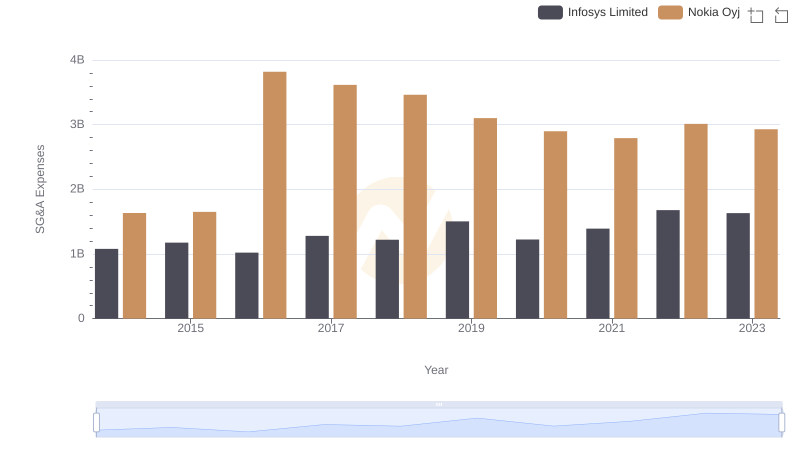

| __timestamp | Infosys Limited | NetApp, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1079000000 | 2179200000 |

| Thursday, January 1, 2015 | 1176000000 | 2197400000 |

| Friday, January 1, 2016 | 1020000000 | 2099000000 |

| Sunday, January 1, 2017 | 1279000000 | 1904000000 |

| Monday, January 1, 2018 | 1220000000 | 2009000000 |

| Tuesday, January 1, 2019 | 1504000000 | 1935000000 |

| Wednesday, January 1, 2020 | 1223000000 | 1848000000 |

| Friday, January 1, 2021 | 1391000000 | 2001000000 |

| Saturday, January 1, 2022 | 1678000000 | 2136000000 |

| Sunday, January 1, 2023 | 1632000000 | 2094000000 |

| Monday, January 1, 2024 | 2136000000 |

Data in motion

In the competitive world of technology, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. From 2014 to 2023, Infosys Limited and NetApp, Inc. have shown distinct strategies in optimizing these costs. Infosys, with a steady increase in SG&A expenses, peaked in 2022 with a 55% rise from 2014. Meanwhile, NetApp's expenses fluctuated, peaking in 2015, and then stabilizing around 2.1 billion USD in recent years. This suggests a more controlled approach, possibly reflecting strategic investments or cost-cutting measures. Notably, Infosys's expenses in 2023 slightly decreased by 3% from the previous year, indicating a potential shift towards efficiency. However, data for Infosys in 2024 is missing, leaving room for speculation. As these tech titans continue to evolve, their SG&A strategies will be pivotal in maintaining competitive edges in the global market.

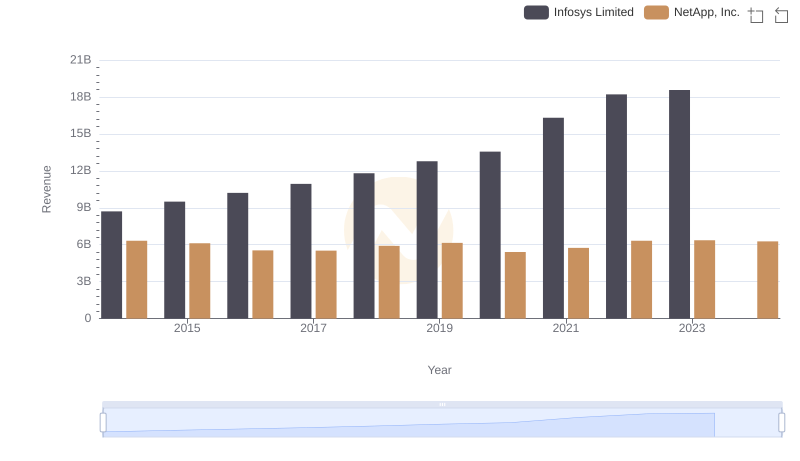

Annual Revenue Comparison: Infosys Limited vs NetApp, Inc.

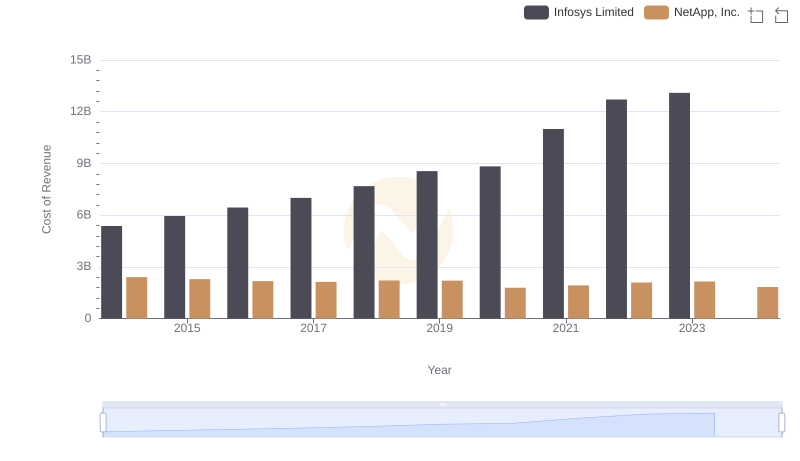

Cost of Revenue Comparison: Infosys Limited vs NetApp, Inc.

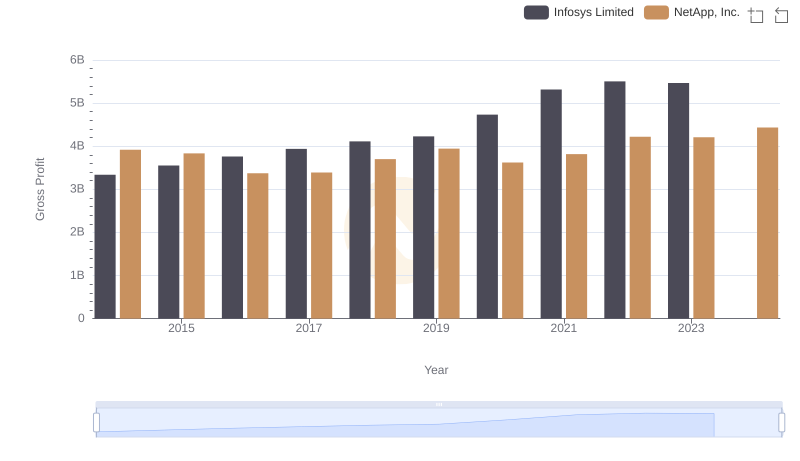

Gross Profit Analysis: Comparing Infosys Limited and NetApp, Inc.

Infosys Limited and Nokia Oyj: SG&A Spending Patterns Compared

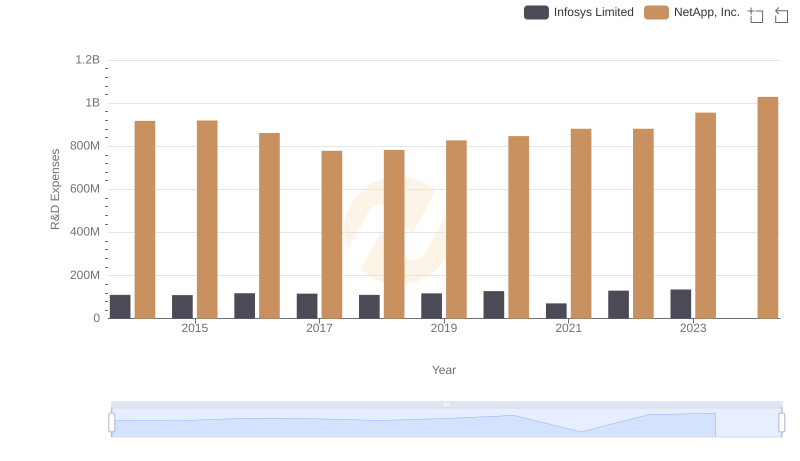

Analyzing R&D Budgets: Infosys Limited vs NetApp, Inc.

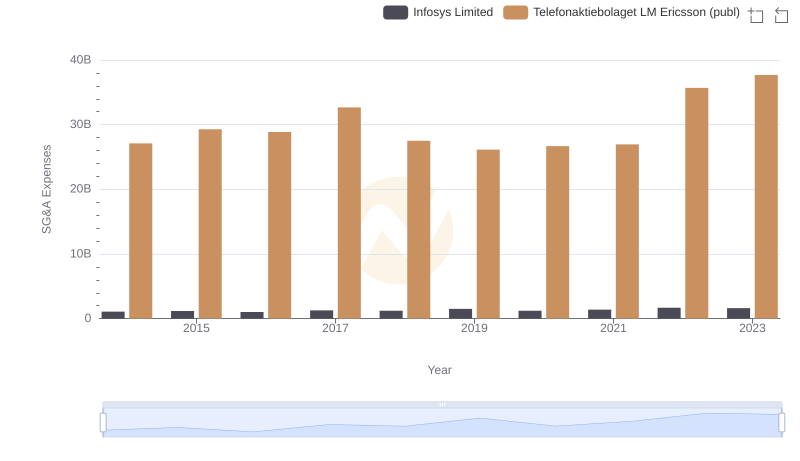

Infosys Limited or Telefonaktiebolaget LM Ericsson (publ): Who Manages SG&A Costs Better?

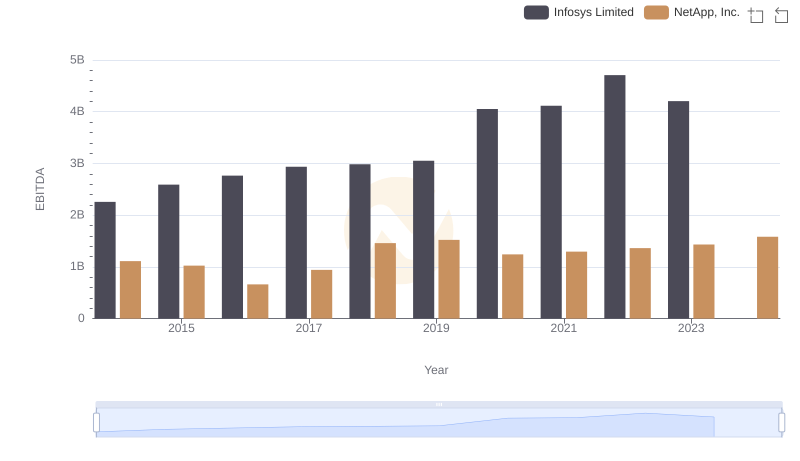

EBITDA Performance Review: Infosys Limited vs NetApp, Inc.

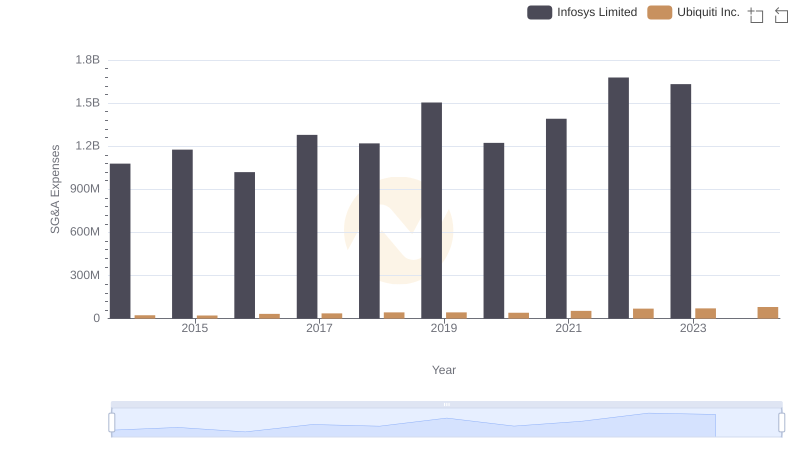

Operational Costs Compared: SG&A Analysis of Infosys Limited and Ubiquiti Inc.

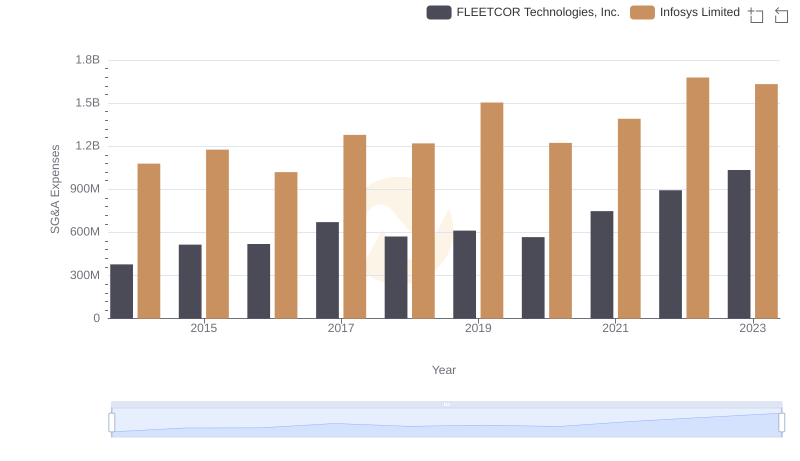

Who Optimizes SG&A Costs Better? Infosys Limited or FLEETCOR Technologies, Inc.

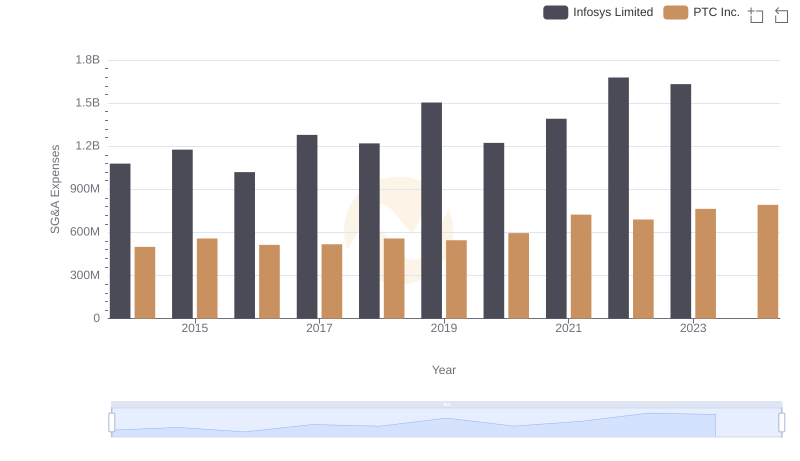

Infosys Limited or PTC Inc.: Who Manages SG&A Costs Better?

Infosys Limited and ON Semiconductor Corporation: SG&A Spending Patterns Compared

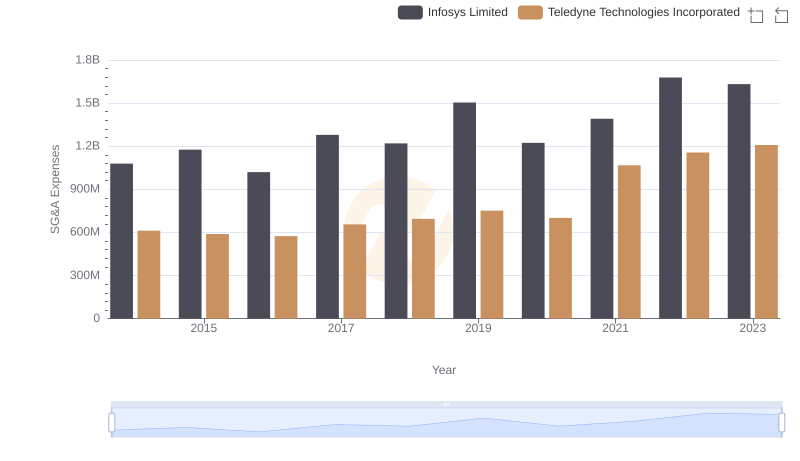

Operational Costs Compared: SG&A Analysis of Infosys Limited and Teledyne Technologies Incorporated