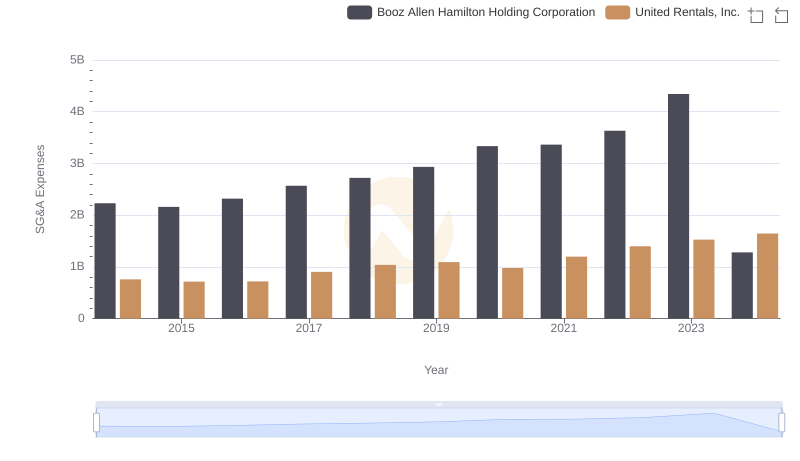

| __timestamp | Booz Allen Hamilton Holding Corporation | United Rentals, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2762580000 | 2432000000 |

| Thursday, January 1, 2015 | 2680921000 | 2480000000 |

| Friday, January 1, 2016 | 2825712000 | 2403000000 |

| Sunday, January 1, 2017 | 3112302000 | 2769000000 |

| Monday, January 1, 2018 | 3304750000 | 3364000000 |

| Tuesday, January 1, 2019 | 3603571000 | 3670000000 |

| Wednesday, January 1, 2020 | 4084661000 | 3183000000 |

| Friday, January 1, 2021 | 4201408000 | 3853000000 |

| Saturday, January 1, 2022 | 4464078000 | 4996000000 |

| Sunday, January 1, 2023 | 4954101000 | 5813000000 |

| Monday, January 1, 2024 | 2459049000 | 6150000000 |

Unlocking the unknown

In the ever-evolving landscape of American business, United Rentals, Inc. and Booz Allen Hamilton Holding Corporation stand as titans in their respective fields. Over the past decade, these companies have showcased remarkable growth in gross profit, reflecting their strategic prowess and market adaptability.

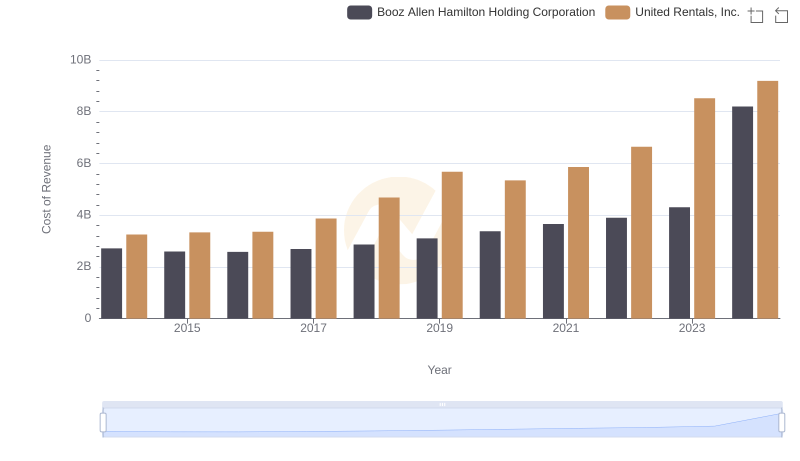

From 2014 to 2023, United Rentals has seen a staggering 139% increase in gross profit, peaking at $5.81 billion in 2023. This growth trajectory underscores the company's robust expansion and operational efficiency. In contrast, Booz Allen Hamilton, a leader in management consulting, experienced a 79% rise in gross profit, reaching $4.95 billion in 2023. This steady climb highlights its resilience and strategic acumen in navigating complex market dynamics.

As we look to the future, the 2024 projections hint at continued growth for United Rentals, while Booz Allen Hamilton faces a potential dip, emphasizing the dynamic nature of these industries.

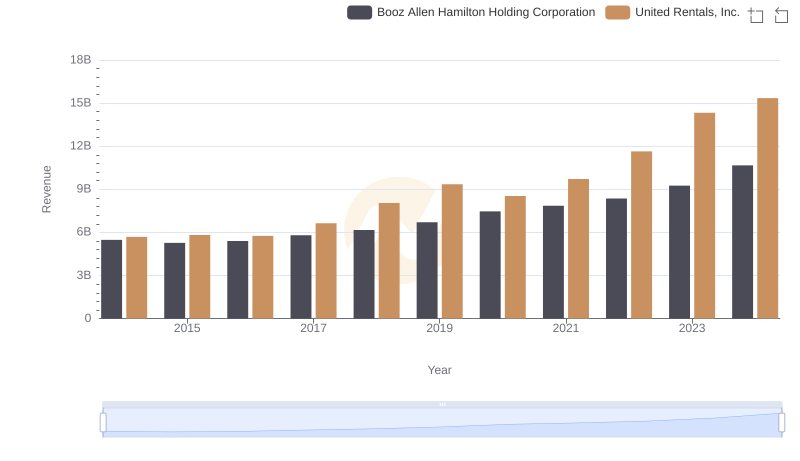

United Rentals, Inc. and Booz Allen Hamilton Holding Corporation: A Comprehensive Revenue Analysis

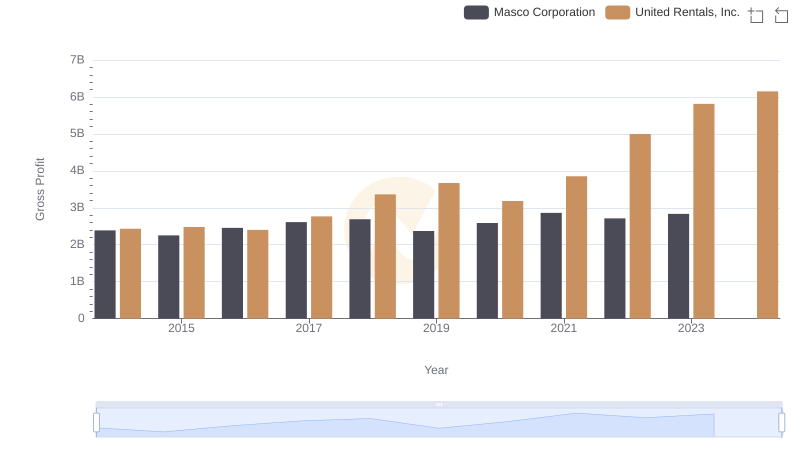

United Rentals, Inc. vs Masco Corporation: A Gross Profit Performance Breakdown

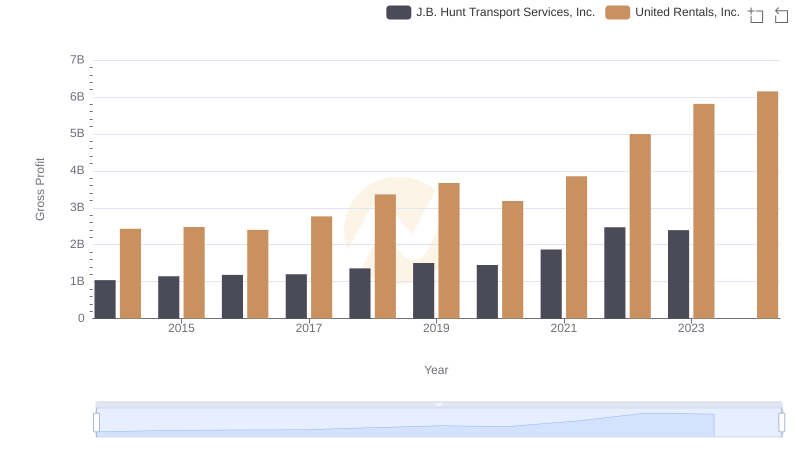

Gross Profit Comparison: United Rentals, Inc. and J.B. Hunt Transport Services, Inc. Trends

Cost of Revenue: Key Insights for United Rentals, Inc. and Booz Allen Hamilton Holding Corporation

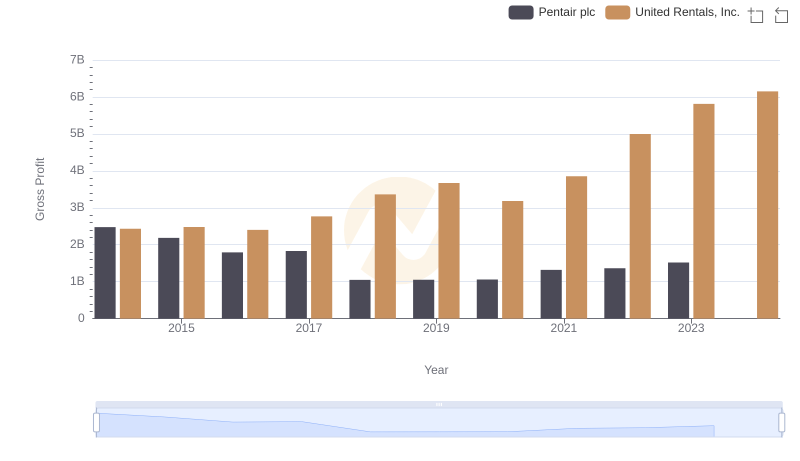

Who Generates Higher Gross Profit? United Rentals, Inc. or Pentair plc

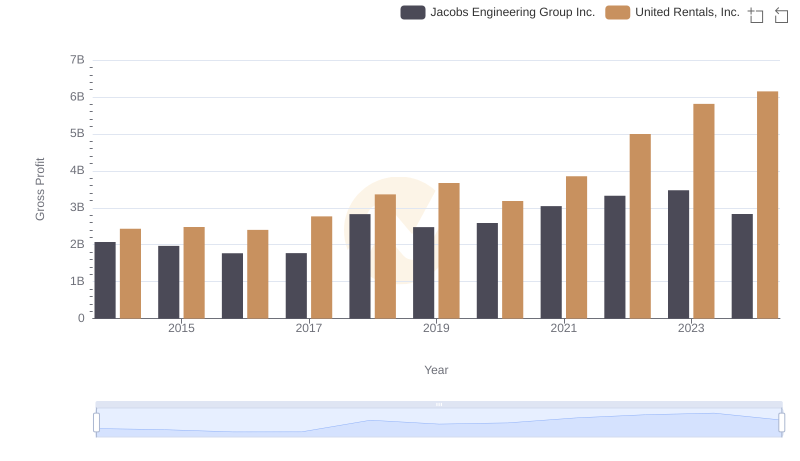

United Rentals, Inc. and Jacobs Engineering Group Inc.: A Detailed Gross Profit Analysis

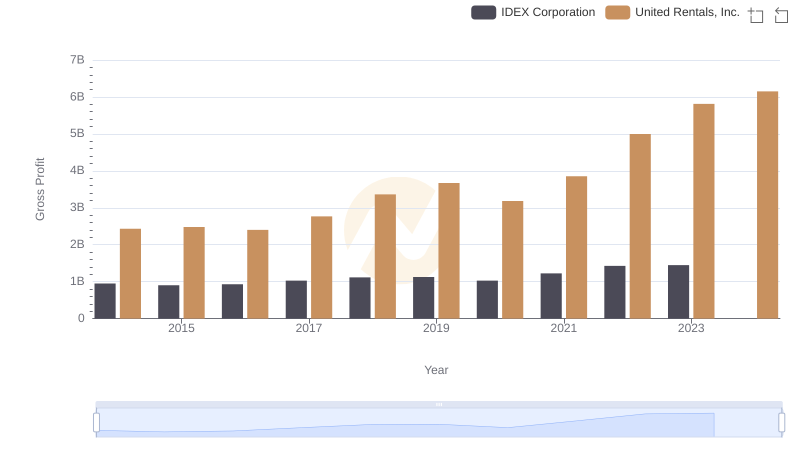

Gross Profit Analysis: Comparing United Rentals, Inc. and IDEX Corporation

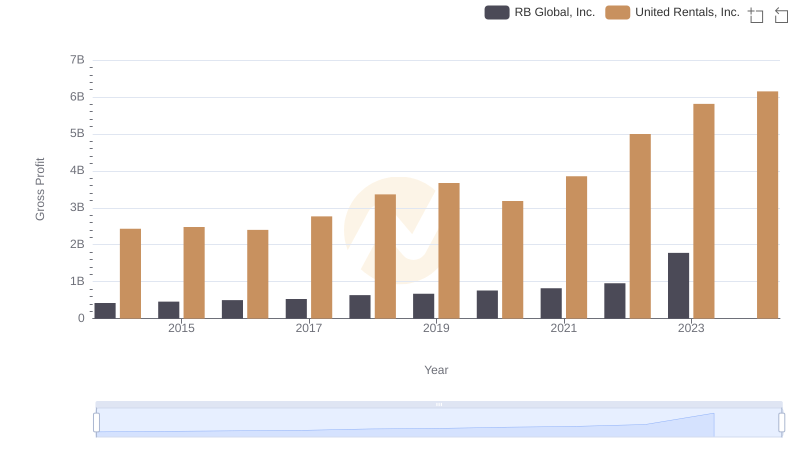

Who Generates Higher Gross Profit? United Rentals, Inc. or RB Global, Inc.

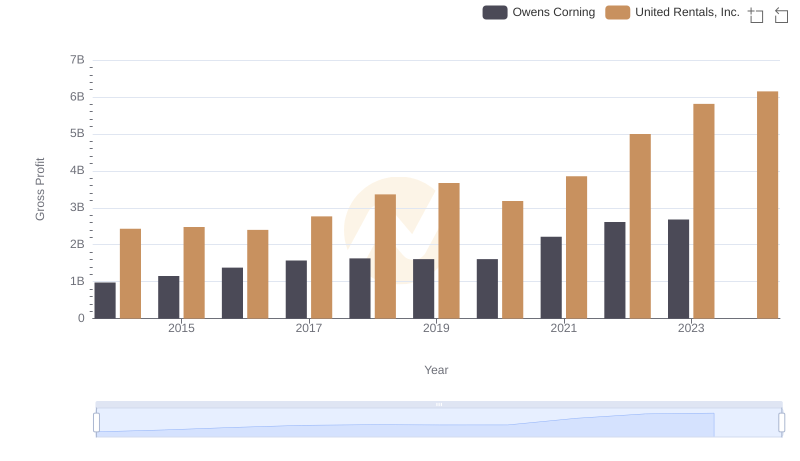

United Rentals, Inc. and Owens Corning: A Detailed Gross Profit Analysis

United Rentals, Inc. and Booz Allen Hamilton Holding Corporation: SG&A Spending Patterns Compared

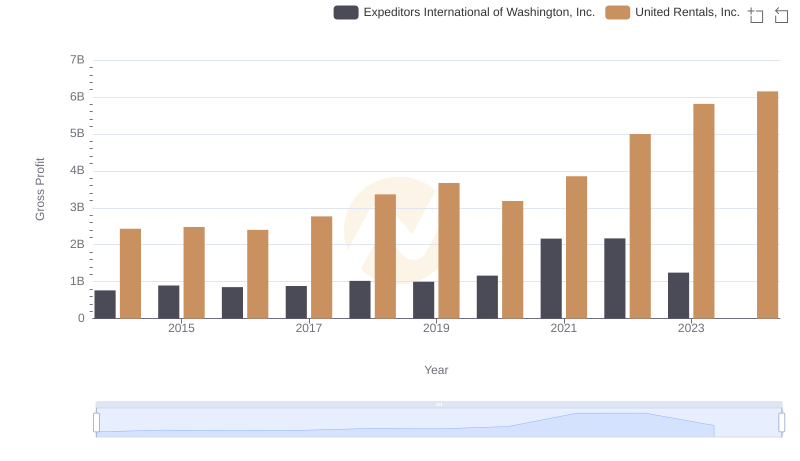

United Rentals, Inc. vs Expeditors International of Washington, Inc.: A Gross Profit Performance Breakdown