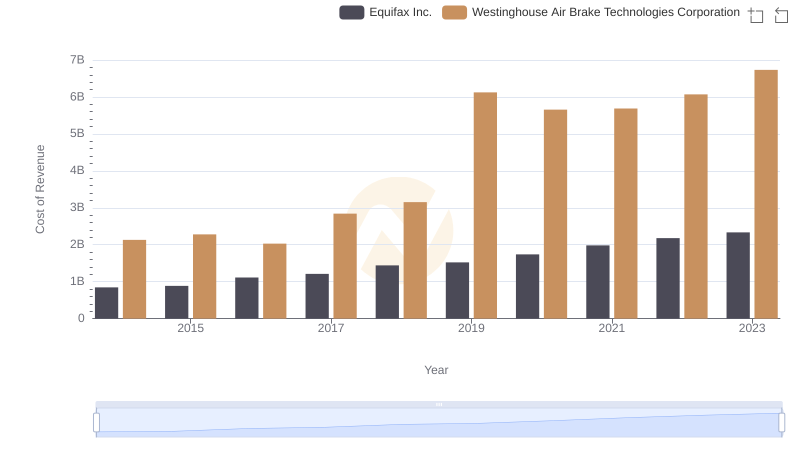

| __timestamp | Equifax Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 751700000 | 324539000 |

| Thursday, January 1, 2015 | 884300000 | 319173000 |

| Friday, January 1, 2016 | 948200000 | 327505000 |

| Sunday, January 1, 2017 | 1039100000 | 482852000 |

| Monday, January 1, 2018 | 1213300000 | 573644000 |

| Tuesday, January 1, 2019 | 1990200000 | 936600000 |

| Wednesday, January 1, 2020 | 1322500000 | 877100000 |

| Friday, January 1, 2021 | 1324600000 | 1005000000 |

| Saturday, January 1, 2022 | 1328900000 | 1020000000 |

| Sunday, January 1, 2023 | 1385700000 | 1139000000 |

| Monday, January 1, 2024 | 1450500000 | 1248000000 |

Cracking the code

In the ever-evolving landscape of corporate finance, understanding the nuances of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Equifax Inc. and Westinghouse Air Brake Technologies Corporation have showcased distinct financial trajectories. From 2014 to 2023, Equifax's SG&A expenses surged by approximately 84%, peaking in 2019. This growth reflects strategic investments in technology and data security, especially post-2017's data breach. Meanwhile, Westinghouse Air Brake Technologies saw a 250% increase, highlighting its aggressive expansion and integration strategies. Notably, 2019 marked a pivotal year for both, with Equifax's expenses reaching their zenith, while Westinghouse's expenses nearly tripled from 2014 levels. This comparative analysis underscores the dynamic nature of SG&A expenses, offering insights into each company's strategic priorities and market positioning.

Westinghouse Air Brake Technologies Corporation vs Equifax Inc.: Efficiency in Cost of Revenue Explored

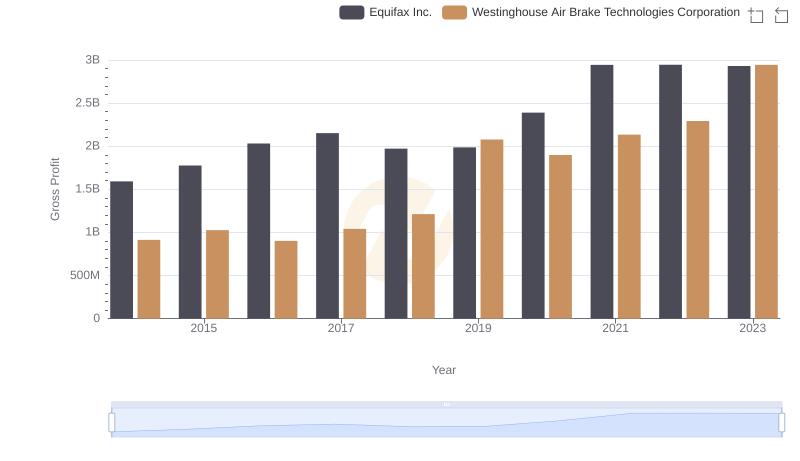

Westinghouse Air Brake Technologies Corporation vs Equifax Inc.: A Gross Profit Performance Breakdown

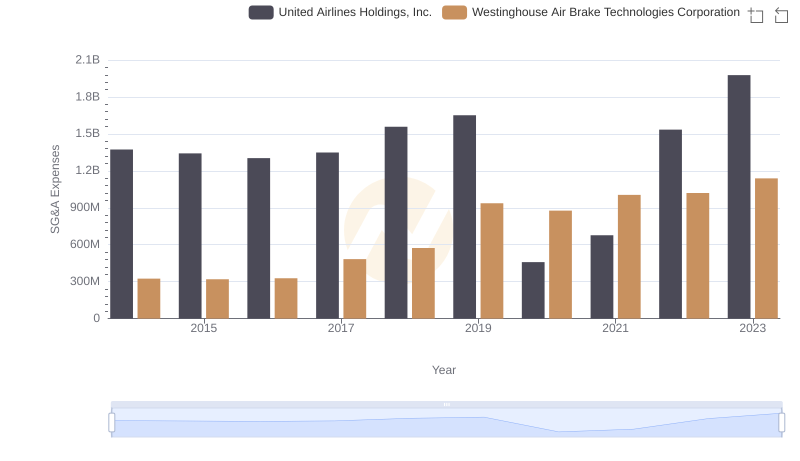

Operational Costs Compared: SG&A Analysis of Westinghouse Air Brake Technologies Corporation and United Airlines Holdings, Inc.

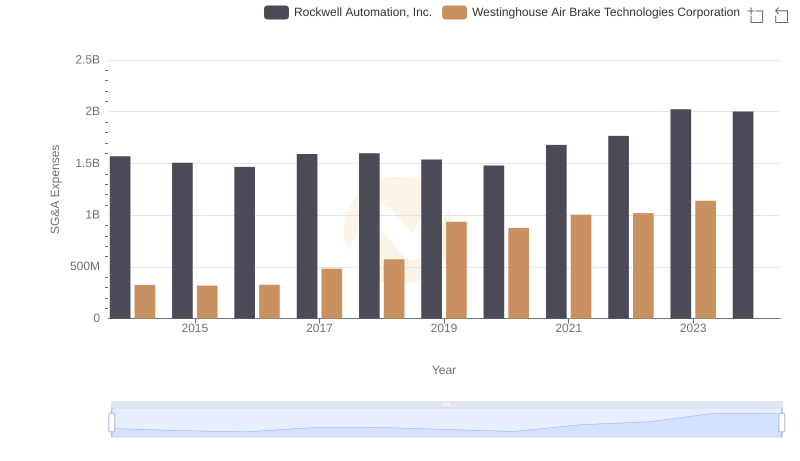

Westinghouse Air Brake Technologies Corporation and Rockwell Automation, Inc.: SG&A Spending Patterns Compared

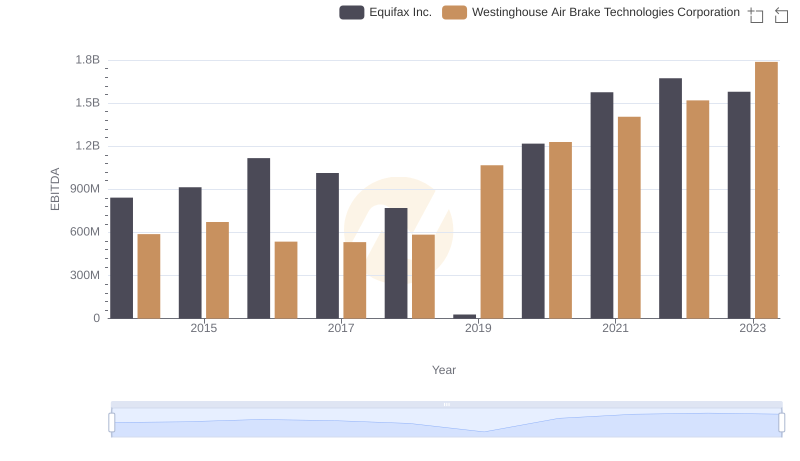

A Side-by-Side Analysis of EBITDA: Westinghouse Air Brake Technologies Corporation and Equifax Inc.

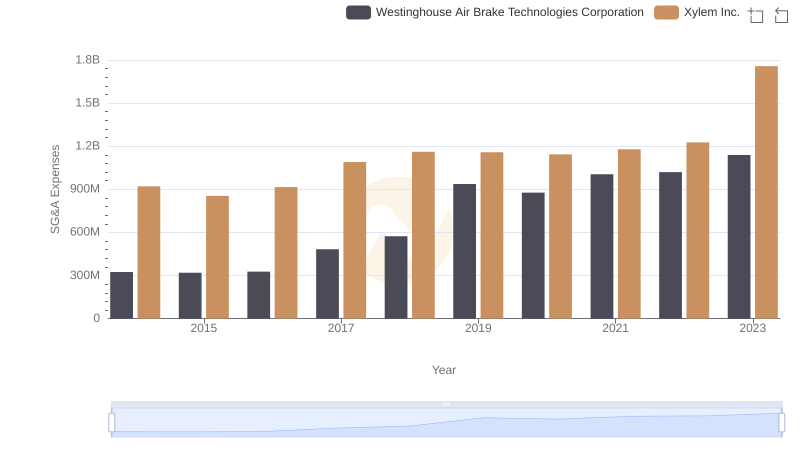

Who Optimizes SG&A Costs Better? Westinghouse Air Brake Technologies Corporation or Xylem Inc.

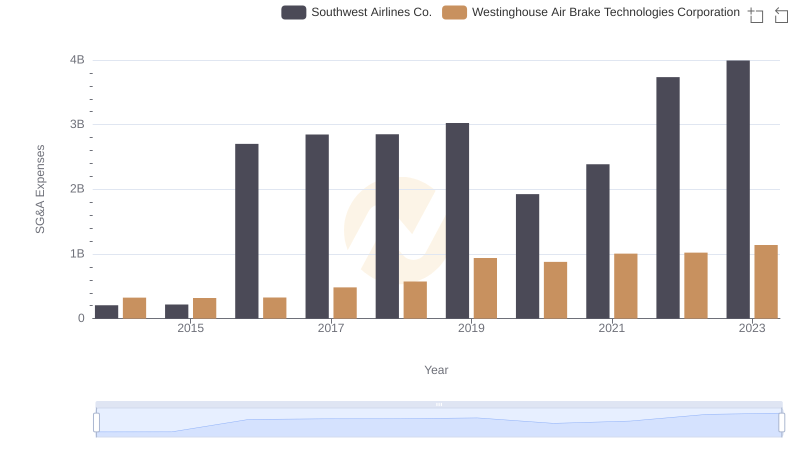

Cost Management Insights: SG&A Expenses for Westinghouse Air Brake Technologies Corporation and Southwest Airlines Co.