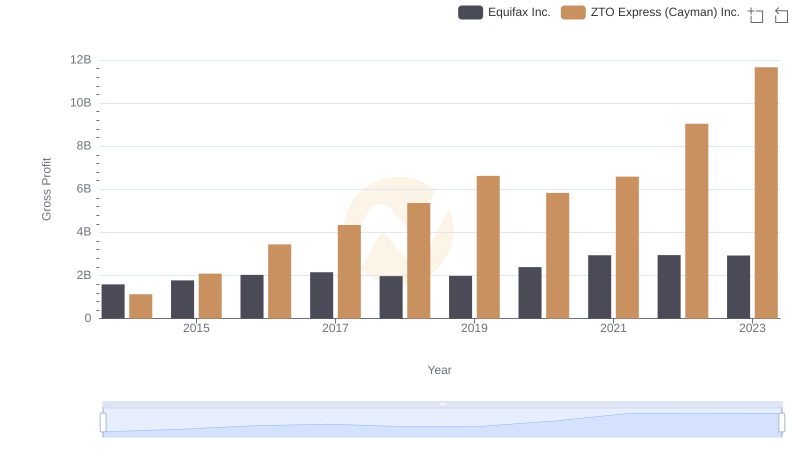

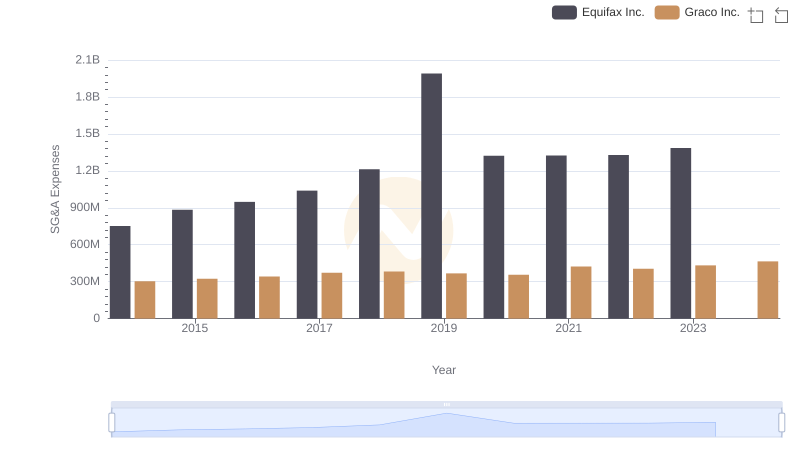

| __timestamp | Equifax Inc. | ZTO Express (Cayman) Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 751700000 | 534537000 |

| Thursday, January 1, 2015 | 884300000 | 591738000 |

| Friday, January 1, 2016 | 948200000 | 705995000 |

| Sunday, January 1, 2017 | 1039100000 | 780517000 |

| Monday, January 1, 2018 | 1213300000 | 1210717000 |

| Tuesday, January 1, 2019 | 1990200000 | 1546227000 |

| Wednesday, January 1, 2020 | 1322500000 | 1663712000 |

| Friday, January 1, 2021 | 1324600000 | 1875869000 |

| Saturday, January 1, 2022 | 1328900000 | 2077372000 |

| Sunday, January 1, 2023 | 1385700000 | 2425253000 |

| Monday, January 1, 2024 | 1450500000 |

In pursuit of knowledge

In the competitive world of business, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, Equifax Inc. and ZTO Express (Cayman) Inc. have shown contrasting trends in their SG&A cost management. From 2014 to 2023, Equifax's SG&A expenses grew by approximately 84%, while ZTO Express saw a staggering increase of around 354%. This significant difference highlights ZTO's rapid expansion and investment in administrative capabilities. However, Equifax's more stable growth suggests a focus on efficiency and cost control. By 2023, ZTO's SG&A expenses were about 75% higher than Equifax's, reflecting its aggressive growth strategy. Understanding these trends provides valuable insights into how these companies prioritize operational efficiency and growth, offering lessons for businesses aiming to optimize their own SG&A costs.

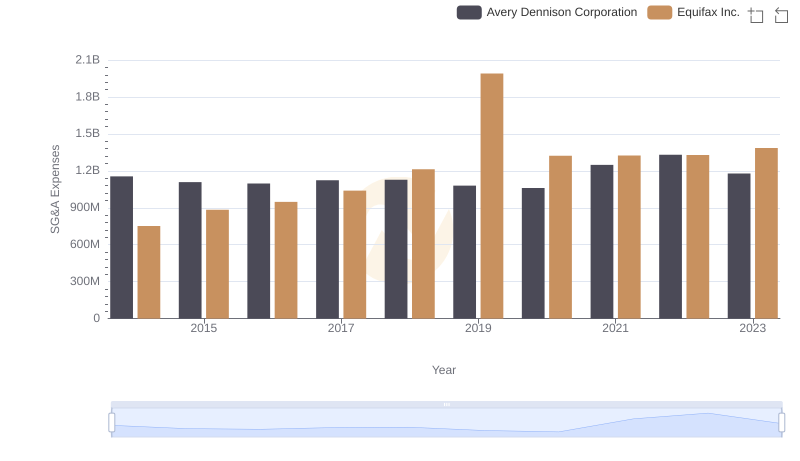

Breaking Down SG&A Expenses: Equifax Inc. vs Avery Dennison Corporation

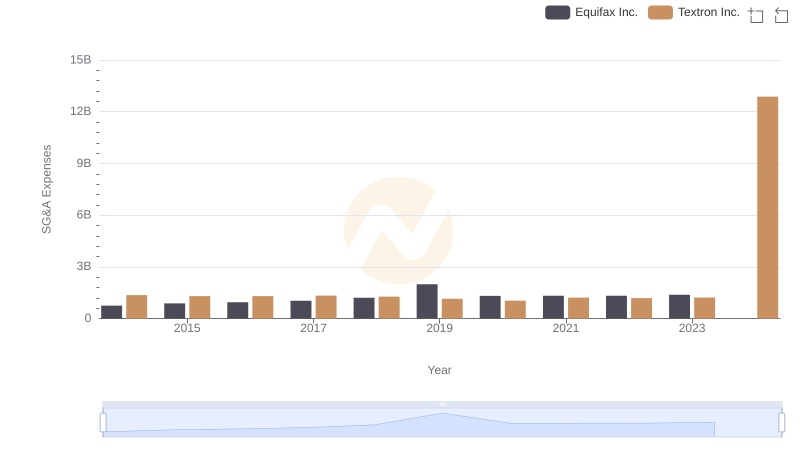

Equifax Inc. vs Textron Inc.: SG&A Expense Trends

Who Generates Higher Gross Profit? Equifax Inc. or ZTO Express (Cayman) Inc.

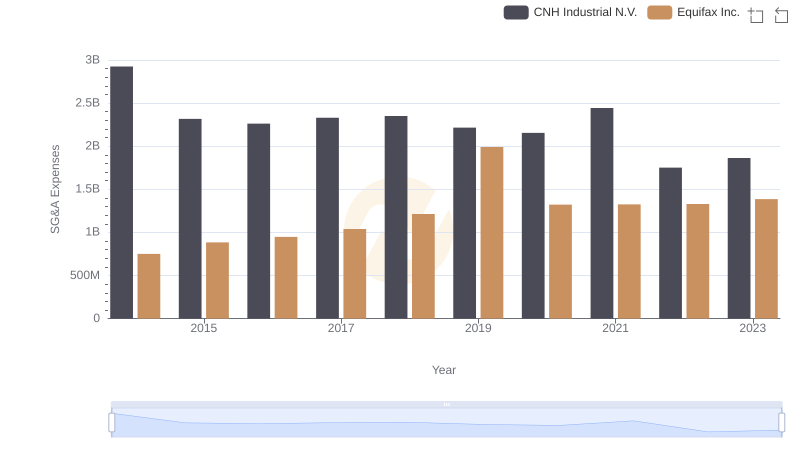

SG&A Efficiency Analysis: Comparing Equifax Inc. and CNH Industrial N.V.

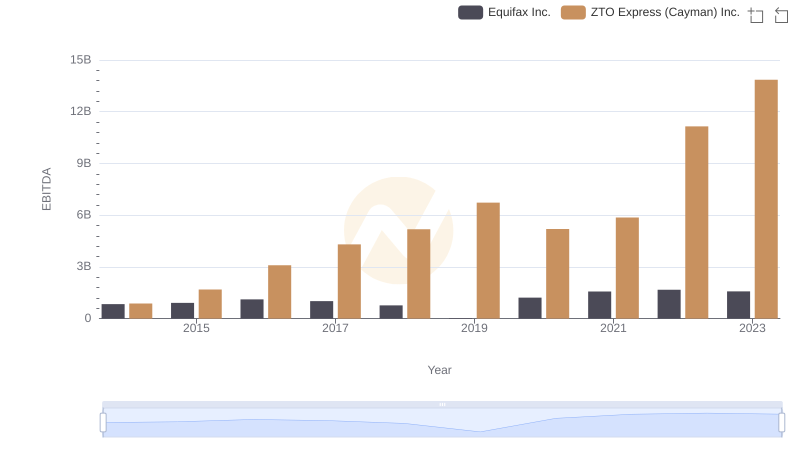

Professional EBITDA Benchmarking: Equifax Inc. vs ZTO Express (Cayman) Inc.

Who Optimizes SG&A Costs Better? Equifax Inc. or Graco Inc.

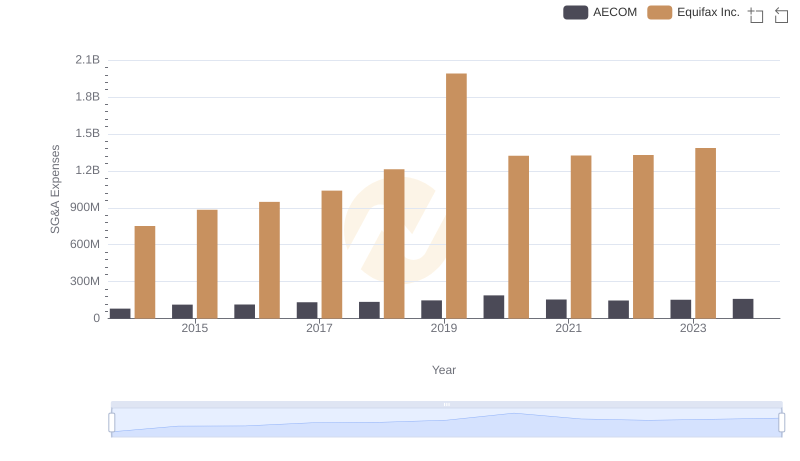

Equifax Inc. and AECOM: SG&A Spending Patterns Compared

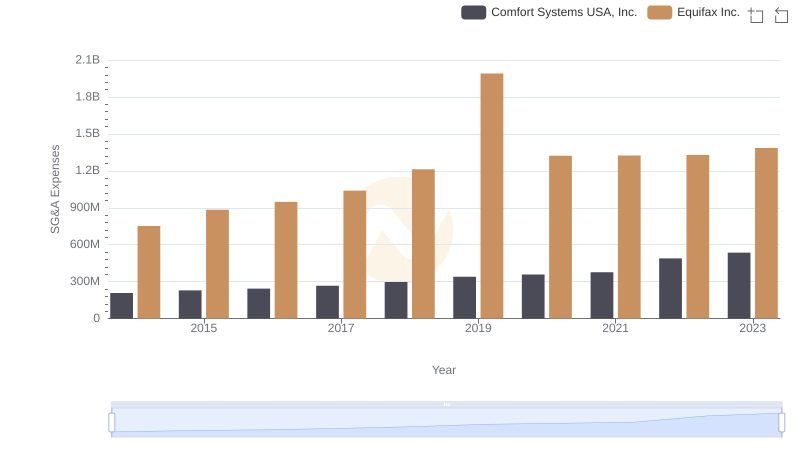

Equifax Inc. or Comfort Systems USA, Inc.: Who Manages SG&A Costs Better?