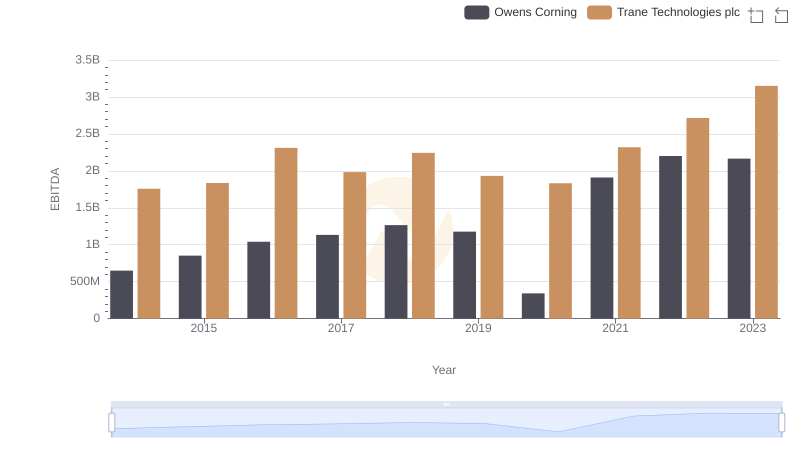

| __timestamp | Owens Corning | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 487000000 | 2503900000 |

| Thursday, January 1, 2015 | 525000000 | 2541100000 |

| Friday, January 1, 2016 | 584000000 | 2606500000 |

| Sunday, January 1, 2017 | 620000000 | 2720700000 |

| Monday, January 1, 2018 | 700000000 | 2903200000 |

| Tuesday, January 1, 2019 | 698000000 | 3129800000 |

| Wednesday, January 1, 2020 | 664000000 | 2270600000 |

| Friday, January 1, 2021 | 757000000 | 2446300000 |

| Saturday, January 1, 2022 | 803000000 | 2545900000 |

| Sunday, January 1, 2023 | 831000000 | 2963200000 |

| Monday, January 1, 2024 | 3580400000 |

Infusing magic into the data realm

In the competitive landscape of industrial manufacturing, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Trane Technologies plc and Owens Corning, two giants in the industry, have shown distinct approaches over the past decade.

From 2014 to 2023, Trane Technologies consistently reported higher SG&A expenses, averaging around 2.66 billion annually. Despite this, their expenses have shown a steady increase of approximately 18% over the period, peaking in 2019. In contrast, Owens Corning maintained a more modest average of 667 million, with a notable 71% increase from 2014 to 2023.

While Trane Technologies' higher expenses might suggest inefficiency, it could also reflect strategic investments in growth. Owens Corning's leaner approach indicates a focus on cost control. Understanding these dynamics offers valuable insights into each company's operational strategies.

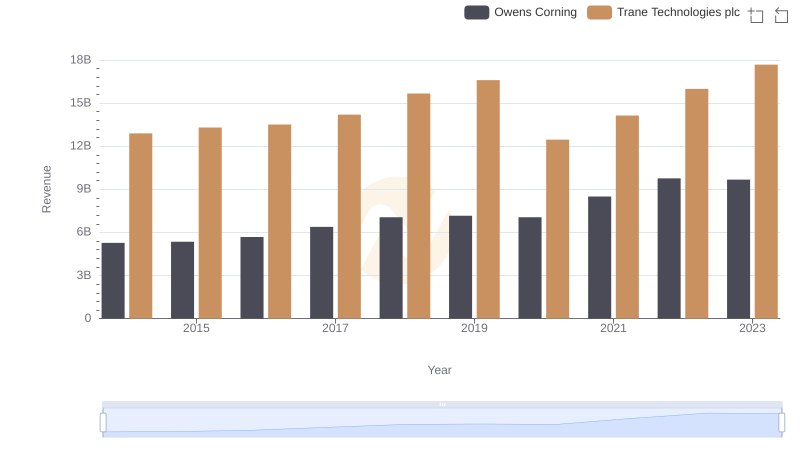

Trane Technologies plc vs Owens Corning: Annual Revenue Growth Compared

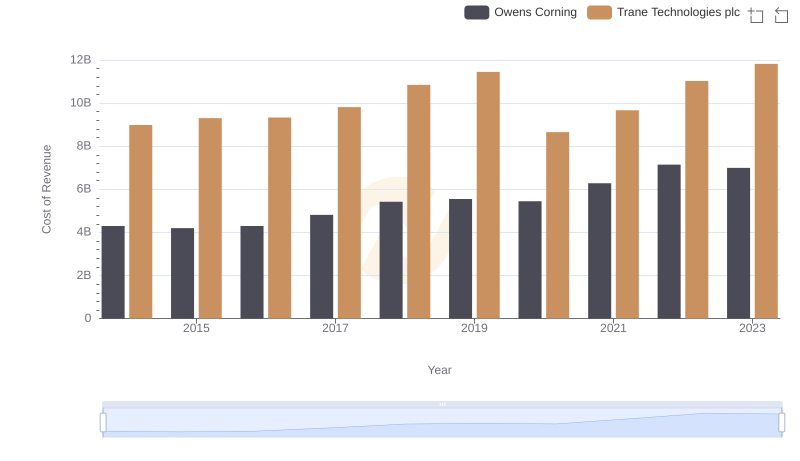

Cost Insights: Breaking Down Trane Technologies plc and Owens Corning's Expenses

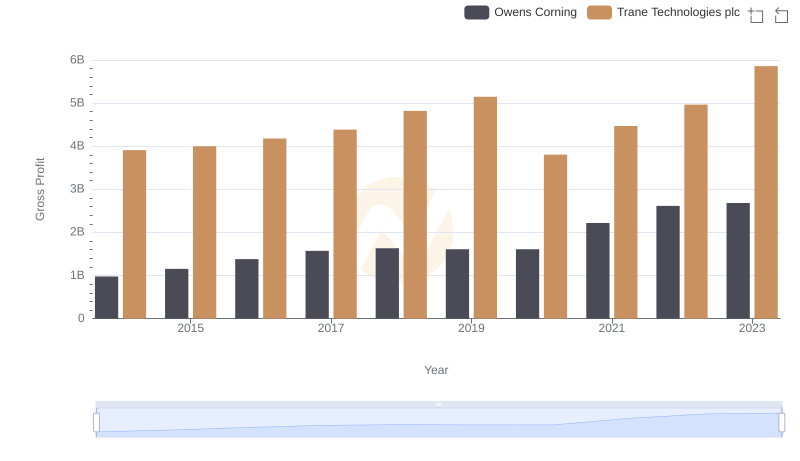

Gross Profit Analysis: Comparing Trane Technologies plc and Owens Corning

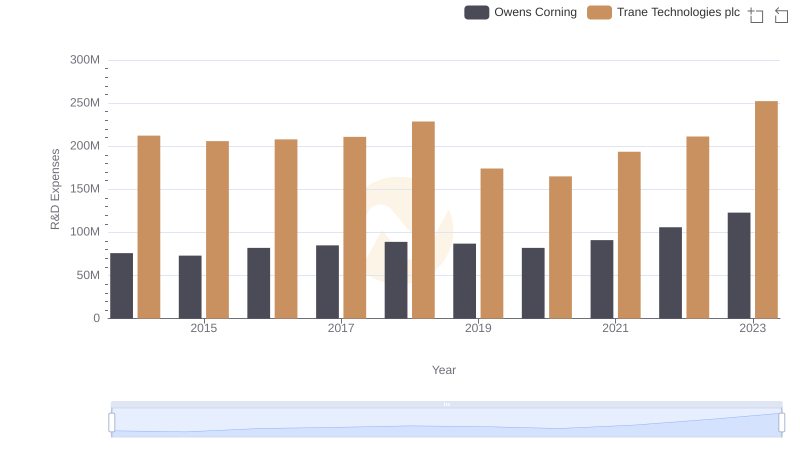

Trane Technologies plc vs Owens Corning: Strategic Focus on R&D Spending

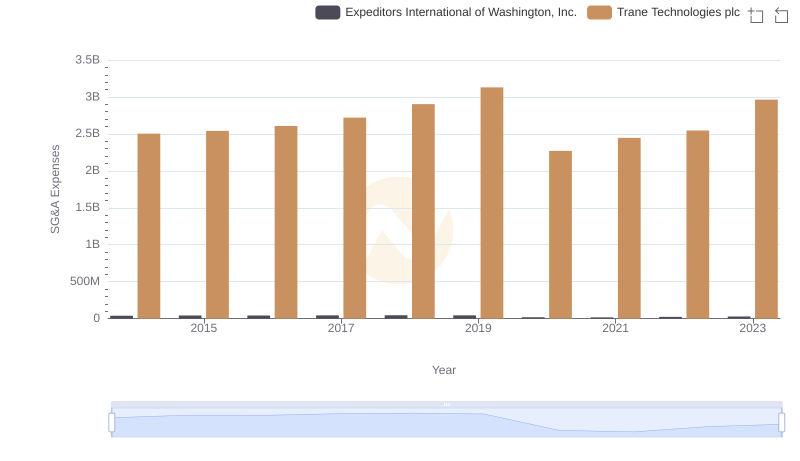

Breaking Down SG&A Expenses: Trane Technologies plc vs Expeditors International of Washington, Inc.

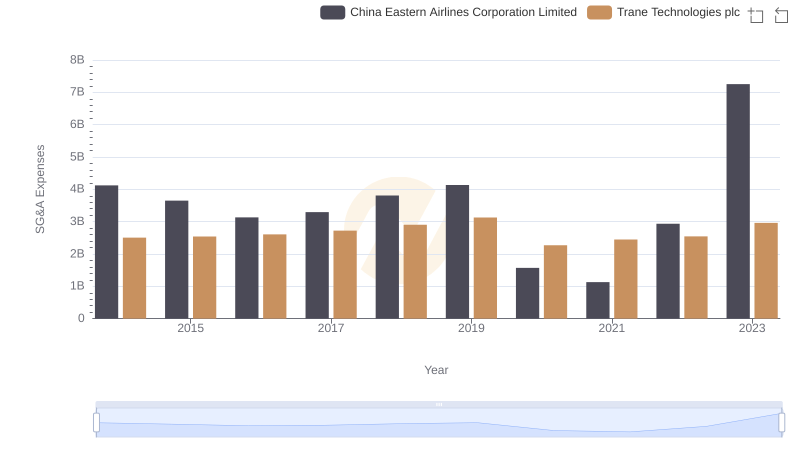

Comparing SG&A Expenses: Trane Technologies plc vs China Eastern Airlines Corporation Limited Trends and Insights

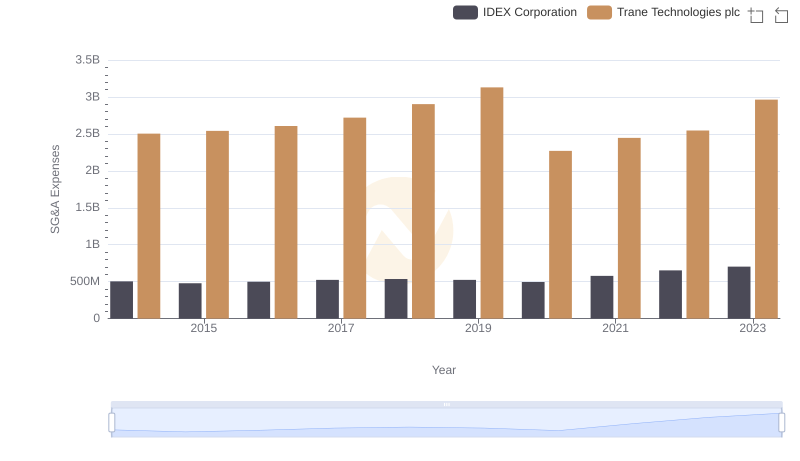

Trane Technologies plc vs IDEX Corporation: SG&A Expense Trends

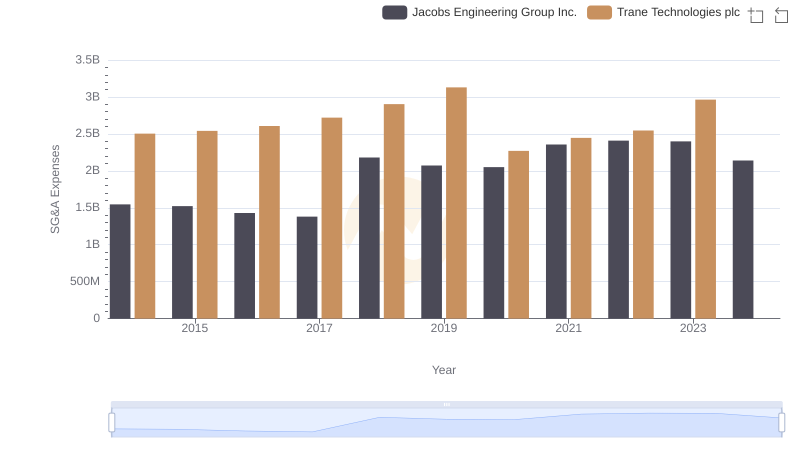

Breaking Down SG&A Expenses: Trane Technologies plc vs Jacobs Engineering Group Inc.

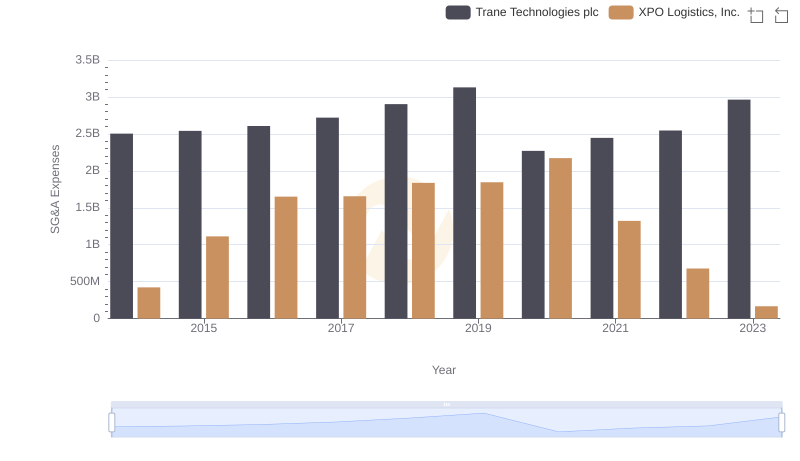

Cost Management Insights: SG&A Expenses for Trane Technologies plc and XPO Logistics, Inc.

A Professional Review of EBITDA: Trane Technologies plc Compared to Owens Corning

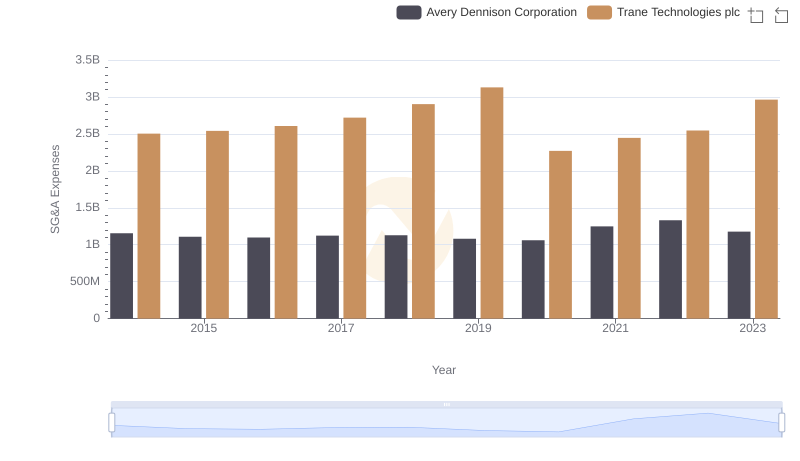

Operational Costs Compared: SG&A Analysis of Trane Technologies plc and Avery Dennison Corporation