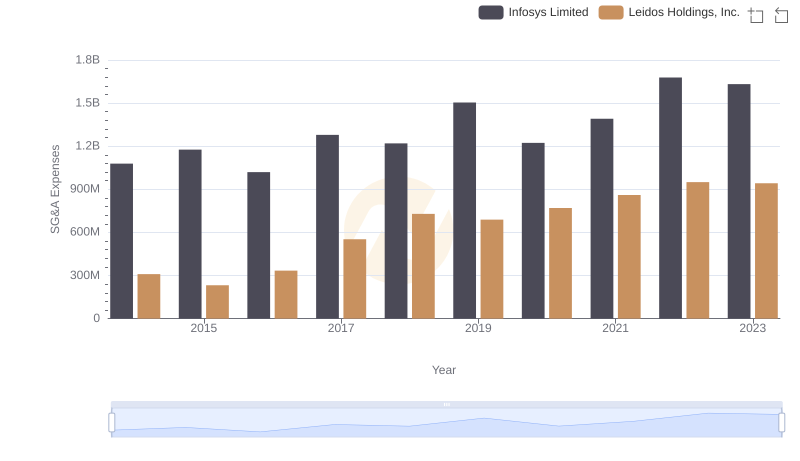

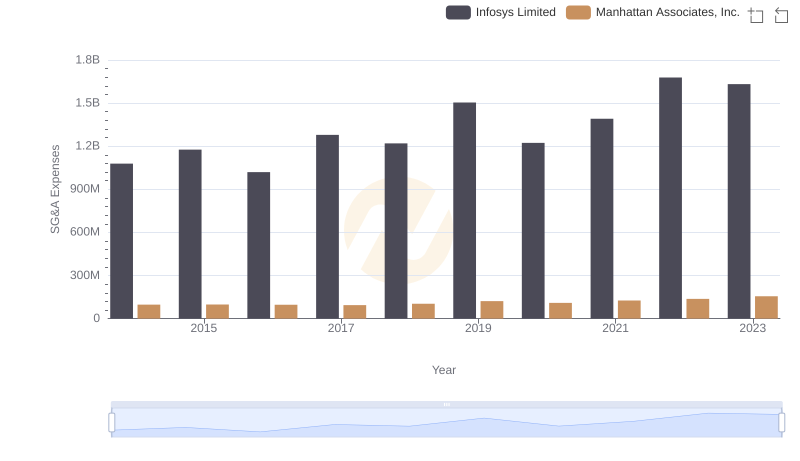

| __timestamp | Infosys Limited | Teradyne, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1079000000 | 319713000 |

| Thursday, January 1, 2015 | 1176000000 | 306313000 |

| Friday, January 1, 2016 | 1020000000 | 315682000 |

| Sunday, January 1, 2017 | 1279000000 | 348287000 |

| Monday, January 1, 2018 | 1220000000 | 390669000 |

| Tuesday, January 1, 2019 | 1504000000 | 437083000 |

| Wednesday, January 1, 2020 | 1223000000 | 464769000 |

| Friday, January 1, 2021 | 1391000000 | 547559000 |

| Saturday, January 1, 2022 | 1678000000 | 558103000 |

| Sunday, January 1, 2023 | 1632000000 | 571426000 |

| Monday, January 1, 2024 | 0 |

Infusing magic into the data realm

In the ever-evolving landscape of global business, understanding the financial strategies of industry leaders is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two prominent companies: Infosys Limited and Teradyne, Inc., from 2014 to 2023.

Infosys Limited, a titan in the IT services sector, has consistently allocated a significant portion of its revenue to SG&A expenses, peaking at approximately 1.68 billion USD in 2022. This represents a 55% increase from 2014, reflecting its strategic investments in global expansion and innovation. In contrast, Teradyne, Inc., a leader in the semiconductor industry, has seen its SG&A expenses grow by 79% over the same period, reaching around 571 million USD in 2023. This growth underscores Teradyne's commitment to enhancing its market presence and operational efficiency.

These insights reveal the distinct financial strategies employed by each company, offering a window into their competitive positioning and future growth trajectories.

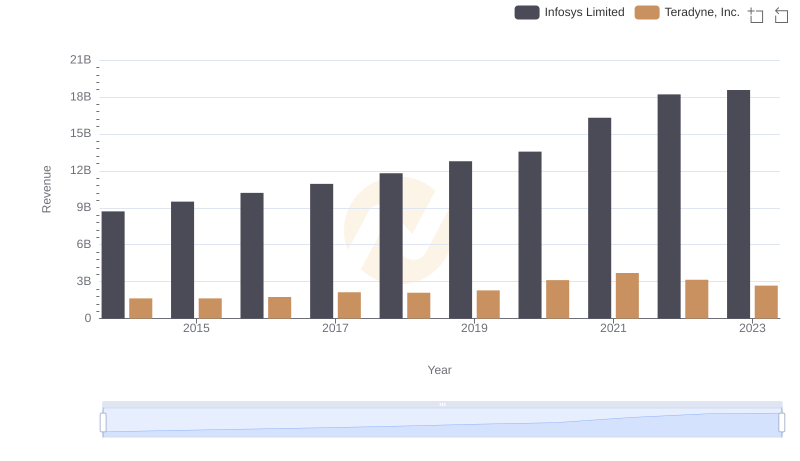

Who Generates More Revenue? Infosys Limited or Teradyne, Inc.

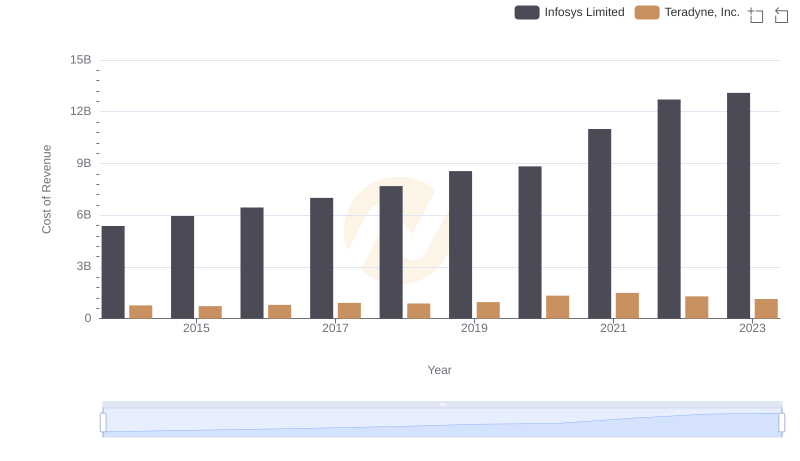

Analyzing Cost of Revenue: Infosys Limited and Teradyne, Inc.

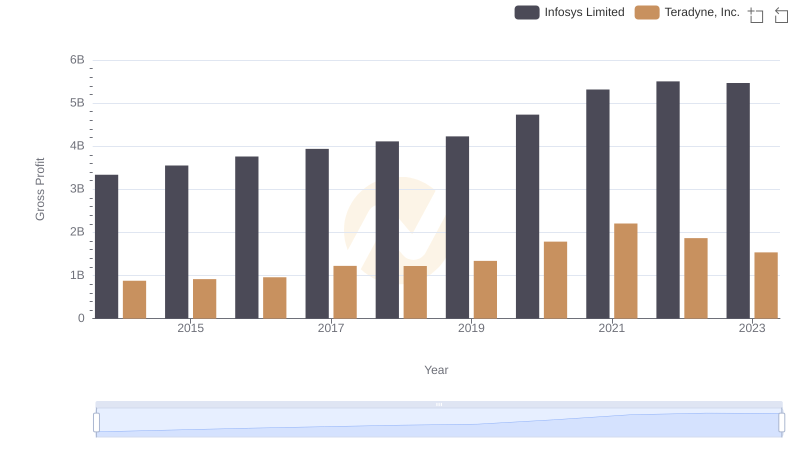

Infosys Limited vs Teradyne, Inc.: A Gross Profit Performance Breakdown

SG&A Efficiency Analysis: Comparing Infosys Limited and Leidos Holdings, Inc.

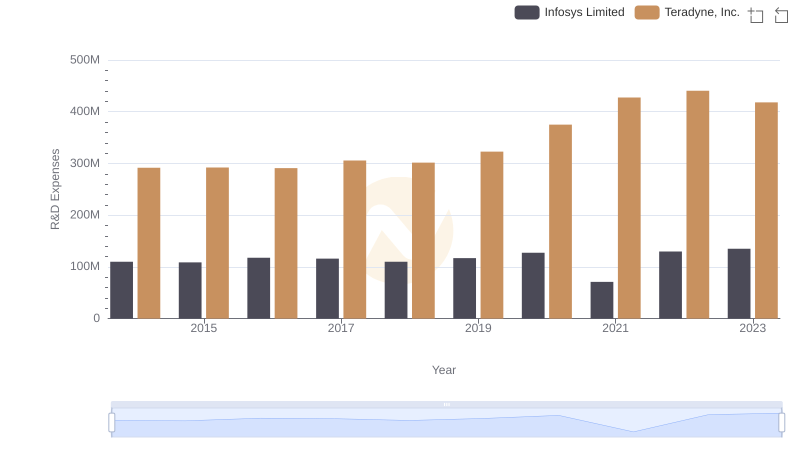

Who Prioritizes Innovation? R&D Spending Compared for Infosys Limited and Teradyne, Inc.

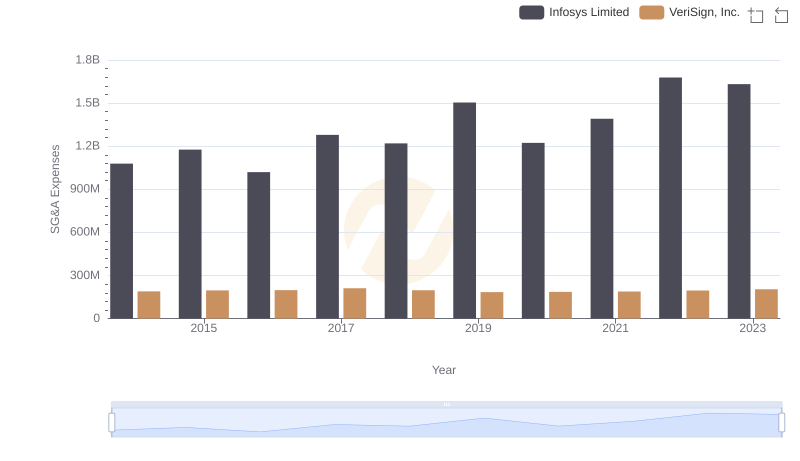

Cost Management Insights: SG&A Expenses for Infosys Limited and VeriSign, Inc.

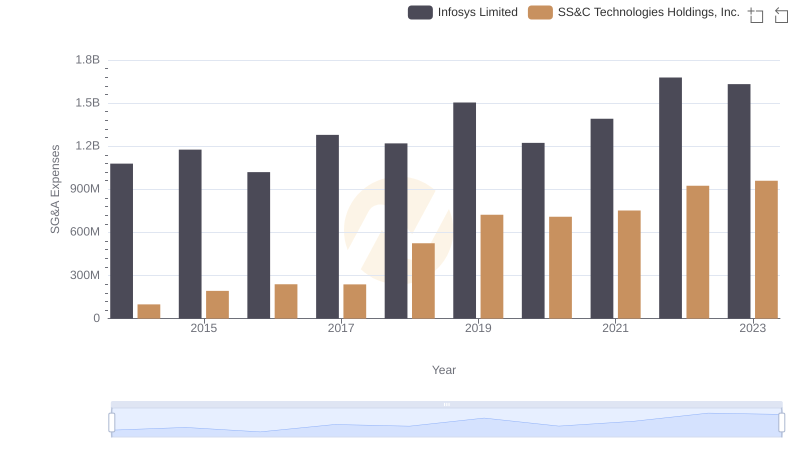

Breaking Down SG&A Expenses: Infosys Limited vs SS&C Technologies Holdings, Inc.

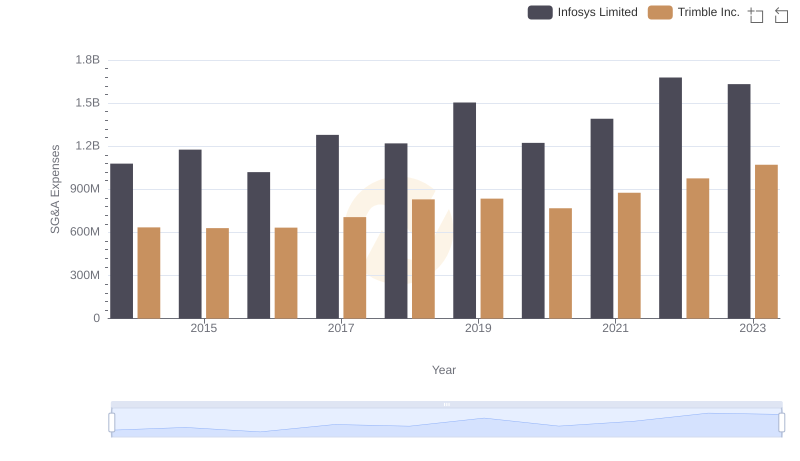

SG&A Efficiency Analysis: Comparing Infosys Limited and Trimble Inc.

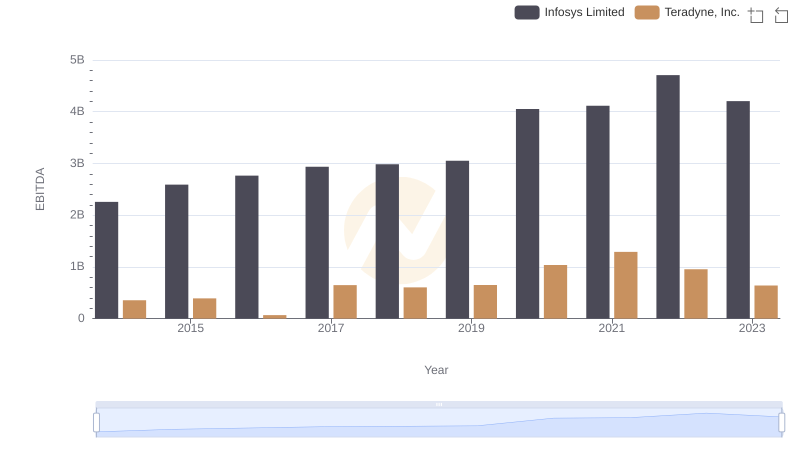

EBITDA Metrics Evaluated: Infosys Limited vs Teradyne, Inc.

Who Optimizes SG&A Costs Better? Infosys Limited or Manhattan Associates, Inc.

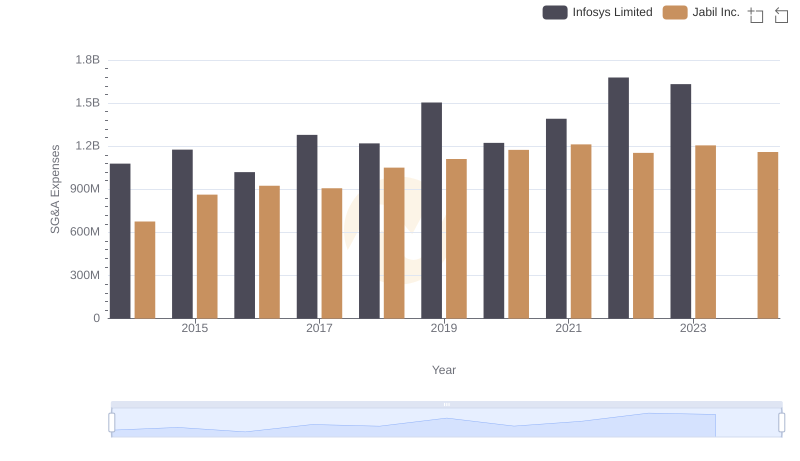

Infosys Limited and Jabil Inc.: SG&A Spending Patterns Compared

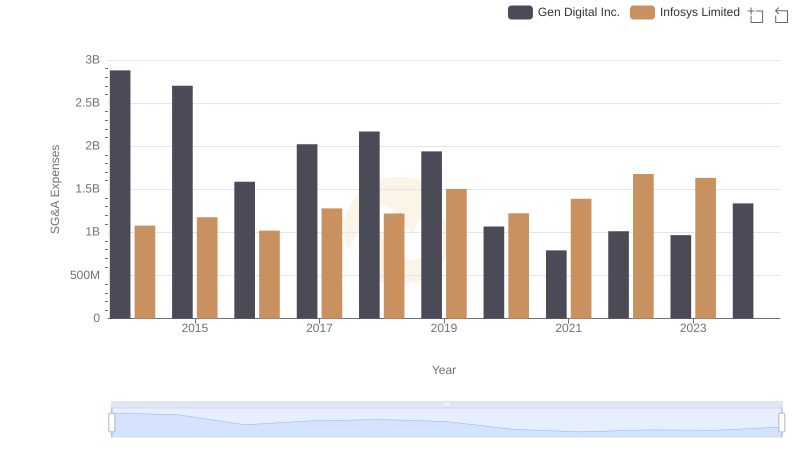

Who Optimizes SG&A Costs Better? Infosys Limited or Gen Digital Inc.