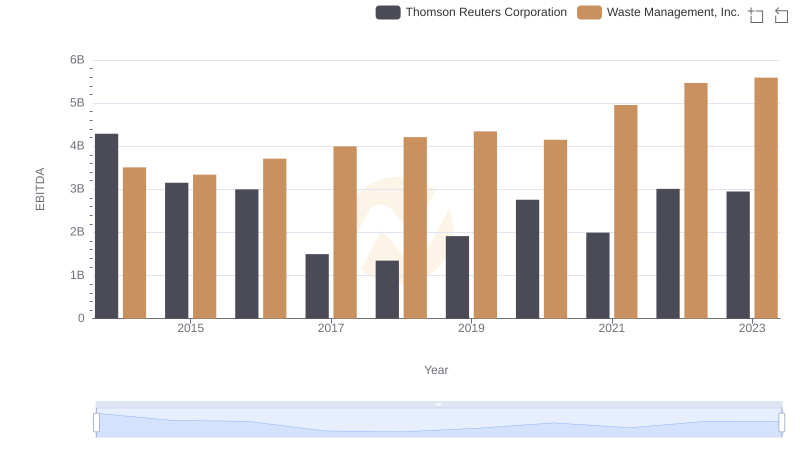

| __timestamp | Thomson Reuters Corporation | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 9209000000 | 1481000000 |

| Thursday, January 1, 2015 | 8810000000 | 1343000000 |

| Friday, January 1, 2016 | 8232000000 | 1410000000 |

| Sunday, January 1, 2017 | 8079000000 | 1468000000 |

| Monday, January 1, 2018 | 4131000000 | 1453000000 |

| Tuesday, January 1, 2019 | 4413000000 | 1631000000 |

| Wednesday, January 1, 2020 | 3999000000 | 1728000000 |

| Friday, January 1, 2021 | 1624000000 | 1864000000 |

| Saturday, January 1, 2022 | 1622000000 | 1938000000 |

| Sunday, January 1, 2023 | 64000000 | 1926000000 |

| Monday, January 1, 2024 | 2264000000 |

Igniting the spark of knowledge

In the world of corporate finance, understanding the spending patterns of industry leaders can offer valuable insights. Waste Management, Inc. and Thomson Reuters Corporation, two titans in their respective fields, have shown contrasting trends in their Selling, General, and Administrative (SG&A) expenses over the past decade.

From 2014 to 2023, Thomson Reuters experienced a dramatic 99% decrease in SG&A expenses, plummeting from a peak in 2014 to a mere fraction by 2023. This sharp decline could indicate strategic cost-cutting measures or a shift in business focus. In contrast, Waste Management's SG&A expenses have steadily increased by approximately 30% over the same period, reflecting potential growth and expansion strategies.

These divergent paths highlight the unique challenges and opportunities faced by companies in different sectors. As businesses navigate the complexities of the modern economy, their financial strategies offer a window into their evolving priorities.

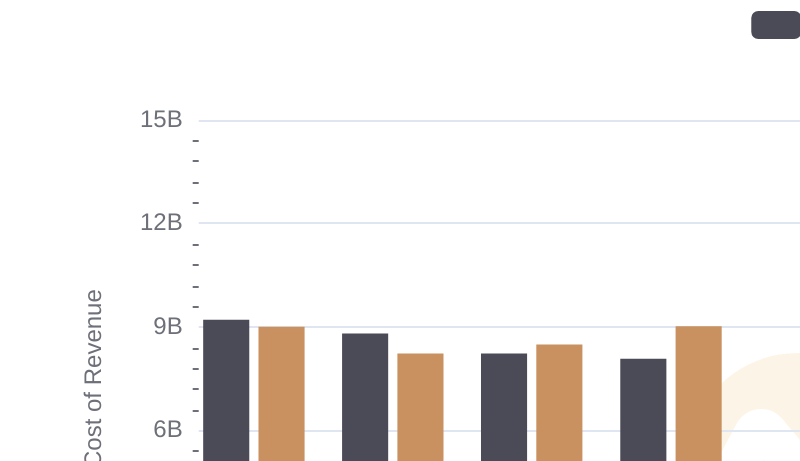

Comparing Cost of Revenue Efficiency: Waste Management, Inc. vs Thomson Reuters Corporation

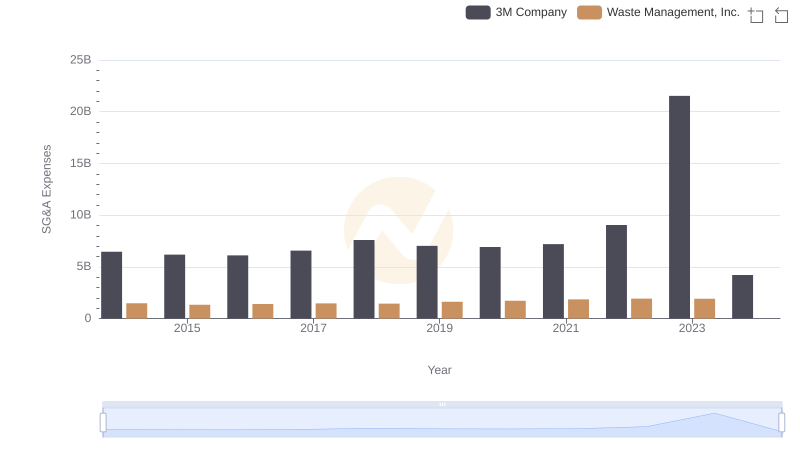

Selling, General, and Administrative Costs: Waste Management, Inc. vs 3M Company

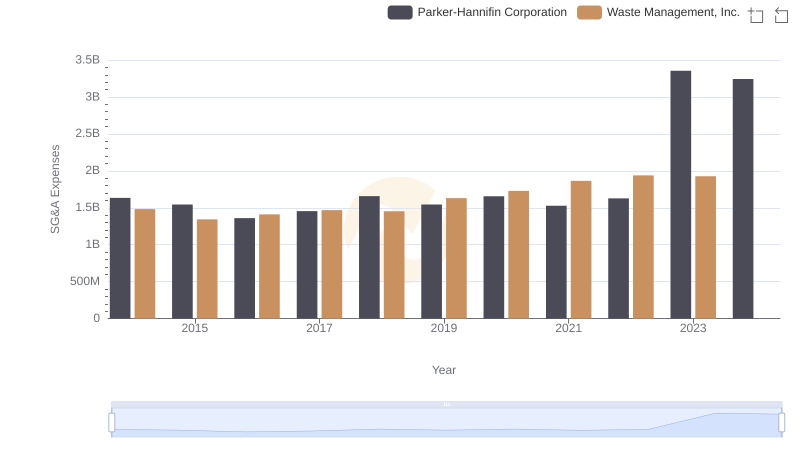

Operational Costs Compared: SG&A Analysis of Waste Management, Inc. and Parker-Hannifin Corporation

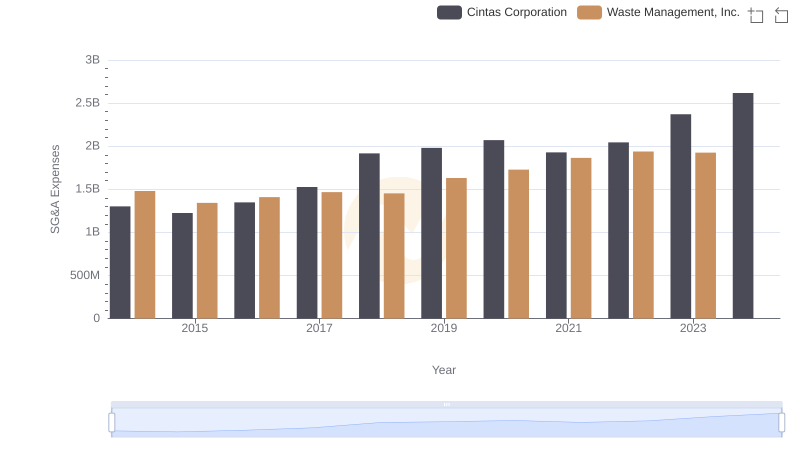

Breaking Down SG&A Expenses: Waste Management, Inc. vs Cintas Corporation

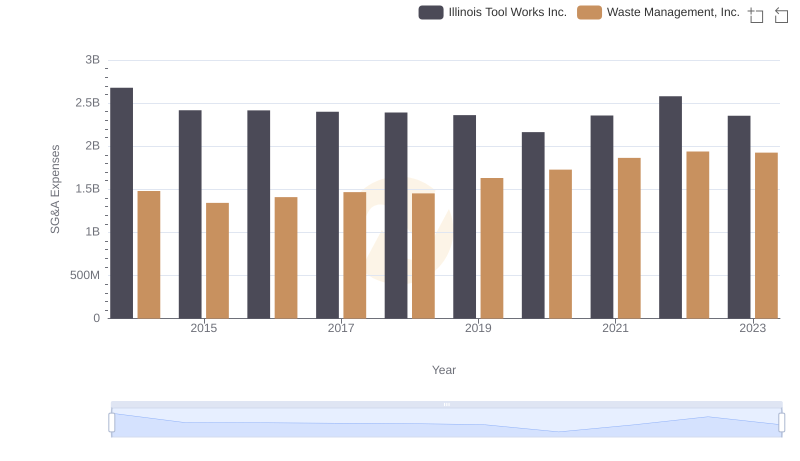

Operational Costs Compared: SG&A Analysis of Waste Management, Inc. and Illinois Tool Works Inc.

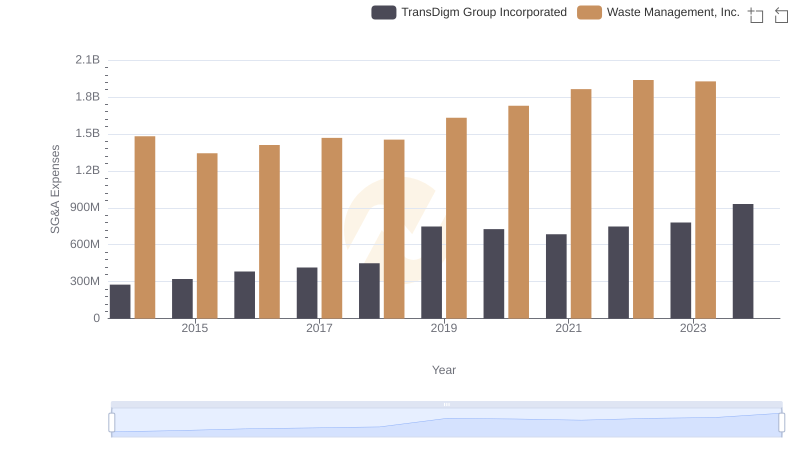

Waste Management, Inc. and TransDigm Group Incorporated: SG&A Spending Patterns Compared

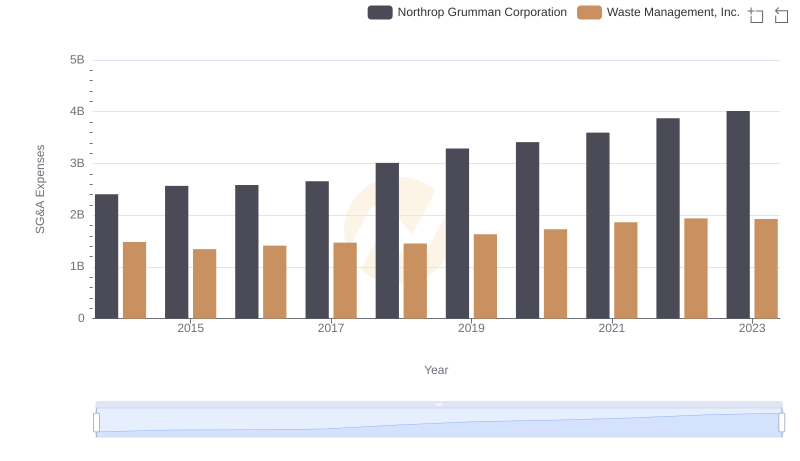

Waste Management, Inc. vs Northrop Grumman Corporation: SG&A Expense Trends

EBITDA Performance Review: Waste Management, Inc. vs Thomson Reuters Corporation