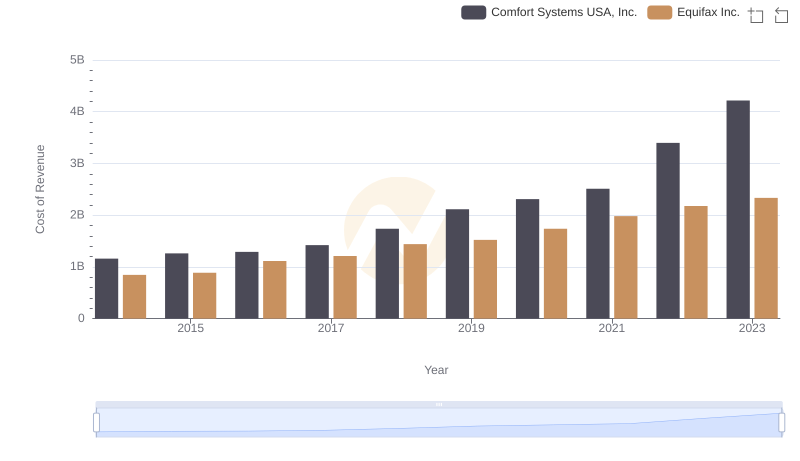

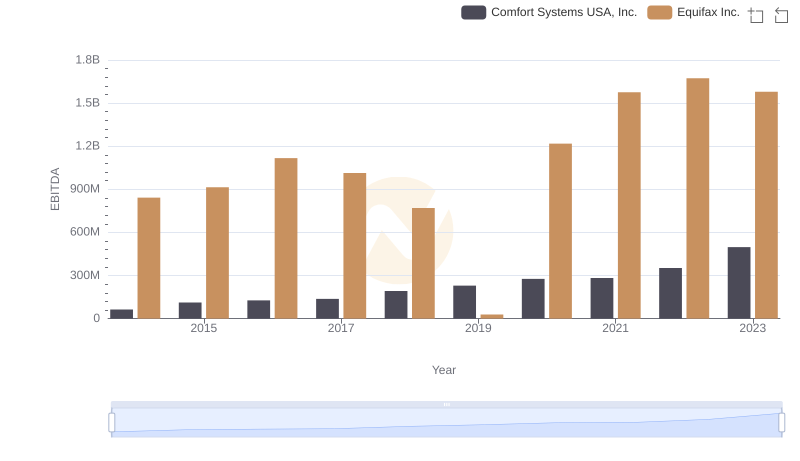

| __timestamp | Comfort Systems USA, Inc. | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 207652000 | 751700000 |

| Thursday, January 1, 2015 | 228965000 | 884300000 |

| Friday, January 1, 2016 | 243201000 | 948200000 |

| Sunday, January 1, 2017 | 266586000 | 1039100000 |

| Monday, January 1, 2018 | 296986000 | 1213300000 |

| Tuesday, January 1, 2019 | 340005000 | 1990200000 |

| Wednesday, January 1, 2020 | 357777000 | 1322500000 |

| Friday, January 1, 2021 | 376309000 | 1324600000 |

| Saturday, January 1, 2022 | 489344000 | 1328900000 |

| Sunday, January 1, 2023 | 536188999 | 1385700000 |

| Monday, January 1, 2024 | 1450500000 |

Unleashing the power of data

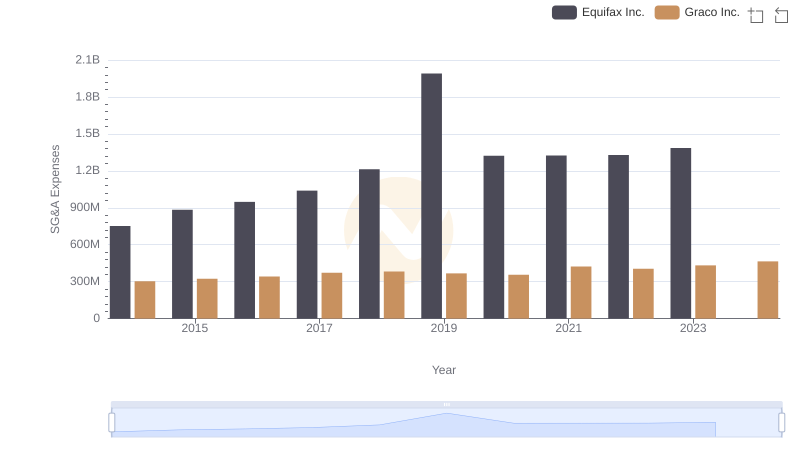

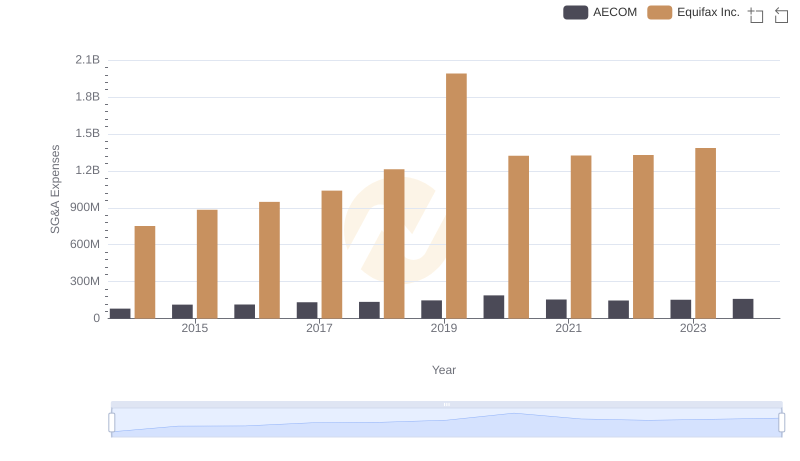

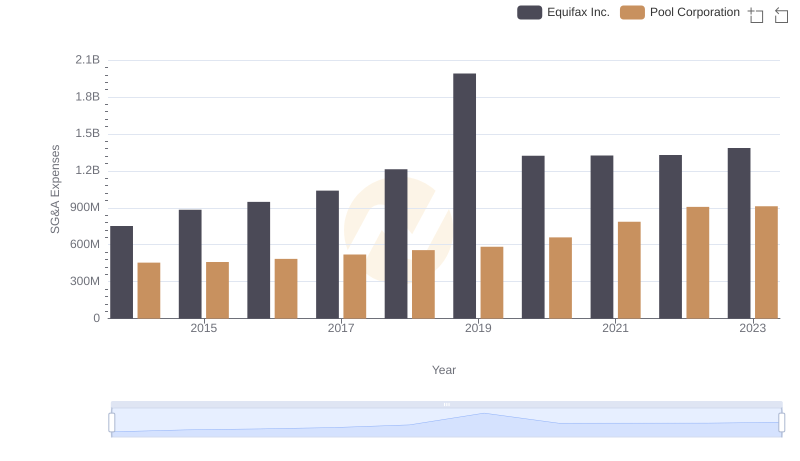

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. From 2014 to 2023, Equifax Inc. and Comfort Systems USA, Inc. have shown distinct approaches to handling these costs. Equifax, a global data analytics company, has consistently reported higher SG&A expenses, peaking at approximately $1.99 billion in 2019. In contrast, Comfort Systems USA, a leader in mechanical systems installation, has maintained a more conservative SG&A growth, with expenses reaching around $536 million in 2023. Over the decade, Equifax's SG&A expenses grew by about 84%, while Comfort Systems USA saw a 158% increase. This data suggests that while Equifax operates on a larger scale, Comfort Systems USA has been more aggressive in expanding its operational footprint. Understanding these trends can offer valuable insights into each company's strategic priorities and operational efficiencies.

Analyzing Cost of Revenue: Equifax Inc. and Comfort Systems USA, Inc.

Key Insights on Gross Profit: Equifax Inc. vs Comfort Systems USA, Inc.

Who Optimizes SG&A Costs Better? Equifax Inc. or Graco Inc.

Equifax Inc. and AECOM: SG&A Spending Patterns Compared

Comparing SG&A Expenses: Equifax Inc. vs Pool Corporation Trends and Insights

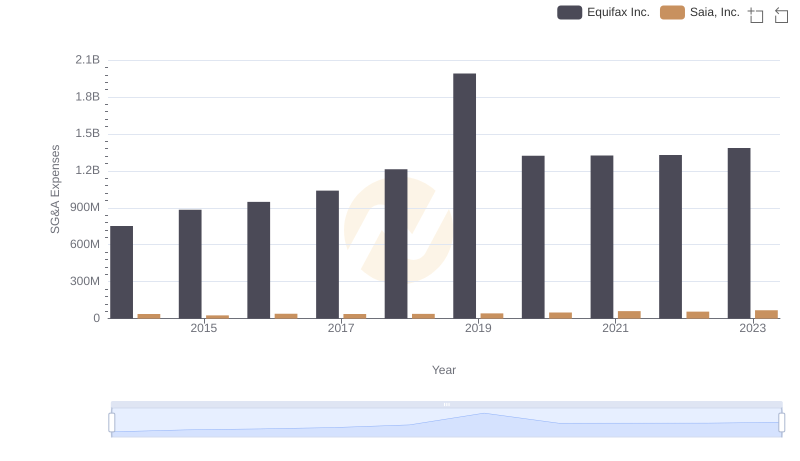

Operational Costs Compared: SG&A Analysis of Equifax Inc. and Saia, Inc.

Equifax Inc. or Curtiss-Wright Corporation: Who Manages SG&A Costs Better?

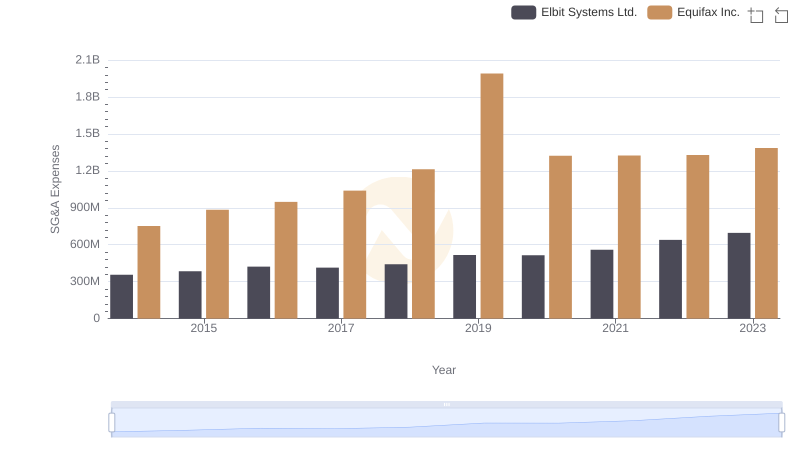

Operational Costs Compared: SG&A Analysis of Equifax Inc. and Elbit Systems Ltd.

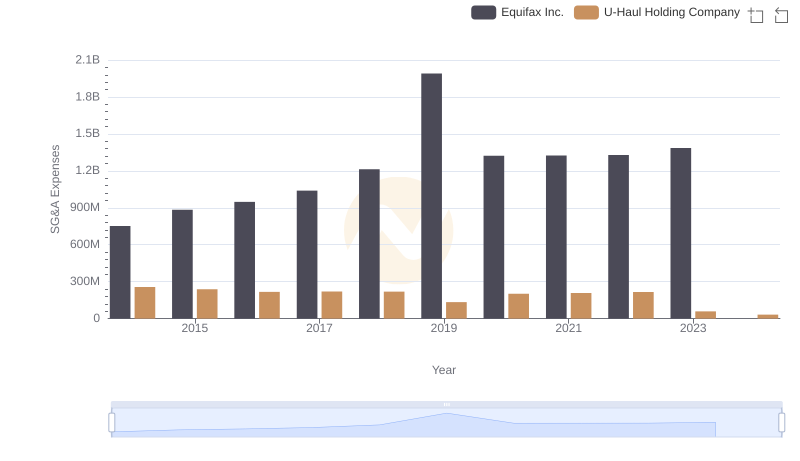

Selling, General, and Administrative Costs: Equifax Inc. vs U-Haul Holding Company

EBITDA Analysis: Evaluating Equifax Inc. Against Comfort Systems USA, Inc.