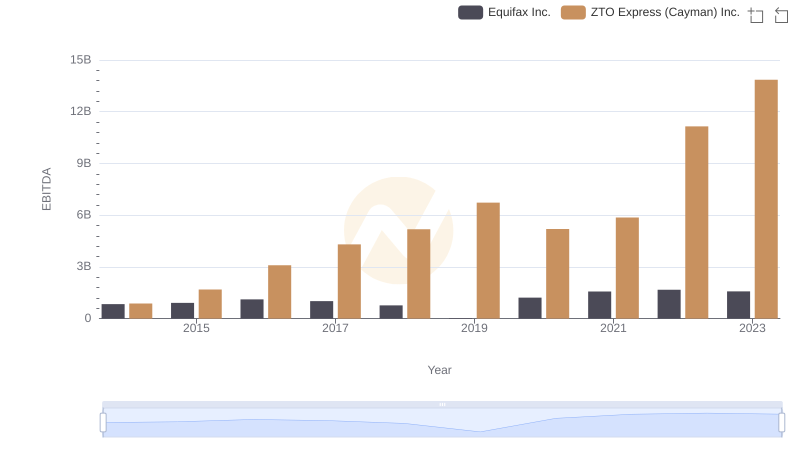

| __timestamp | Equifax Inc. | ZTO Express (Cayman) Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1591700000 | 1133042000 |

| Thursday, January 1, 2015 | 1776200000 | 2087718000 |

| Friday, January 1, 2016 | 2031500000 | 3442869000 |

| Sunday, January 1, 2017 | 2151500000 | 4345584000 |

| Monday, January 1, 2018 | 1971700000 | 5364883000 |

| Tuesday, January 1, 2019 | 1985900000 | 6621168000 |

| Wednesday, January 1, 2020 | 2390100000 | 5837106000 |

| Friday, January 1, 2021 | 2943000000 | 6589377000 |

| Saturday, January 1, 2022 | 2945000000 | 9039275000 |

| Sunday, January 1, 2023 | 2930100000 | 11662526000 |

| Monday, January 1, 2024 | 5681100000 |

Unlocking the unknown

In the ever-evolving landscape of global business, understanding which companies lead in profitability is crucial. Over the past decade, Equifax Inc. and ZTO Express (Cayman) Inc. have showcased contrasting trajectories in gross profit generation. From 2014 to 2023, ZTO Express has consistently outperformed Equifax, with a staggering 300% increase in gross profit, peaking at over $11.6 billion in 2023. In contrast, Equifax's growth has been more modest, with a 90% increase, reaching approximately $2.9 billion in the same year. This trend highlights the dynamic nature of the logistics and data analytics sectors, with ZTO Express capitalizing on the booming e-commerce market in China, while Equifax navigates the complexities of data security and consumer credit reporting. As we look to the future, these insights offer a glimpse into the strategic maneuvers that define industry leaders.

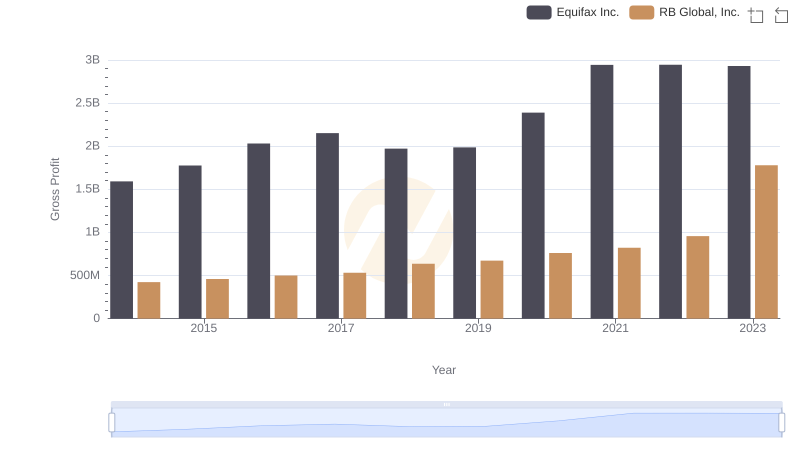

Gross Profit Comparison: Equifax Inc. and RB Global, Inc. Trends

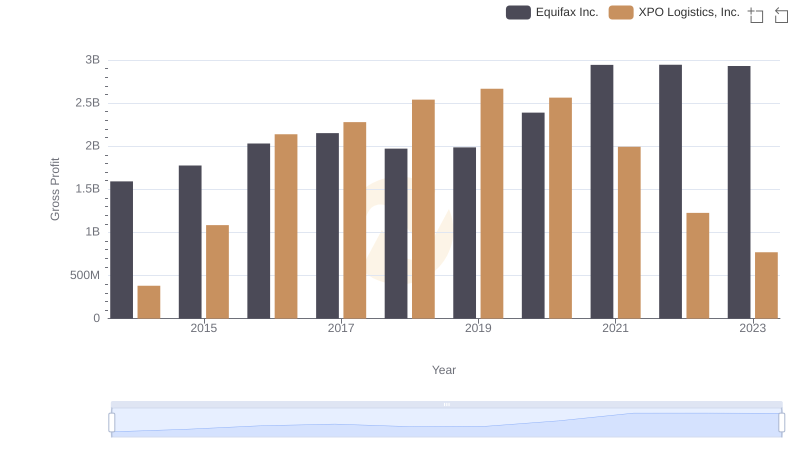

Equifax Inc. vs XPO Logistics, Inc.: A Gross Profit Performance Breakdown

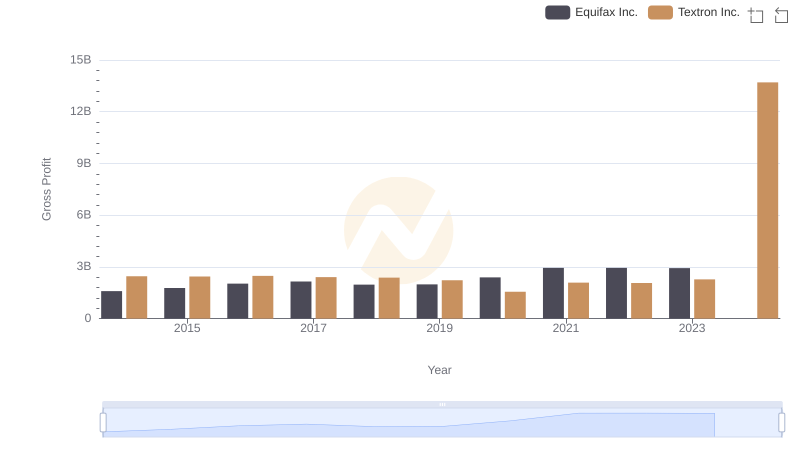

Key Insights on Gross Profit: Equifax Inc. vs Textron Inc.

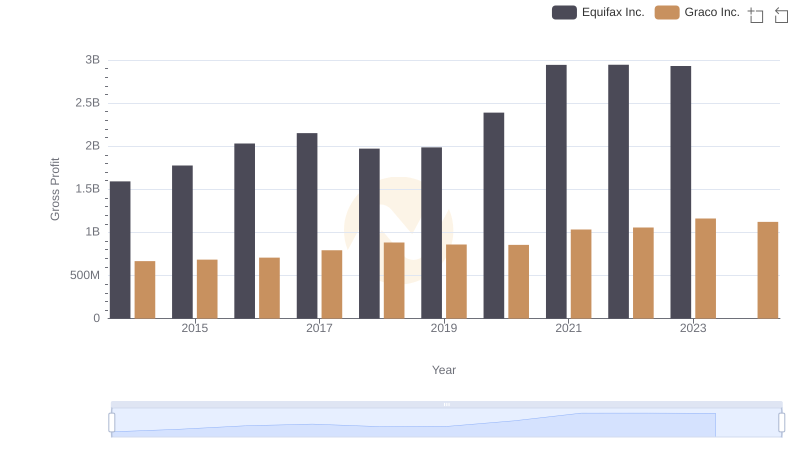

Who Generates Higher Gross Profit? Equifax Inc. or Graco Inc.

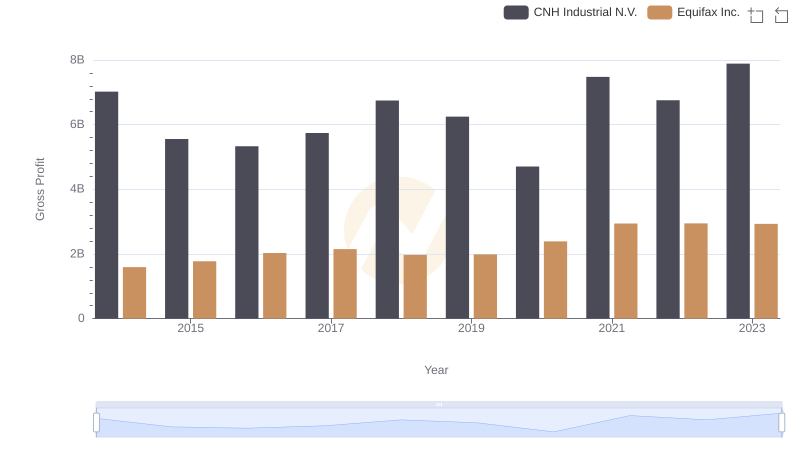

Gross Profit Analysis: Comparing Equifax Inc. and CNH Industrial N.V.

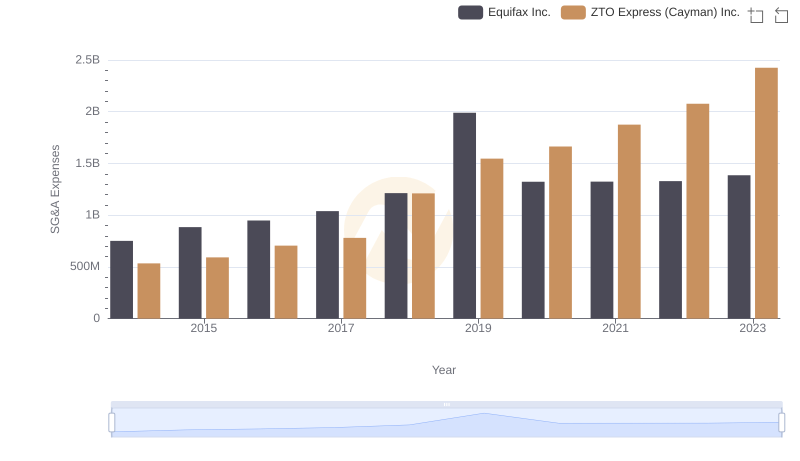

Who Optimizes SG&A Costs Better? Equifax Inc. or ZTO Express (Cayman) Inc.

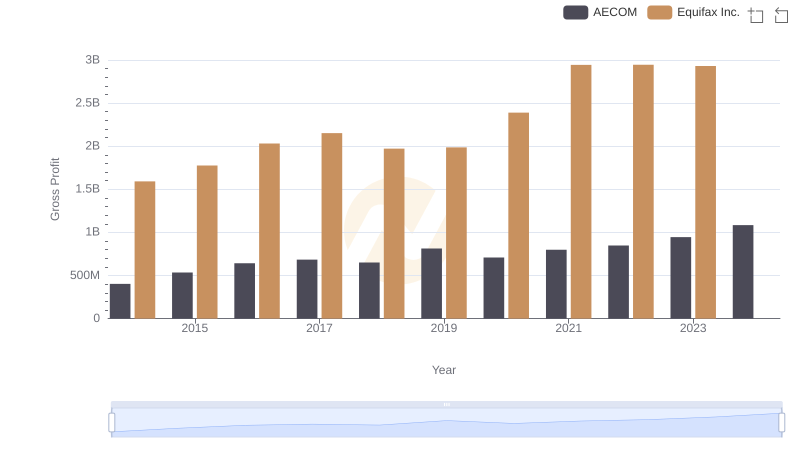

Who Generates Higher Gross Profit? Equifax Inc. or AECOM

Key Insights on Gross Profit: Equifax Inc. vs Comfort Systems USA, Inc.

Professional EBITDA Benchmarking: Equifax Inc. vs ZTO Express (Cayman) Inc.