| __timestamp | Delta Air Lines, Inc. | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2785000000 | 1481000000 |

| Thursday, January 1, 2015 | 3162000000 | 1343000000 |

| Friday, January 1, 2016 | 2825000000 | 1410000000 |

| Sunday, January 1, 2017 | 2892000000 | 1468000000 |

| Monday, January 1, 2018 | 3242000000 | 1453000000 |

| Tuesday, January 1, 2019 | 3636000000 | 1631000000 |

| Wednesday, January 1, 2020 | 582000000 | 1728000000 |

| Friday, January 1, 2021 | 1061000000 | 1864000000 |

| Saturday, January 1, 2022 | 2454000000 | 1938000000 |

| Sunday, January 1, 2023 | 2334000000 | 1926000000 |

| Monday, January 1, 2024 | 2485000000 | 2264000000 |

Unlocking the unknown

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Waste Management, Inc. and Delta Air Lines, Inc. offer a fascinating comparison. Over the past decade, Delta Air Lines has seen its SG&A expenses fluctuate significantly, peaking in 2019 before a sharp decline in 2020, likely due to the pandemic's impact. In contrast, Waste Management has maintained a more stable trajectory, with expenses increasing steadily by approximately 30% from 2014 to 2023.

Delta's SG&A expenses in 2020 were notably low, at just 20% of their 2019 peak, reflecting industry-wide challenges. Meanwhile, Waste Management's expenses have shown resilience, with a consistent upward trend, reaching their highest in 2022. This stability suggests a more controlled approach to cost management, despite missing data for 2024. As businesses navigate economic uncertainties, these insights highlight the importance of strategic SG&A management.

Breaking Down Revenue Trends: Waste Management, Inc. vs Delta Air Lines, Inc.

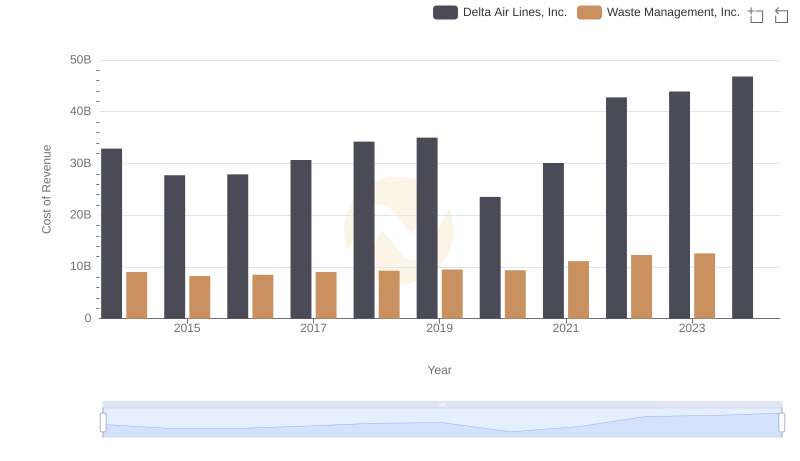

Cost of Revenue: Key Insights for Waste Management, Inc. and Delta Air Lines, Inc.

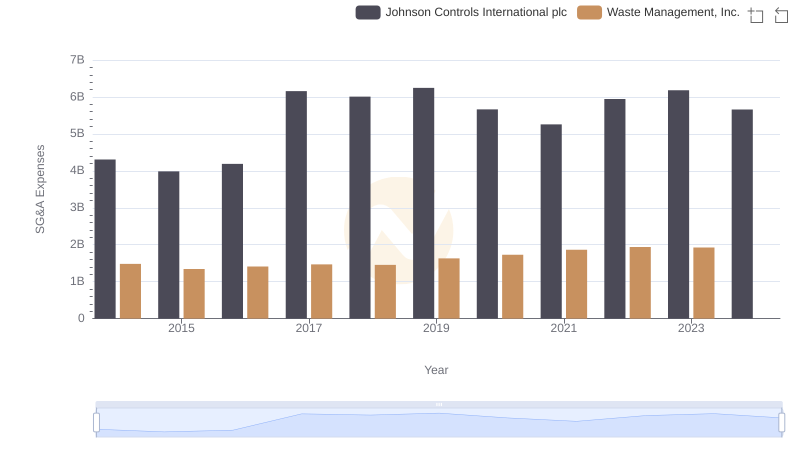

Waste Management, Inc. and Johnson Controls International plc: SG&A Spending Patterns Compared

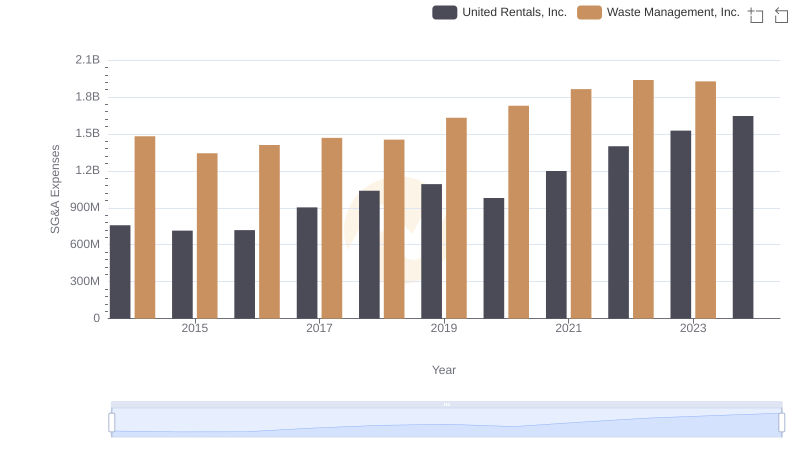

Selling, General, and Administrative Costs: Waste Management, Inc. vs United Rentals, Inc.

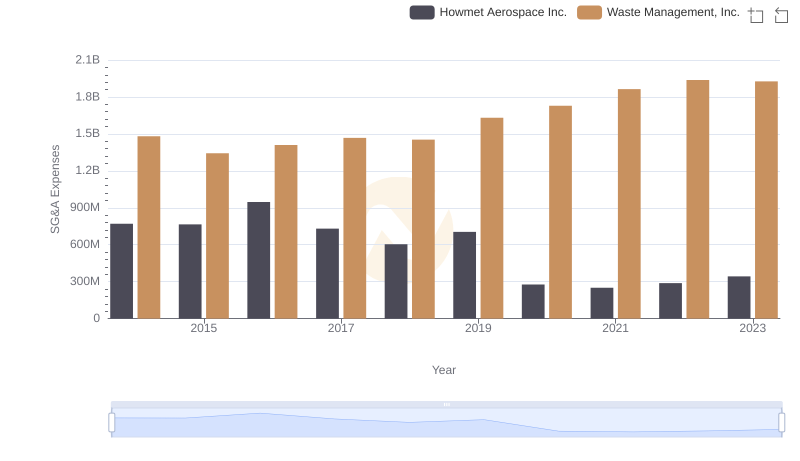

Cost Management Insights: SG&A Expenses for Waste Management, Inc. and Howmet Aerospace Inc.

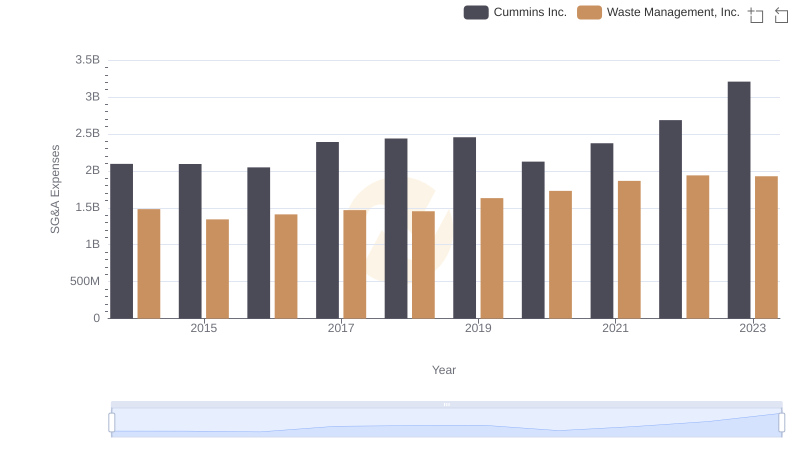

Breaking Down SG&A Expenses: Waste Management, Inc. vs Cummins Inc.

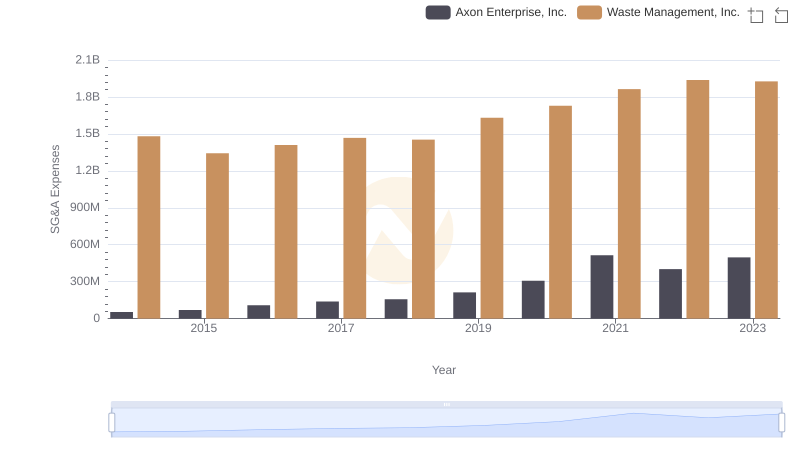

Who Optimizes SG&A Costs Better? Waste Management, Inc. or Axon Enterprise, Inc.

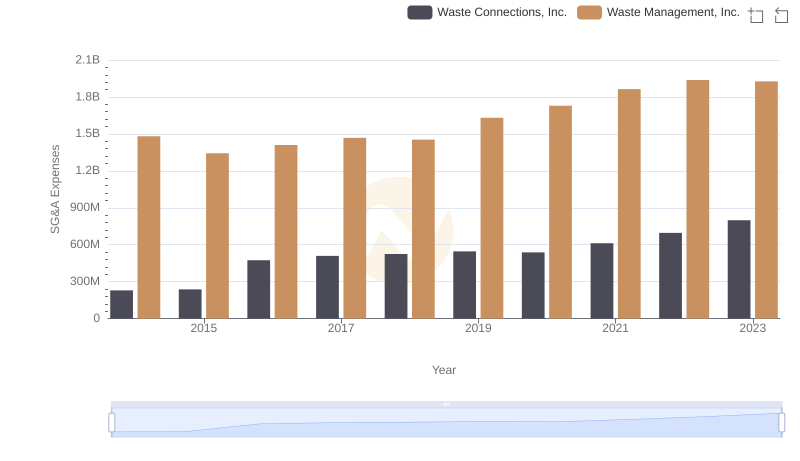

SG&A Efficiency Analysis: Comparing Waste Management, Inc. and Waste Connections, Inc.

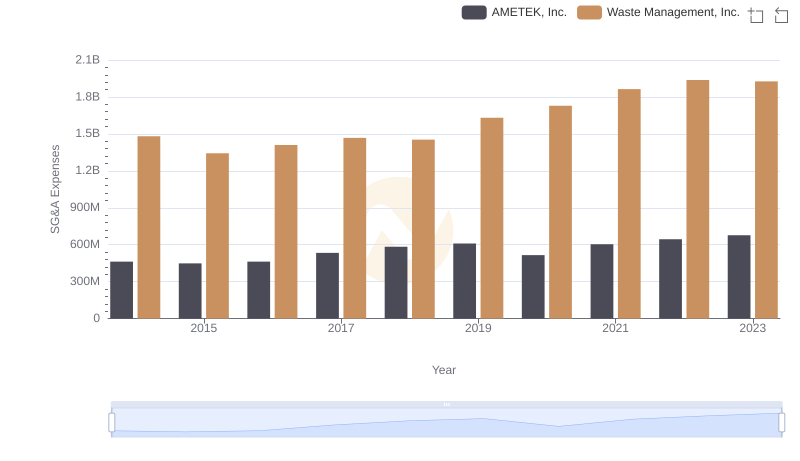

SG&A Efficiency Analysis: Comparing Waste Management, Inc. and AMETEK, Inc.

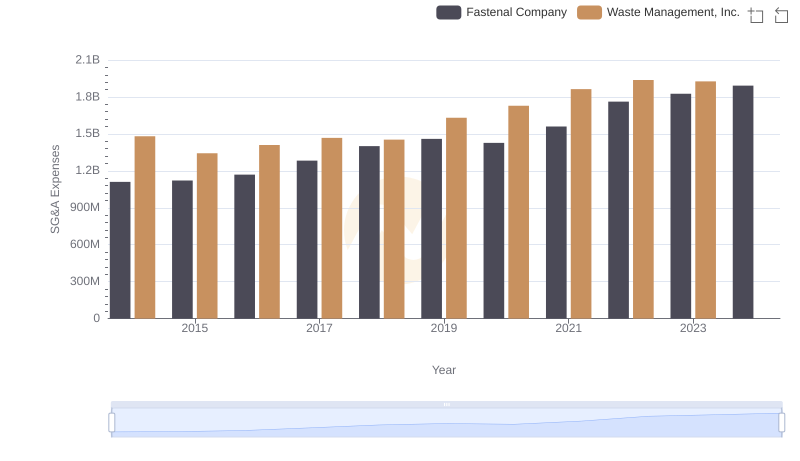

Waste Management, Inc. vs Fastenal Company: SG&A Expense Trends

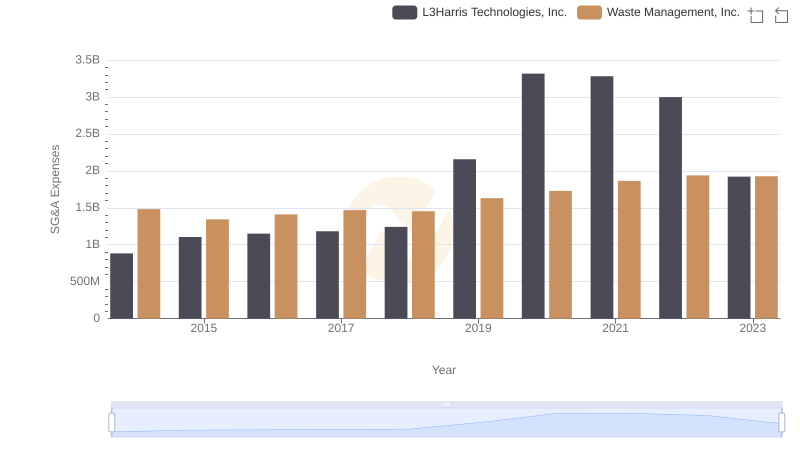

Selling, General, and Administrative Costs: Waste Management, Inc. vs L3Harris Technologies, Inc.

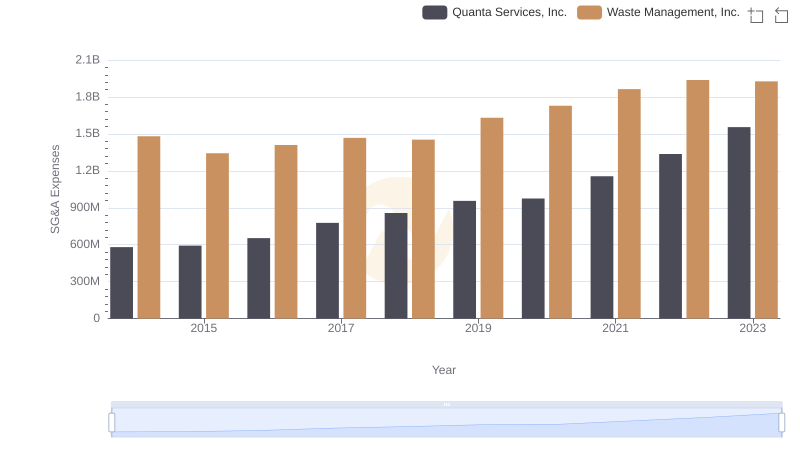

Operational Costs Compared: SG&A Analysis of Waste Management, Inc. and Quanta Services, Inc.