| __timestamp | Axon Enterprise, Inc. | HEICO Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 54158000 | 194924000 |

| Thursday, January 1, 2015 | 69698000 | 204523000 |

| Friday, January 1, 2016 | 108076000 | 250147000 |

| Sunday, January 1, 2017 | 138692000 | 268067000 |

| Monday, January 1, 2018 | 156886000 | 314470000 |

| Tuesday, January 1, 2019 | 212959000 | 356743000 |

| Wednesday, January 1, 2020 | 307286000 | 305479000 |

| Friday, January 1, 2021 | 515007000 | 334523000 |

| Saturday, January 1, 2022 | 401575000 | 365915000 |

| Sunday, January 1, 2023 | 496874000 | 516292000 |

| Monday, January 1, 2024 | 677271000 |

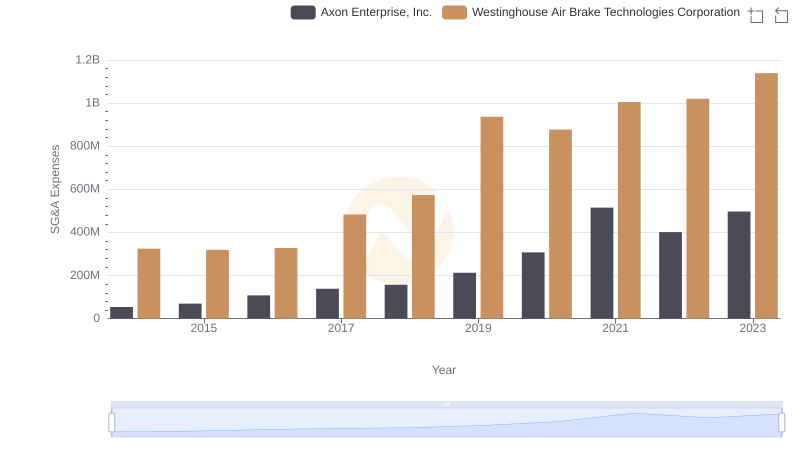

Unlocking the unknown

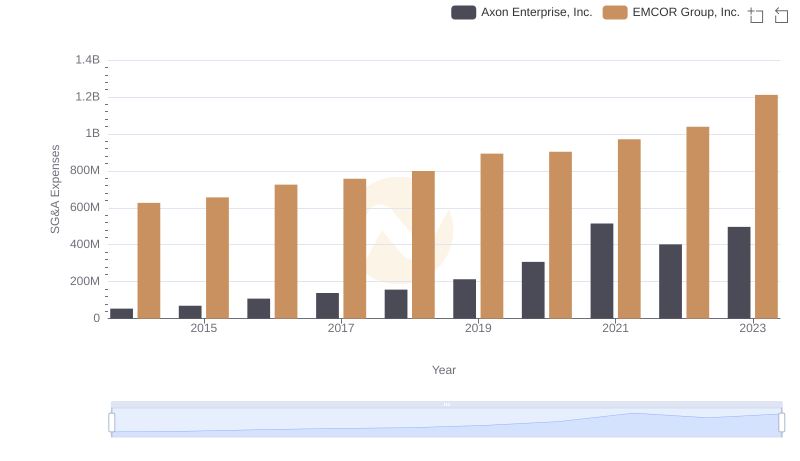

In the ever-evolving landscape of operational costs, Selling, General, and Administrative (SG&A) expenses serve as a critical indicator of a company's efficiency and strategic focus. Over the past decade, Axon Enterprise, Inc. and HEICO Corporation have showcased contrasting trajectories in their SG&A expenditures.

From 2014 to 2023, Axon saw a staggering 817% increase in SG&A expenses, peaking in 2021. This surge reflects Axon's aggressive expansion and investment in innovation, particularly in public safety technology.

HEICO, a leader in aerospace and electronics, experienced a more moderate 165% rise in SG&A costs over the same period. The company's steady growth underscores its strategic acquisitions and market expansion.

While Axon's rapid increase highlights its dynamic growth strategy, HEICO's consistent rise points to a stable, long-term approach. Missing data for 2024 suggests ongoing developments in this financial narrative.

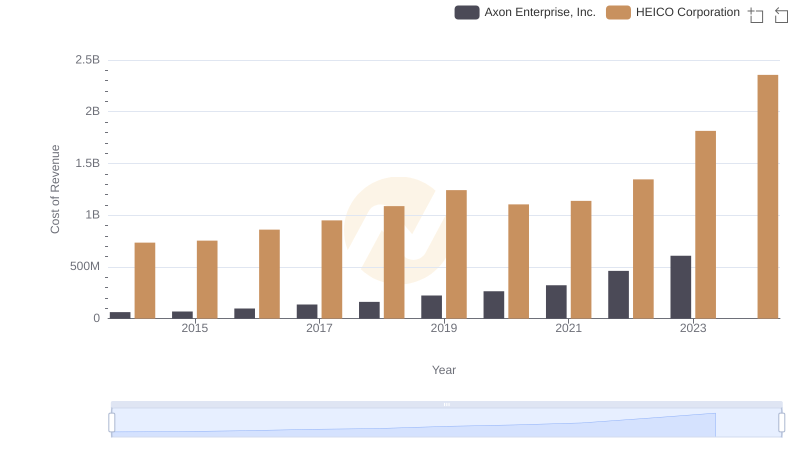

Cost of Revenue Trends: Axon Enterprise, Inc. vs HEICO Corporation

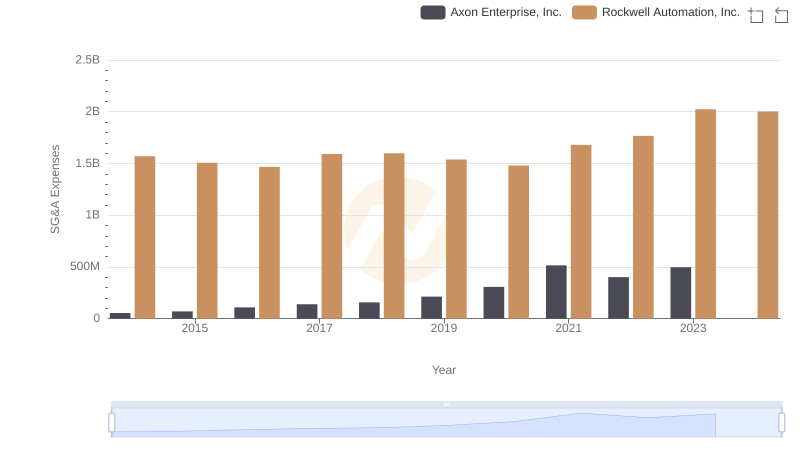

Operational Costs Compared: SG&A Analysis of Axon Enterprise, Inc. and Rockwell Automation, Inc.

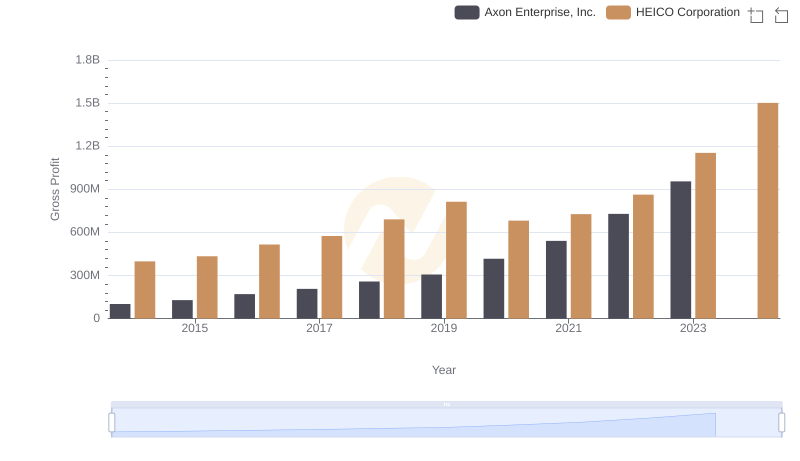

Gross Profit Analysis: Comparing Axon Enterprise, Inc. and HEICO Corporation

Selling, General, and Administrative Costs: Axon Enterprise, Inc. vs Westinghouse Air Brake Technologies Corporation

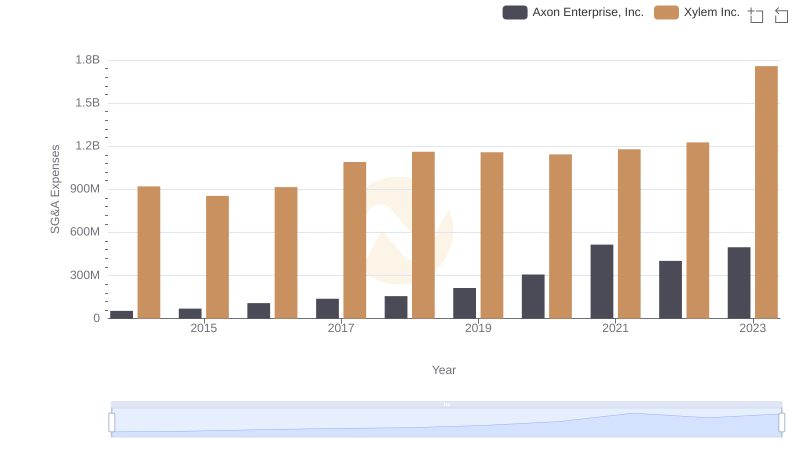

Axon Enterprise, Inc. vs Xylem Inc.: SG&A Expense Trends

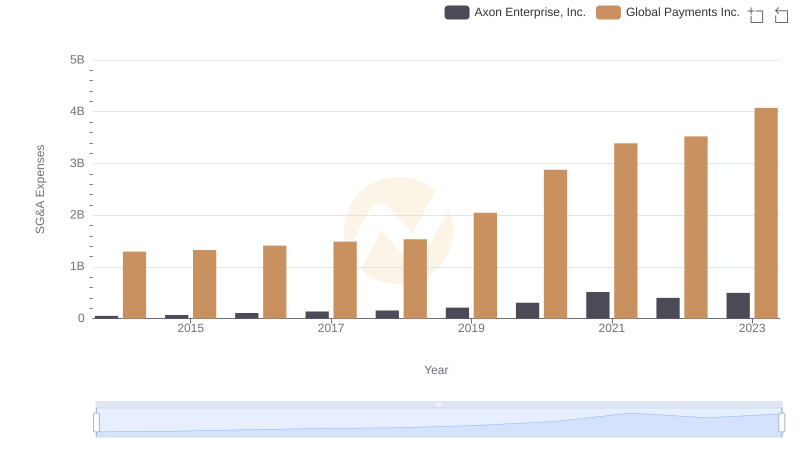

Breaking Down SG&A Expenses: Axon Enterprise, Inc. vs Global Payments Inc.

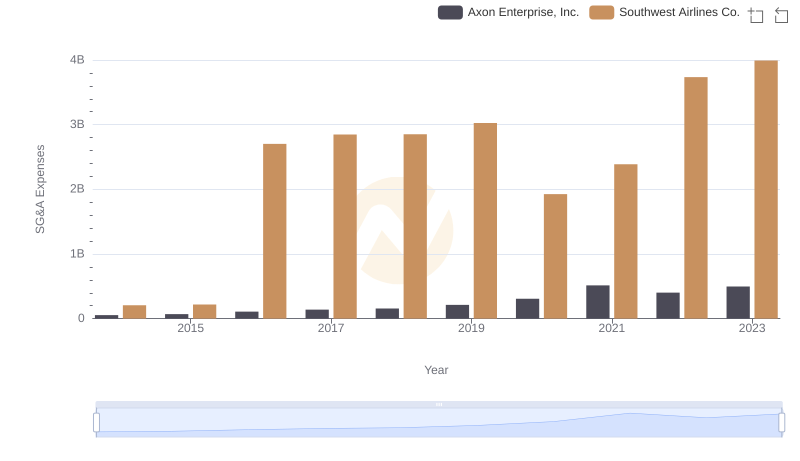

Who Optimizes SG&A Costs Better? Axon Enterprise, Inc. or Southwest Airlines Co.

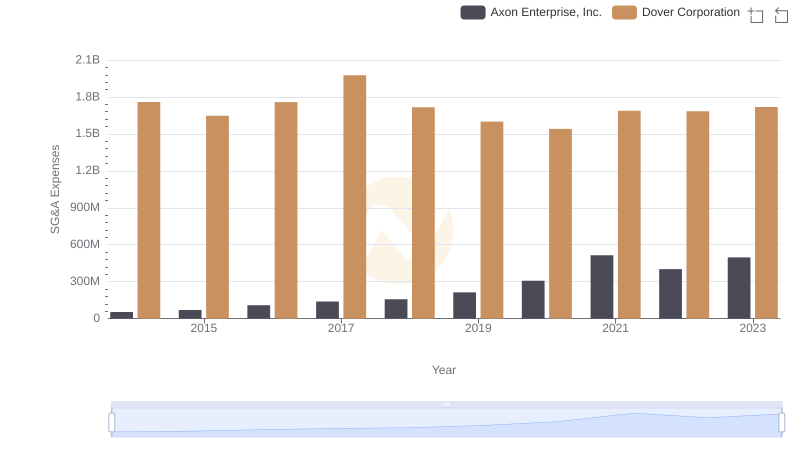

Selling, General, and Administrative Costs: Axon Enterprise, Inc. vs Dover Corporation

SG&A Efficiency Analysis: Comparing Axon Enterprise, Inc. and EMCOR Group, Inc.