| __timestamp | Axon Enterprise, Inc. | Southwest Airlines Co. |

|---|---|---|

| Wednesday, January 1, 2014 | 54158000 | 207000000 |

| Thursday, January 1, 2015 | 69698000 | 218000000 |

| Friday, January 1, 2016 | 108076000 | 2703000000 |

| Sunday, January 1, 2017 | 138692000 | 2847000000 |

| Monday, January 1, 2018 | 156886000 | 2852000000 |

| Tuesday, January 1, 2019 | 212959000 | 3026000000 |

| Wednesday, January 1, 2020 | 307286000 | 1926000000 |

| Friday, January 1, 2021 | 515007000 | 2388000000 |

| Saturday, January 1, 2022 | 401575000 | 3735000000 |

| Sunday, January 1, 2023 | 496874000 | 3992000000 |

| Monday, January 1, 2024 | 0 |

Unleashing insights

In the competitive landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. This analysis compares the SG&A cost optimization strategies of Axon Enterprise, Inc. and Southwest Airlines Co. over the past decade.

From 2014 to 2023, Axon Enterprise, Inc. demonstrated a steady increase in SG&A expenses, peaking in 2021 with a 10-fold increase from 2014. Meanwhile, Southwest Airlines Co. experienced a more volatile trajectory, with expenses surging by nearly 1,800% in 2016, reflecting industry-specific challenges.

Axon's consistent growth in SG&A expenses suggests a strategic investment in scaling operations, while Southwest's fluctuations highlight the impact of external factors like fuel prices and economic cycles. Understanding these trends provides valuable insights into each company's financial resilience and strategic priorities.

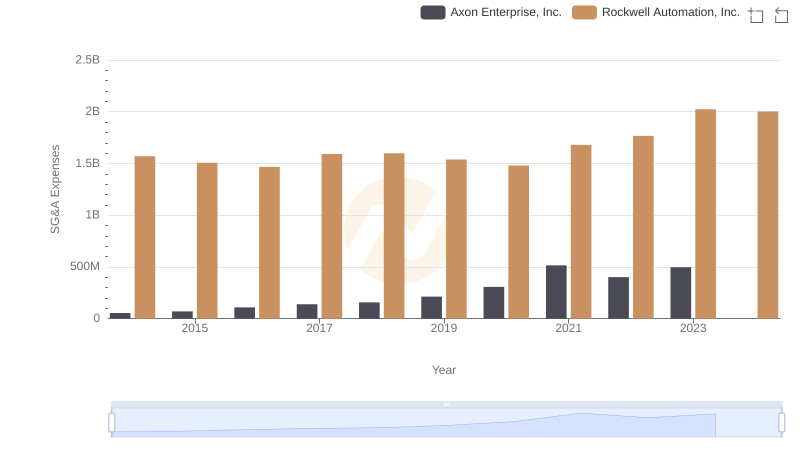

Operational Costs Compared: SG&A Analysis of Axon Enterprise, Inc. and Rockwell Automation, Inc.

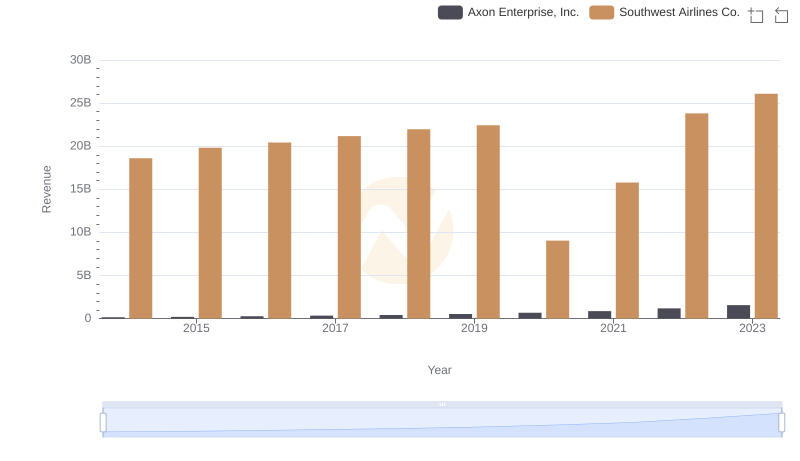

Revenue Showdown: Axon Enterprise, Inc. vs Southwest Airlines Co.

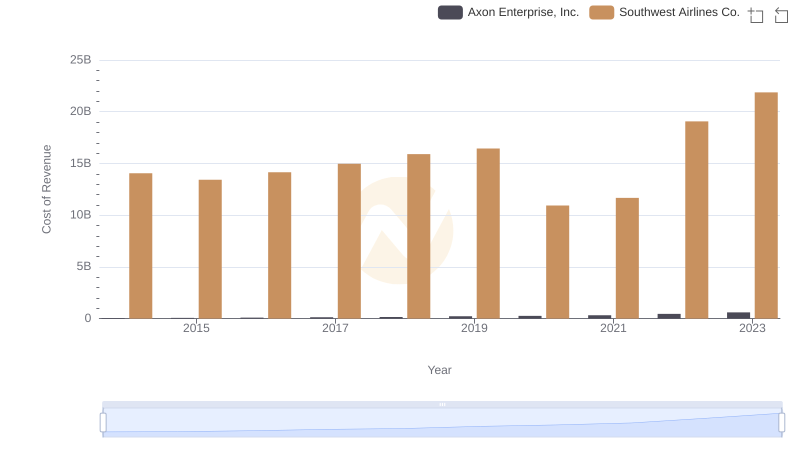

Cost of Revenue Trends: Axon Enterprise, Inc. vs Southwest Airlines Co.

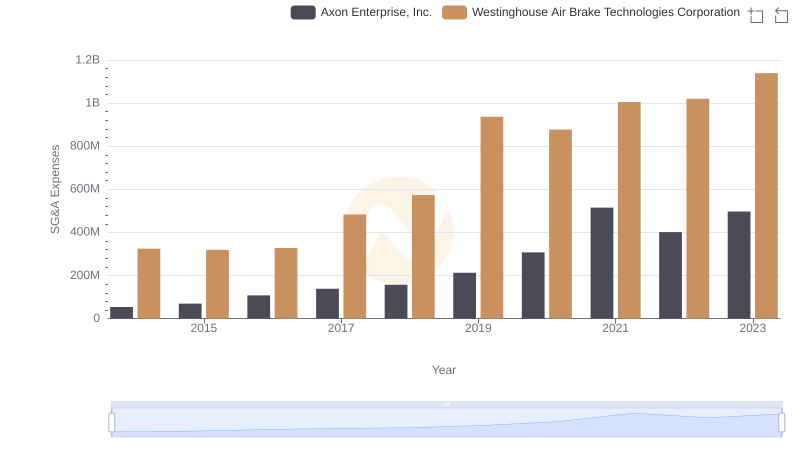

Selling, General, and Administrative Costs: Axon Enterprise, Inc. vs Westinghouse Air Brake Technologies Corporation

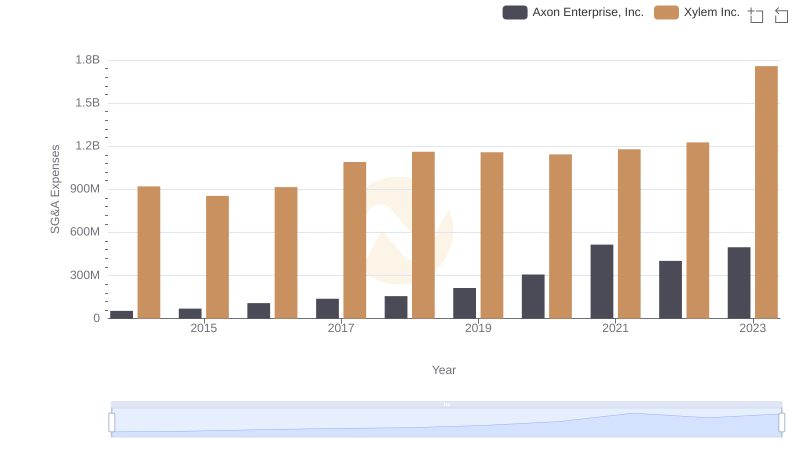

Axon Enterprise, Inc. vs Xylem Inc.: SG&A Expense Trends

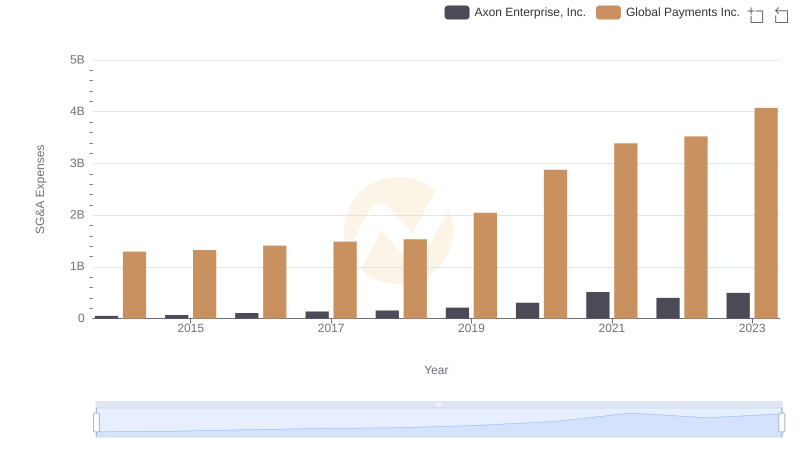

Breaking Down SG&A Expenses: Axon Enterprise, Inc. vs Global Payments Inc.

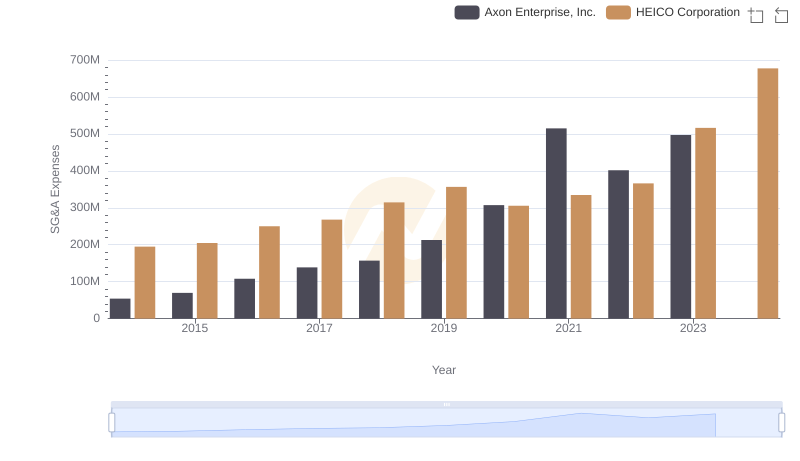

Operational Costs Compared: SG&A Analysis of Axon Enterprise, Inc. and HEICO Corporation

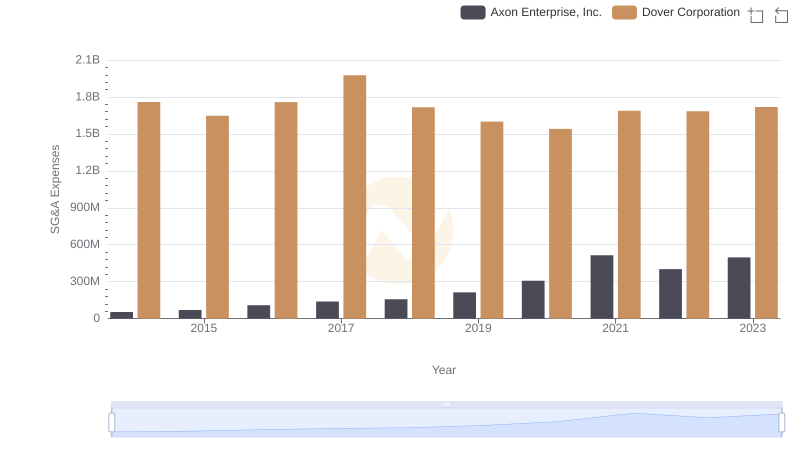

Selling, General, and Administrative Costs: Axon Enterprise, Inc. vs Dover Corporation

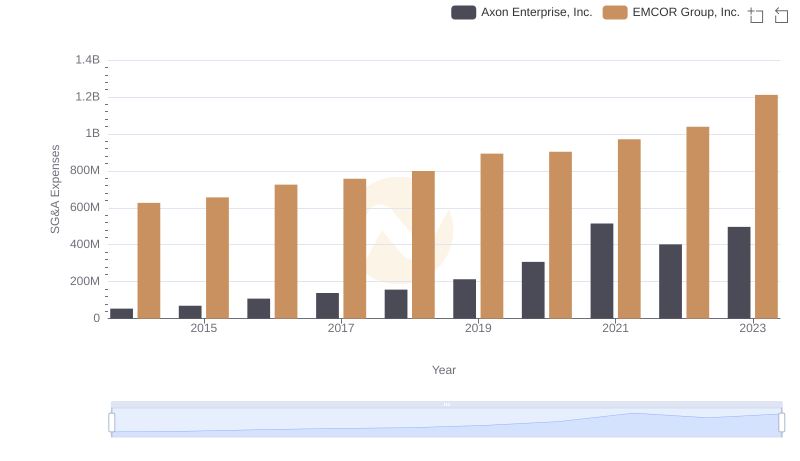

SG&A Efficiency Analysis: Comparing Axon Enterprise, Inc. and EMCOR Group, Inc.

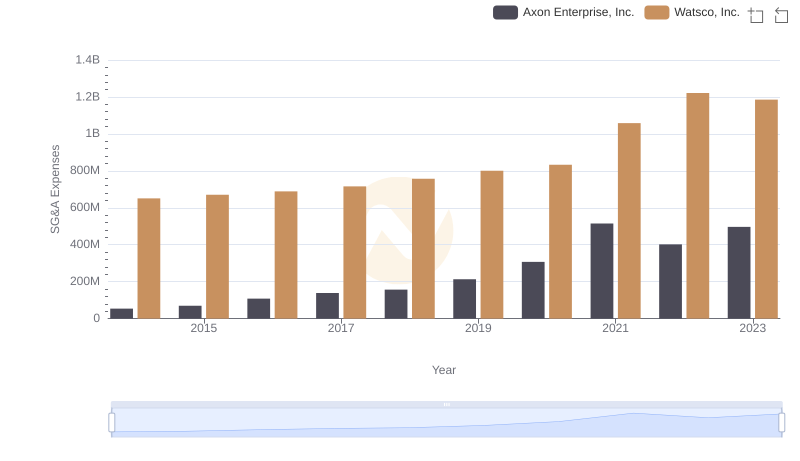

Comparing SG&A Expenses: Axon Enterprise, Inc. vs Watsco, Inc. Trends and Insights