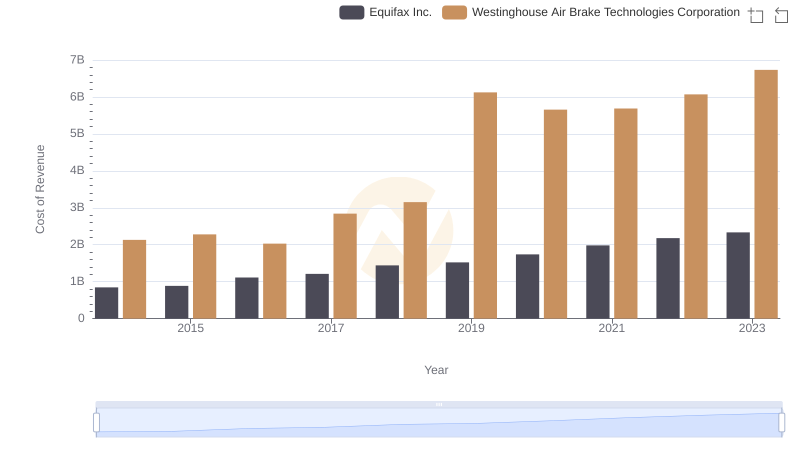

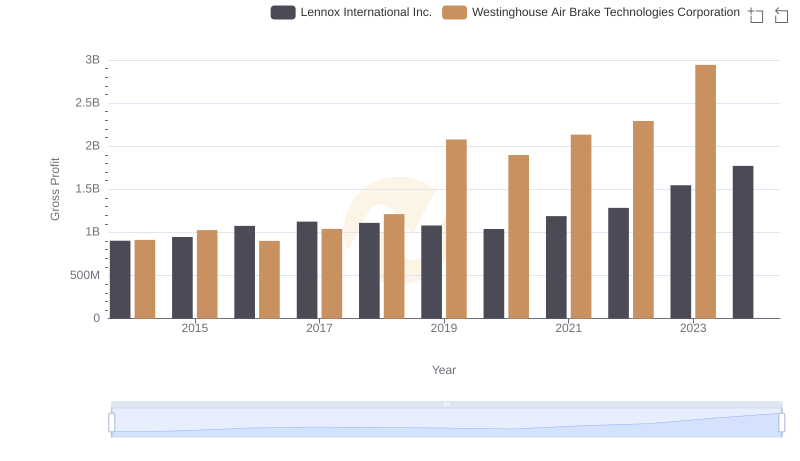

| __timestamp | Equifax Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1591700000 | 913534000 |

| Thursday, January 1, 2015 | 1776200000 | 1026153000 |

| Friday, January 1, 2016 | 2031500000 | 901541000 |

| Sunday, January 1, 2017 | 2151500000 | 1040597000 |

| Monday, January 1, 2018 | 1971700000 | 1211731000 |

| Tuesday, January 1, 2019 | 1985900000 | 2077600000 |

| Wednesday, January 1, 2020 | 2390100000 | 1898700000 |

| Friday, January 1, 2021 | 2943000000 | 2135000000 |

| Saturday, January 1, 2022 | 2945000000 | 2292000000 |

| Sunday, January 1, 2023 | 2930100000 | 2944000000 |

| Monday, January 1, 2024 | 5681100000 | 3366000000 |

Cracking the code

In the ever-evolving landscape of corporate finance, the gross profit performance of Westinghouse Air Brake Technologies Corporation and Equifax Inc. offers a fascinating glimpse into the dynamics of industrial and financial sectors. Over the past decade, Equifax Inc. has seen a steady increase in gross profit, peaking in 2022 with a remarkable 85% growth from its 2014 figures. Meanwhile, Westinghouse Air Brake Technologies Corporation has demonstrated a robust upward trajectory, culminating in a 222% increase by 2023, surpassing Equifax's performance in the same year.

This data underscores the resilience and adaptability of these companies amidst economic fluctuations. While Equifax's growth reflects the increasing demand for credit reporting services, Westinghouse's surge highlights the critical role of transportation technology in global supply chains. As we look to the future, these trends provide valuable insights for investors and industry analysts alike.

Westinghouse Air Brake Technologies Corporation vs Equifax Inc.: Efficiency in Cost of Revenue Explored

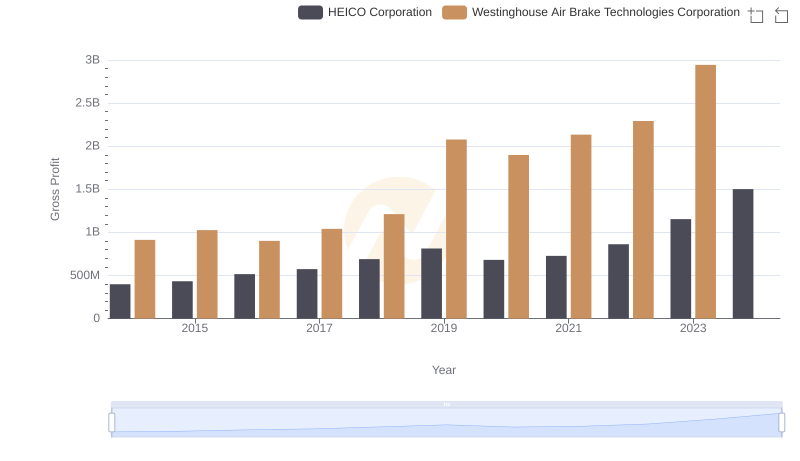

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and HEICO Corporation Trends

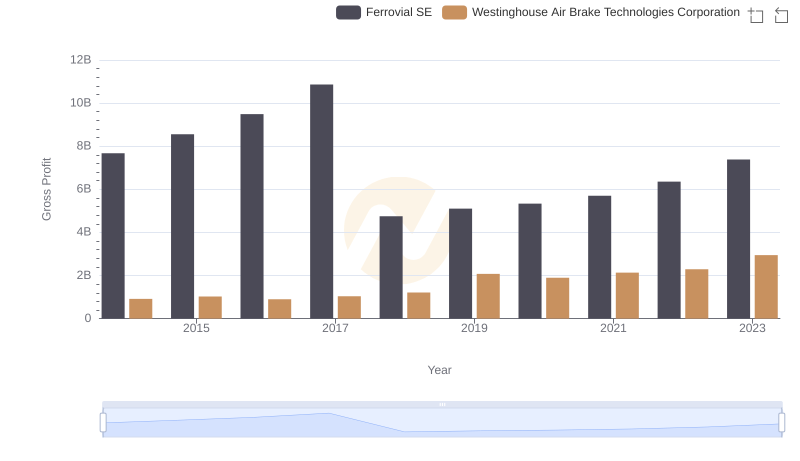

Gross Profit Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Ferrovial SE

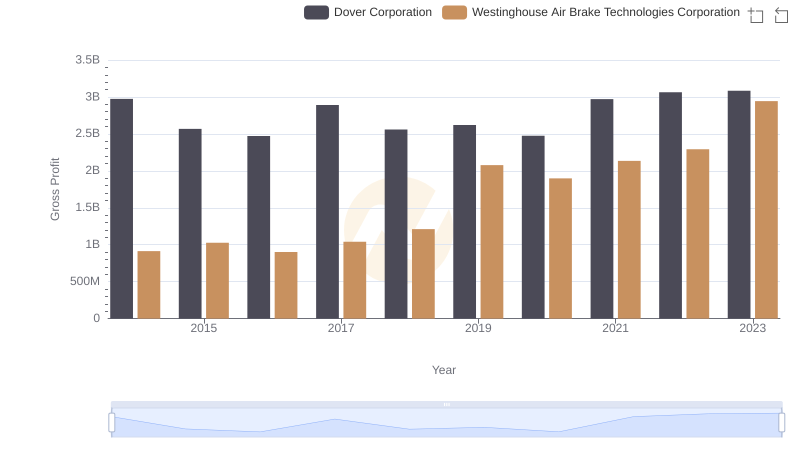

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and Dover Corporation Trends

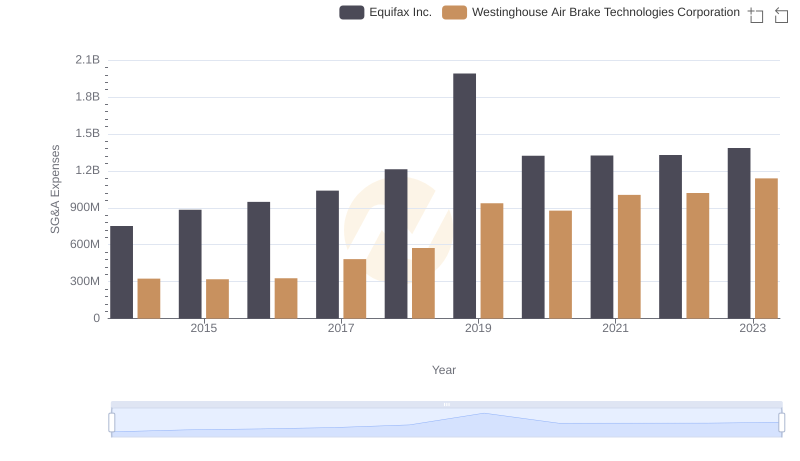

Breaking Down SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs Equifax Inc.

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and Lennox International Inc. Trends

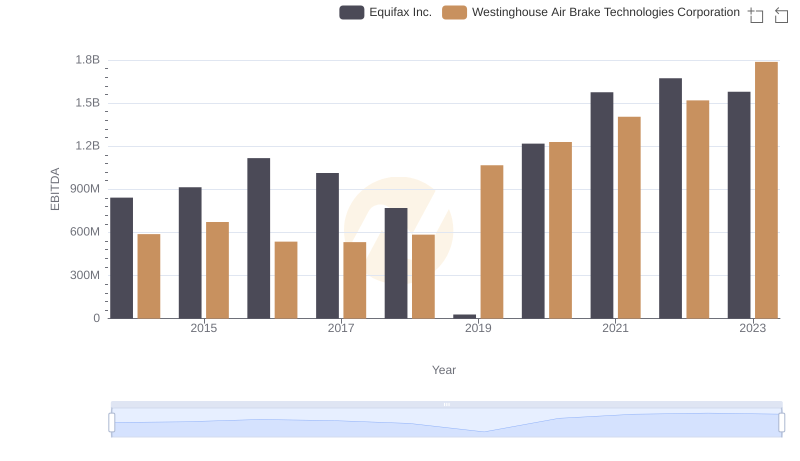

A Side-by-Side Analysis of EBITDA: Westinghouse Air Brake Technologies Corporation and Equifax Inc.