| __timestamp | Axon Enterprise, Inc. | Dover Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 54158000 | 1758765000 |

| Thursday, January 1, 2015 | 69698000 | 1647382000 |

| Friday, January 1, 2016 | 108076000 | 1757523000 |

| Sunday, January 1, 2017 | 138692000 | 1975932000 |

| Monday, January 1, 2018 | 156886000 | 1716444000 |

| Tuesday, January 1, 2019 | 212959000 | 1599098000 |

| Wednesday, January 1, 2020 | 307286000 | 1541032000 |

| Friday, January 1, 2021 | 515007000 | 1688278000 |

| Saturday, January 1, 2022 | 401575000 | 1684226000 |

| Sunday, January 1, 2023 | 496874000 | 1718290000 |

| Monday, January 1, 2024 | 1752266000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of corporate finance, understanding the dynamics of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Axon Enterprise, Inc. and Dover Corporation have showcased contrasting trajectories in their SG&A expenditures. From 2014 to 2023, Axon Enterprise, Inc. saw a staggering increase of over 800% in their SG&A costs, reflecting their aggressive growth and expansion strategies. In contrast, Dover Corporation maintained a relatively stable SG&A expense, with fluctuations of less than 15% annually, indicating a more consistent operational approach.

This comparison highlights the diverse strategies companies employ to manage operational costs. While Axon's rising expenses suggest a focus on scaling and innovation, Dover's steady figures may point to efficiency and stability. As investors and analysts, understanding these trends can provide valuable insights into a company's strategic direction and financial health.

Axon Enterprise, Inc. or Dover Corporation: Who Leads in Yearly Revenue?

Cost of Revenue Comparison: Axon Enterprise, Inc. vs Dover Corporation

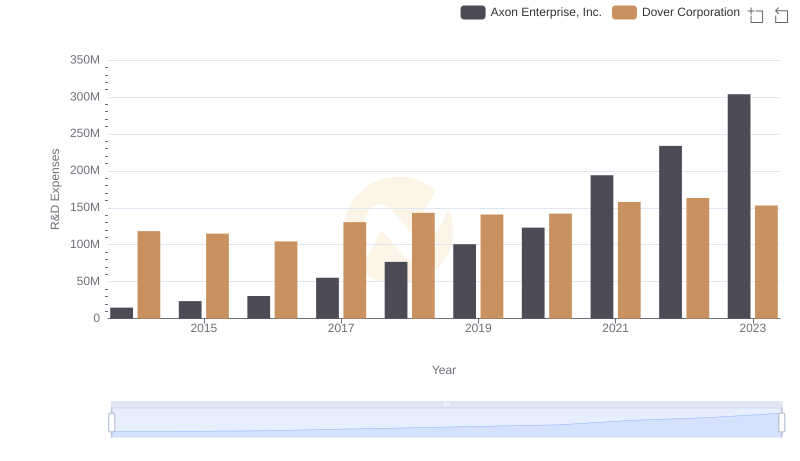

Axon Enterprise, Inc. or Dover Corporation: Who Invests More in Innovation?

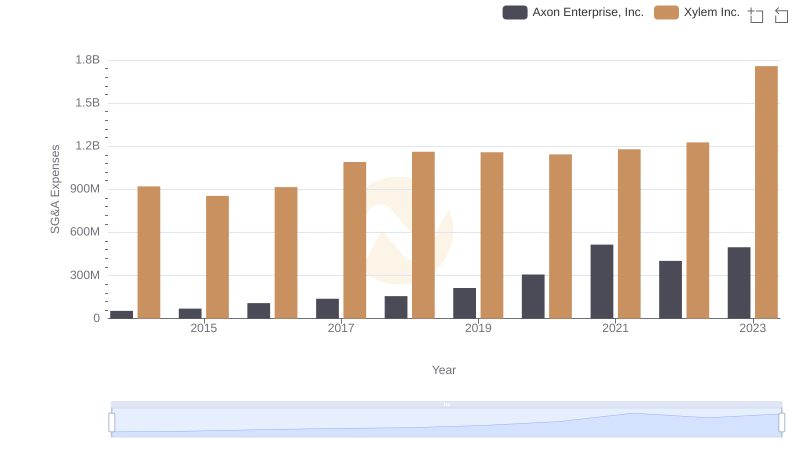

Axon Enterprise, Inc. vs Xylem Inc.: SG&A Expense Trends

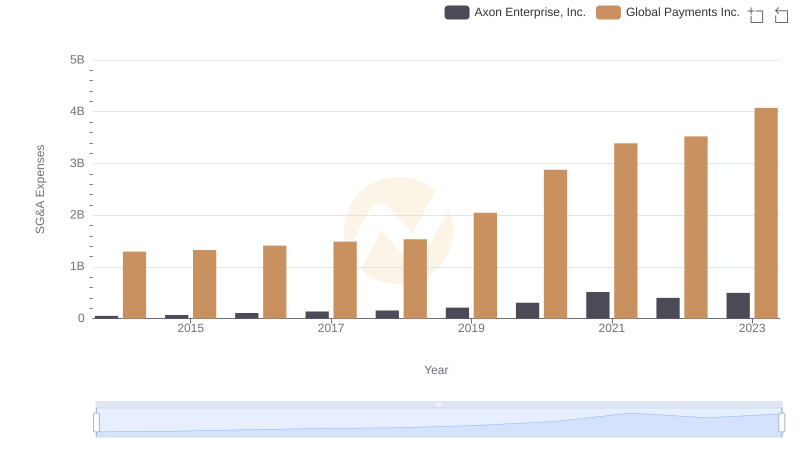

Breaking Down SG&A Expenses: Axon Enterprise, Inc. vs Global Payments Inc.

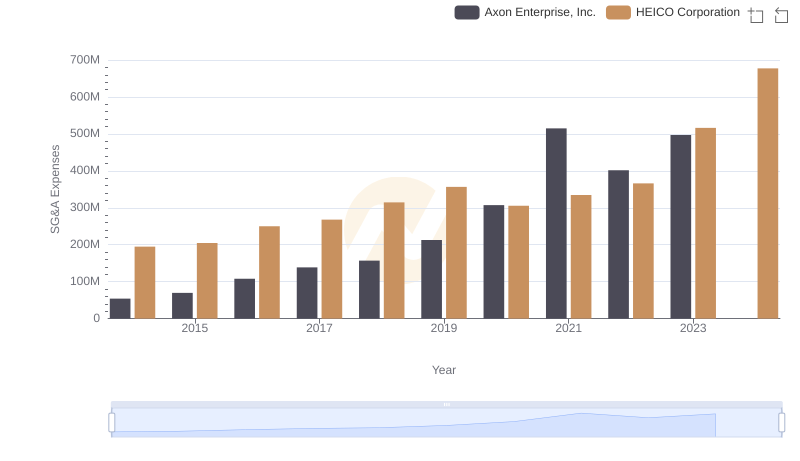

Operational Costs Compared: SG&A Analysis of Axon Enterprise, Inc. and HEICO Corporation

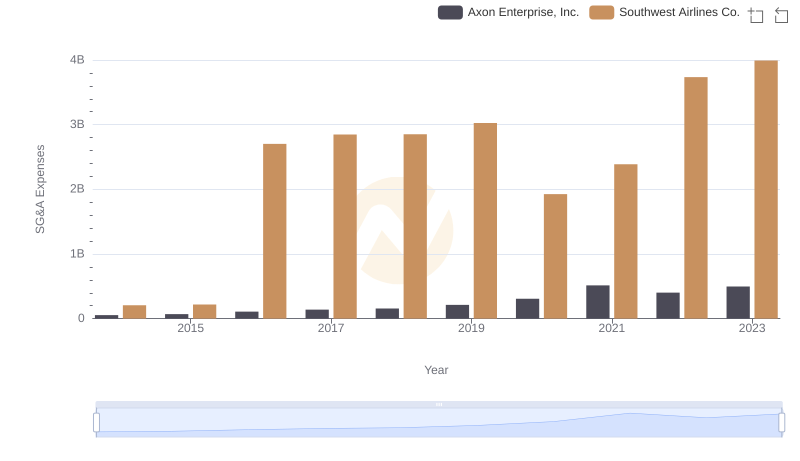

Who Optimizes SG&A Costs Better? Axon Enterprise, Inc. or Southwest Airlines Co.

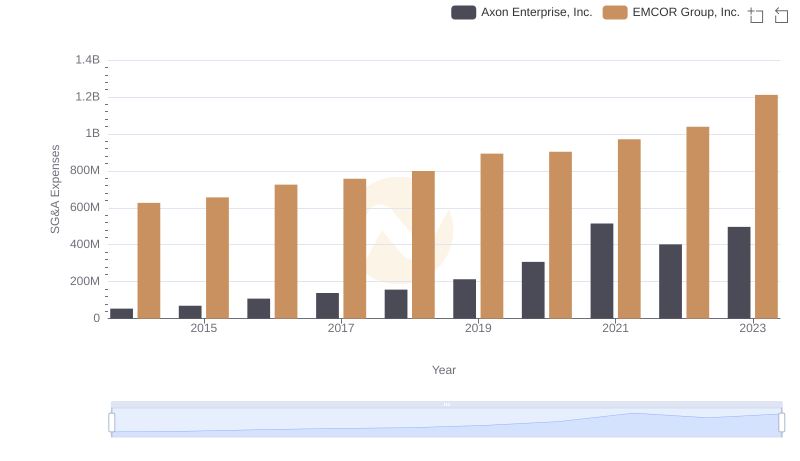

SG&A Efficiency Analysis: Comparing Axon Enterprise, Inc. and EMCOR Group, Inc.

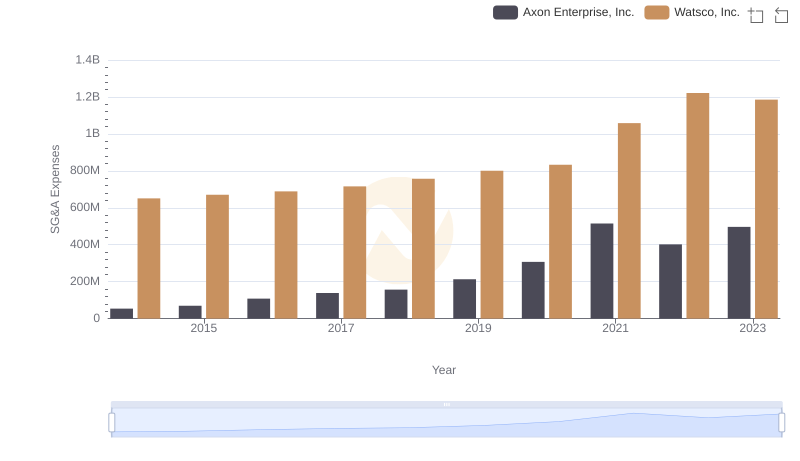

Comparing SG&A Expenses: Axon Enterprise, Inc. vs Watsco, Inc. Trends and Insights