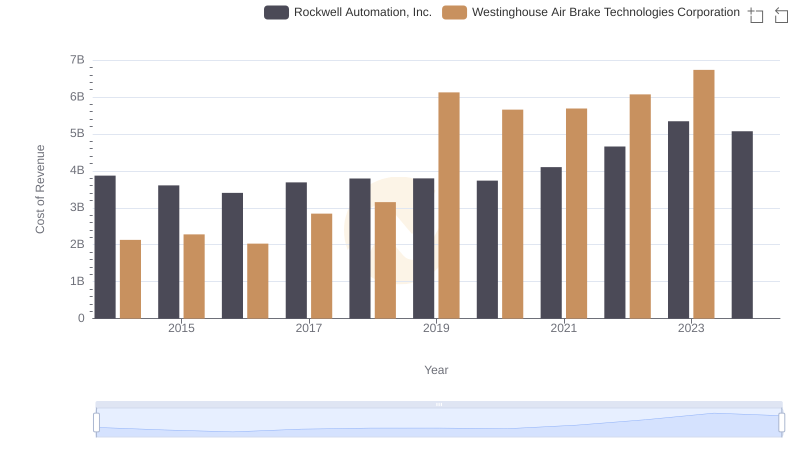

| __timestamp | Rockwell Automation, Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 6623500000 | 3044454000 |

| Thursday, January 1, 2015 | 6307900000 | 3307998000 |

| Friday, January 1, 2016 | 5879500000 | 2931188000 |

| Sunday, January 1, 2017 | 6311300000 | 3881756000 |

| Monday, January 1, 2018 | 6666000000 | 4363547000 |

| Tuesday, January 1, 2019 | 6694800000 | 8200000000 |

| Wednesday, January 1, 2020 | 6329800000 | 7556100000 |

| Friday, January 1, 2021 | 6997400000 | 7822000000 |

| Saturday, January 1, 2022 | 7760400000 | 8362000000 |

| Sunday, January 1, 2023 | 9058000000 | 9677000000 |

| Monday, January 1, 2024 | 8264200000 | 10387000000 |

Unleashing the power of data

In the ever-evolving landscape of industrial technology, two titans have emerged as leaders: Westinghouse Air Brake Technologies Corporation and Rockwell Automation, Inc. Over the past decade, these companies have showcased remarkable growth and resilience. From 2014 to 2023, Rockwell Automation's revenue surged by approximately 37%, peaking in 2023. Meanwhile, Westinghouse Air Brake Technologies saw an impressive 218% increase in revenue, highlighting its rapid expansion and market penetration.

As we look to the future, these companies continue to shape the industrial sector, driving innovation and setting benchmarks for excellence.

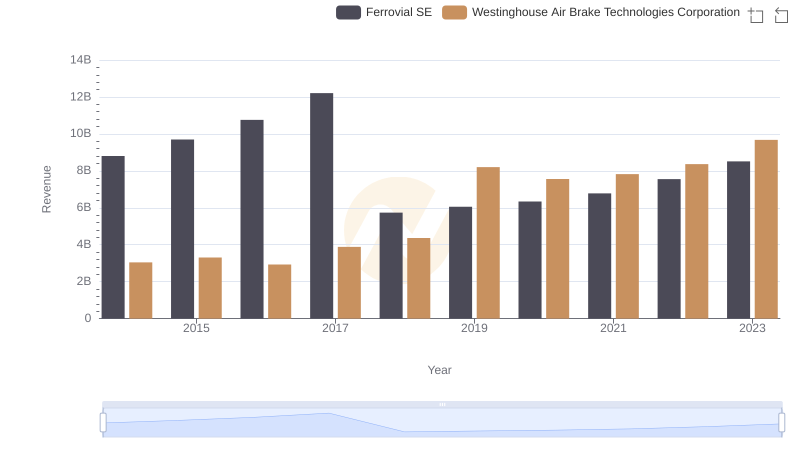

Westinghouse Air Brake Technologies Corporation vs Ferrovial SE: Annual Revenue Growth Compared

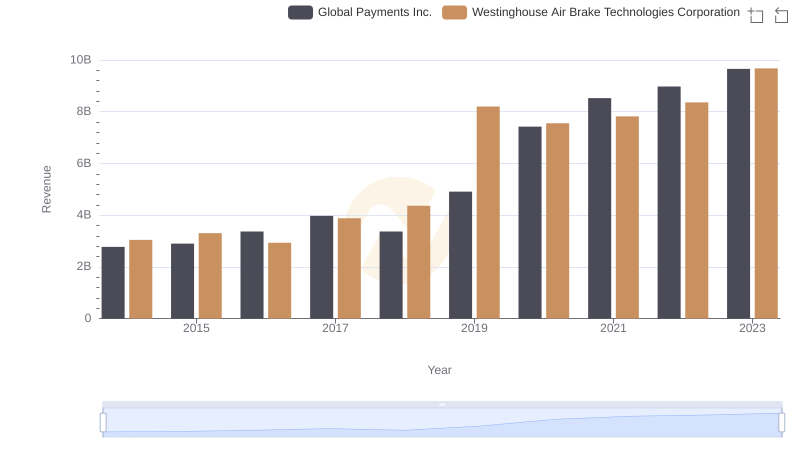

Westinghouse Air Brake Technologies Corporation or Global Payments Inc.: Who Leads in Yearly Revenue?

Westinghouse Air Brake Technologies Corporation vs Rockwell Automation, Inc.: Efficiency in Cost of Revenue Explored

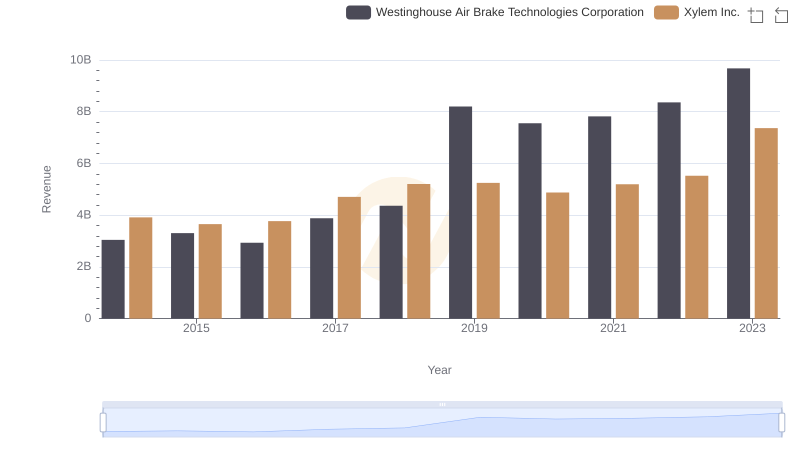

Who Generates More Revenue? Westinghouse Air Brake Technologies Corporation or Xylem Inc.

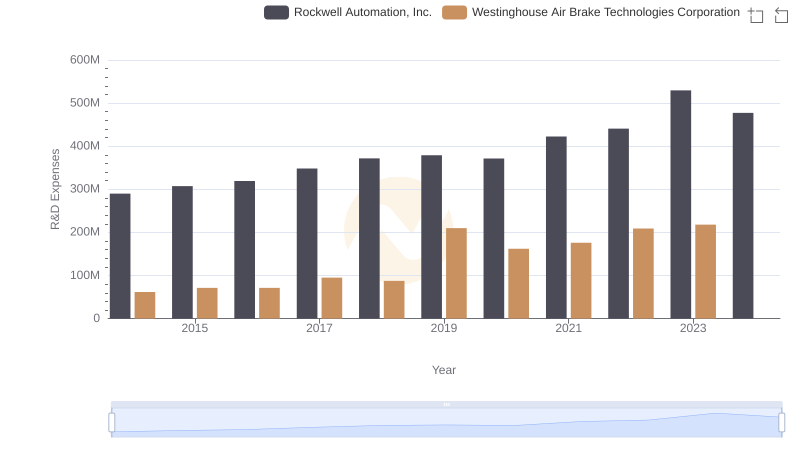

Westinghouse Air Brake Technologies Corporation vs Rockwell Automation, Inc.: Strategic Focus on R&D Spending

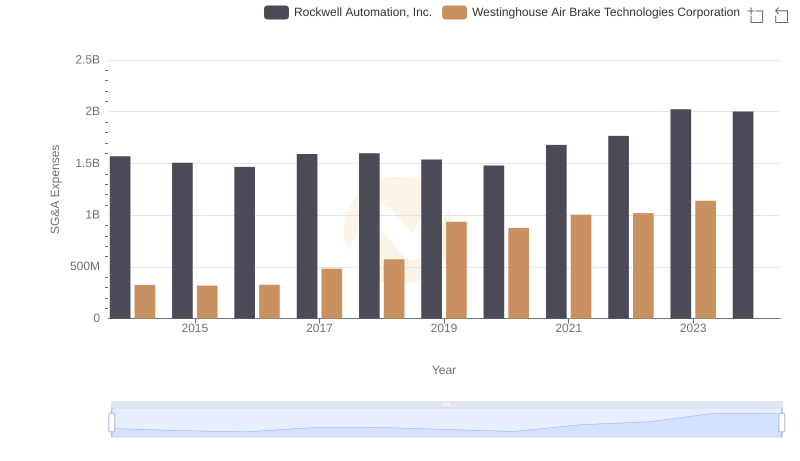

Westinghouse Air Brake Technologies Corporation and Rockwell Automation, Inc.: SG&A Spending Patterns Compared

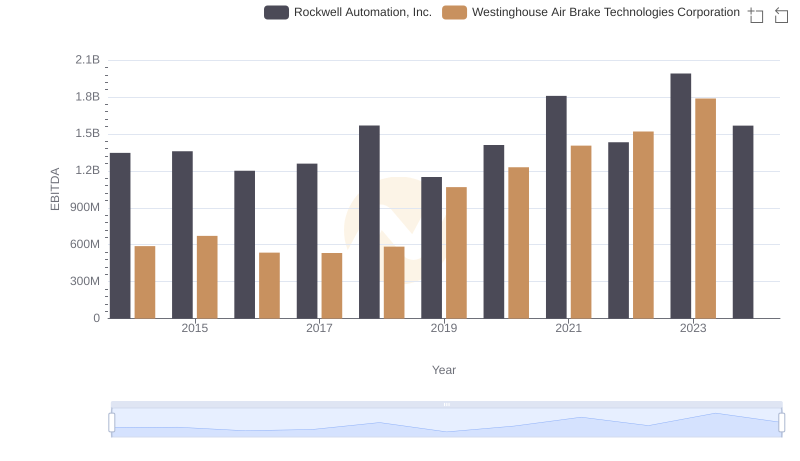

Westinghouse Air Brake Technologies Corporation and Rockwell Automation, Inc.: A Detailed Examination of EBITDA Performance