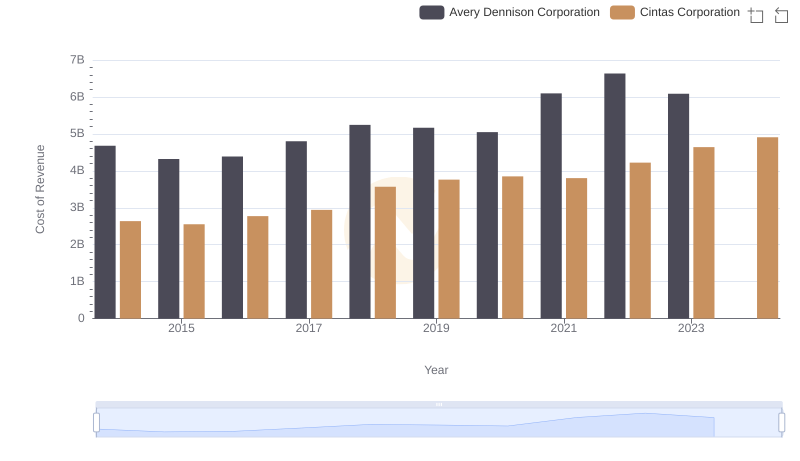

| __timestamp | Avery Dennison Corporation | Cintas Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1651200000 | 1914386000 |

| Thursday, January 1, 2015 | 1645800000 | 1921337000 |

| Friday, January 1, 2016 | 1699700000 | 2129870000 |

| Sunday, January 1, 2017 | 1812200000 | 2380295000 |

| Monday, January 1, 2018 | 1915500000 | 2908523000 |

| Tuesday, January 1, 2019 | 1904100000 | 3128588000 |

| Wednesday, January 1, 2020 | 1923300000 | 3233748000 |

| Friday, January 1, 2021 | 2312800000 | 3314651000 |

| Saturday, January 1, 2022 | 2404200000 | 3632246000 |

| Sunday, January 1, 2023 | 2277499999 | 4173368000 |

| Monday, January 1, 2024 | 2530700000 | 4686416000 |

Unleashing insights

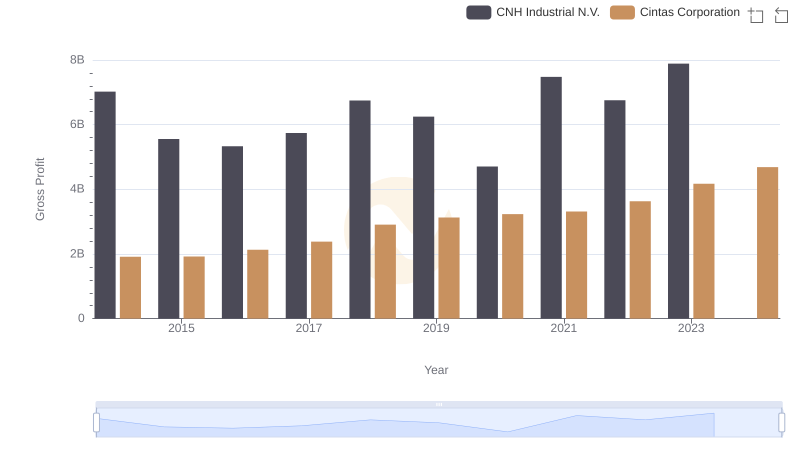

In the competitive landscape of corporate America, Cintas Corporation and Avery Dennison Corporation stand as titans in their respective industries. Over the past decade, Cintas has consistently outperformed Avery Dennison in terms of gross profit. From 2014 to 2023, Cintas saw a remarkable growth of approximately 118%, with gross profits soaring from around $1.9 billion to over $4.1 billion. In contrast, Avery Dennison's growth was more modest, with an increase of about 38% during the same period, reaching a peak of $2.4 billion in 2022.

The data reveals a clear trend: Cintas has not only maintained but expanded its lead over Avery Dennison. This growth trajectory underscores Cintas's strategic prowess and market adaptability. As we look to the future, the missing data for 2024 leaves us eagerly anticipating whether Cintas will continue its upward momentum.

Cost of Revenue: Key Insights for Cintas Corporation and Avery Dennison Corporation

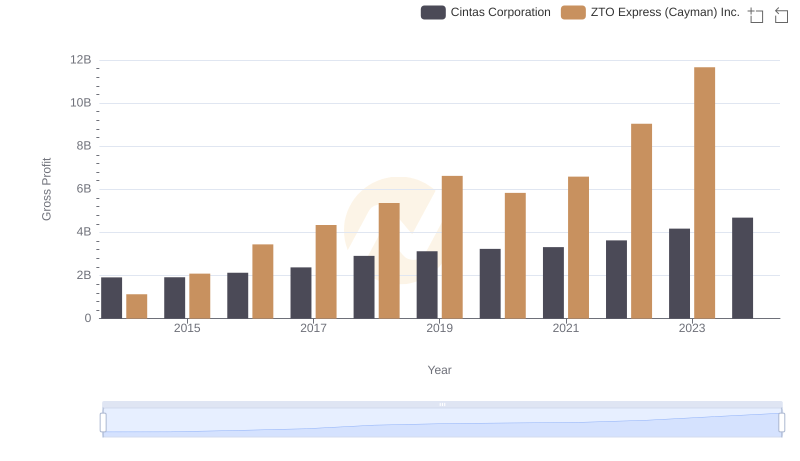

Cintas Corporation vs ZTO Express (Cayman) Inc.: A Gross Profit Performance Breakdown

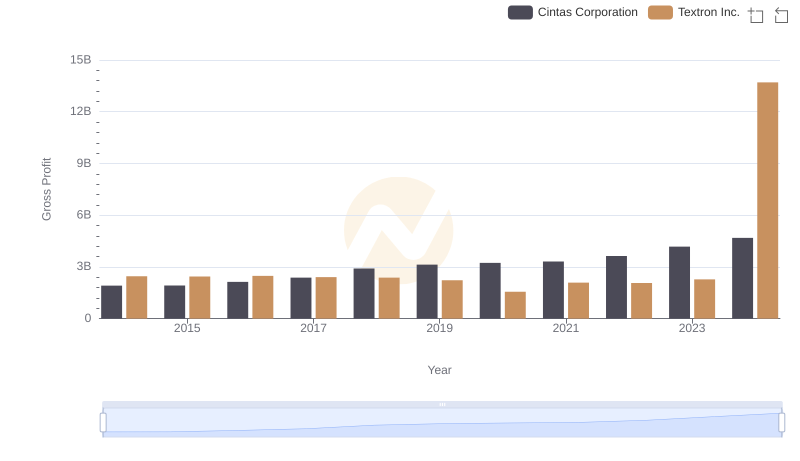

Key Insights on Gross Profit: Cintas Corporation vs Textron Inc.

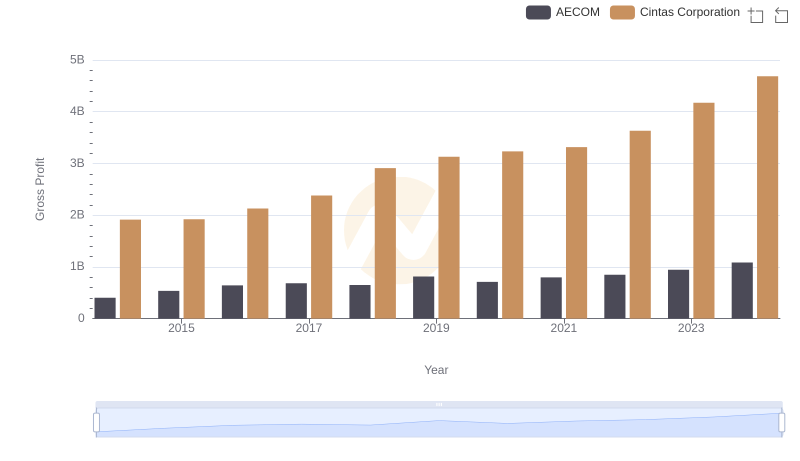

Gross Profit Trends Compared: Cintas Corporation vs AECOM

Who Generates Higher Gross Profit? Cintas Corporation or CNH Industrial N.V.

Gross Profit Analysis: Comparing Cintas Corporation and Graco Inc.

Key Insights on Gross Profit: Cintas Corporation vs Comfort Systems USA, Inc.

A Side-by-Side Analysis of EBITDA: Cintas Corporation and Avery Dennison Corporation