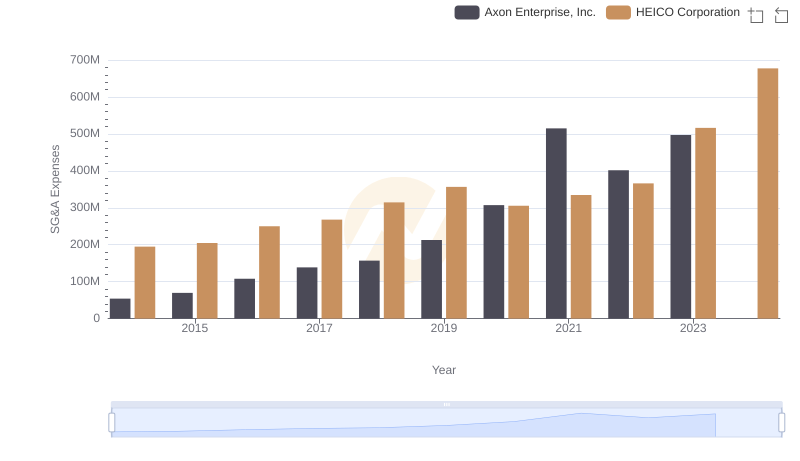

| __timestamp | Axon Enterprise, Inc. | EMCOR Group, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 54158000 | 626478000 |

| Thursday, January 1, 2015 | 69698000 | 656573000 |

| Friday, January 1, 2016 | 108076000 | 725538000 |

| Sunday, January 1, 2017 | 138692000 | 757062000 |

| Monday, January 1, 2018 | 156886000 | 799157000 |

| Tuesday, January 1, 2019 | 212959000 | 893453000 |

| Wednesday, January 1, 2020 | 307286000 | 903584000 |

| Friday, January 1, 2021 | 515007000 | 970937000 |

| Saturday, January 1, 2022 | 401575000 | 1038717000 |

| Sunday, January 1, 2023 | 496874000 | 1211233000 |

In pursuit of knowledge

In the ever-evolving landscape of corporate finance, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Axon Enterprise, Inc. and EMCOR Group, Inc. have showcased contrasting trajectories in their SG&A expenditures.

From 2014 to 2023, Axon Enterprise, Inc. saw a staggering increase in SG&A expenses, growing by over 800%. This surge reflects the company's aggressive expansion and investment in administrative capabilities. Notably, 2021 marked a peak with expenses reaching nearly 515 million, a testament to their strategic growth initiatives.

Conversely, EMCOR Group, Inc. maintained a more stable growth pattern, with SG&A expenses increasing by approximately 93% over the same period. By 2023, their expenses had reached over 1.2 billion, indicating a steady yet robust approach to managing operational costs.

This analysis highlights the diverse strategies companies employ in managing their operational efficiencies, offering valuable insights for investors and analysts alike.

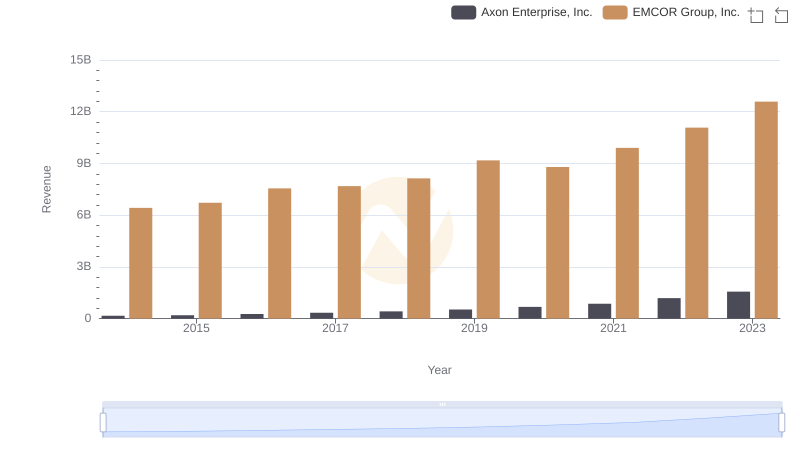

Comparing Revenue Performance: Axon Enterprise, Inc. or EMCOR Group, Inc.?

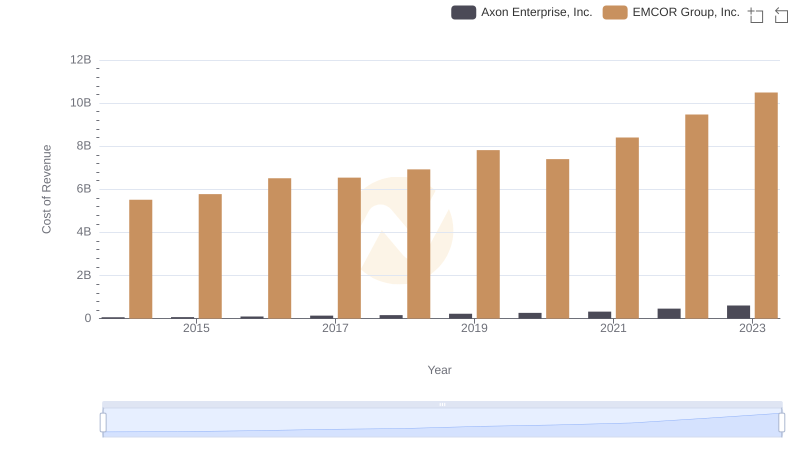

Cost of Revenue Comparison: Axon Enterprise, Inc. vs EMCOR Group, Inc.

Operational Costs Compared: SG&A Analysis of Axon Enterprise, Inc. and HEICO Corporation

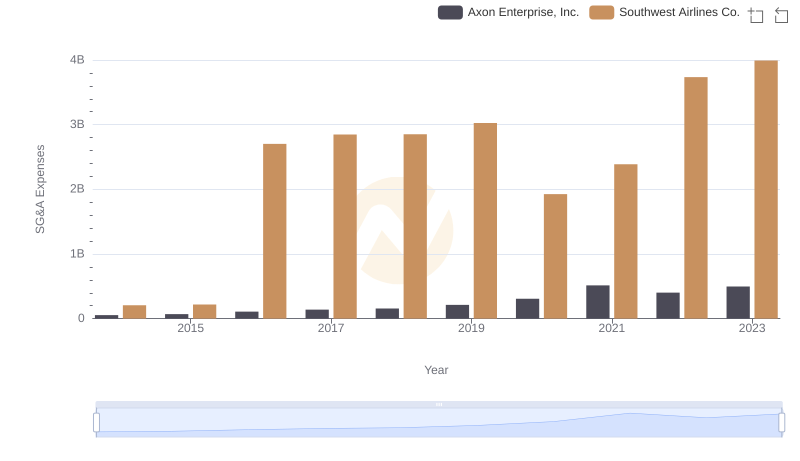

Who Optimizes SG&A Costs Better? Axon Enterprise, Inc. or Southwest Airlines Co.

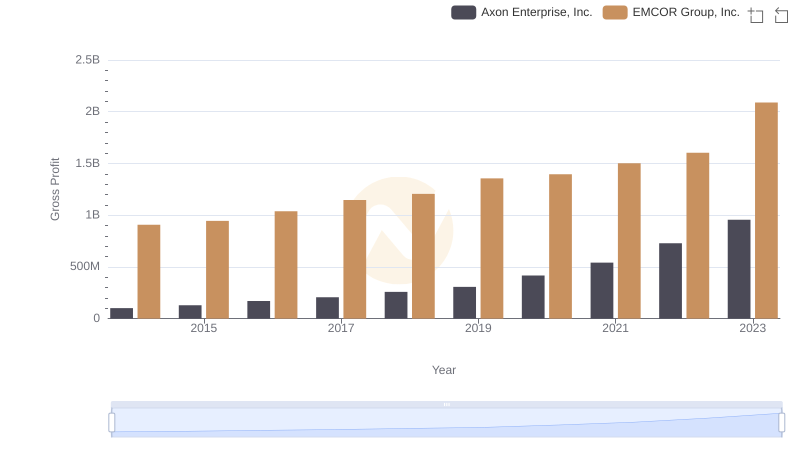

Key Insights on Gross Profit: Axon Enterprise, Inc. vs EMCOR Group, Inc.

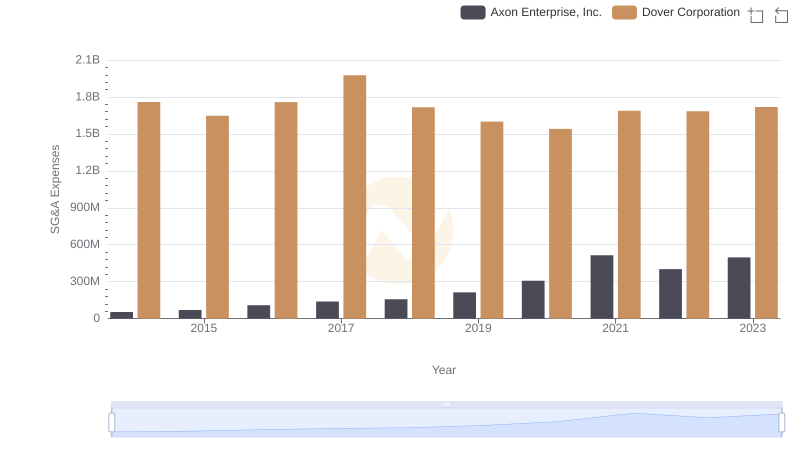

Selling, General, and Administrative Costs: Axon Enterprise, Inc. vs Dover Corporation

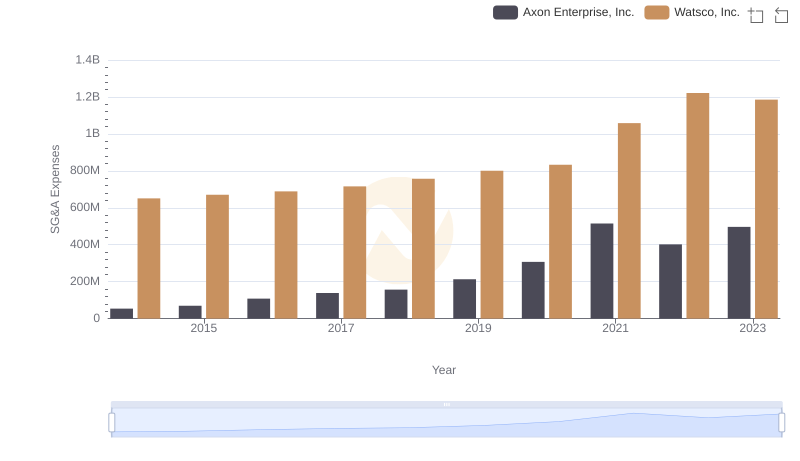

Comparing SG&A Expenses: Axon Enterprise, Inc. vs Watsco, Inc. Trends and Insights

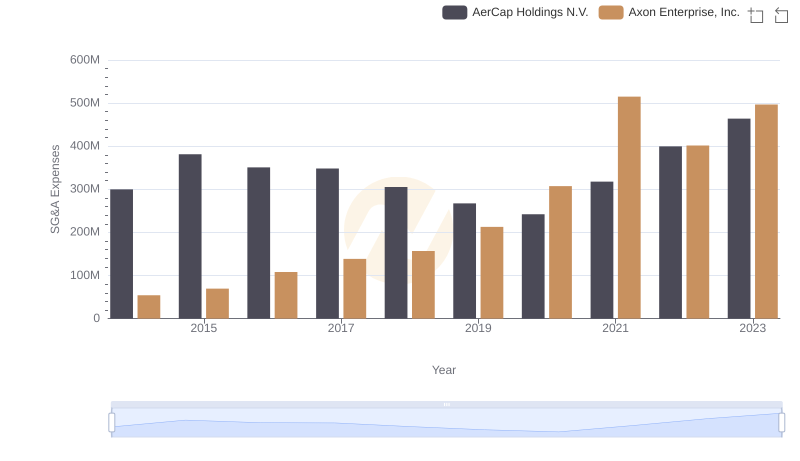

Comparing SG&A Expenses: Axon Enterprise, Inc. vs AerCap Holdings N.V. Trends and Insights

Axon Enterprise, Inc. vs Builders FirstSource, Inc.: SG&A Expense Trends

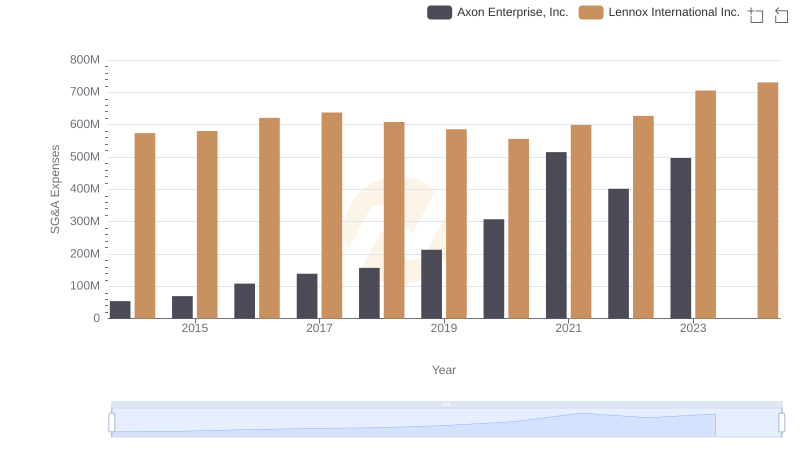

Axon Enterprise, Inc. and Lennox International Inc.: SG&A Spending Patterns Compared