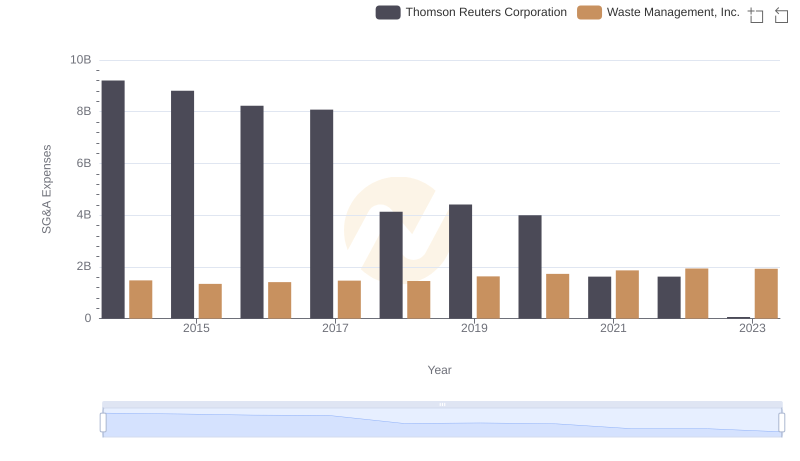

| __timestamp | Thomson Reuters Corporation | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 9209000000 | 9002000000 |

| Thursday, January 1, 2015 | 8810000000 | 8231000000 |

| Friday, January 1, 2016 | 8232000000 | 8486000000 |

| Sunday, January 1, 2017 | 8079000000 | 9021000000 |

| Monday, January 1, 2018 | 4131000000 | 9249000000 |

| Tuesday, January 1, 2019 | 2431000000 | 9496000000 |

| Wednesday, January 1, 2020 | 2269000000 | 9341000000 |

| Friday, January 1, 2021 | 2478000000 | 11111000000 |

| Saturday, January 1, 2022 | 2408000000 | 12294000000 |

| Sunday, January 1, 2023 | 4095000000 | 12606000000 |

| Monday, January 1, 2024 | 13383000000 |

Unleashing the power of data

In the ever-evolving landscape of corporate finance, understanding cost efficiency is paramount. Waste Management, Inc. and Thomson Reuters Corporation, two titans in their respective industries, offer a fascinating study in contrasts over the past decade. From 2014 to 2023, Waste Management, Inc. consistently demonstrated robust cost efficiency, with its cost of revenue peaking at approximately 12.6 billion in 2023, marking a 40% increase from 2014. In contrast, Thomson Reuters Corporation saw a significant decline, with its cost of revenue dropping by over 55% during the same period, reaching a low of around 2.4 billion in 2022. This divergence highlights Waste Management's steady growth and operational efficiency, while Thomson Reuters appears to have streamlined its operations, possibly reflecting strategic shifts or market challenges. As we delve deeper into these trends, the data underscores the importance of strategic cost management in maintaining competitive advantage.

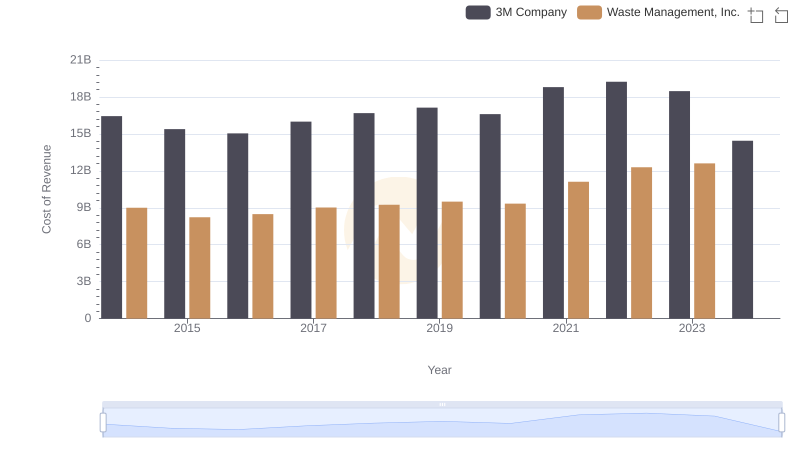

Comparing Cost of Revenue Efficiency: Waste Management, Inc. vs 3M Company

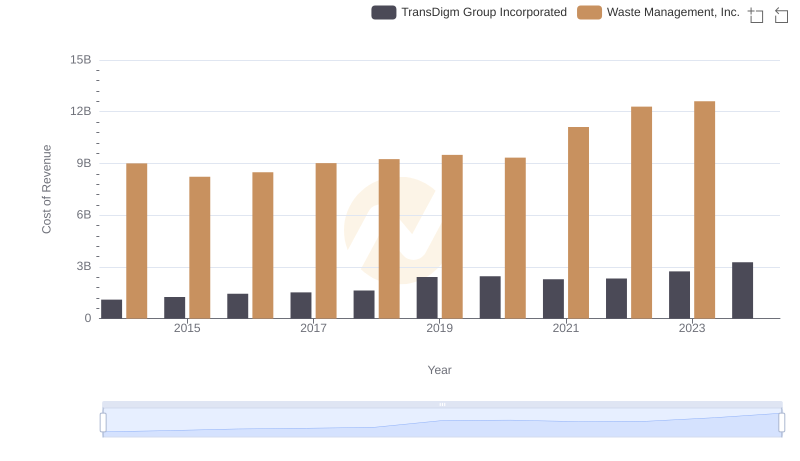

Cost of Revenue: Key Insights for Waste Management, Inc. and TransDigm Group Incorporated

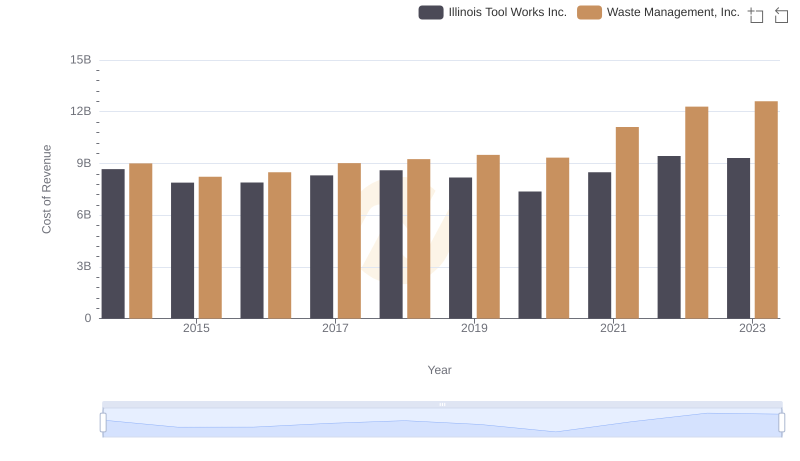

Cost Insights: Breaking Down Waste Management, Inc. and Illinois Tool Works Inc.'s Expenses

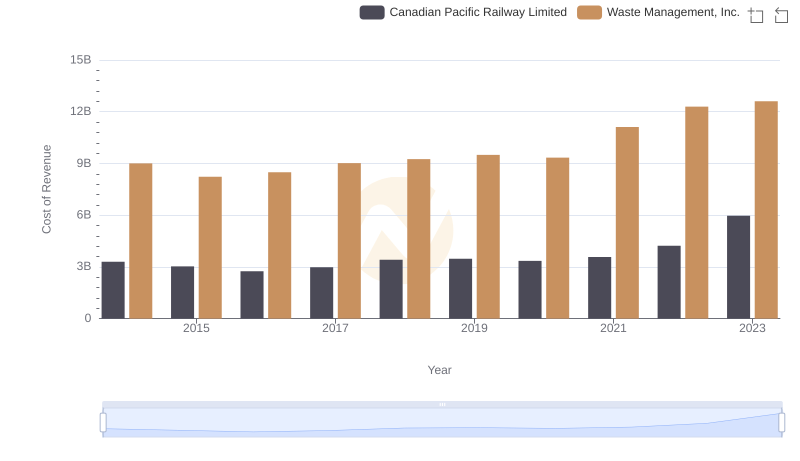

Comparing Cost of Revenue Efficiency: Waste Management, Inc. vs Canadian Pacific Railway Limited

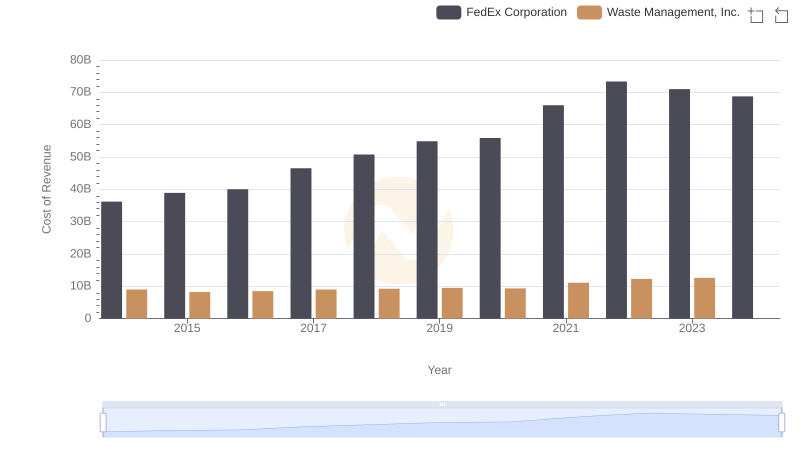

Comparing Cost of Revenue Efficiency: Waste Management, Inc. vs FedEx Corporation

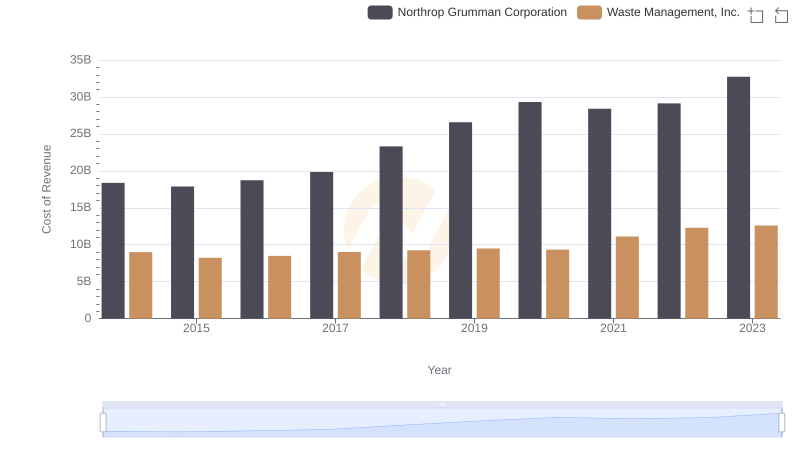

Cost Insights: Breaking Down Waste Management, Inc. and Northrop Grumman Corporation's Expenses

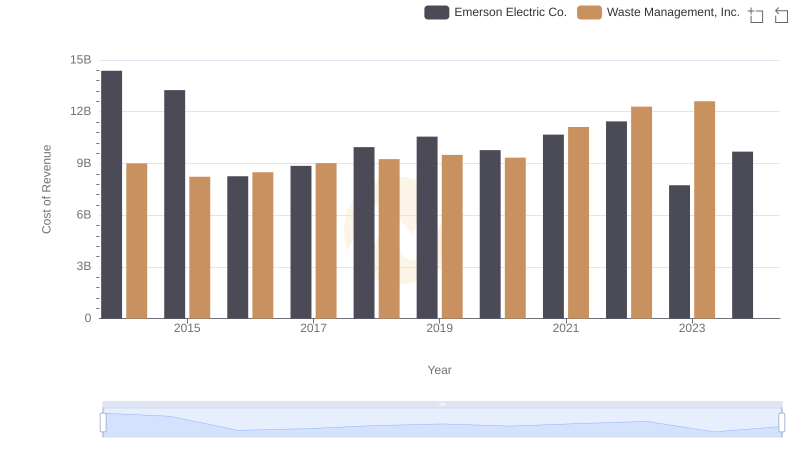

Cost of Revenue Trends: Waste Management, Inc. vs Emerson Electric Co.

Waste Management, Inc. and Thomson Reuters Corporation: SG&A Spending Patterns Compared

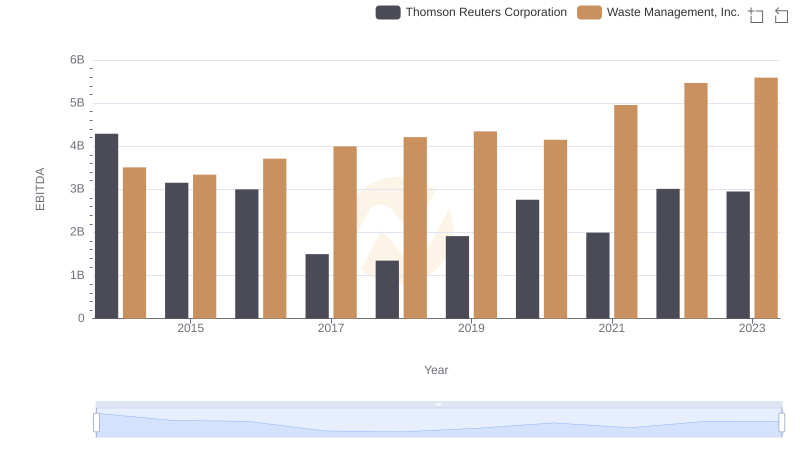

EBITDA Performance Review: Waste Management, Inc. vs Thomson Reuters Corporation