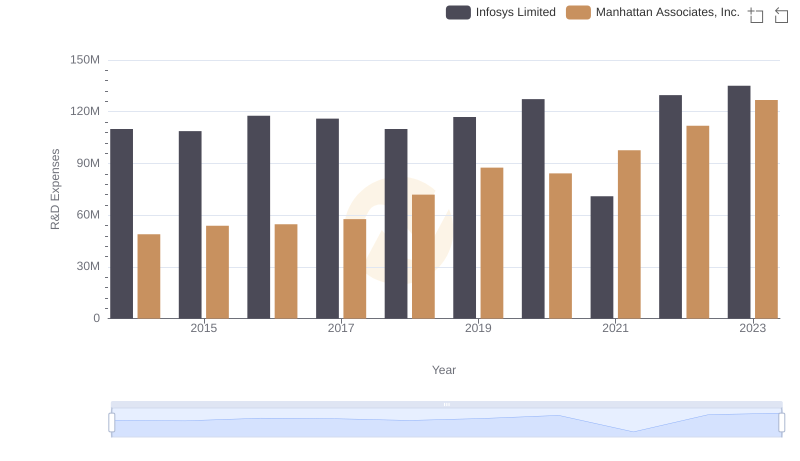

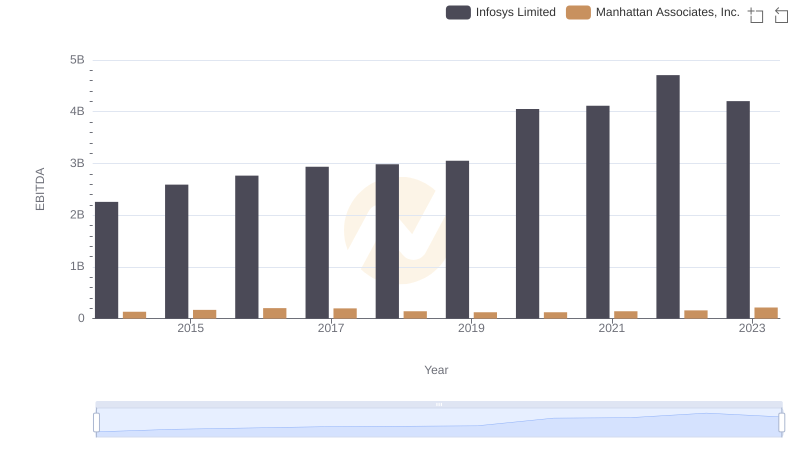

| __timestamp | Infosys Limited | Manhattan Associates, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1079000000 | 97072000 |

| Thursday, January 1, 2015 | 1176000000 | 97874000 |

| Friday, January 1, 2016 | 1020000000 | 96545000 |

| Sunday, January 1, 2017 | 1279000000 | 93536000 |

| Monday, January 1, 2018 | 1220000000 | 103880000 |

| Tuesday, January 1, 2019 | 1504000000 | 121463000 |

| Wednesday, January 1, 2020 | 1223000000 | 109202000 |

| Friday, January 1, 2021 | 1391000000 | 125941000 |

| Saturday, January 1, 2022 | 1678000000 | 137607000 |

| Sunday, January 1, 2023 | 1632000000 | 155664000 |

| Monday, January 1, 2024 | 165786000 |

Unveiling the hidden dimensions of data

In the competitive world of technology, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Infosys Limited and Manhattan Associates, Inc. have been at the forefront of this challenge since 2014. Over the past decade, Infosys has seen its SG&A expenses grow by approximately 51%, peaking in 2022. In contrast, Manhattan Associates has managed a more modest increase of around 71% over the same period, with a notable rise in 2023.

While Infosys's expenses are significantly higher, reflecting its larger scale, Manhattan Associates demonstrates a consistent upward trend, suggesting strategic investments in growth. The data for 2024 is incomplete, but the trends indicate a continued focus on optimizing costs. This analysis provides valuable insights into how these tech giants balance growth and efficiency in a dynamic market.

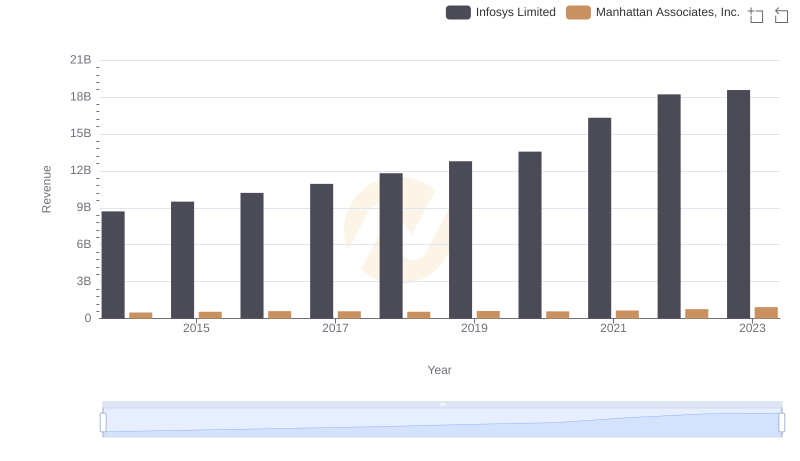

Annual Revenue Comparison: Infosys Limited vs Manhattan Associates, Inc.

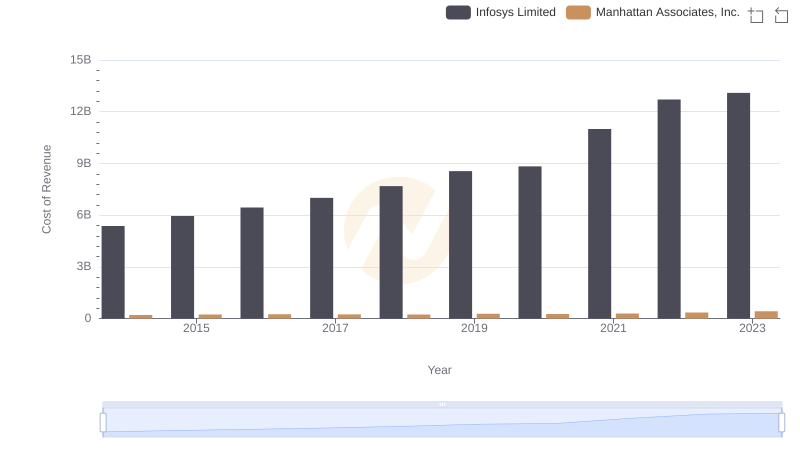

Cost of Revenue Trends: Infosys Limited vs Manhattan Associates, Inc.

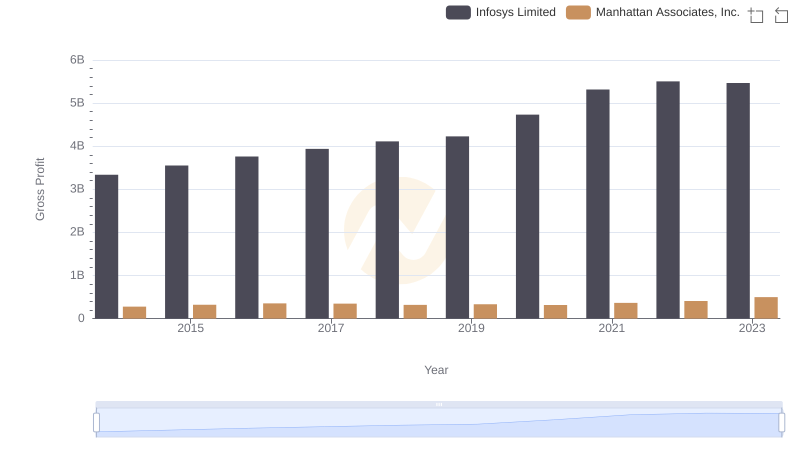

Who Generates Higher Gross Profit? Infosys Limited or Manhattan Associates, Inc.

Breaking Down SG&A Expenses: Infosys Limited vs Teradyne, Inc.

Who Prioritizes Innovation? R&D Spending Compared for Infosys Limited and Manhattan Associates, Inc.

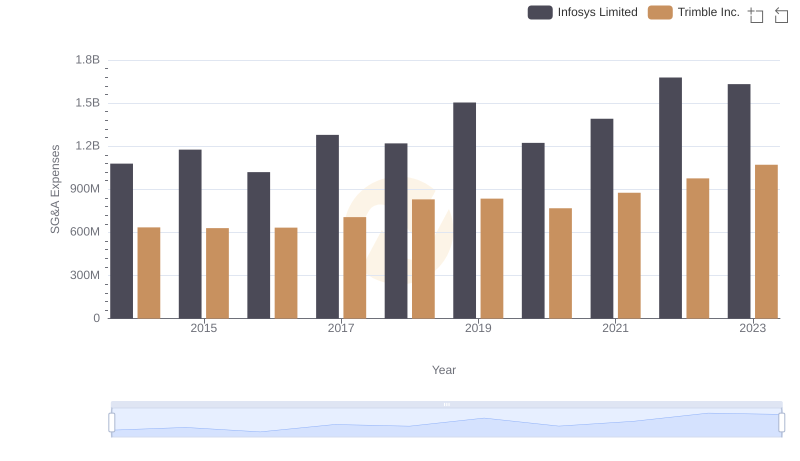

SG&A Efficiency Analysis: Comparing Infosys Limited and Trimble Inc.

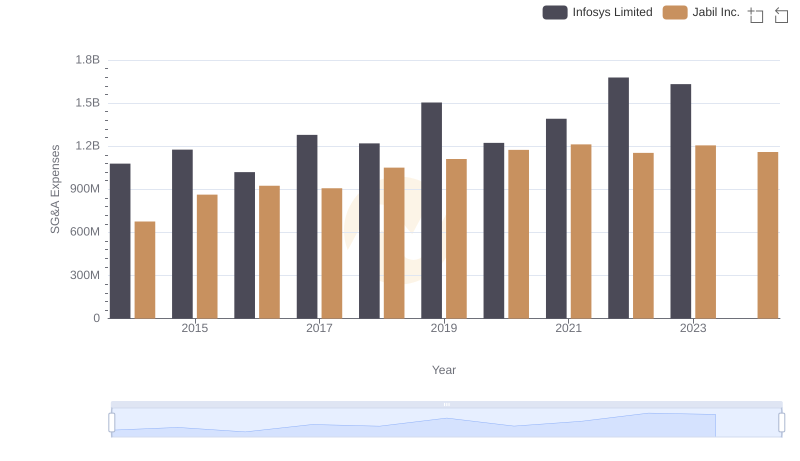

Infosys Limited and Jabil Inc.: SG&A Spending Patterns Compared

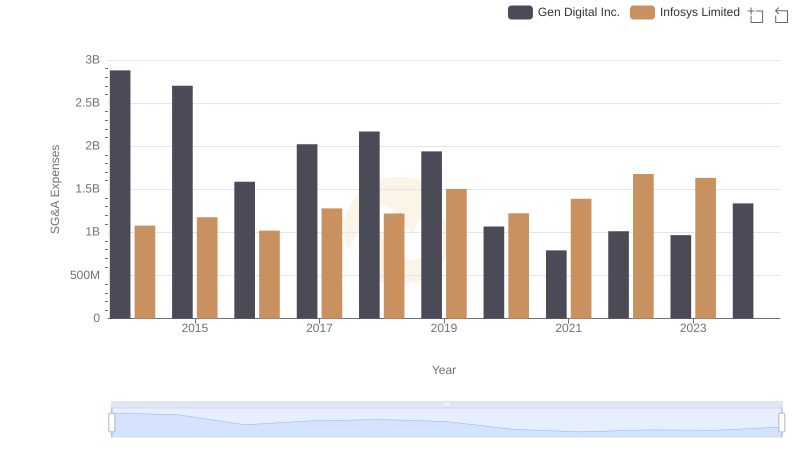

Who Optimizes SG&A Costs Better? Infosys Limited or Gen Digital Inc.

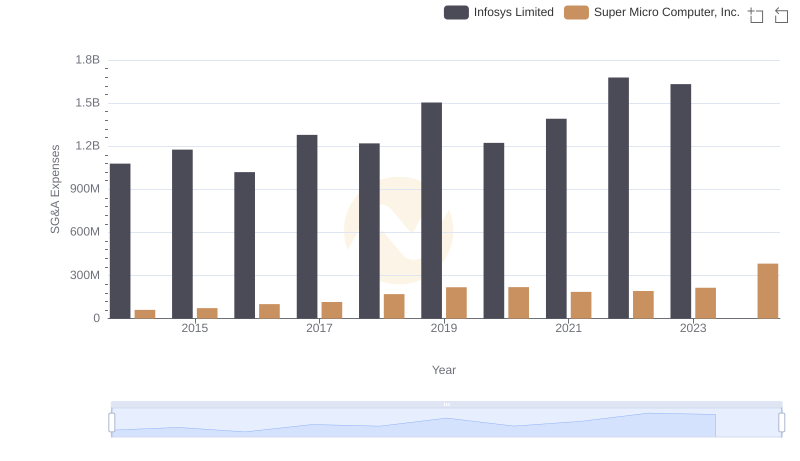

Breaking Down SG&A Expenses: Infosys Limited vs Super Micro Computer, Inc.

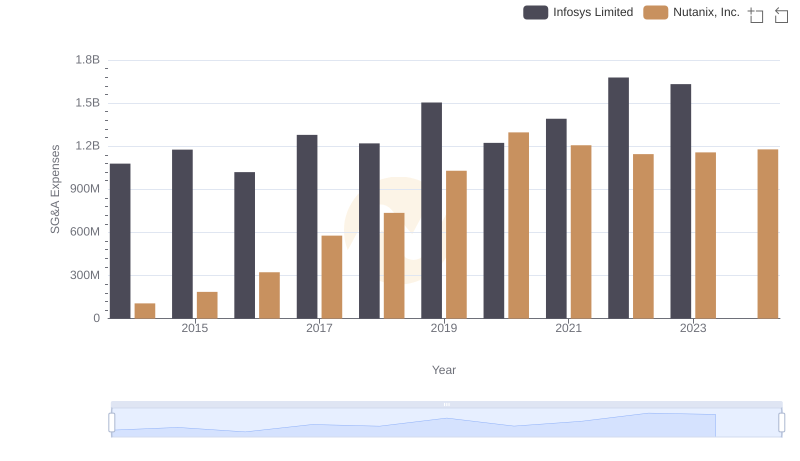

Comparing SG&A Expenses: Infosys Limited vs Nutanix, Inc. Trends and Insights

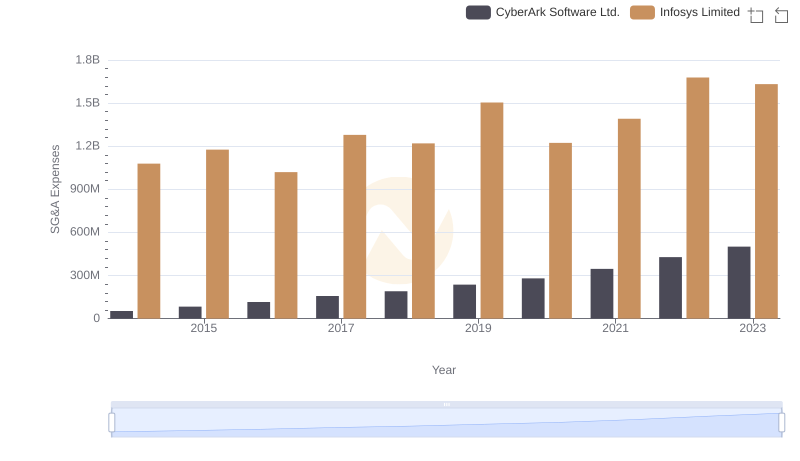

Breaking Down SG&A Expenses: Infosys Limited vs CyberArk Software Ltd.

Comprehensive EBITDA Comparison: Infosys Limited vs Manhattan Associates, Inc.