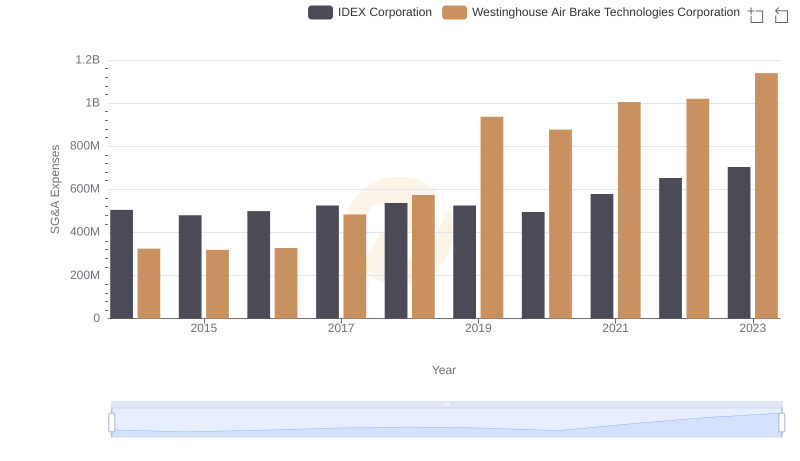

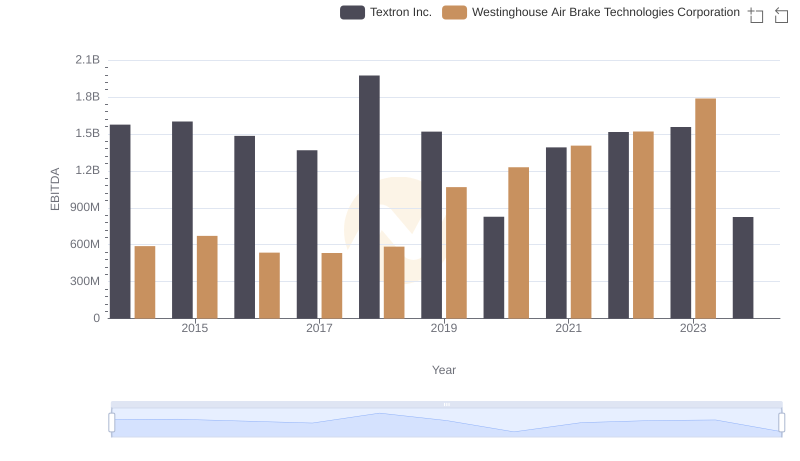

| __timestamp | Textron Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1361000000 | 324539000 |

| Thursday, January 1, 2015 | 1304000000 | 319173000 |

| Friday, January 1, 2016 | 1304000000 | 327505000 |

| Sunday, January 1, 2017 | 1337000000 | 482852000 |

| Monday, January 1, 2018 | 1275000000 | 573644000 |

| Tuesday, January 1, 2019 | 1152000000 | 936600000 |

| Wednesday, January 1, 2020 | 1045000000 | 877100000 |

| Friday, January 1, 2021 | 1221000000 | 1005000000 |

| Saturday, January 1, 2022 | 1186000000 | 1020000000 |

| Sunday, January 1, 2023 | 1225000000 | 1139000000 |

| Monday, January 1, 2024 | 1156000000 | 1248000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of corporate finance, understanding operational costs is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industrial giants: Westinghouse Air Brake Technologies Corporation and Textron Inc., from 2014 to 2023.

Textron Inc. consistently outpaces Westinghouse in SG&A expenses, with an average of approximately 2.3 billion annually, peaking in 2024 with a staggering 1,287% increase from the previous year. In contrast, Westinghouse's expenses show a steady rise, reaching their zenith in 2023 with a 256% increase since 2014.

This trend highlights Textron's expansive operational scale, while Westinghouse's growth trajectory suggests strategic investments in administrative capabilities. Notably, the absence of data for Westinghouse in 2024 suggests a potential shift or anomaly worth further exploration.

Understanding these dynamics offers valuable insights into the strategic priorities and financial health of these industry leaders.

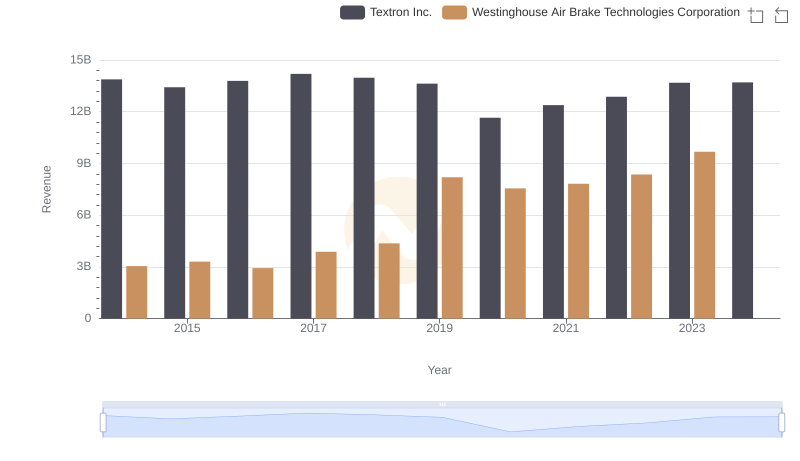

Westinghouse Air Brake Technologies Corporation or Textron Inc.: Who Leads in Yearly Revenue?

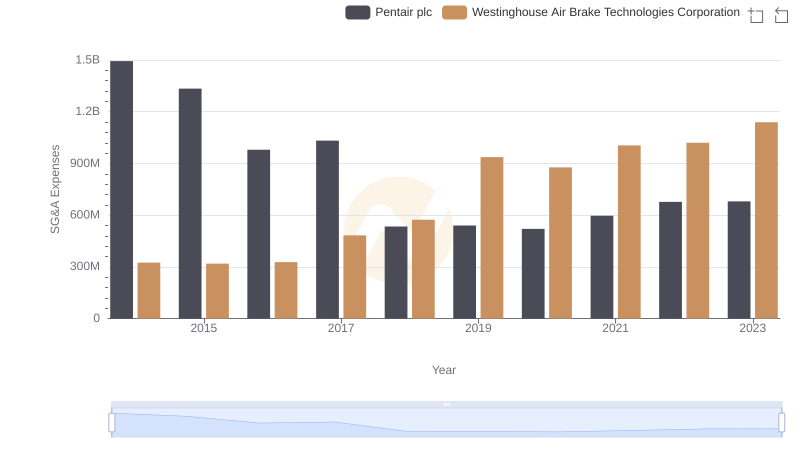

Westinghouse Air Brake Technologies Corporation or Pentair plc: Who Manages SG&A Costs Better?

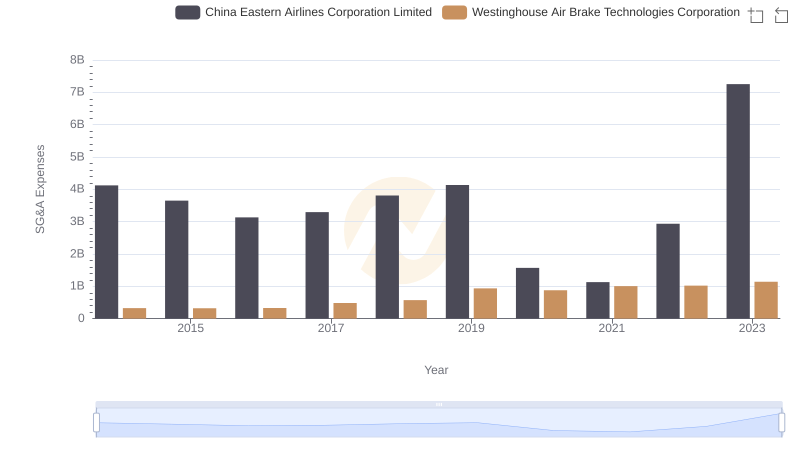

Westinghouse Air Brake Technologies Corporation or China Eastern Airlines Corporation Limited: Who Manages SG&A Costs Better?

Cost Management Insights: SG&A Expenses for Westinghouse Air Brake Technologies Corporation and IDEX Corporation

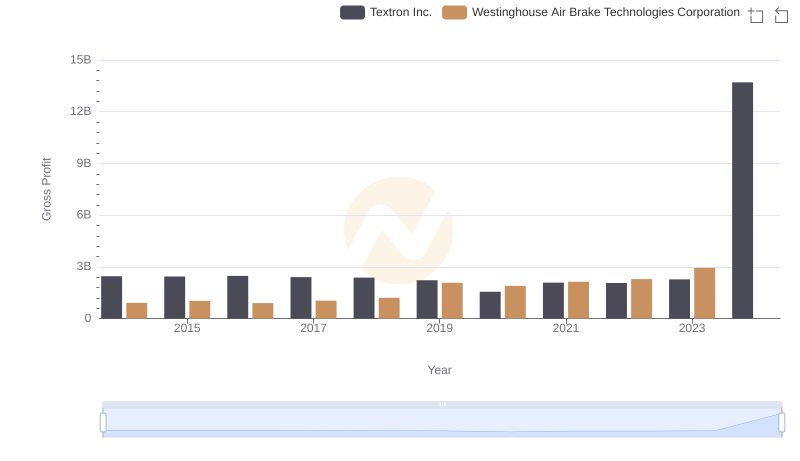

Westinghouse Air Brake Technologies Corporation vs Textron Inc.: A Gross Profit Performance Breakdown

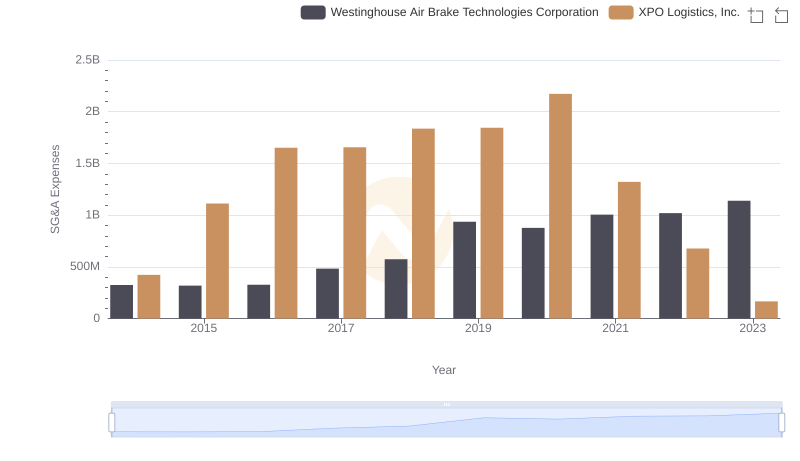

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs XPO Logistics, Inc.

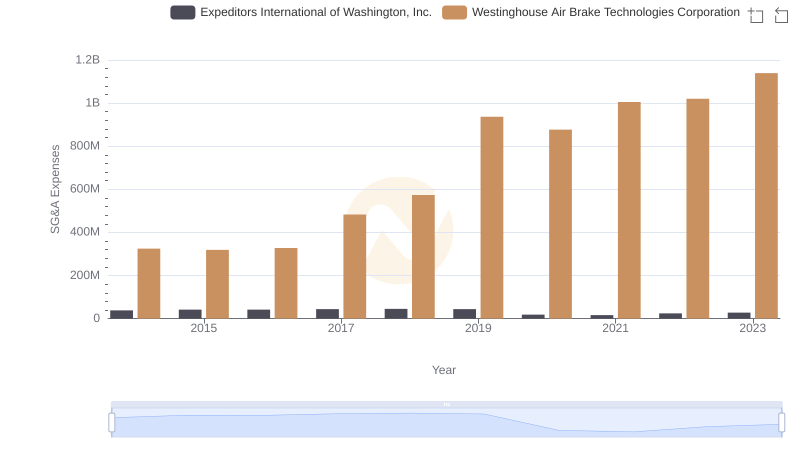

Breaking Down SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs Expeditors International of Washington, Inc.

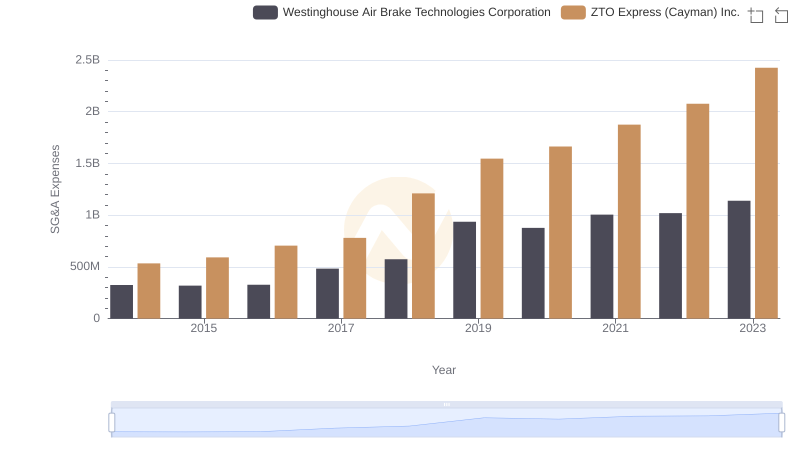

Westinghouse Air Brake Technologies Corporation or ZTO Express (Cayman) Inc.: Who Manages SG&A Costs Better?

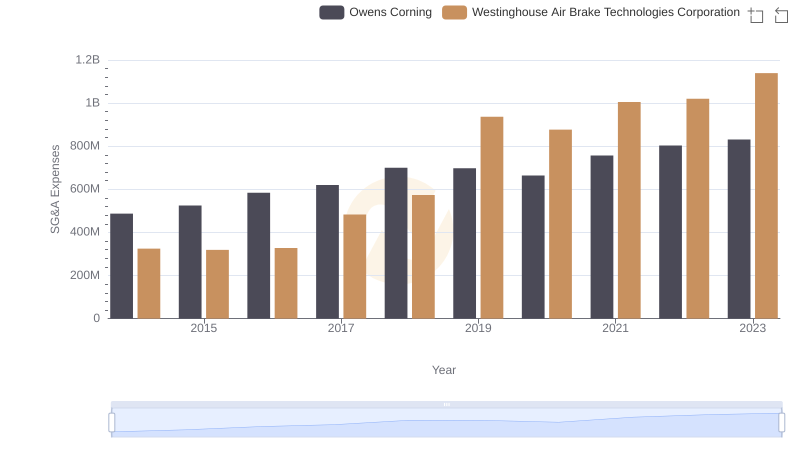

Who Optimizes SG&A Costs Better? Westinghouse Air Brake Technologies Corporation or Owens Corning

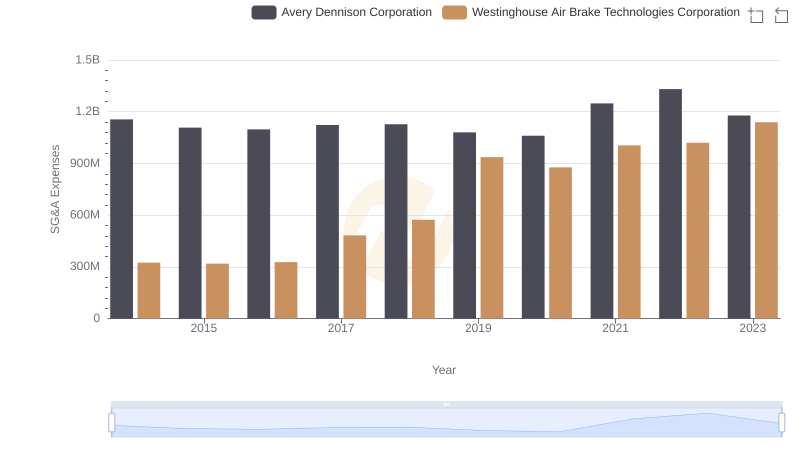

Westinghouse Air Brake Technologies Corporation vs Avery Dennison Corporation: SG&A Expense Trends

A Side-by-Side Analysis of EBITDA: Westinghouse Air Brake Technologies Corporation and Textron Inc.

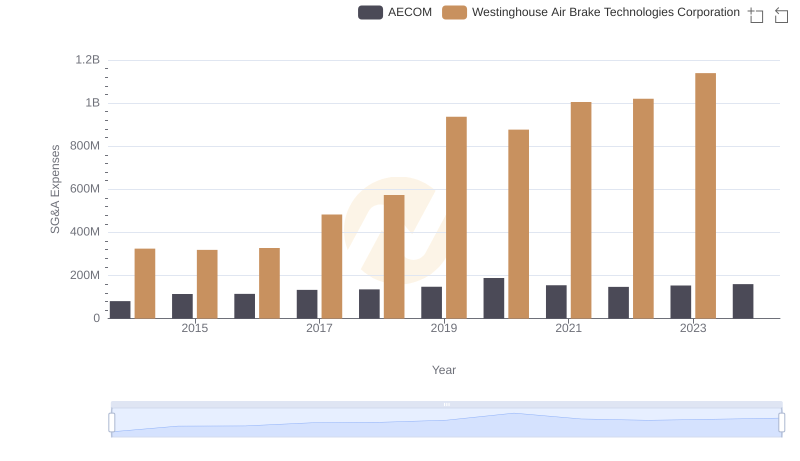

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs AECOM Trends and Insights