| __timestamp | Axon Enterprise, Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 54158000 | 324539000 |

| Thursday, January 1, 2015 | 69698000 | 319173000 |

| Friday, January 1, 2016 | 108076000 | 327505000 |

| Sunday, January 1, 2017 | 138692000 | 482852000 |

| Monday, January 1, 2018 | 156886000 | 573644000 |

| Tuesday, January 1, 2019 | 212959000 | 936600000 |

| Wednesday, January 1, 2020 | 307286000 | 877100000 |

| Friday, January 1, 2021 | 515007000 | 1005000000 |

| Saturday, January 1, 2022 | 401575000 | 1020000000 |

| Sunday, January 1, 2023 | 496874000 | 1139000000 |

| Monday, January 1, 2024 | 1248000000 |

Unleashing insights

In the competitive landscape of industrial technology, understanding the financial strategies of leading companies is crucial. Axon Enterprise, Inc. and Westinghouse Air Brake Technologies Corporation have shown distinct trends in their Selling, General, and Administrative (SG&A) expenses from 2014 to 2023. Axon, known for its innovative public safety solutions, saw a remarkable increase in SG&A expenses, growing by over 800% from 2014 to 2023. This reflects their aggressive expansion and investment in new technologies. Meanwhile, Westinghouse, a stalwart in rail technology, experienced a more modest 250% increase, indicating a steady growth strategy. Notably, in 2023, Westinghouse's SG&A expenses were more than double those of Axon, highlighting their larger scale of operations. These trends offer a window into the strategic priorities of each company, with Axon focusing on rapid growth and Westinghouse maintaining a steady course.

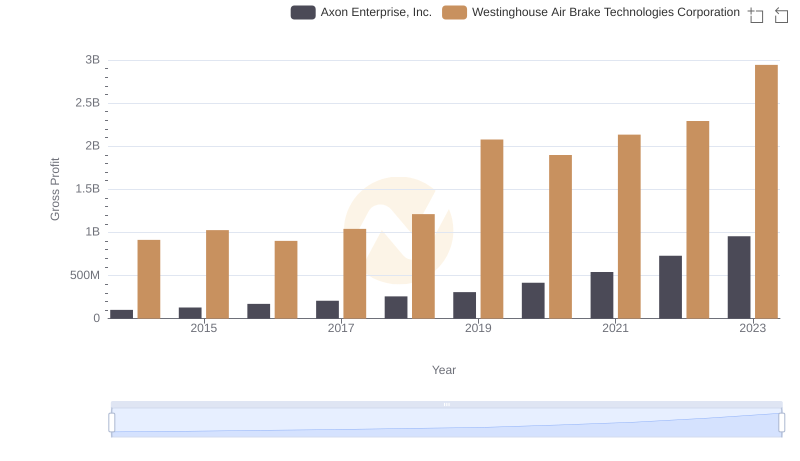

Key Insights on Gross Profit: Axon Enterprise, Inc. vs Westinghouse Air Brake Technologies Corporation

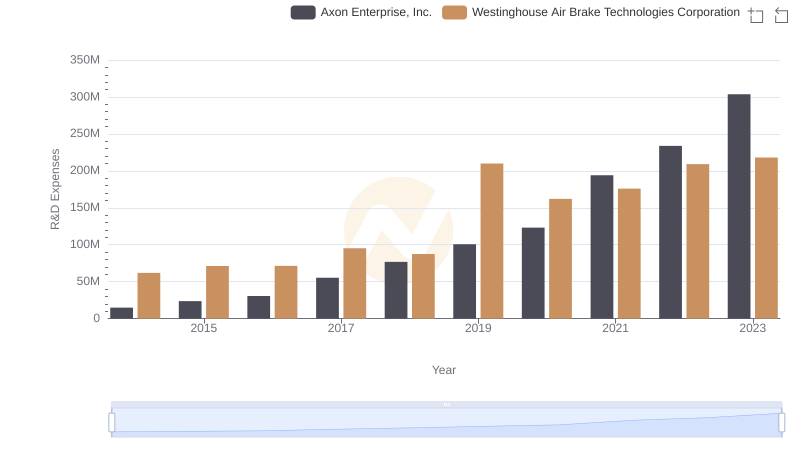

Axon Enterprise, Inc. or Westinghouse Air Brake Technologies Corporation: Who Invests More in Innovation?

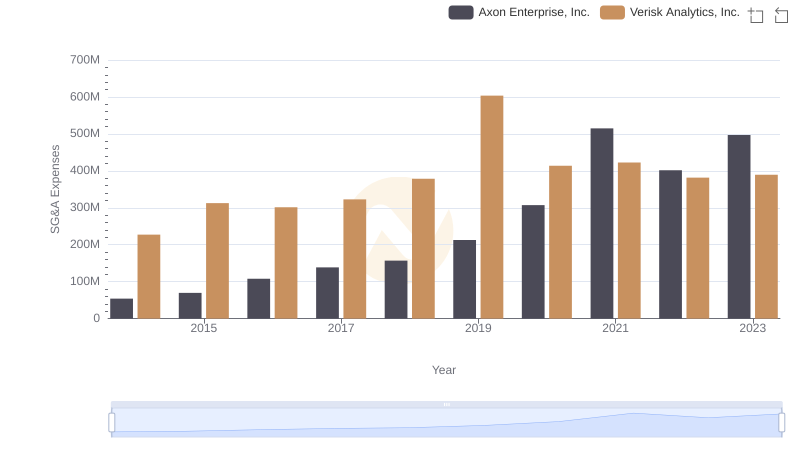

Axon Enterprise, Inc. vs Verisk Analytics, Inc.: SG&A Expense Trends

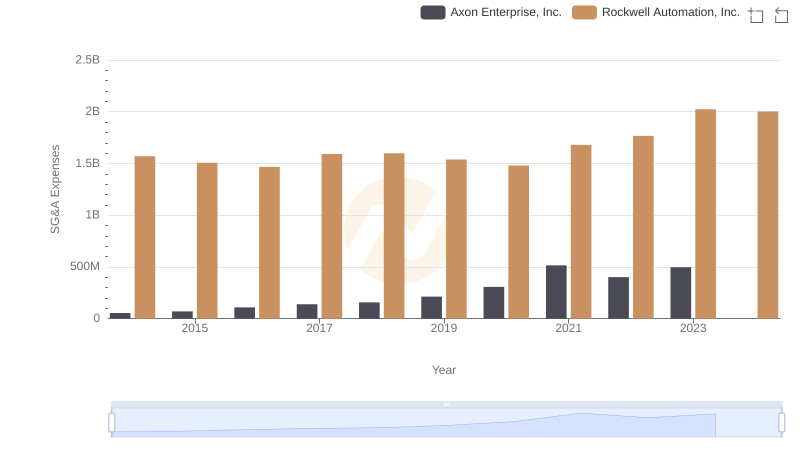

Operational Costs Compared: SG&A Analysis of Axon Enterprise, Inc. and Rockwell Automation, Inc.

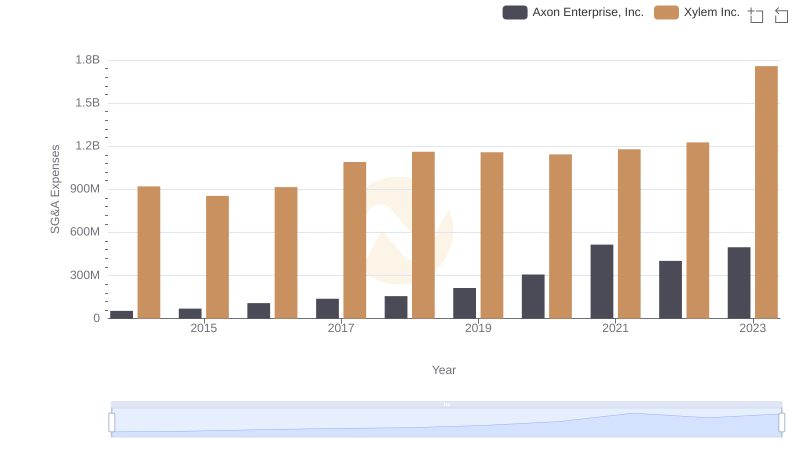

Axon Enterprise, Inc. vs Xylem Inc.: SG&A Expense Trends

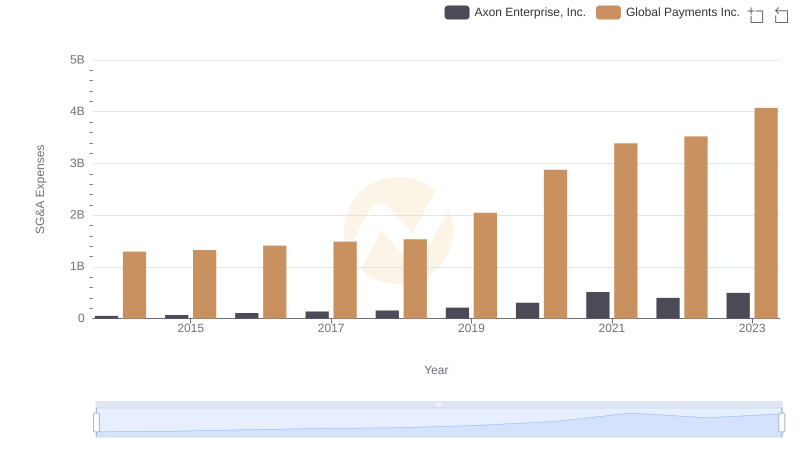

Breaking Down SG&A Expenses: Axon Enterprise, Inc. vs Global Payments Inc.

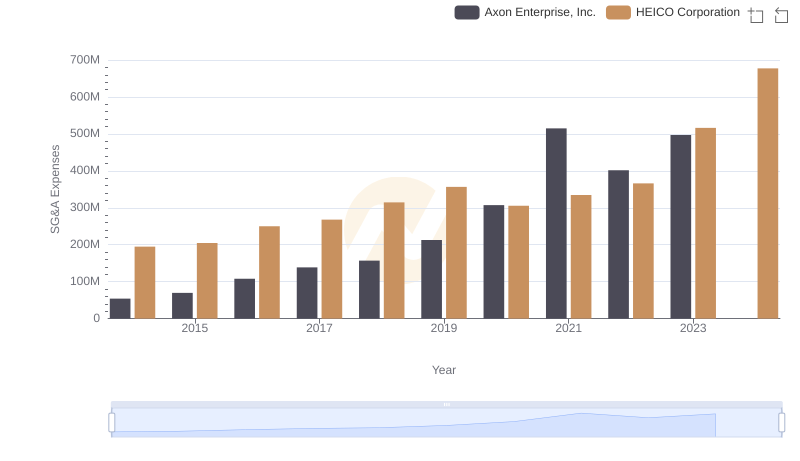

Operational Costs Compared: SG&A Analysis of Axon Enterprise, Inc. and HEICO Corporation

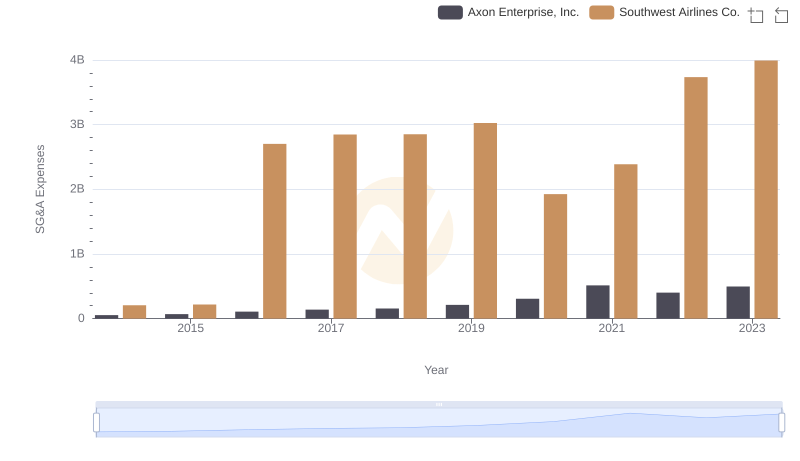

Who Optimizes SG&A Costs Better? Axon Enterprise, Inc. or Southwest Airlines Co.

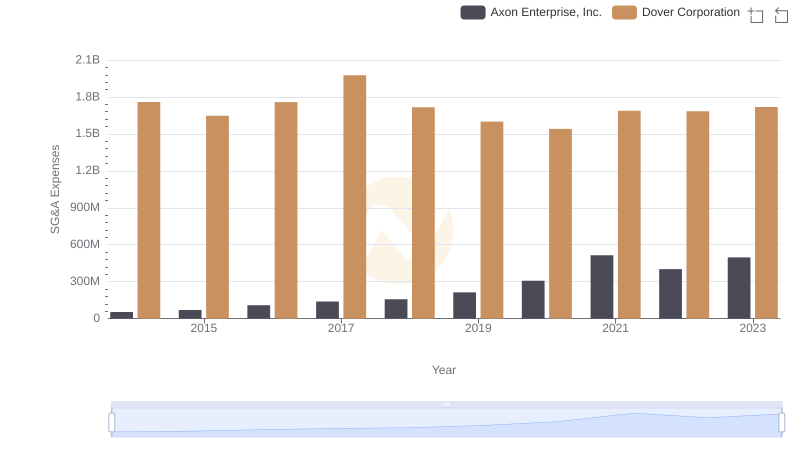

Selling, General, and Administrative Costs: Axon Enterprise, Inc. vs Dover Corporation