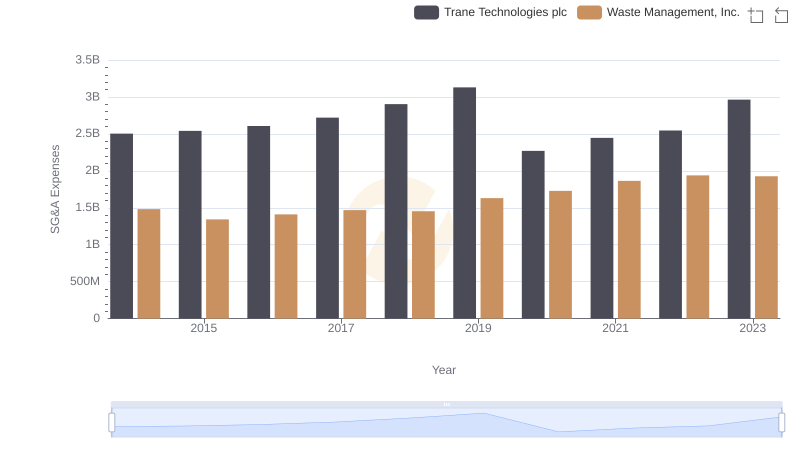

| __timestamp | Illinois Tool Works Inc. | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2678000000 | 1481000000 |

| Thursday, January 1, 2015 | 2417000000 | 1343000000 |

| Friday, January 1, 2016 | 2415000000 | 1410000000 |

| Sunday, January 1, 2017 | 2400000000 | 1468000000 |

| Monday, January 1, 2018 | 2391000000 | 1453000000 |

| Tuesday, January 1, 2019 | 2361000000 | 1631000000 |

| Wednesday, January 1, 2020 | 2163000000 | 1728000000 |

| Friday, January 1, 2021 | 2356000000 | 1864000000 |

| Saturday, January 1, 2022 | 2579000000 | 1938000000 |

| Sunday, January 1, 2023 | 2354000000 | 1926000000 |

| Monday, January 1, 2024 | -101000000 | 2264000000 |

Unveiling the hidden dimensions of data

Over the past decade, the operational strategies of Waste Management, Inc. and Illinois Tool Works Inc. have been reflected in their Selling, General, and Administrative (SG&A) expenses. From 2014 to 2023, Illinois Tool Works consistently maintained higher SG&A expenses, peaking in 2014. However, a notable decline of approximately 12% was observed by 2023. In contrast, Waste Management's SG&A expenses showed a steady upward trajectory, increasing by about 30% over the same period. This divergence highlights differing strategic focuses: Illinois Tool Works appears to be optimizing costs, while Waste Management is potentially investing in growth and expansion. These trends offer a window into how each company navigates the complexities of their respective industries, with Illinois Tool Works focusing on efficiency and Waste Management on scaling operations.

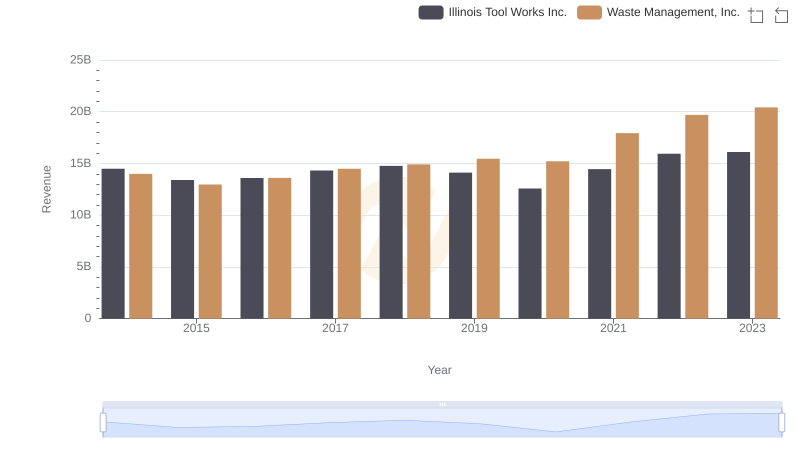

Revenue Showdown: Waste Management, Inc. vs Illinois Tool Works Inc.

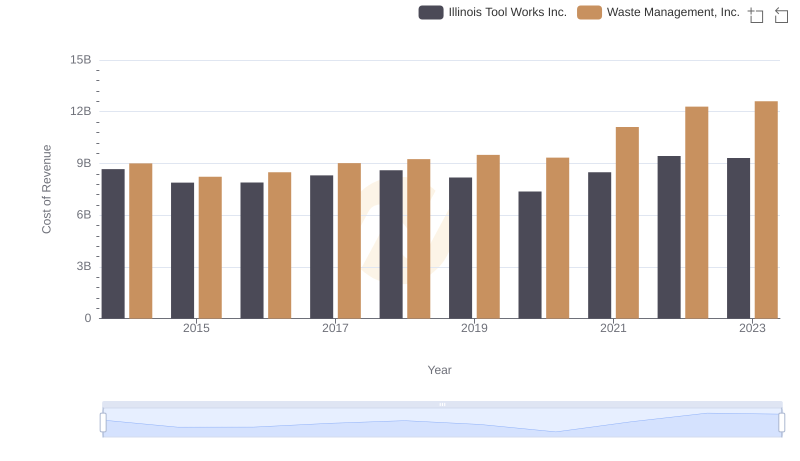

Cost Insights: Breaking Down Waste Management, Inc. and Illinois Tool Works Inc.'s Expenses

Comparing SG&A Expenses: Waste Management, Inc. vs Trane Technologies plc Trends and Insights

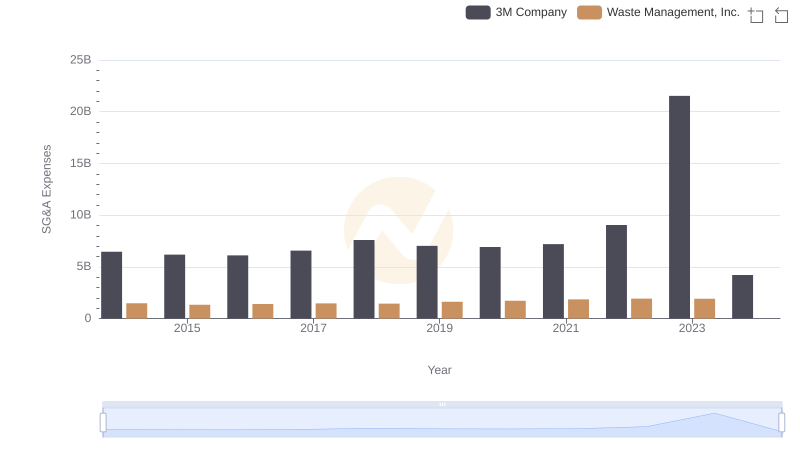

Selling, General, and Administrative Costs: Waste Management, Inc. vs 3M Company

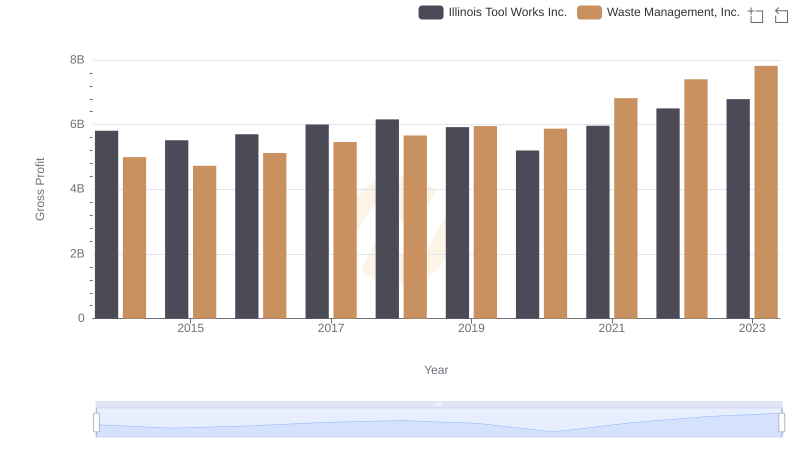

Who Generates Higher Gross Profit? Waste Management, Inc. or Illinois Tool Works Inc.

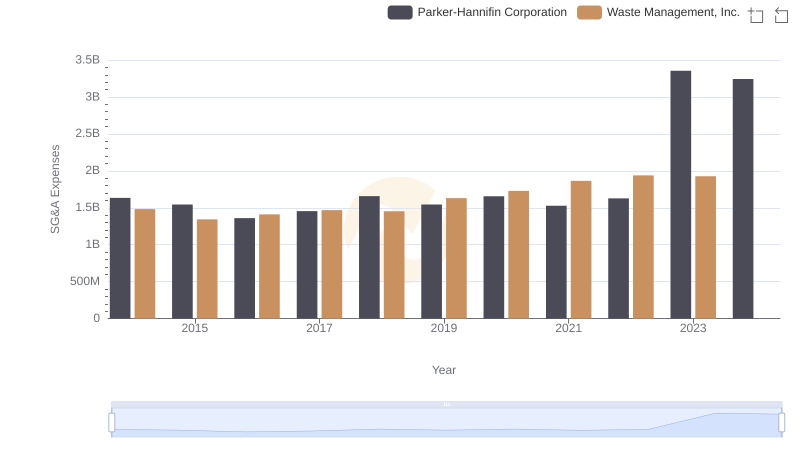

Operational Costs Compared: SG&A Analysis of Waste Management, Inc. and Parker-Hannifin Corporation

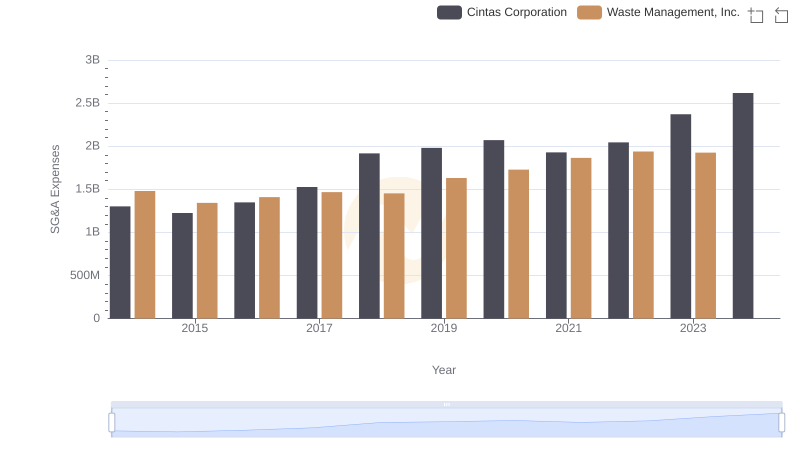

Breaking Down SG&A Expenses: Waste Management, Inc. vs Cintas Corporation

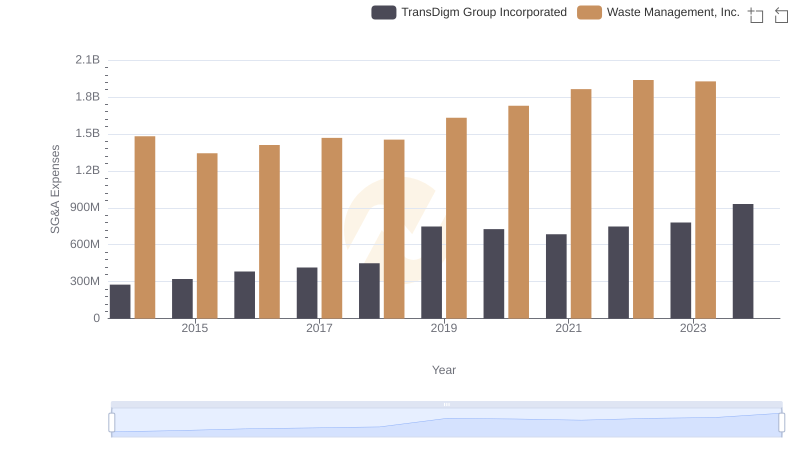

Waste Management, Inc. and TransDigm Group Incorporated: SG&A Spending Patterns Compared

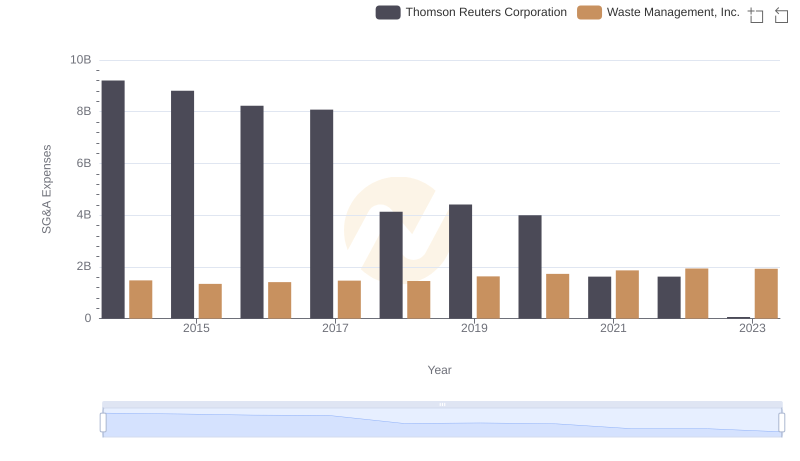

Waste Management, Inc. and Thomson Reuters Corporation: SG&A Spending Patterns Compared

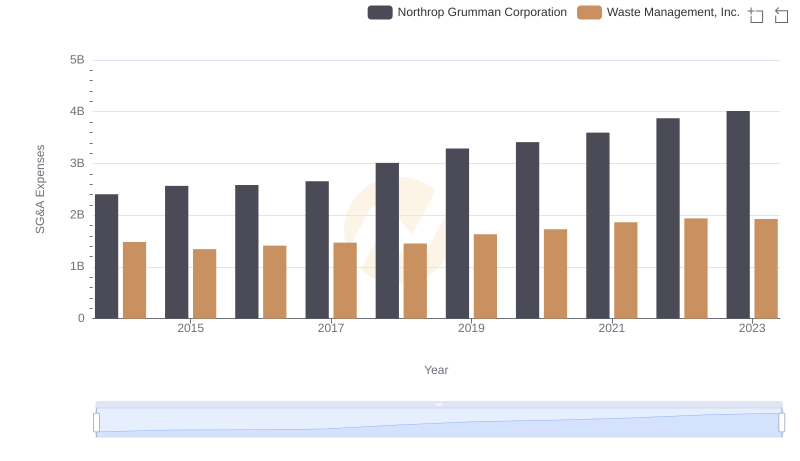

Waste Management, Inc. vs Northrop Grumman Corporation: SG&A Expense Trends