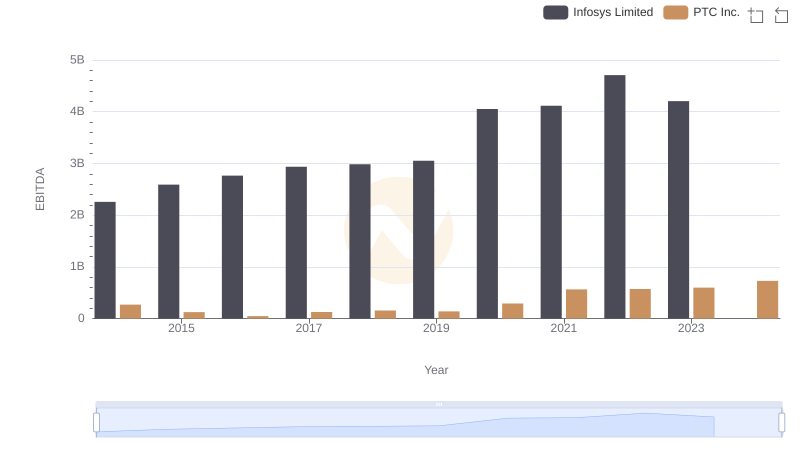

| __timestamp | Infosys Limited | PTC Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1079000000 | 499679000 |

| Thursday, January 1, 2015 | 1176000000 | 557301000 |

| Friday, January 1, 2016 | 1020000000 | 513080000 |

| Sunday, January 1, 2017 | 1279000000 | 518013000 |

| Monday, January 1, 2018 | 1220000000 | 557505000 |

| Tuesday, January 1, 2019 | 1504000000 | 545368000 |

| Wednesday, January 1, 2020 | 1223000000 | 595277000 |

| Friday, January 1, 2021 | 1391000000 | 723785000 |

| Saturday, January 1, 2022 | 1678000000 | 689979000 |

| Sunday, January 1, 2023 | 1632000000 | 763641000 |

| Monday, January 1, 2024 | 791331000 |

Unleashing insights

In the competitive landscape of global business, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. From 2014 to 2023, Infosys Limited and PTC Inc. have shown distinct strategies in handling these costs. Infosys, a leader in IT services, has seen its SG&A expenses grow by approximately 51% over the decade, peaking in 2022. Meanwhile, PTC Inc., a prominent software company, has managed a steadier increase of around 58%, with a notable rise in 2023. Despite Infosys's higher absolute expenses, PTC's consistent growth suggests a strategic investment in operational efficiency. Missing data for Infosys in 2024 indicates a potential shift or reevaluation in their cost management strategy. As businesses navigate economic uncertainties, understanding these trends offers valuable insights into corporate financial health and strategic planning.

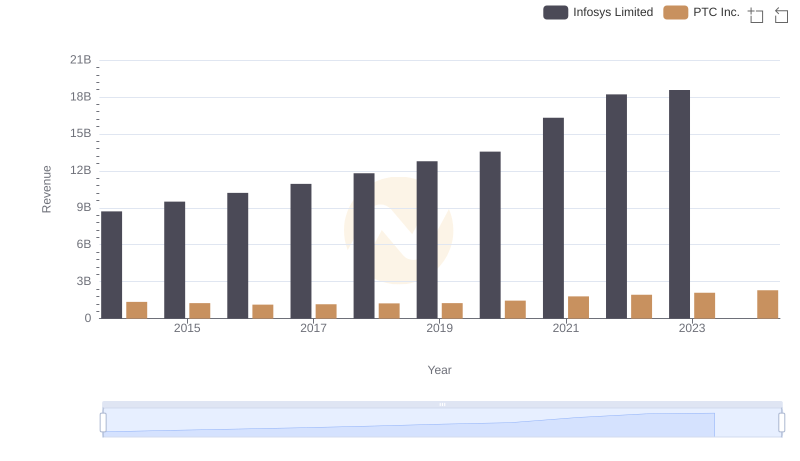

Who Generates More Revenue? Infosys Limited or PTC Inc.

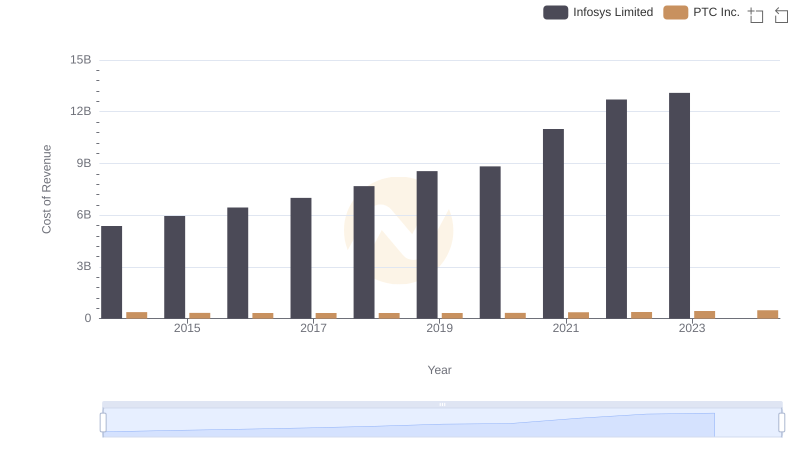

Cost of Revenue Comparison: Infosys Limited vs PTC Inc.

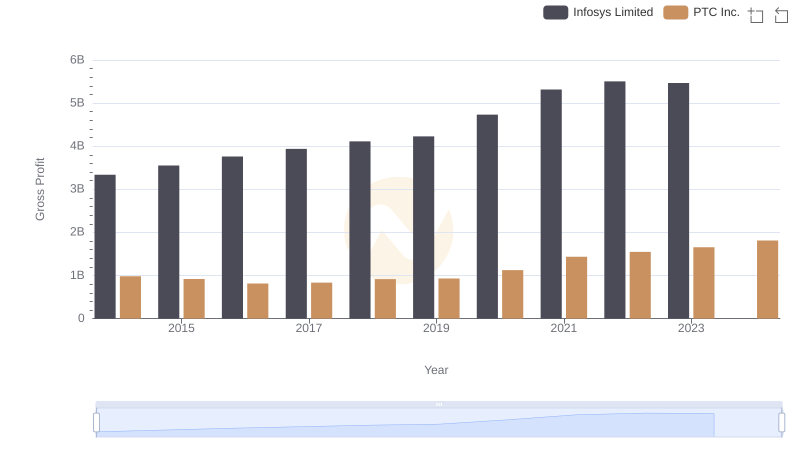

Infosys Limited vs PTC Inc.: A Gross Profit Performance Breakdown

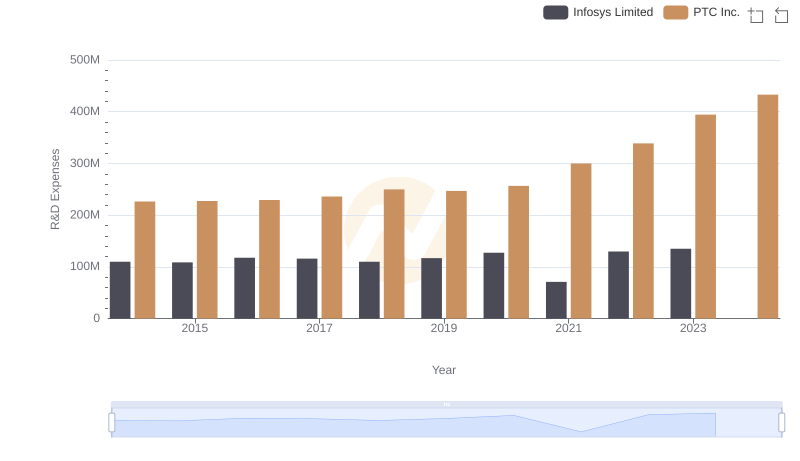

Research and Development: Comparing Key Metrics for Infosys Limited and PTC Inc.

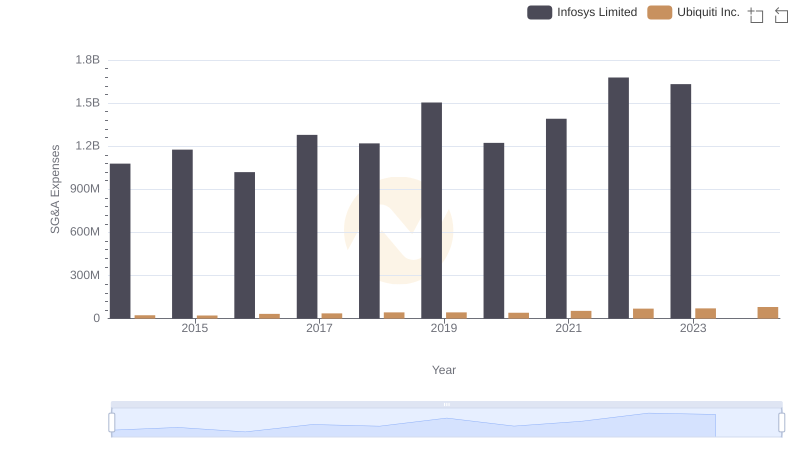

Operational Costs Compared: SG&A Analysis of Infosys Limited and Ubiquiti Inc.

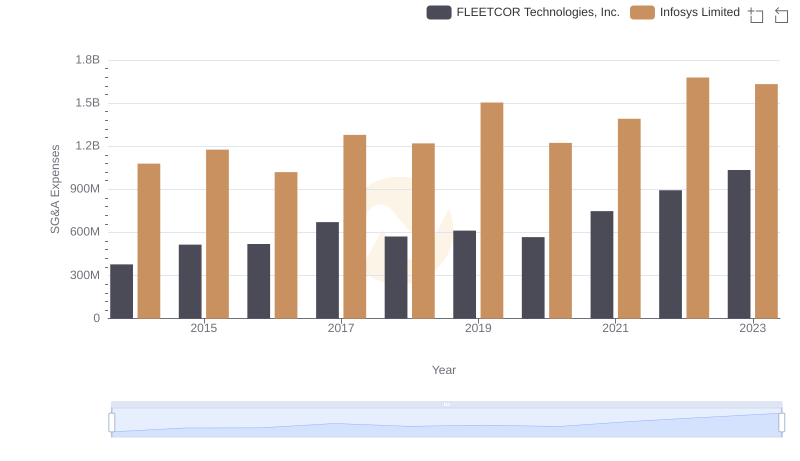

Who Optimizes SG&A Costs Better? Infosys Limited or FLEETCOR Technologies, Inc.

Infosys Limited and ON Semiconductor Corporation: SG&A Spending Patterns Compared

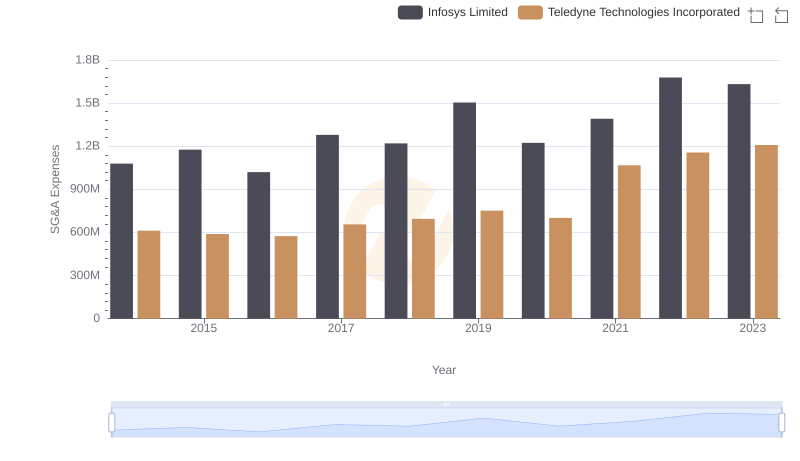

Operational Costs Compared: SG&A Analysis of Infosys Limited and Teledyne Technologies Incorporated

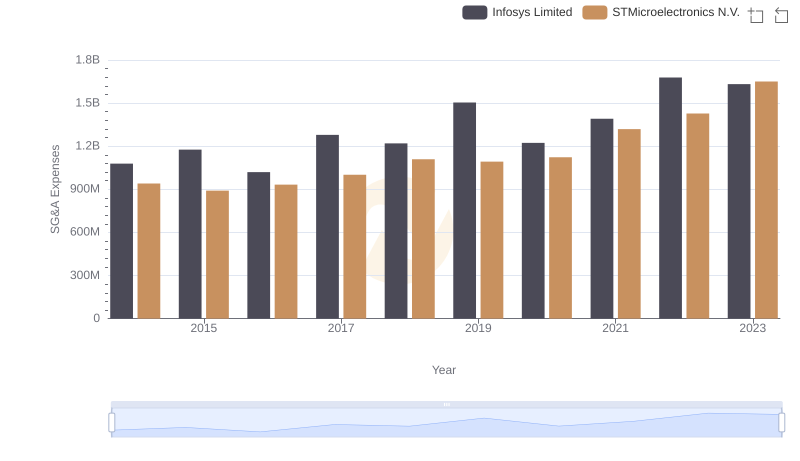

Infosys Limited or STMicroelectronics N.V.: Who Manages SG&A Costs Better?

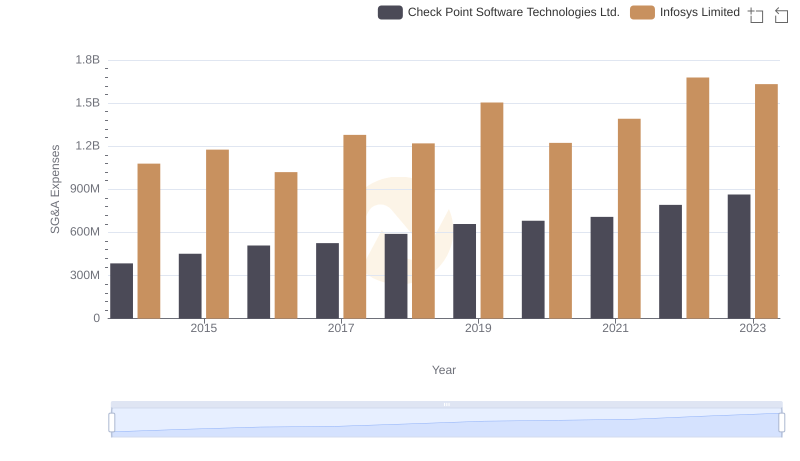

Who Optimizes SG&A Costs Better? Infosys Limited or Check Point Software Technologies Ltd.

A Side-by-Side Analysis of EBITDA: Infosys Limited and PTC Inc.

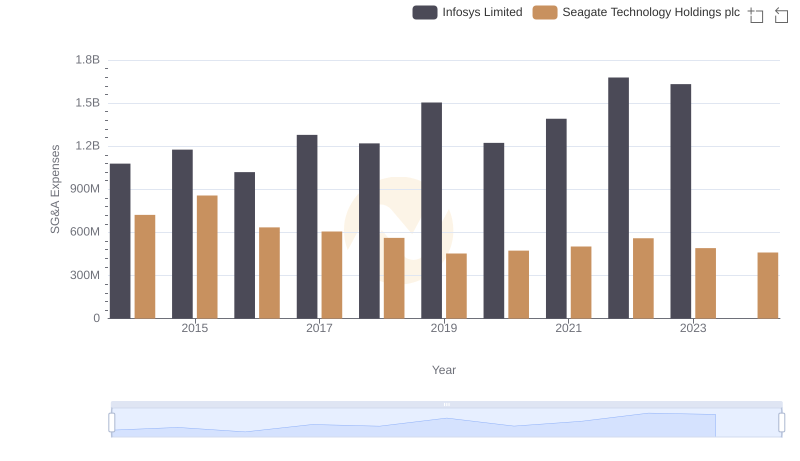

Infosys Limited or Seagate Technology Holdings plc: Who Manages SG&A Costs Better?