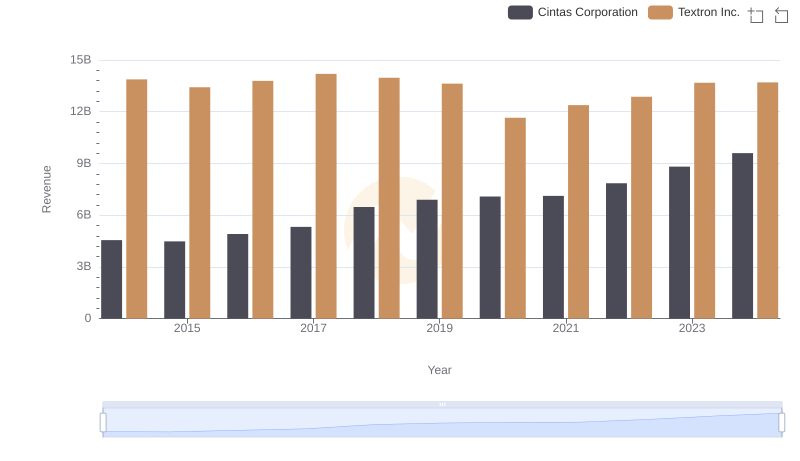

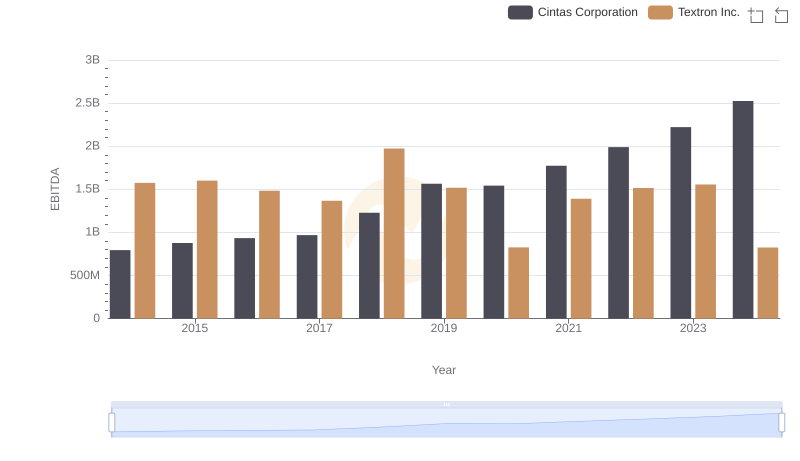

| __timestamp | Cintas Corporation | Textron Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1914386000 | 2457000000 |

| Thursday, January 1, 2015 | 1921337000 | 2444000000 |

| Friday, January 1, 2016 | 2129870000 | 2477000000 |

| Sunday, January 1, 2017 | 2380295000 | 2403000000 |

| Monday, January 1, 2018 | 2908523000 | 2378000000 |

| Tuesday, January 1, 2019 | 3128588000 | 2224000000 |

| Wednesday, January 1, 2020 | 3233748000 | 1557000000 |

| Friday, January 1, 2021 | 3314651000 | 2085000000 |

| Saturday, January 1, 2022 | 3632246000 | 2069000000 |

| Sunday, January 1, 2023 | 4173368000 | 2278000000 |

| Monday, January 1, 2024 | 4686416000 | 2502000000 |

Unleashing insights

In the competitive landscape of the American corporate world, Cintas Corporation and Textron Inc. have showcased intriguing trajectories in their gross profit over the past decade. From 2014 to 2024, Cintas Corporation has demonstrated a robust growth, with its gross profit surging by approximately 145%, from $1.9 billion to an impressive $4.7 billion. This consistent upward trend highlights Cintas's strategic prowess in expanding its market share and optimizing operational efficiencies.

Conversely, Textron Inc. presents a more volatile picture. Despite starting strong in 2014 with a gross profit of $2.5 billion, Textron experienced fluctuations, culminating in a remarkable spike to $13.7 billion in 2024. This dramatic increase suggests significant strategic shifts or acquisitions that have bolstered its financial standing.

These insights underscore the dynamic nature of corporate growth strategies and the diverse paths companies take to achieve financial success.

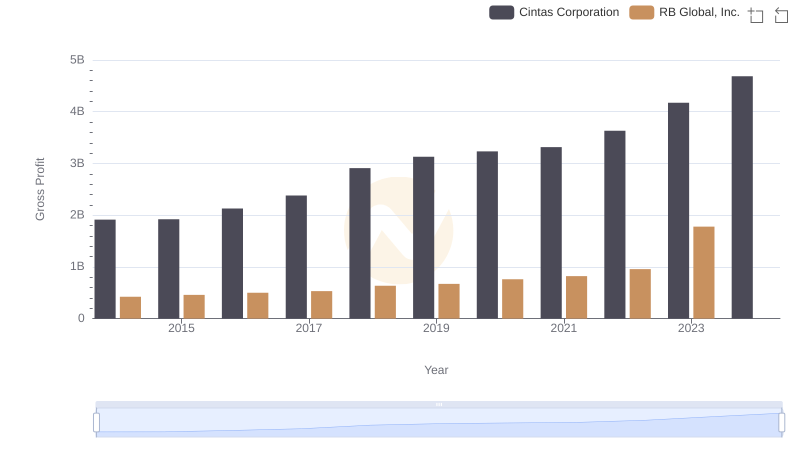

Key Insights on Gross Profit: Cintas Corporation vs RB Global, Inc.

Cintas Corporation vs Textron Inc.: Annual Revenue Growth Compared

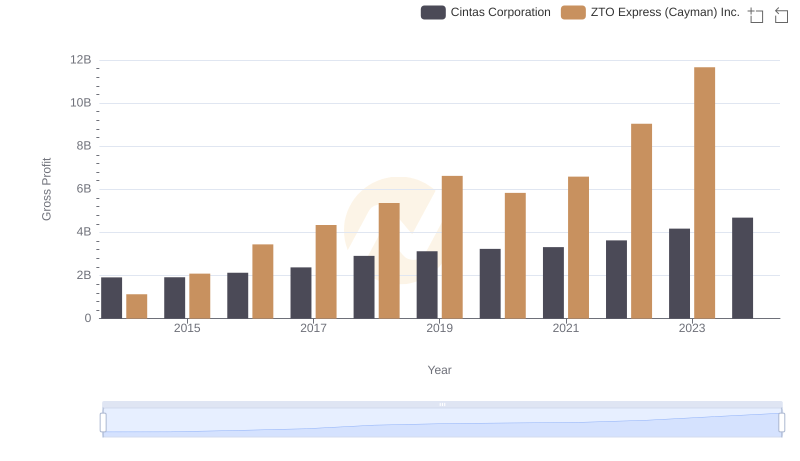

Cintas Corporation vs ZTO Express (Cayman) Inc.: A Gross Profit Performance Breakdown

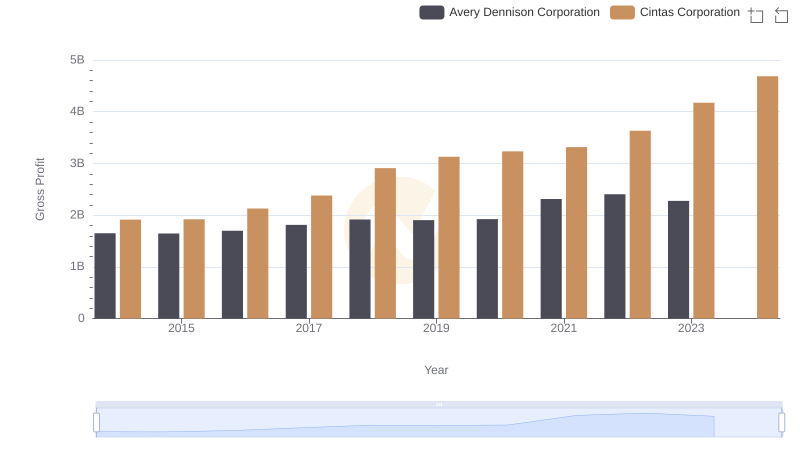

Who Generates Higher Gross Profit? Cintas Corporation or Avery Dennison Corporation

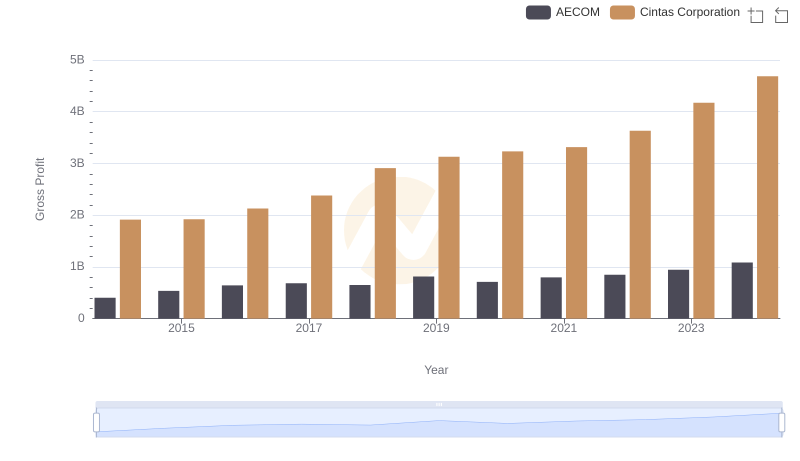

Gross Profit Trends Compared: Cintas Corporation vs AECOM

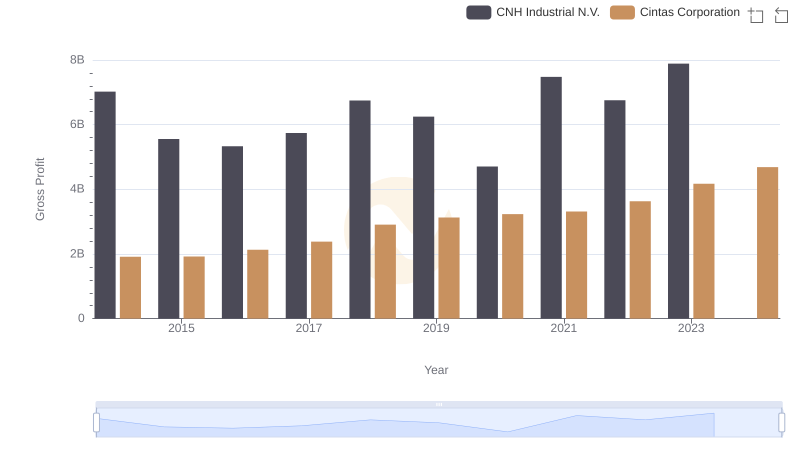

Who Generates Higher Gross Profit? Cintas Corporation or CNH Industrial N.V.

Gross Profit Analysis: Comparing Cintas Corporation and Graco Inc.

Key Insights on Gross Profit: Cintas Corporation vs Comfort Systems USA, Inc.

Comparative EBITDA Analysis: Cintas Corporation vs Textron Inc.