| __timestamp | Equifax Inc. | Graco Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 751700000 | 303565000 |

| Thursday, January 1, 2015 | 884300000 | 324016000 |

| Friday, January 1, 2016 | 948200000 | 341734000 |

| Sunday, January 1, 2017 | 1039100000 | 372496000 |

| Monday, January 1, 2018 | 1213300000 | 382988000 |

| Tuesday, January 1, 2019 | 1990200000 | 367743000 |

| Wednesday, January 1, 2020 | 1322500000 | 355796000 |

| Friday, January 1, 2021 | 1324600000 | 422975000 |

| Saturday, January 1, 2022 | 1328900000 | 404731000 |

| Sunday, January 1, 2023 | 1385700000 | 432156000 |

| Monday, January 1, 2024 | 1450500000 | 465133000 |

Unleashing the power of data

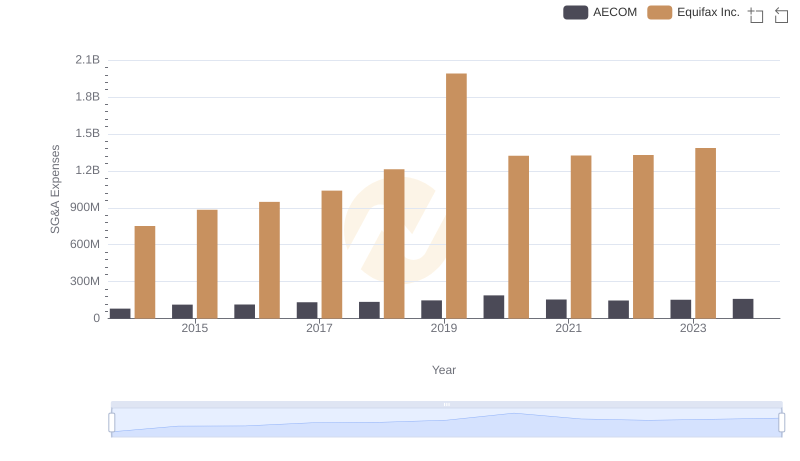

In the competitive landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. From 2014 to 2023, Equifax Inc. and Graco Inc. have shown distinct strategies in optimizing these costs. Equifax's SG&A expenses have seen a significant increase, peaking in 2019 with a 163% rise from 2014 levels. This trend suggests a strategic investment in administrative capabilities, possibly to support growth initiatives. In contrast, Graco Inc. has maintained a more stable SG&A trajectory, with a modest 43% increase over the same period, indicating a focus on cost efficiency. Notably, Graco's expenses in 2023 were 68% lower than Equifax's, highlighting their lean operational model. As we look to 2024, Graco's data remains consistent, while Equifax's is yet to be revealed, leaving room for speculation on their future financial strategies.

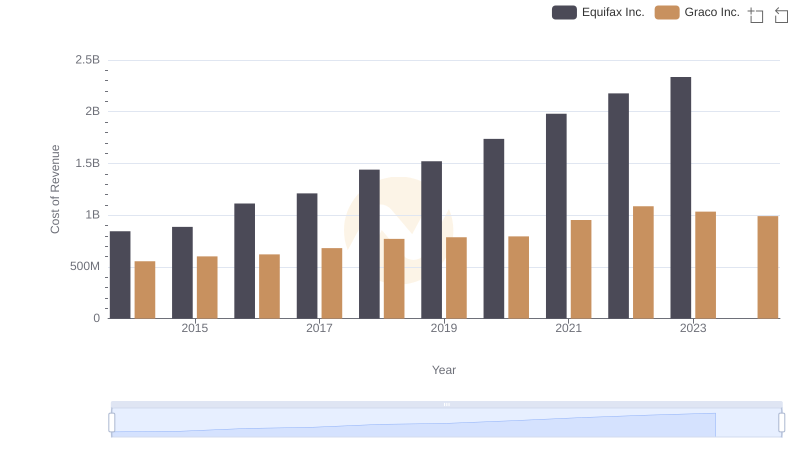

Analyzing Cost of Revenue: Equifax Inc. and Graco Inc.

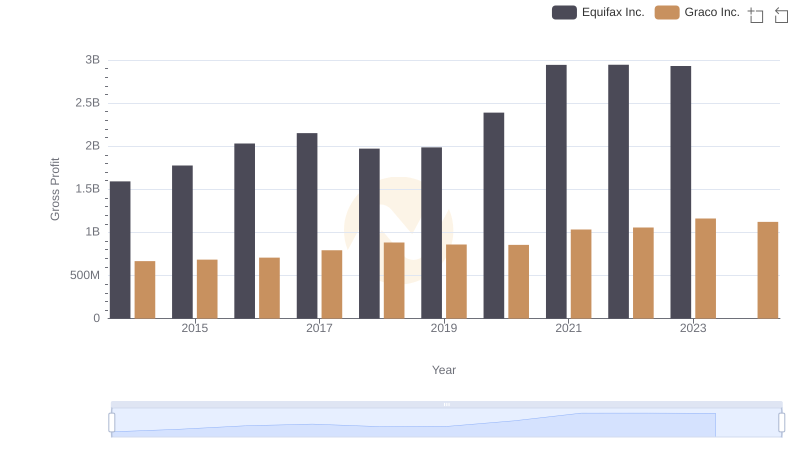

Who Generates Higher Gross Profit? Equifax Inc. or Graco Inc.

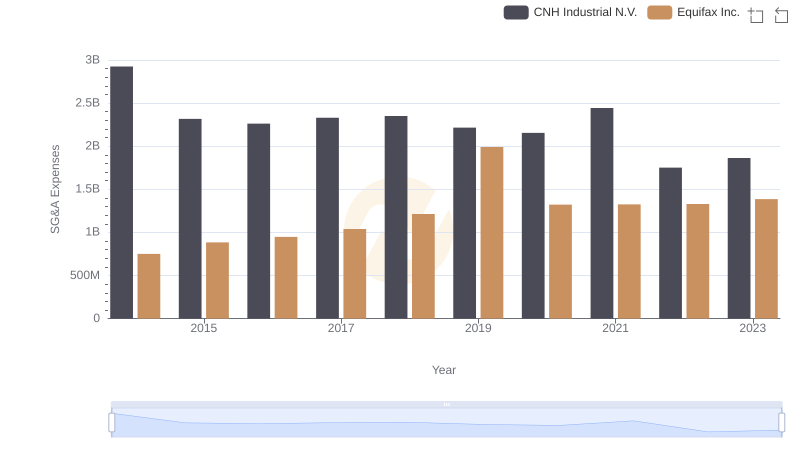

SG&A Efficiency Analysis: Comparing Equifax Inc. and CNH Industrial N.V.

Equifax Inc. and AECOM: SG&A Spending Patterns Compared

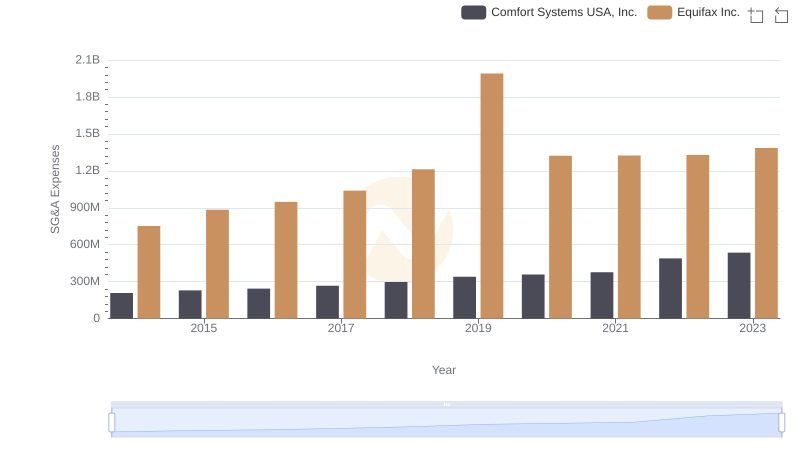

Equifax Inc. or Comfort Systems USA, Inc.: Who Manages SG&A Costs Better?

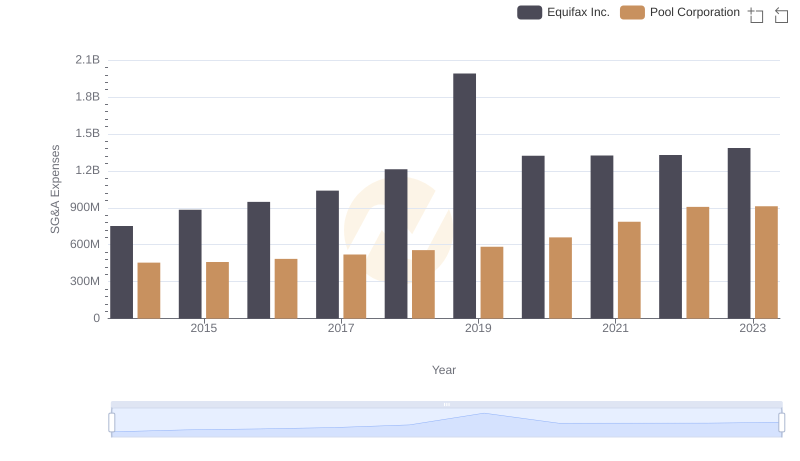

Comparing SG&A Expenses: Equifax Inc. vs Pool Corporation Trends and Insights

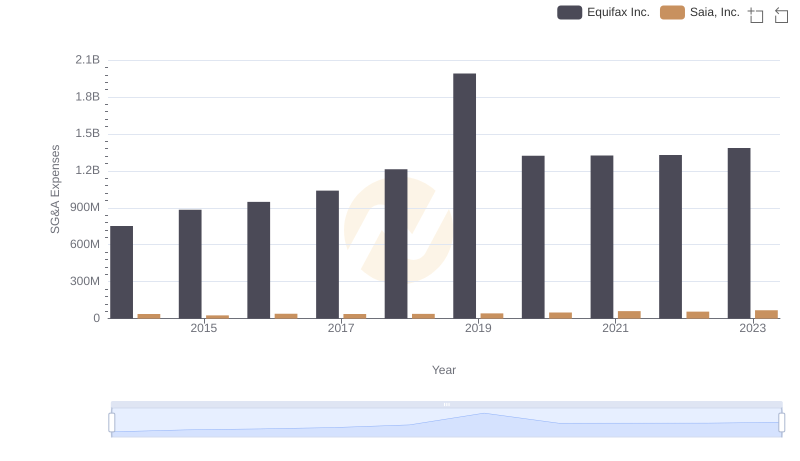

Operational Costs Compared: SG&A Analysis of Equifax Inc. and Saia, Inc.

Equifax Inc. or Curtiss-Wright Corporation: Who Manages SG&A Costs Better?

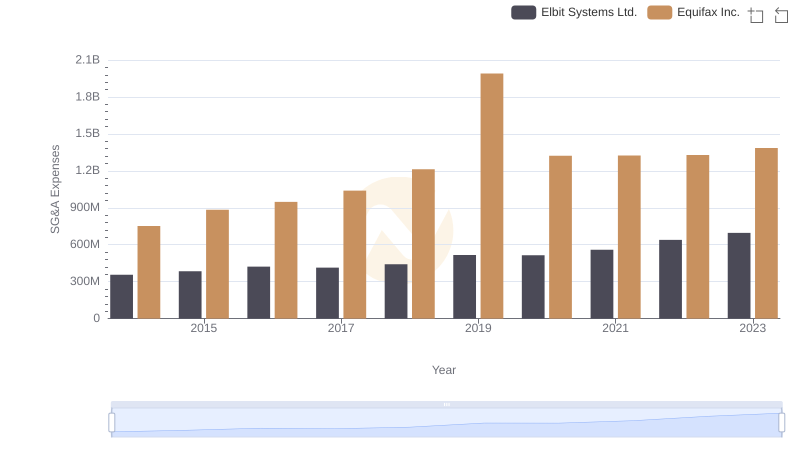

Operational Costs Compared: SG&A Analysis of Equifax Inc. and Elbit Systems Ltd.