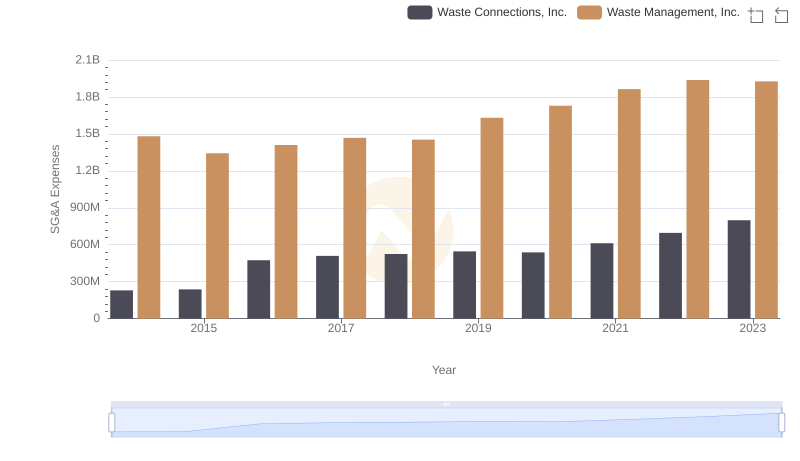

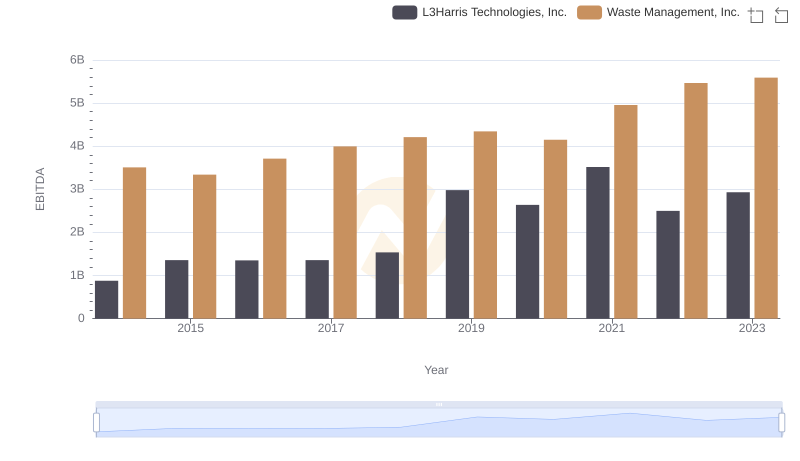

| __timestamp | L3Harris Technologies, Inc. | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 883000000 | 1481000000 |

| Thursday, January 1, 2015 | 1105000000 | 1343000000 |

| Friday, January 1, 2016 | 1150000000 | 1410000000 |

| Sunday, January 1, 2017 | 1182000000 | 1468000000 |

| Monday, January 1, 2018 | 1242000000 | 1453000000 |

| Tuesday, January 1, 2019 | 2156000000 | 1631000000 |

| Wednesday, January 1, 2020 | 3315000000 | 1728000000 |

| Friday, January 1, 2021 | 3280000000 | 1864000000 |

| Saturday, January 1, 2022 | 2998000000 | 1938000000 |

| Sunday, January 1, 2023 | 1921000000 | 1926000000 |

| Monday, January 1, 2024 | 3568000000 | 2264000000 |

Unlocking the unknown

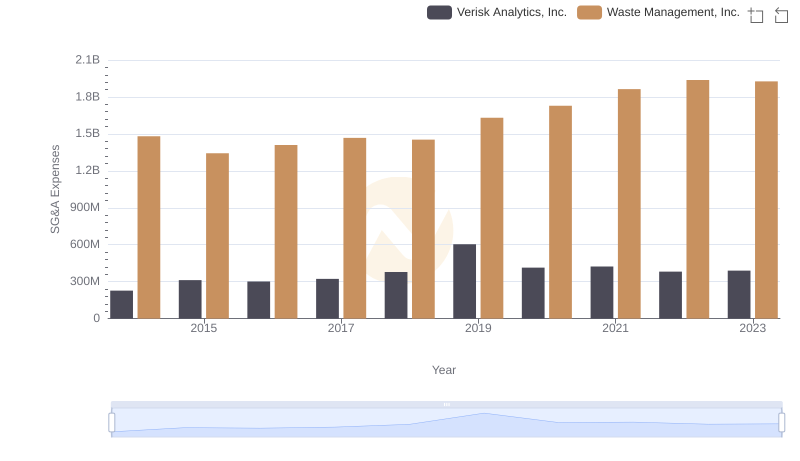

In the ever-evolving landscape of corporate finance, Selling, General, and Administrative (SG&A) expenses serve as a critical indicator of a company's operational efficiency. This analysis delves into the SG&A expenses of two industry giants: Waste Management, Inc. and L3Harris Technologies, Inc., from 2014 to 2023.

Over the past decade, L3Harris Technologies has seen a dramatic increase in SG&A expenses, peaking in 2020 with a staggering 275% rise from 2014 levels. This surge reflects the company's aggressive expansion and strategic investments. In contrast, Waste Management's SG&A expenses have remained relatively stable, with a modest 30% increase over the same period, highlighting its consistent operational strategy.

The data reveals a fascinating narrative of growth and stability, offering valuable insights for investors and industry analysts alike. As these companies continue to navigate the complexities of their respective markets, their SG&A trends provide a window into their strategic priorities and financial health.

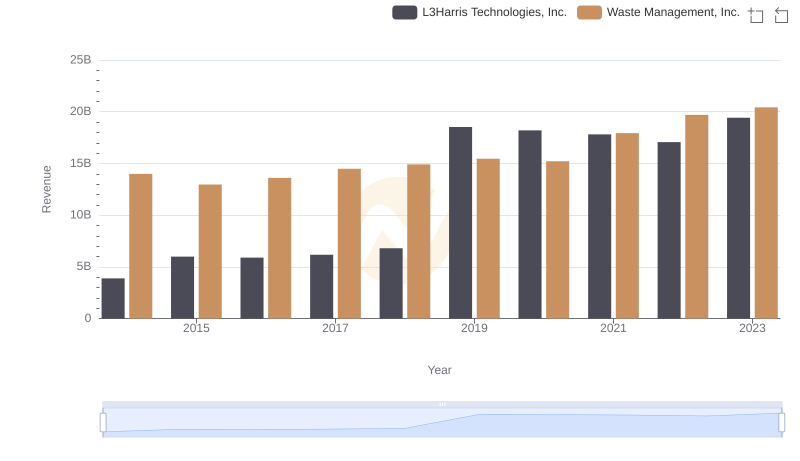

Waste Management, Inc. vs L3Harris Technologies, Inc.: Annual Revenue Growth Compared

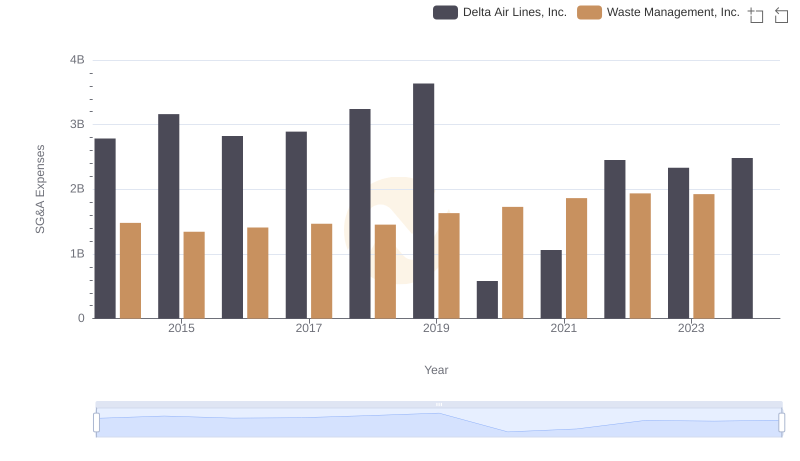

Waste Management, Inc. or Delta Air Lines, Inc.: Who Manages SG&A Costs Better?

SG&A Efficiency Analysis: Comparing Waste Management, Inc. and Waste Connections, Inc.

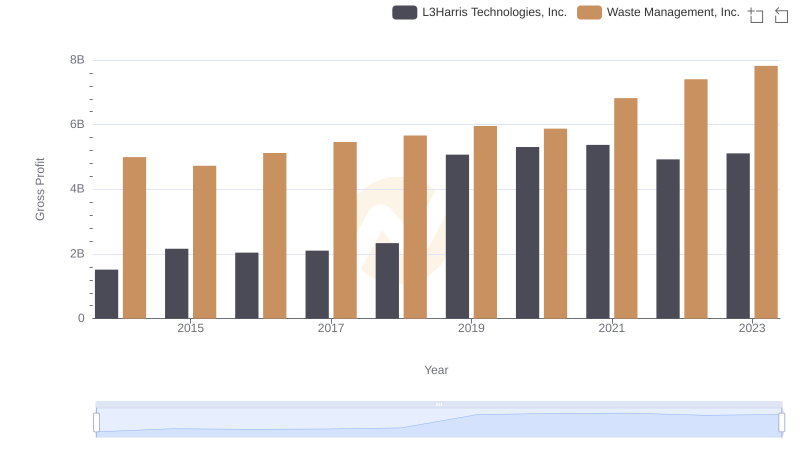

Who Generates Higher Gross Profit? Waste Management, Inc. or L3Harris Technologies, Inc.

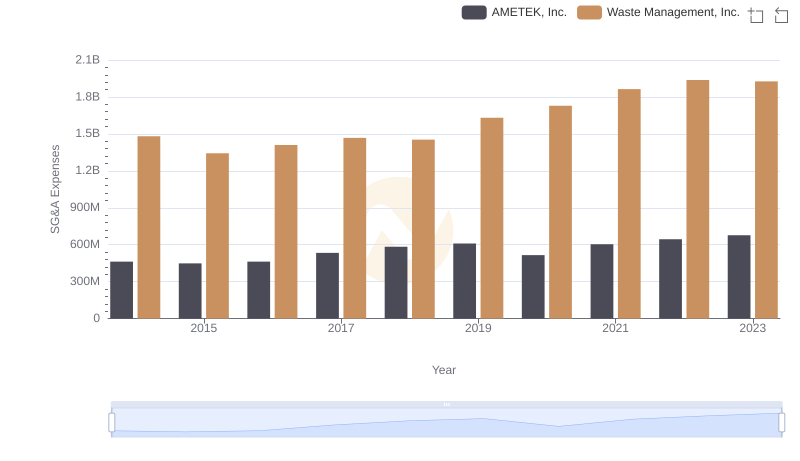

SG&A Efficiency Analysis: Comparing Waste Management, Inc. and AMETEK, Inc.

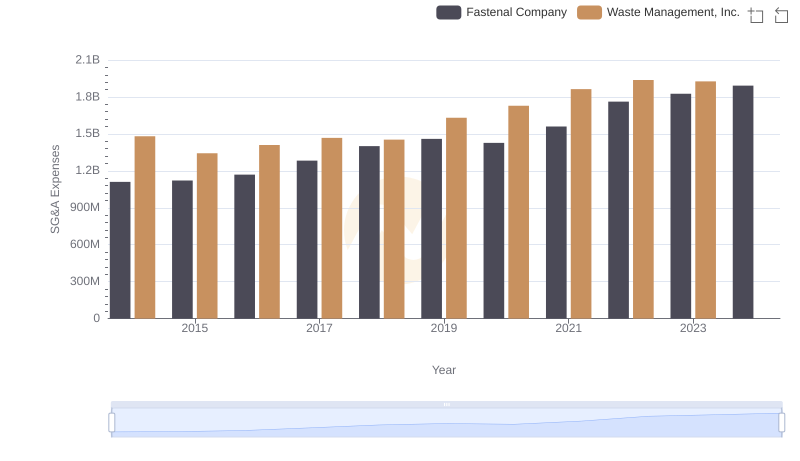

Waste Management, Inc. vs Fastenal Company: SG&A Expense Trends

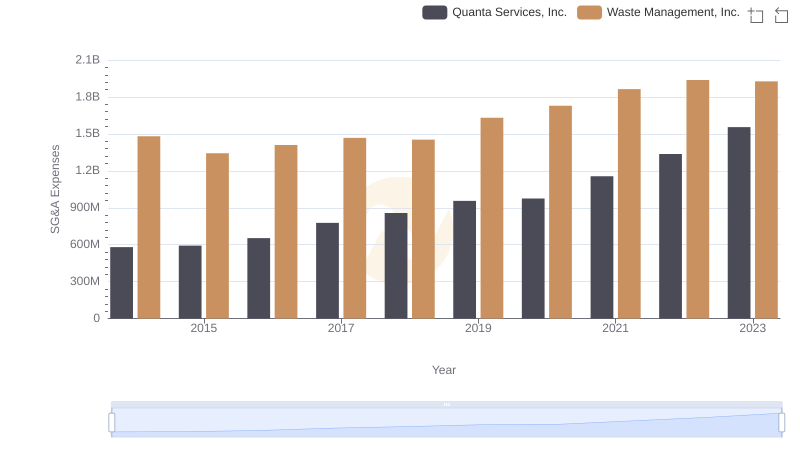

Operational Costs Compared: SG&A Analysis of Waste Management, Inc. and Quanta Services, Inc.

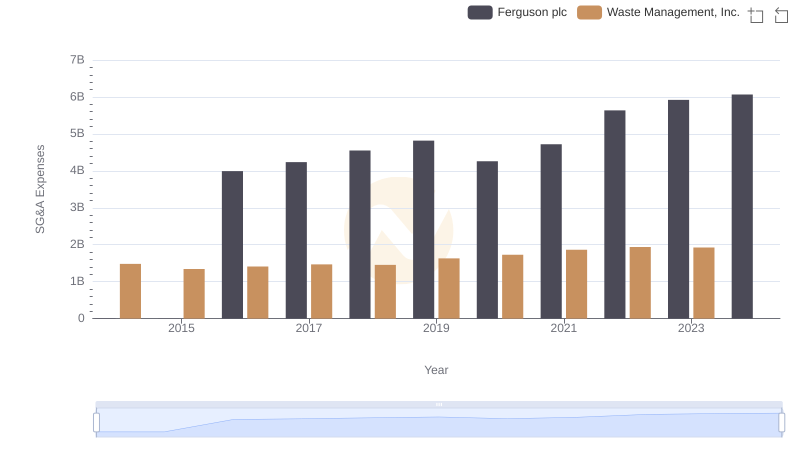

Breaking Down SG&A Expenses: Waste Management, Inc. vs Ferguson plc

SG&A Efficiency Analysis: Comparing Waste Management, Inc. and Old Dominion Freight Line, Inc.

Breaking Down SG&A Expenses: Waste Management, Inc. vs Verisk Analytics, Inc.

Waste Management, Inc. and L3Harris Technologies, Inc.: A Detailed Examination of EBITDA Performance