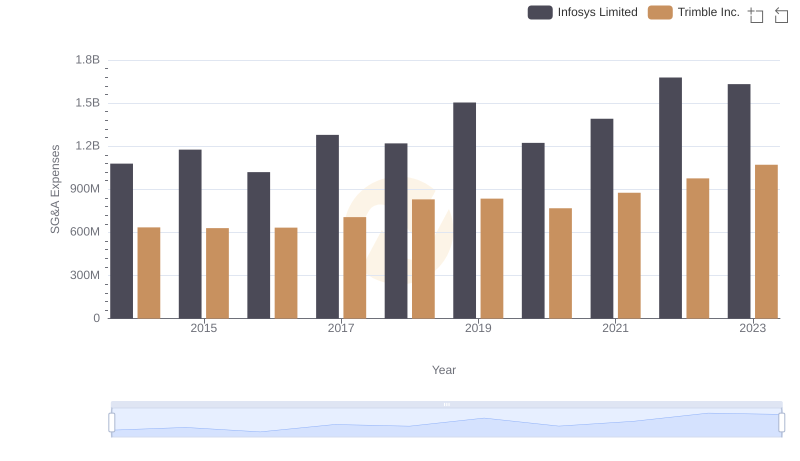

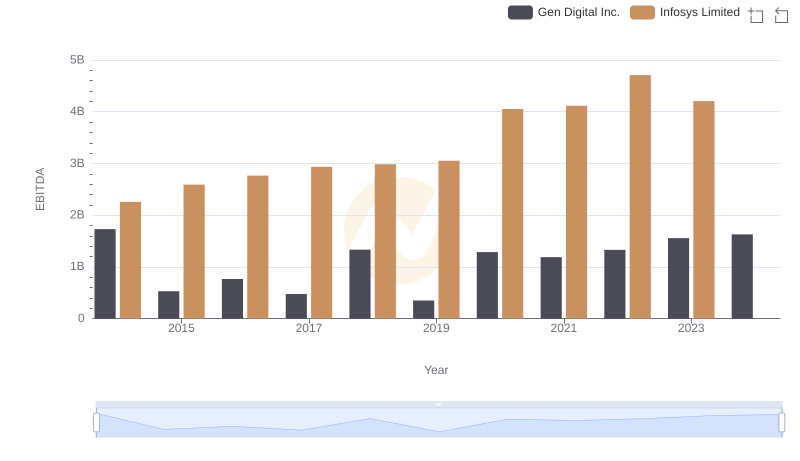

| __timestamp | Gen Digital Inc. | Infosys Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 2880000000 | 1079000000 |

| Thursday, January 1, 2015 | 2702000000 | 1176000000 |

| Friday, January 1, 2016 | 1587000000 | 1020000000 |

| Sunday, January 1, 2017 | 2023000000 | 1279000000 |

| Monday, January 1, 2018 | 2171000000 | 1220000000 |

| Tuesday, January 1, 2019 | 1940000000 | 1504000000 |

| Wednesday, January 1, 2020 | 1069000000 | 1223000000 |

| Friday, January 1, 2021 | 791000000 | 1391000000 |

| Saturday, January 1, 2022 | 1014000000 | 1678000000 |

| Sunday, January 1, 2023 | 968000000 | 1632000000 |

| Monday, January 1, 2024 | 1337000000 |

Unlocking the unknown

In the competitive world of global business, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. This analysis compares the SG&A cost optimization strategies of two industry leaders: Infosys Limited and Gen Digital Inc., from 2014 to 2023.

Gen Digital Inc. has shown a remarkable reduction in SG&A expenses, decreasing by approximately 67% from 2014 to 2023. This strategic cost management reflects their commitment to operational efficiency. In contrast, Infosys Limited has experienced a steady increase in SG&A expenses, rising by about 51% over the same period. This could indicate a strategic investment in growth and expansion.

While Gen Digital Inc. has successfully trimmed costs, Infosys Limited's rising expenses suggest a focus on scaling operations. The absence of data for Infosys in 2024 leaves room for speculation on their future strategy. As these companies continue to evolve, their approaches to SG&A cost management will be pivotal in shaping their competitive edge.

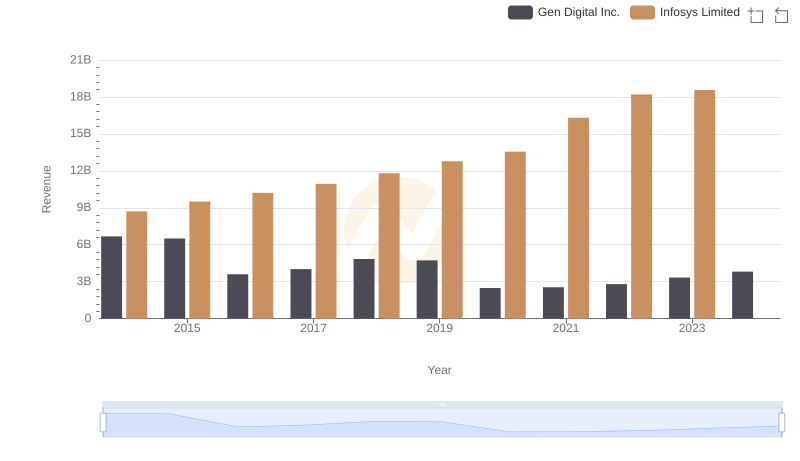

Annual Revenue Comparison: Infosys Limited vs Gen Digital Inc.

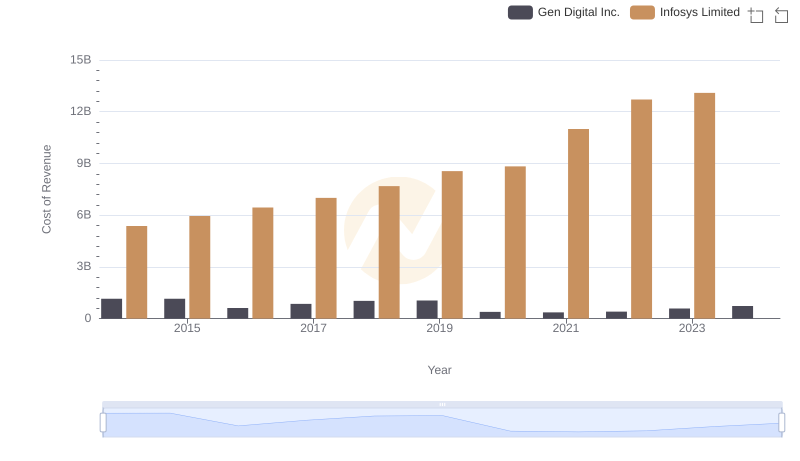

Cost of Revenue Trends: Infosys Limited vs Gen Digital Inc.

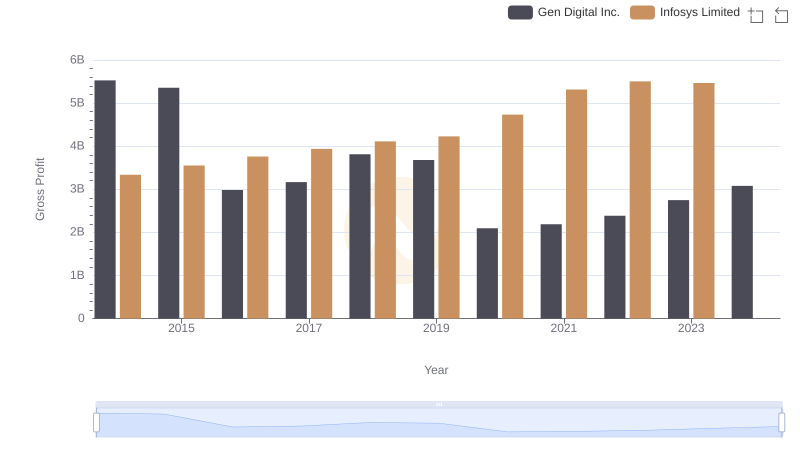

Infosys Limited vs Gen Digital Inc.: A Gross Profit Performance Breakdown

SG&A Efficiency Analysis: Comparing Infosys Limited and Trimble Inc.

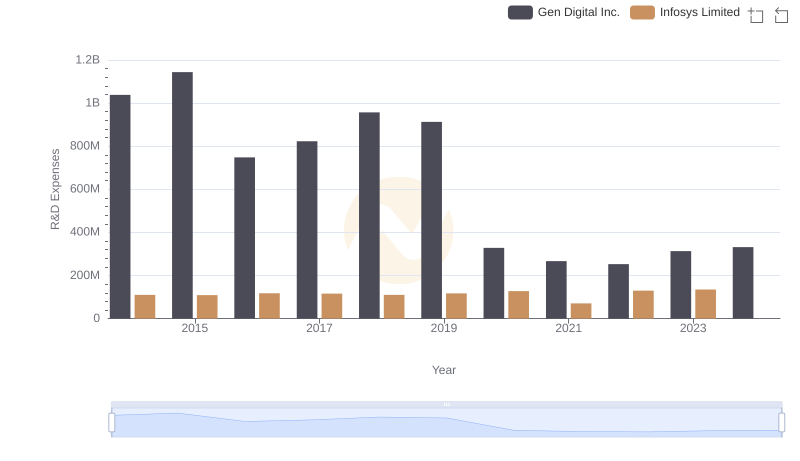

Comparing Innovation Spending: Infosys Limited and Gen Digital Inc.

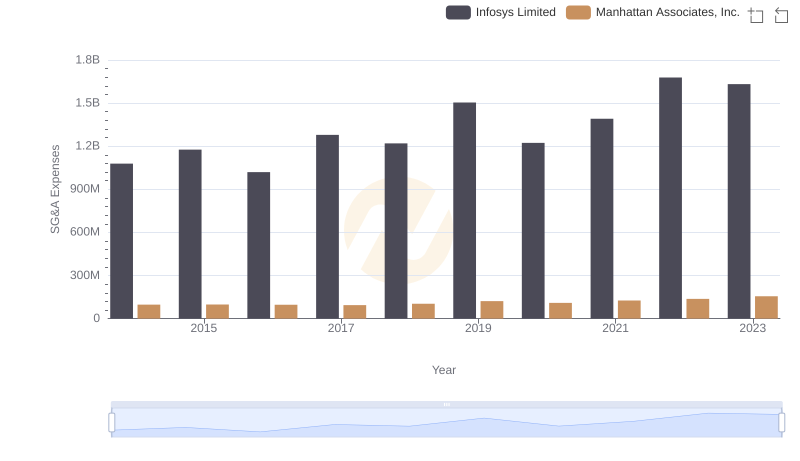

Who Optimizes SG&A Costs Better? Infosys Limited or Manhattan Associates, Inc.

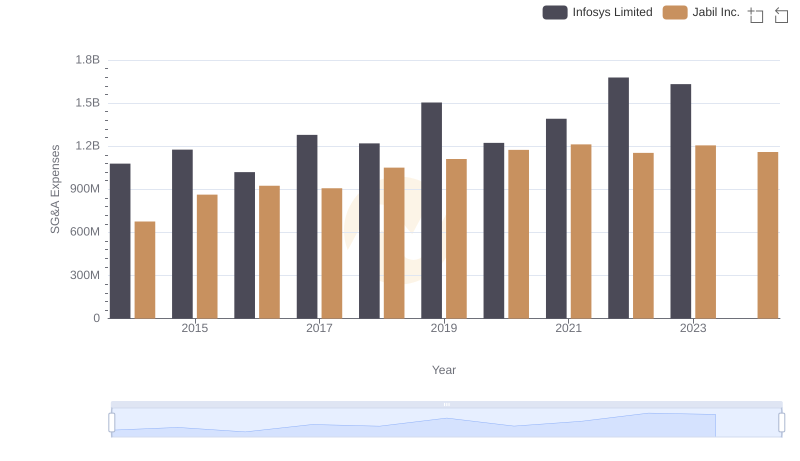

Infosys Limited and Jabil Inc.: SG&A Spending Patterns Compared

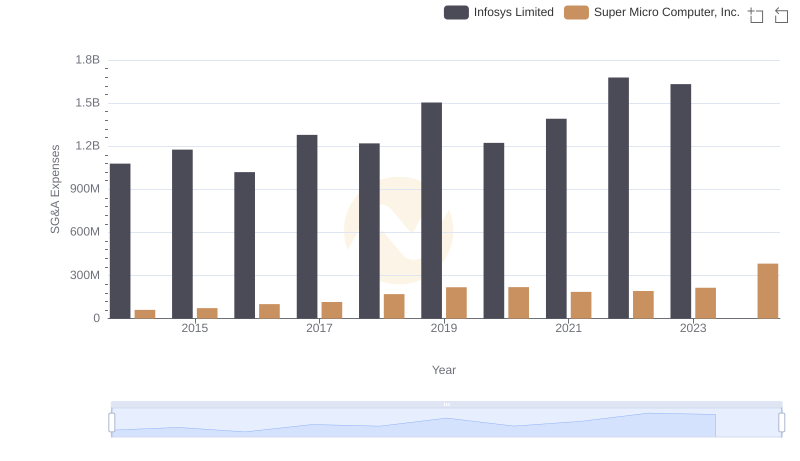

Breaking Down SG&A Expenses: Infosys Limited vs Super Micro Computer, Inc.

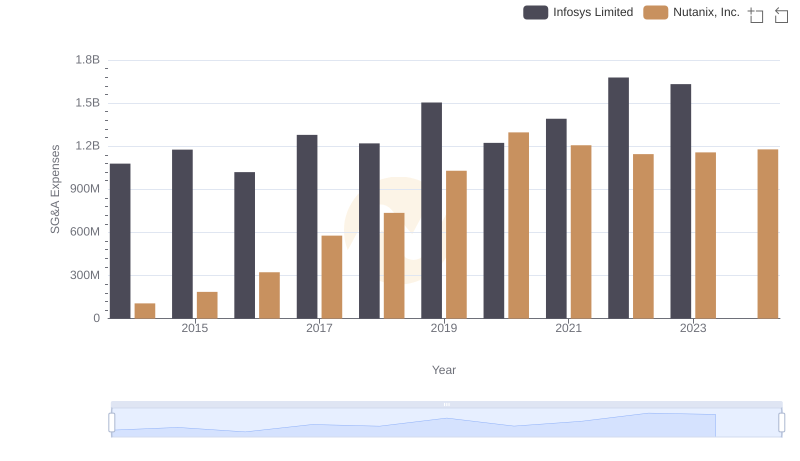

Comparing SG&A Expenses: Infosys Limited vs Nutanix, Inc. Trends and Insights

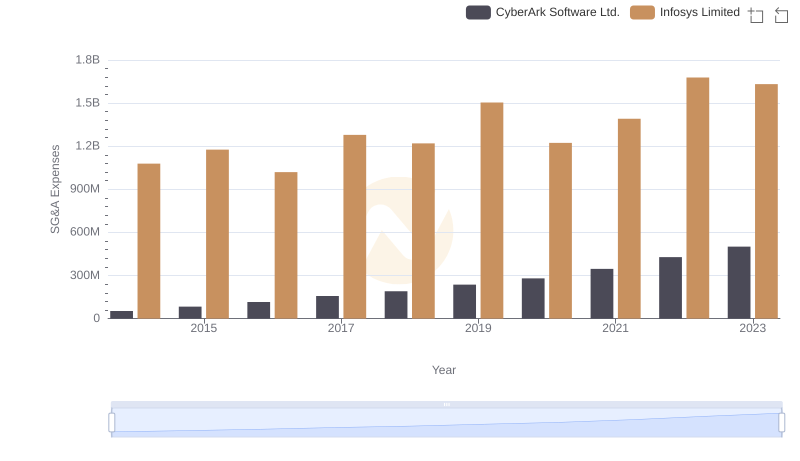

Breaking Down SG&A Expenses: Infosys Limited vs CyberArk Software Ltd.

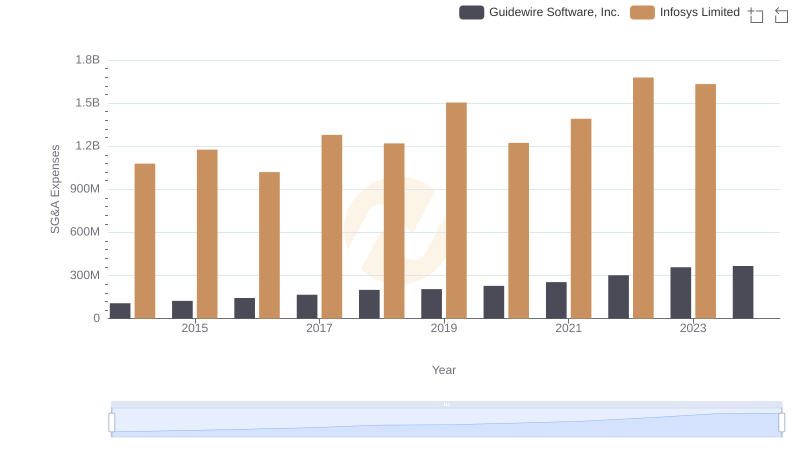

Selling, General, and Administrative Costs: Infosys Limited vs Guidewire Software, Inc.

A Side-by-Side Analysis of EBITDA: Infosys Limited and Gen Digital Inc.