| __timestamp | 3M Company | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 6469000000 | 1481000000 |

| Thursday, January 1, 2015 | 6182000000 | 1343000000 |

| Friday, January 1, 2016 | 6111000000 | 1410000000 |

| Sunday, January 1, 2017 | 6572000000 | 1468000000 |

| Monday, January 1, 2018 | 7602000000 | 1453000000 |

| Tuesday, January 1, 2019 | 7029000000 | 1631000000 |

| Wednesday, January 1, 2020 | 6929000000 | 1728000000 |

| Friday, January 1, 2021 | 7197000000 | 1864000000 |

| Saturday, January 1, 2022 | 9049000000 | 1938000000 |

| Sunday, January 1, 2023 | 21526000000 | 1926000000 |

| Monday, January 1, 2024 | 4221000000 | 2264000000 |

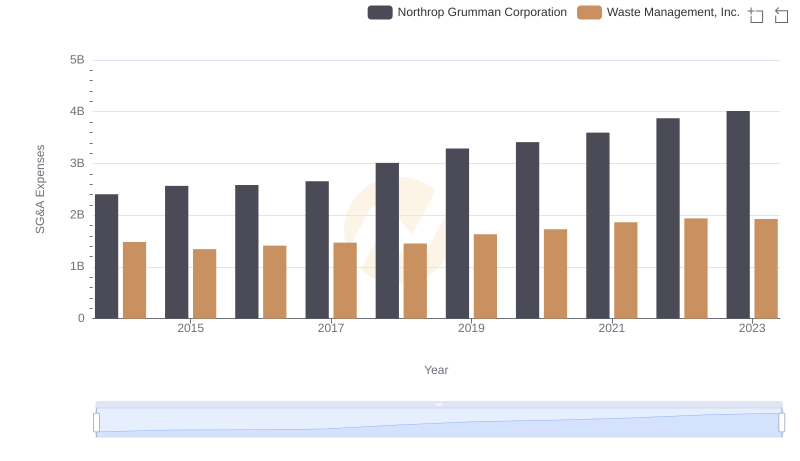

Unlocking the unknown

In the world of corporate finance, Selling, General, and Administrative (SG&A) expenses are a crucial indicator of a company's operational efficiency. Over the past decade, 3M Company and Waste Management, Inc. have showcased contrasting trends in their SG&A expenses.

From 2014 to 2023, 3M's SG&A expenses have seen a significant fluctuation. Starting at approximately $6.5 billion in 2014, they peaked dramatically in 2023, reaching over $21 billion, a staggering 230% increase. This surge reflects strategic investments and possibly increased operational costs.

In contrast, Waste Management, Inc. has maintained a more stable trajectory. Their SG&A expenses hovered around $1.5 billion to $1.9 billion, showing a modest 30% increase over the same period. This stability underscores their consistent operational strategy.

The data for 2024 is incomplete, leaving room for speculation on future trends.

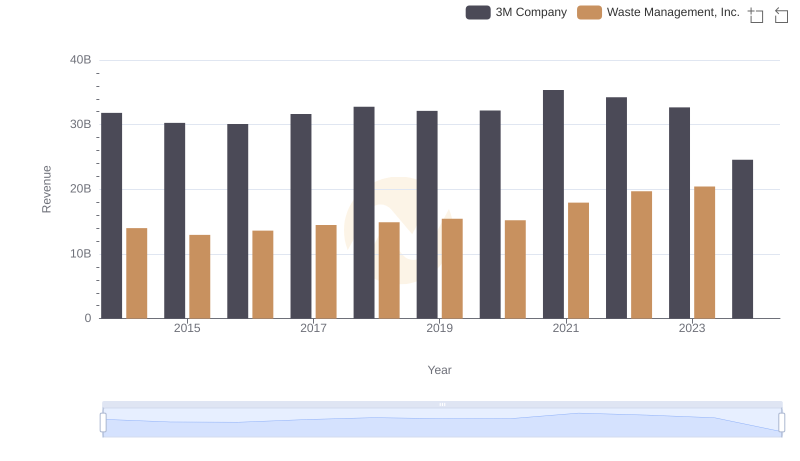

Who Generates More Revenue? Waste Management, Inc. or 3M Company

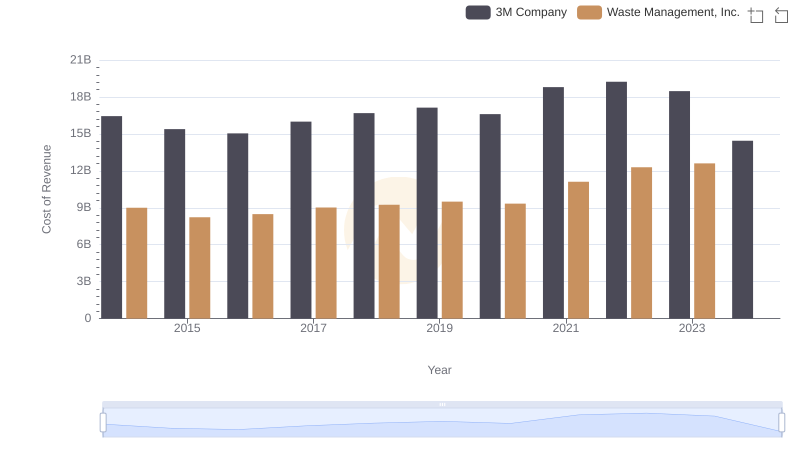

Comparing Cost of Revenue Efficiency: Waste Management, Inc. vs 3M Company

Who Generates Higher Gross Profit? Waste Management, Inc. or 3M Company

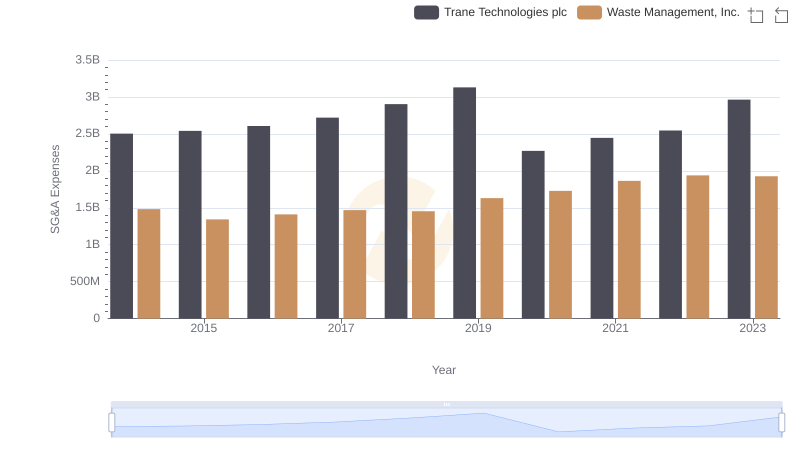

Comparing SG&A Expenses: Waste Management, Inc. vs Trane Technologies plc Trends and Insights

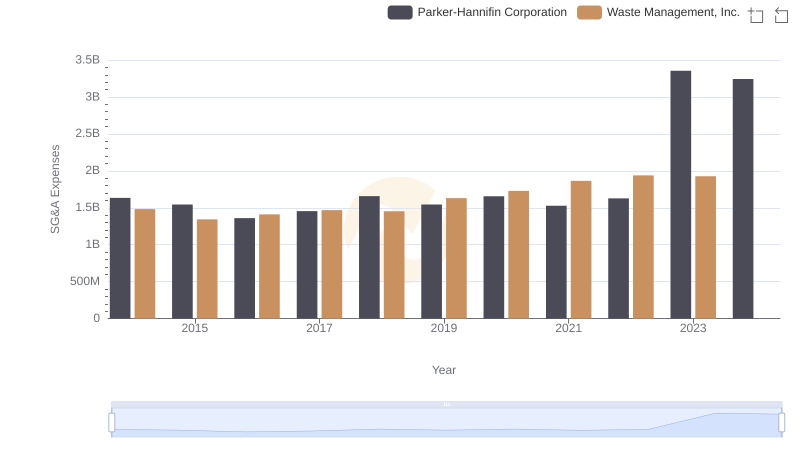

Operational Costs Compared: SG&A Analysis of Waste Management, Inc. and Parker-Hannifin Corporation

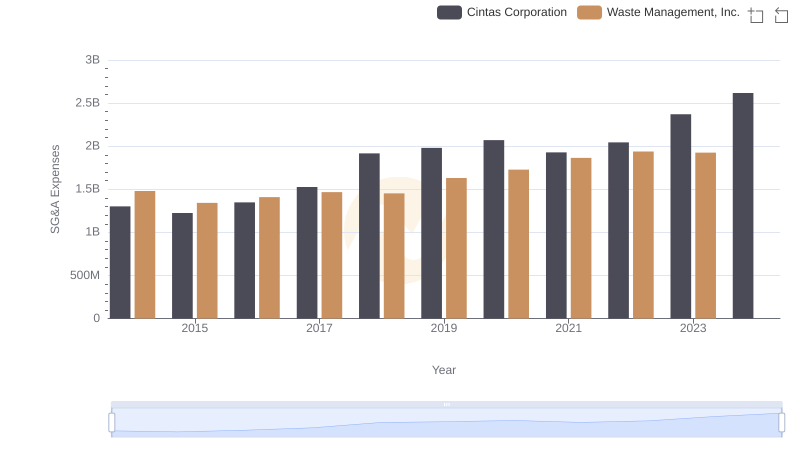

Breaking Down SG&A Expenses: Waste Management, Inc. vs Cintas Corporation

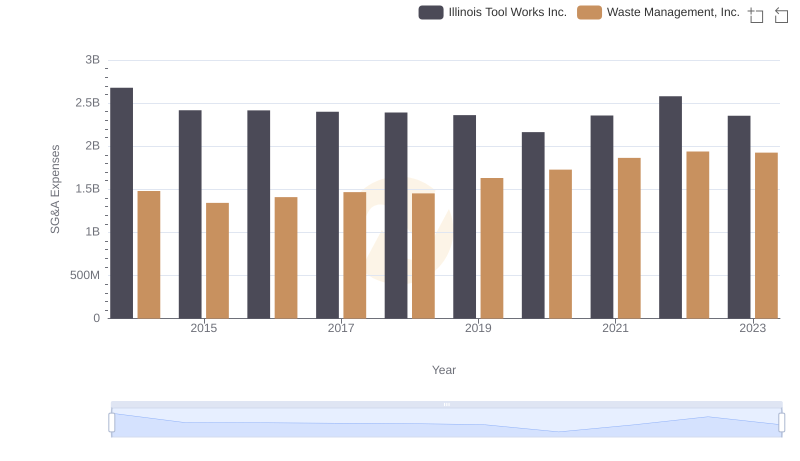

Operational Costs Compared: SG&A Analysis of Waste Management, Inc. and Illinois Tool Works Inc.

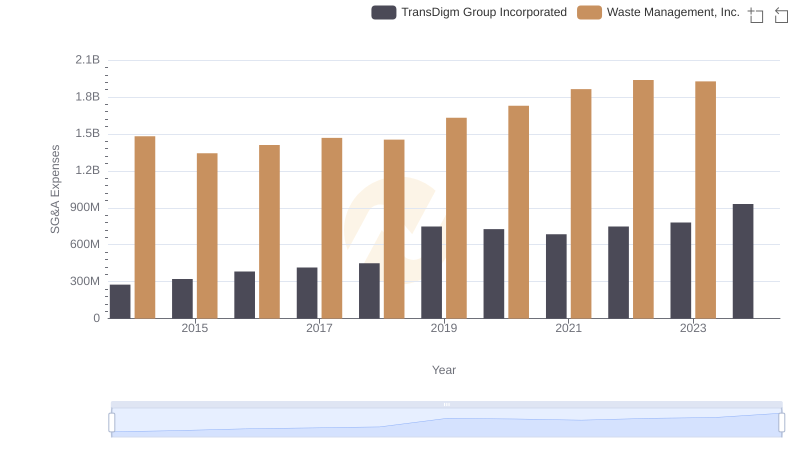

Waste Management, Inc. and TransDigm Group Incorporated: SG&A Spending Patterns Compared

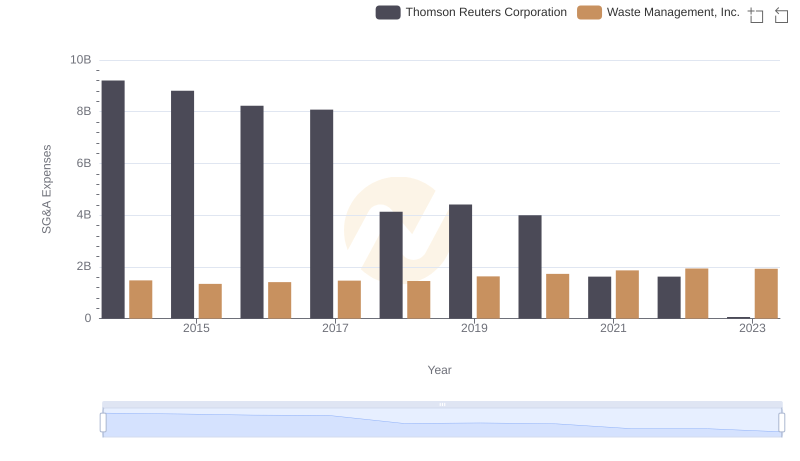

Waste Management, Inc. and Thomson Reuters Corporation: SG&A Spending Patterns Compared

Waste Management, Inc. vs Northrop Grumman Corporation: SG&A Expense Trends