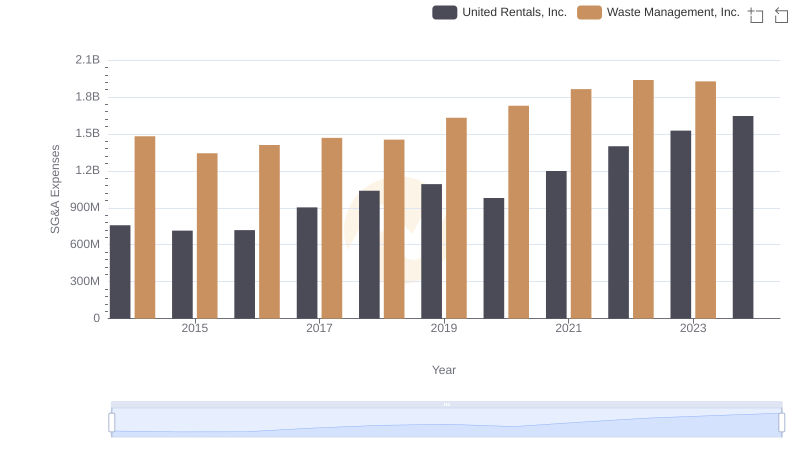

| __timestamp | Axon Enterprise, Inc. | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 54158000 | 1481000000 |

| Thursday, January 1, 2015 | 69698000 | 1343000000 |

| Friday, January 1, 2016 | 108076000 | 1410000000 |

| Sunday, January 1, 2017 | 138692000 | 1468000000 |

| Monday, January 1, 2018 | 156886000 | 1453000000 |

| Tuesday, January 1, 2019 | 212959000 | 1631000000 |

| Wednesday, January 1, 2020 | 307286000 | 1728000000 |

| Friday, January 1, 2021 | 515007000 | 1864000000 |

| Saturday, January 1, 2022 | 401575000 | 1938000000 |

| Sunday, January 1, 2023 | 496874000 | 1926000000 |

| Monday, January 1, 2024 | 2264000000 |

In pursuit of knowledge

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Waste Management, Inc. and Axon Enterprise, Inc. offer a fascinating comparison in this regard. Over the past decade, Waste Management has consistently maintained higher SG&A expenses, peaking at nearly $1.93 billion in 2022. In contrast, Axon Enterprise's SG&A costs have grown more dynamically, increasing by over 800% from 2014 to 2023.

From 2014 to 2023, Axon Enterprise's SG&A expenses surged, reflecting its aggressive growth strategy. Meanwhile, Waste Management's expenses remained relatively stable, indicating a focus on operational efficiency. This divergence highlights different strategic priorities: Axon’s investment in expansion versus Waste Management’s emphasis on cost control.

Understanding these trends offers valuable insights into how companies balance growth and efficiency, a critical consideration for investors and stakeholders alike.

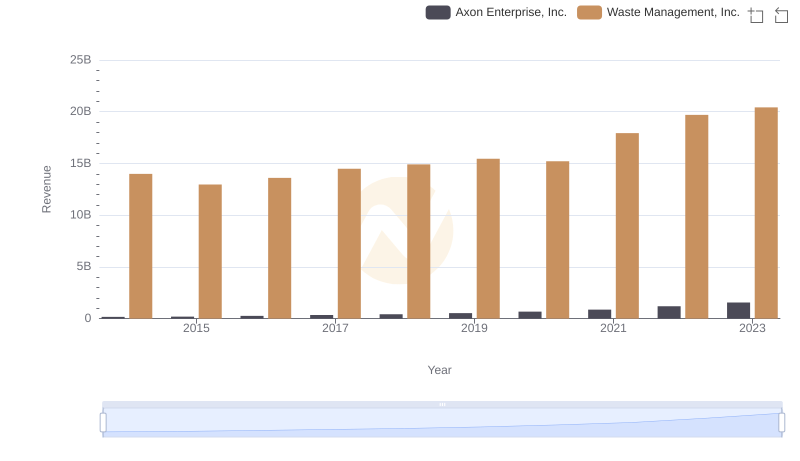

Waste Management, Inc. or Axon Enterprise, Inc.: Who Leads in Yearly Revenue?

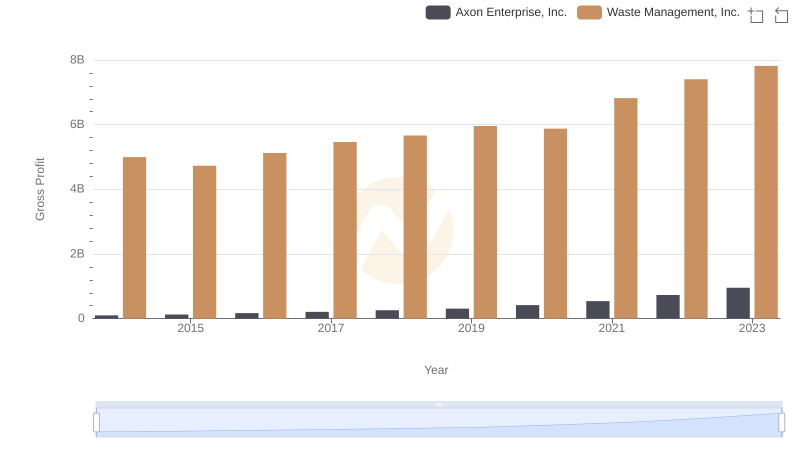

Analyzing Cost of Revenue: Waste Management, Inc. and Axon Enterprise, Inc.

Gross Profit Comparison: Waste Management, Inc. and Axon Enterprise, Inc. Trends

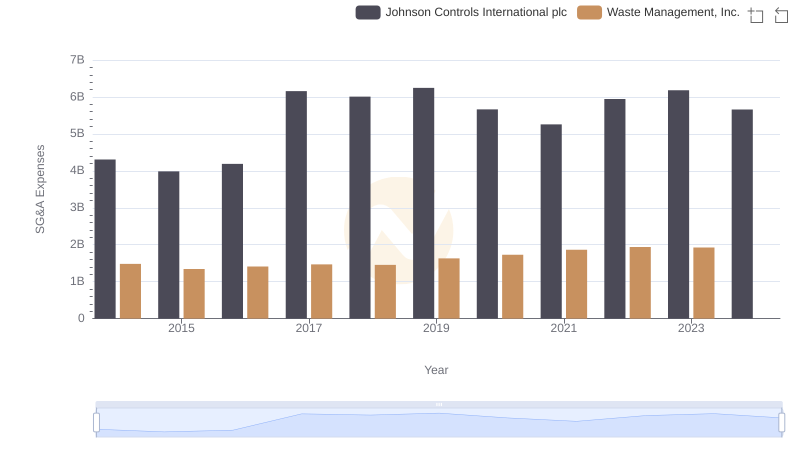

Waste Management, Inc. and Johnson Controls International plc: SG&A Spending Patterns Compared

Selling, General, and Administrative Costs: Waste Management, Inc. vs United Rentals, Inc.

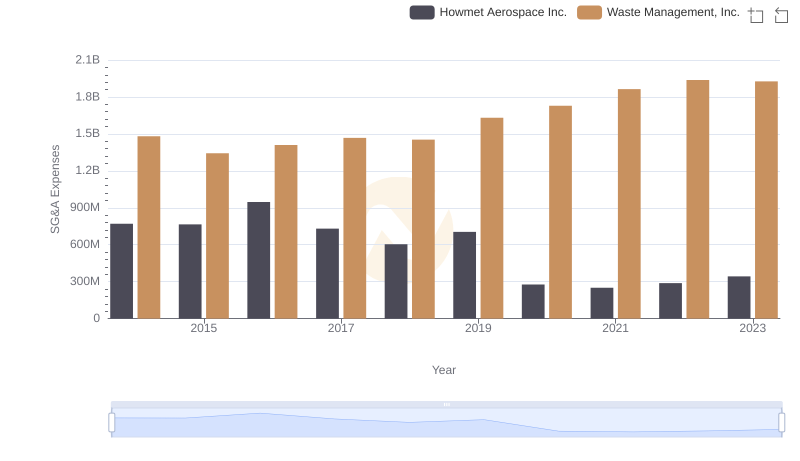

Cost Management Insights: SG&A Expenses for Waste Management, Inc. and Howmet Aerospace Inc.

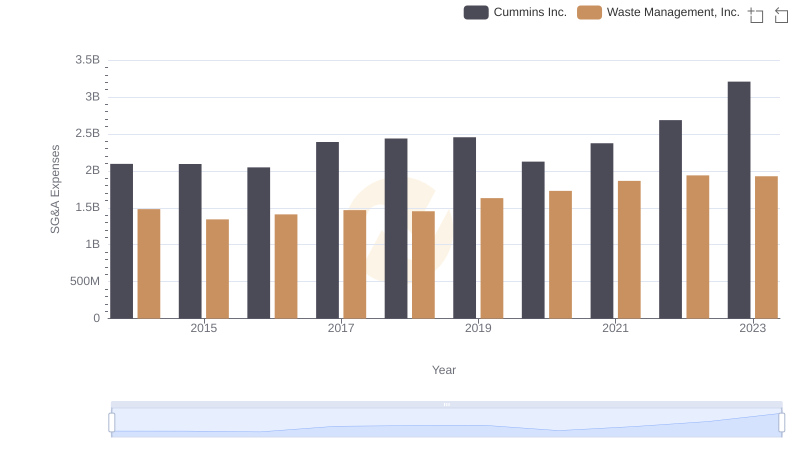

Breaking Down SG&A Expenses: Waste Management, Inc. vs Cummins Inc.

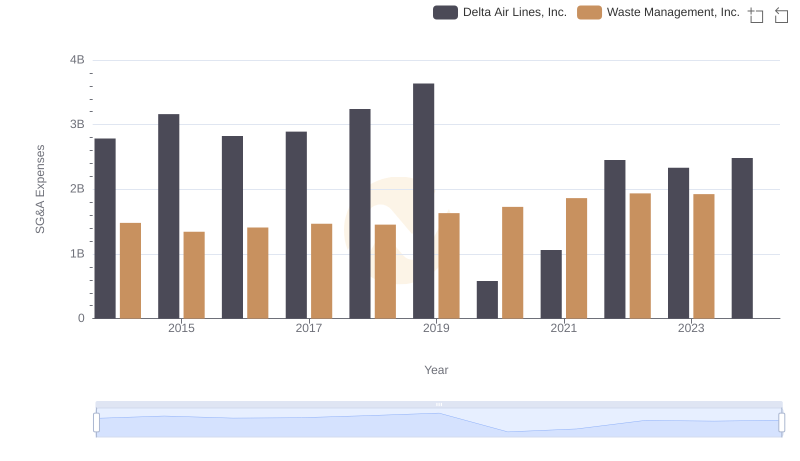

Waste Management, Inc. or Delta Air Lines, Inc.: Who Manages SG&A Costs Better?

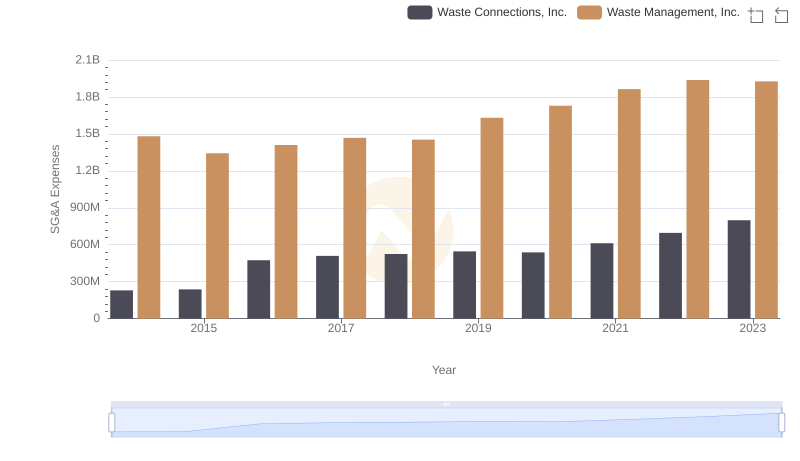

SG&A Efficiency Analysis: Comparing Waste Management, Inc. and Waste Connections, Inc.

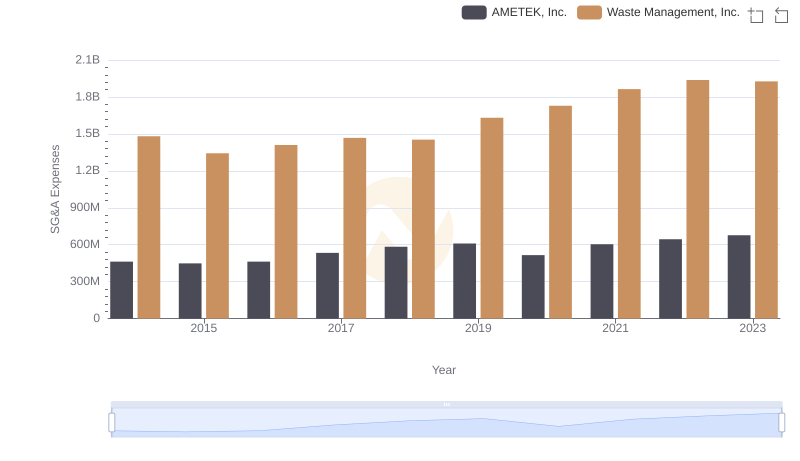

SG&A Efficiency Analysis: Comparing Waste Management, Inc. and AMETEK, Inc.

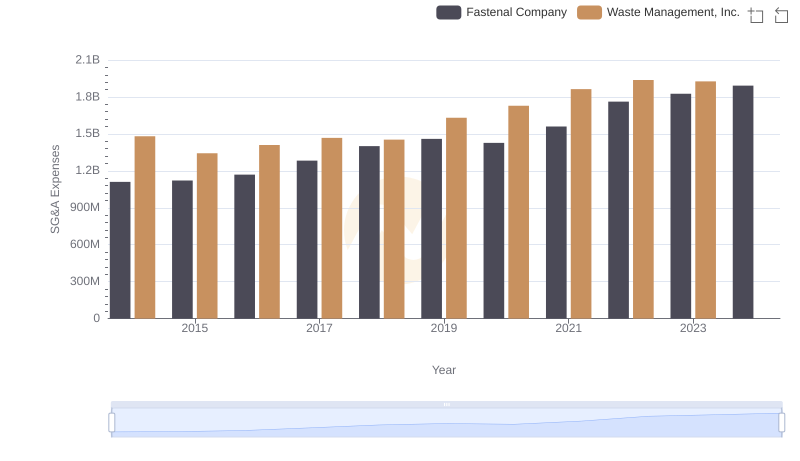

Waste Management, Inc. vs Fastenal Company: SG&A Expense Trends

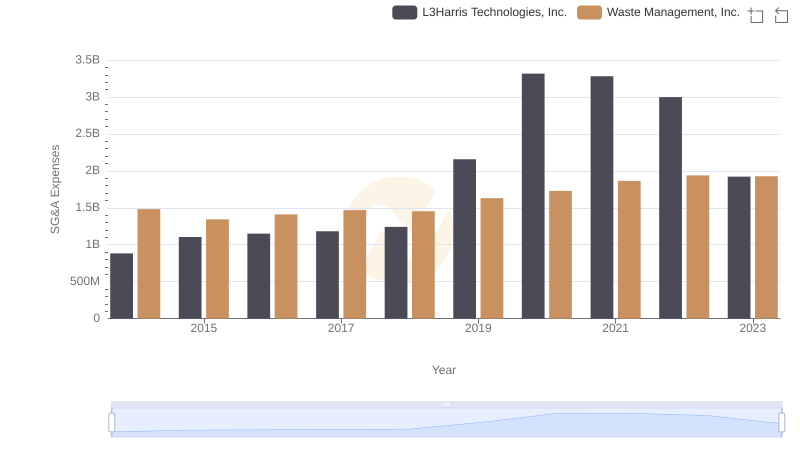

Selling, General, and Administrative Costs: Waste Management, Inc. vs L3Harris Technologies, Inc.