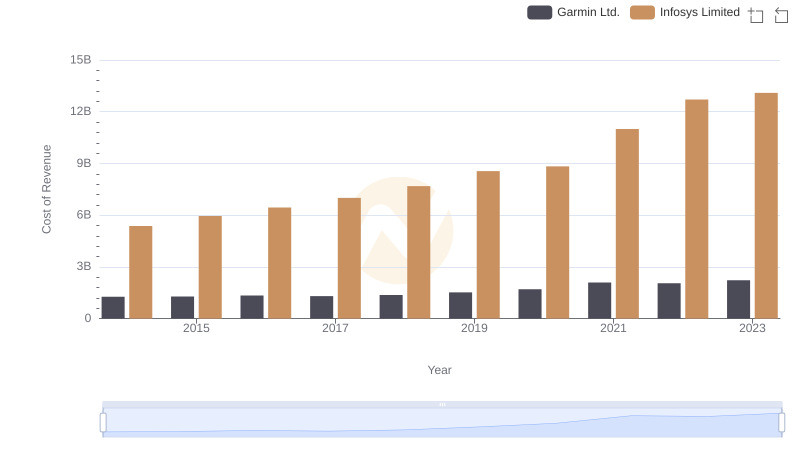

Cost of Revenue Comparison: Infosys Limited vs Garmin Ltd.

Infosys Limited vs Take-Two Interactive Software, Inc.: Examining Key Revenue Metrics

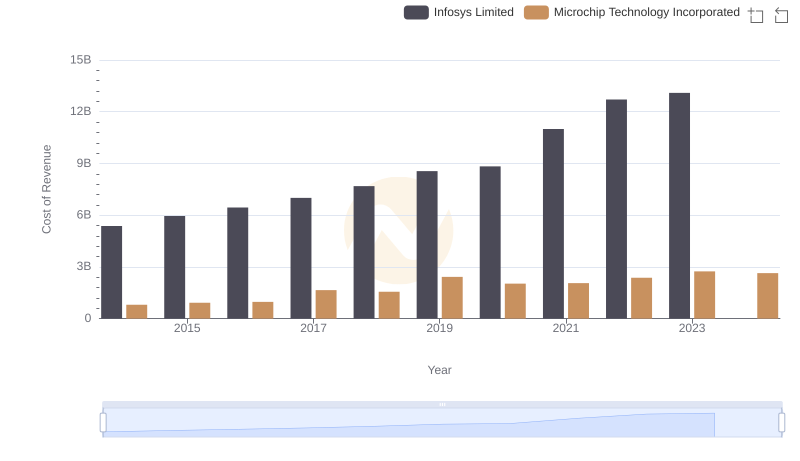

Cost Insights: Breaking Down Infosys Limited and Microchip Technology Incorporated's Expenses

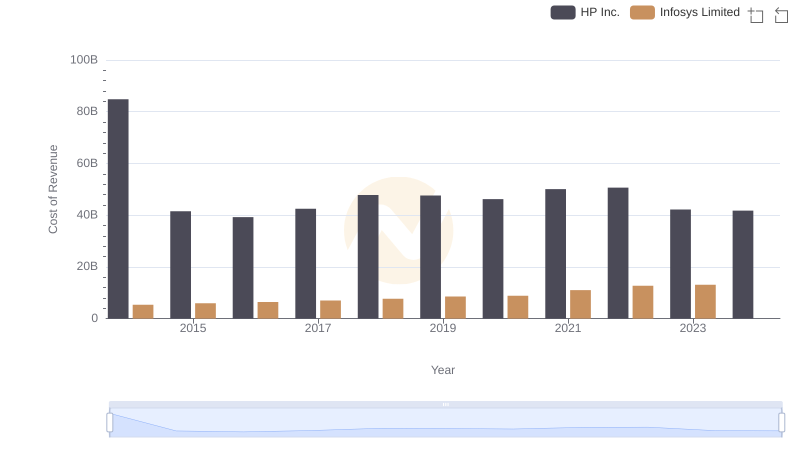

Analyzing Cost of Revenue: Infosys Limited and HP Inc.

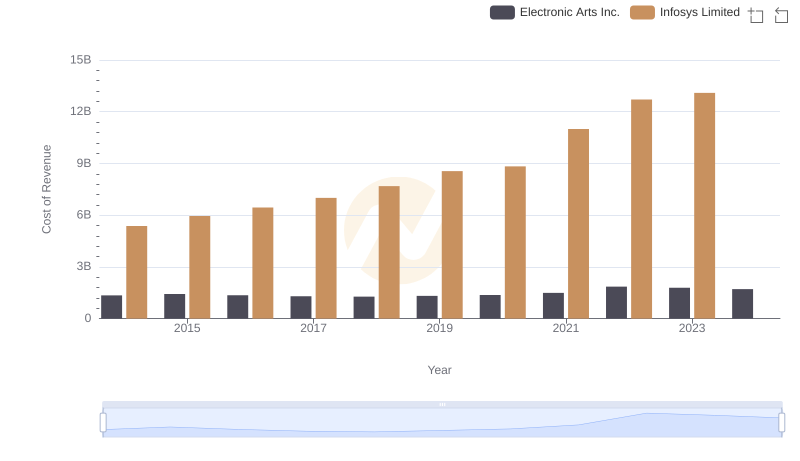

Analyzing Cost of Revenue: Infosys Limited and Electronic Arts Inc.

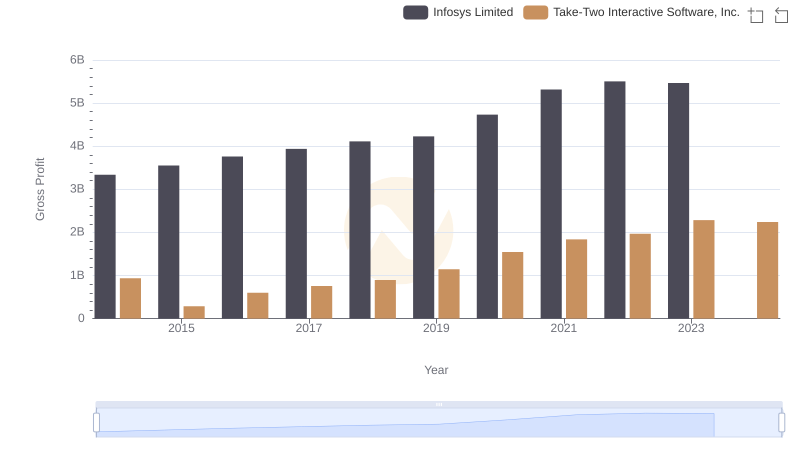

Gross Profit Trends Compared: Infosys Limited vs Take-Two Interactive Software, Inc.

Analyzing Cost of Revenue: Infosys Limited and II-VI Incorporated

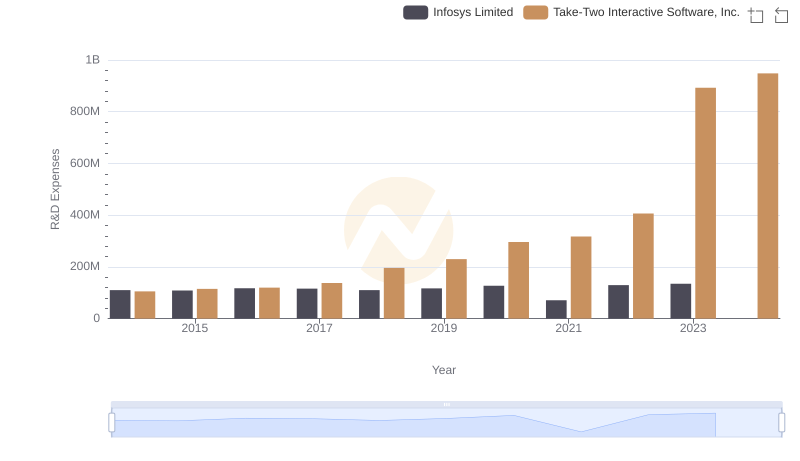

Infosys Limited or Take-Two Interactive Software, Inc.: Who Invests More in Innovation?

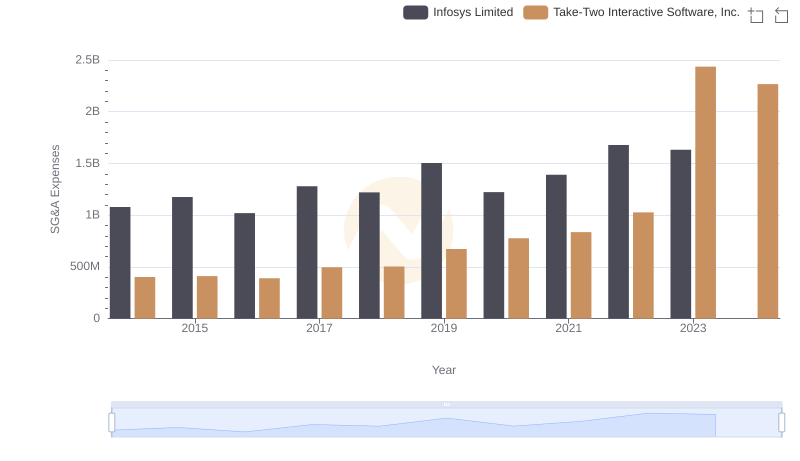

Who Optimizes SG&A Costs Better? Infosys Limited or Take-Two Interactive Software, Inc.