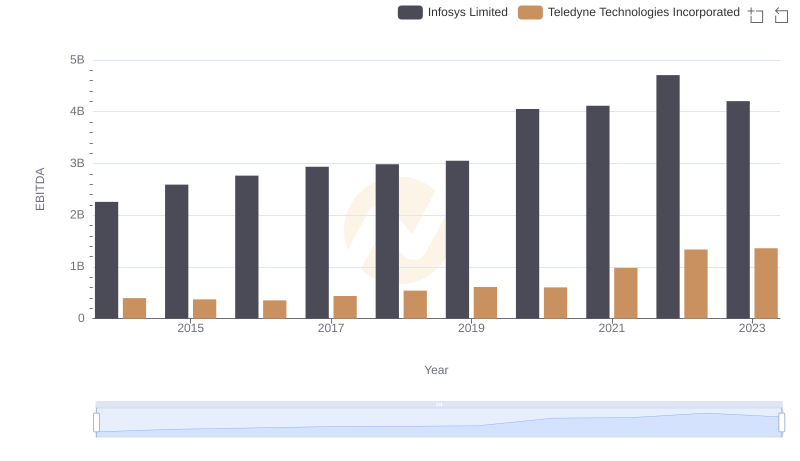

| __timestamp | Infosys Limited | Teledyne Technologies Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 1079000000 | 612400000 |

| Thursday, January 1, 2015 | 1176000000 | 588600000 |

| Friday, January 1, 2016 | 1020000000 | 574100000 |

| Sunday, January 1, 2017 | 1279000000 | 656000000 |

| Monday, January 1, 2018 | 1220000000 | 694200000 |

| Tuesday, January 1, 2019 | 1504000000 | 751600000 |

| Wednesday, January 1, 2020 | 1223000000 | 700800000 |

| Friday, January 1, 2021 | 1391000000 | 1067800000 |

| Saturday, January 1, 2022 | 1678000000 | 1156600000 |

| Sunday, January 1, 2023 | 1632000000 | 1208300000 |

In pursuit of knowledge

In the ever-evolving landscape of global business, operational efficiency is paramount. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry giants: Infosys Limited and Teledyne Technologies Incorporated, from 2014 to 2023.

Over the past decade, Infosys has consistently outpaced Teledyne in SG&A expenses, reflecting its expansive operational scale. In 2023, Infosys's SG&A expenses were approximately 35% higher than Teledyne's, highlighting its significant investment in administrative and sales functions. Notably, Infosys's expenses surged by 55% from 2014 to 2023, indicating robust growth and strategic investments.

Conversely, Teledyne's expenses grew by nearly 97% over the same period, showcasing its aggressive expansion and adaptation strategies. The year 2021 marked a pivotal point for Teledyne, with a 52% increase in SG&A expenses compared to 2020, underscoring its commitment to scaling operations.

This comparative analysis offers a window into the strategic priorities and growth trajectories of these two influential companies.

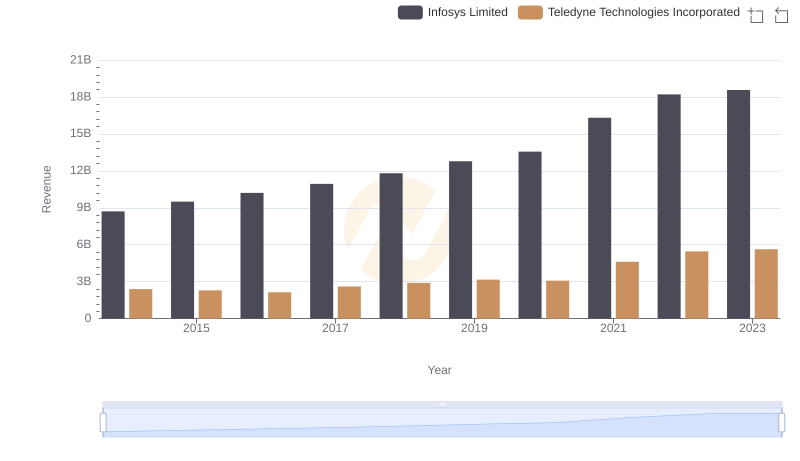

Revenue Showdown: Infosys Limited vs Teledyne Technologies Incorporated

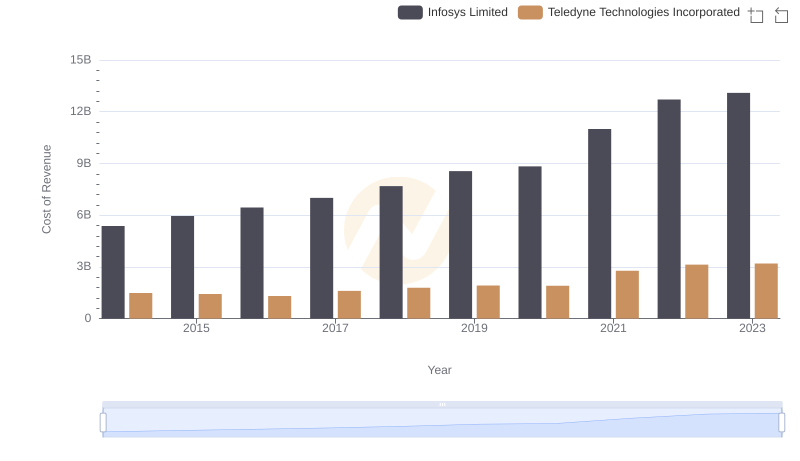

Infosys Limited vs Teledyne Technologies Incorporated: Efficiency in Cost of Revenue Explored

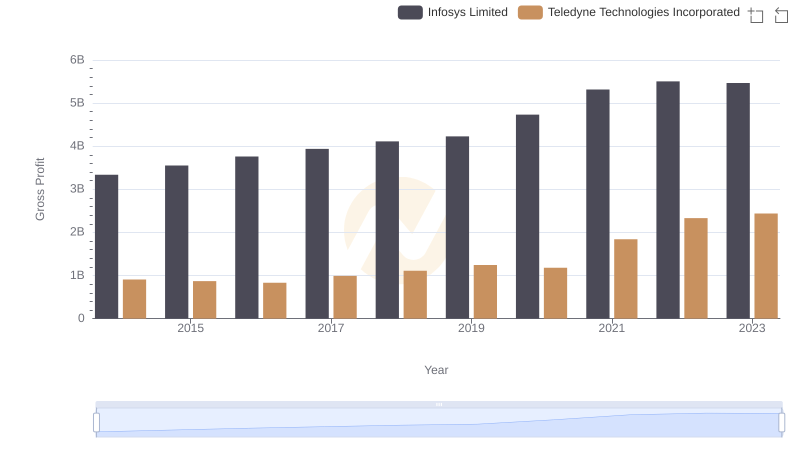

Gross Profit Comparison: Infosys Limited and Teledyne Technologies Incorporated Trends

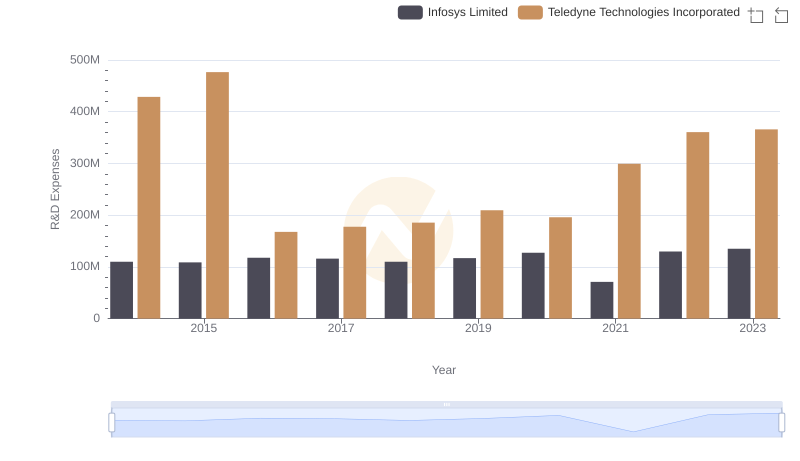

Analyzing R&D Budgets: Infosys Limited vs Teledyne Technologies Incorporated

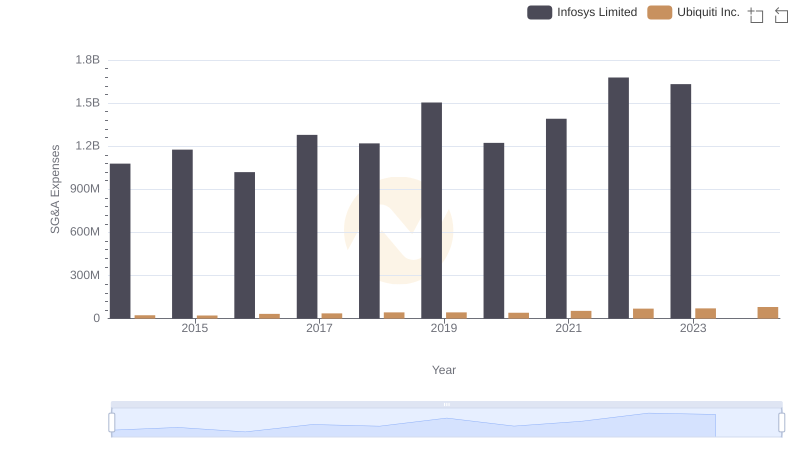

Operational Costs Compared: SG&A Analysis of Infosys Limited and Ubiquiti Inc.

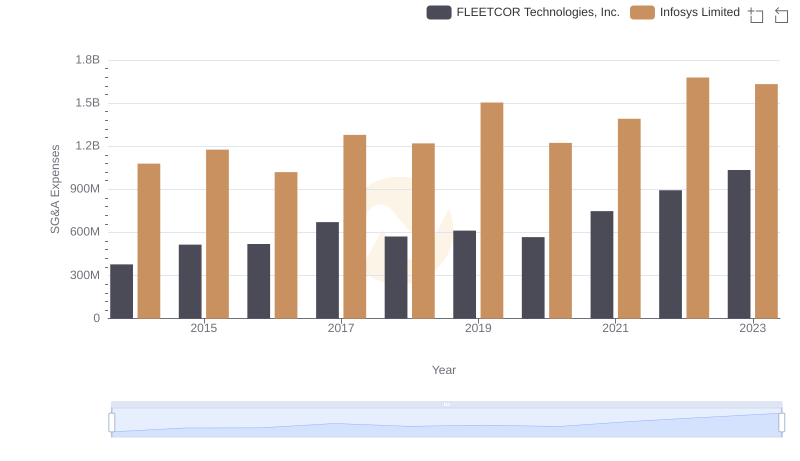

Who Optimizes SG&A Costs Better? Infosys Limited or FLEETCOR Technologies, Inc.

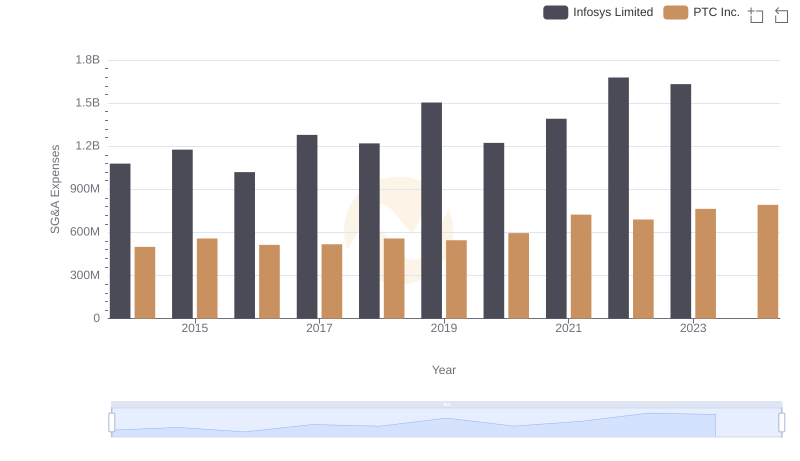

Infosys Limited or PTC Inc.: Who Manages SG&A Costs Better?

Infosys Limited and ON Semiconductor Corporation: SG&A Spending Patterns Compared

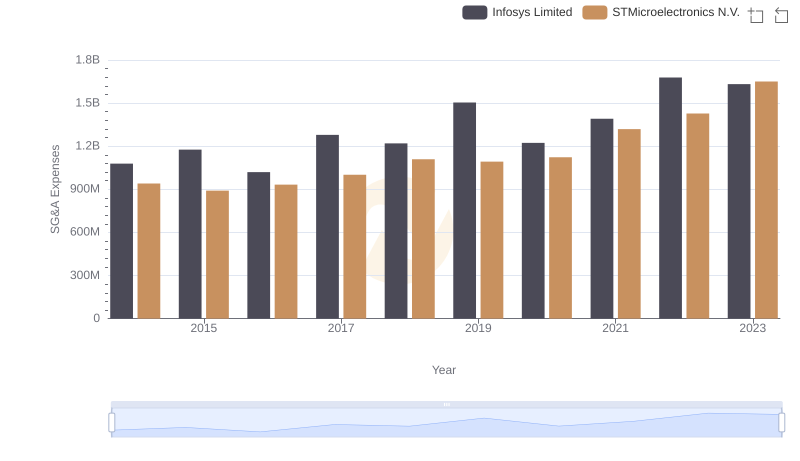

Infosys Limited or STMicroelectronics N.V.: Who Manages SG&A Costs Better?

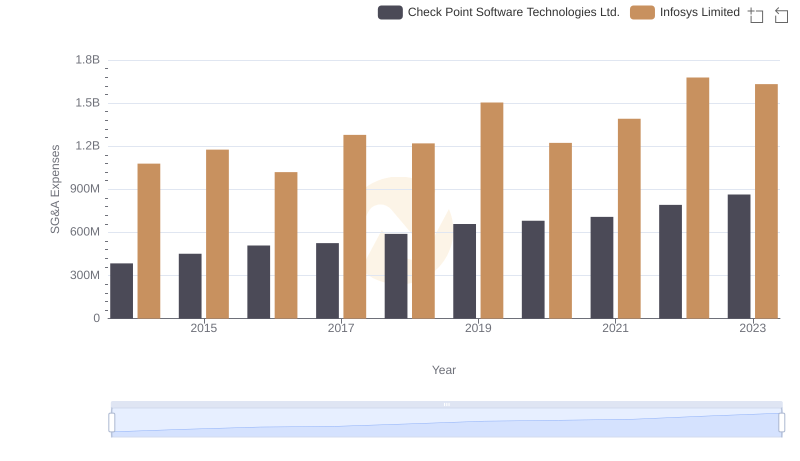

Who Optimizes SG&A Costs Better? Infosys Limited or Check Point Software Technologies Ltd.

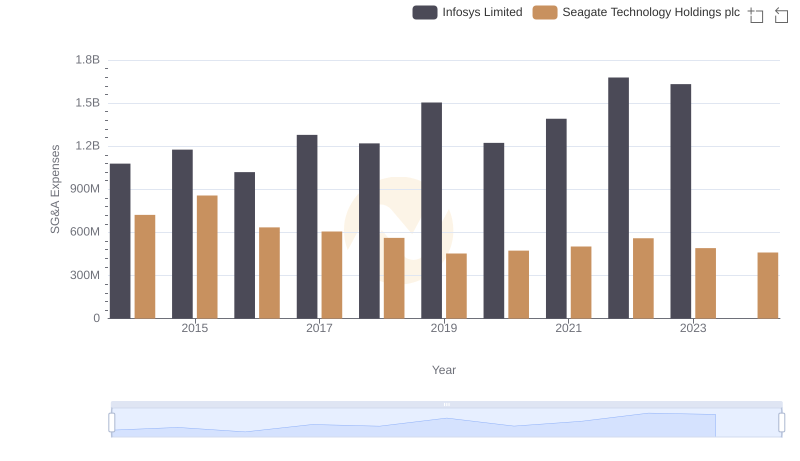

Infosys Limited or Seagate Technology Holdings plc: Who Manages SG&A Costs Better?

EBITDA Performance Review: Infosys Limited vs Teledyne Technologies Incorporated