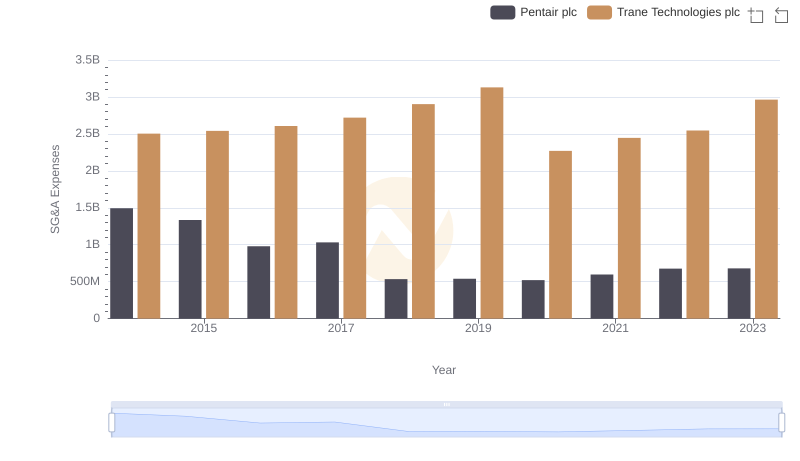

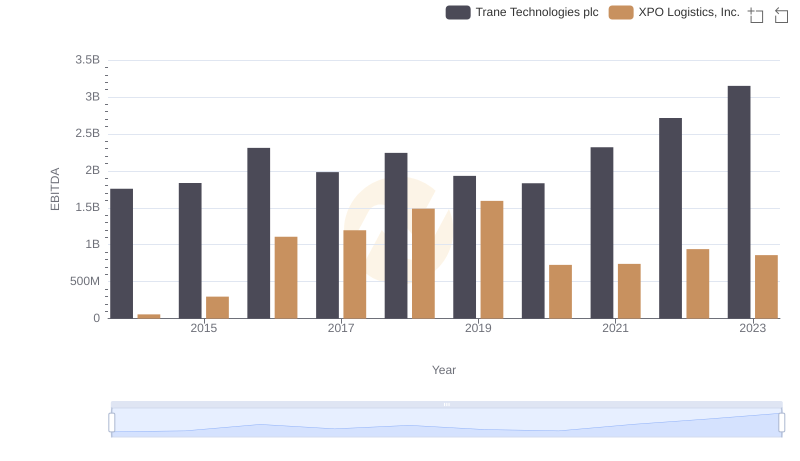

| __timestamp | Trane Technologies plc | XPO Logistics, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2503900000 | 422500000 |

| Thursday, January 1, 2015 | 2541100000 | 1113400000 |

| Friday, January 1, 2016 | 2606500000 | 1651200000 |

| Sunday, January 1, 2017 | 2720700000 | 1656500000 |

| Monday, January 1, 2018 | 2903200000 | 1837000000 |

| Tuesday, January 1, 2019 | 3129800000 | 1845000000 |

| Wednesday, January 1, 2020 | 2270600000 | 2172000000 |

| Friday, January 1, 2021 | 2446300000 | 1322000000 |

| Saturday, January 1, 2022 | 2545900000 | 678000000 |

| Sunday, January 1, 2023 | 2963200000 | 167000000 |

| Monday, January 1, 2024 | 3580400000 | 134000000 |

Cracking the code

In the ever-evolving landscape of corporate finance, effective cost management is crucial for sustaining growth and profitability. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of Trane Technologies plc and XPO Logistics, Inc. over the past decade, offering insights into their financial strategies.

From 2014 to 2023, Trane Technologies plc has demonstrated a consistent upward trend in SG&A expenses, peaking in 2019 with a 25% increase from 2014. Despite a dip in 2020, the company rebounded, showcasing resilience and strategic cost management.

Conversely, XPO Logistics, Inc. experienced significant fluctuations. After a dramatic rise in 2016, expenses plummeted by 92% by 2023, reflecting strategic shifts and potential restructuring efforts.

This comparative analysis underscores the diverse approaches to cost management, highlighting the importance of adaptability in the corporate world.

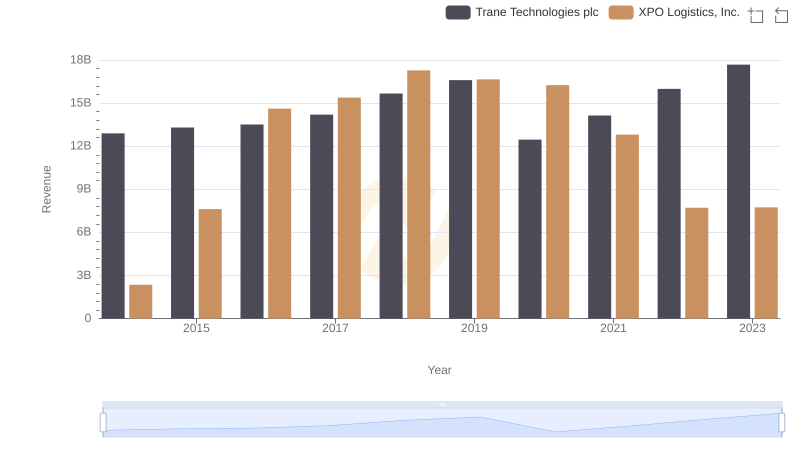

Trane Technologies plc or XPO Logistics, Inc.: Who Leads in Yearly Revenue?

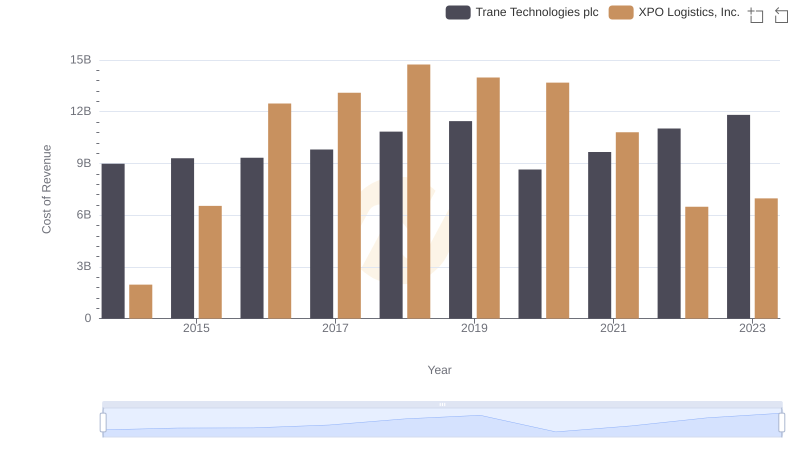

Cost of Revenue Trends: Trane Technologies plc vs XPO Logistics, Inc.

SG&A Efficiency Analysis: Comparing Trane Technologies plc and Pentair plc

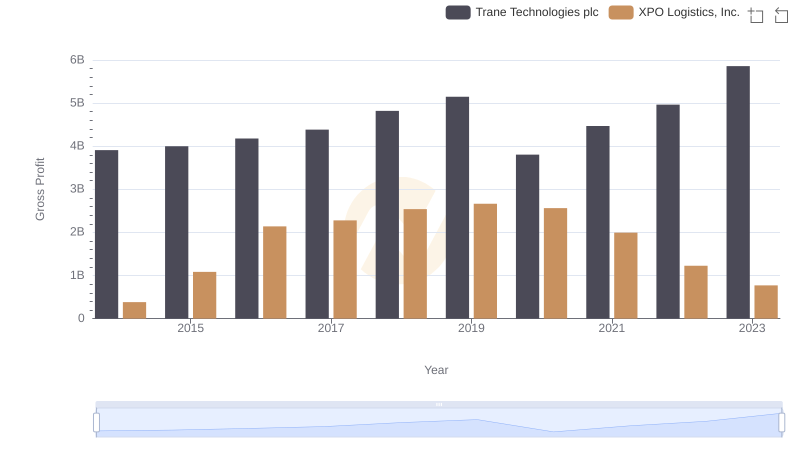

Key Insights on Gross Profit: Trane Technologies plc vs XPO Logistics, Inc.

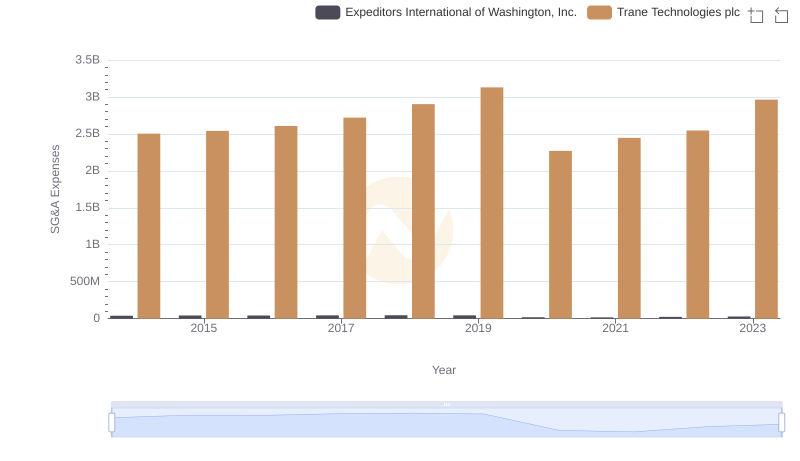

Breaking Down SG&A Expenses: Trane Technologies plc vs Expeditors International of Washington, Inc.

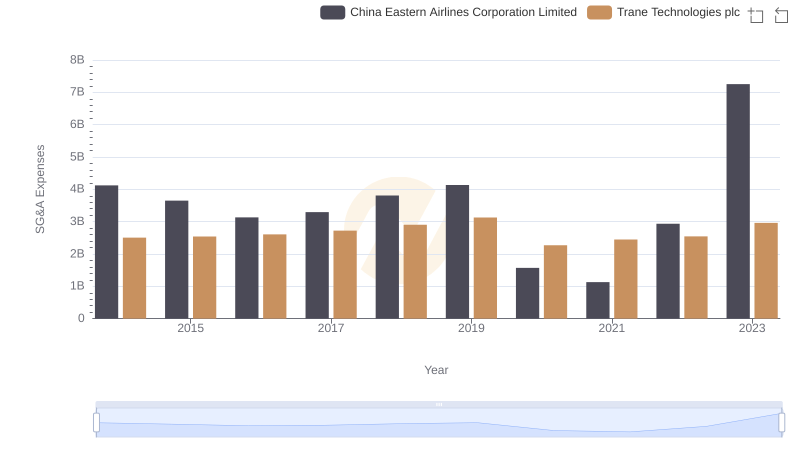

Comparing SG&A Expenses: Trane Technologies plc vs China Eastern Airlines Corporation Limited Trends and Insights

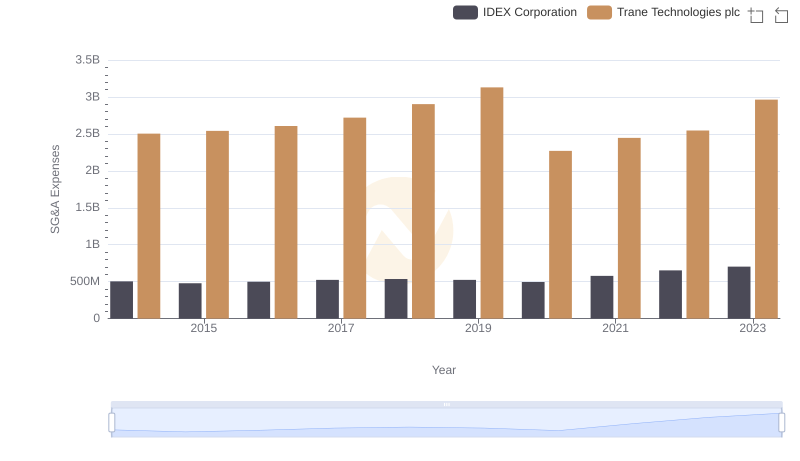

Trane Technologies plc vs IDEX Corporation: SG&A Expense Trends

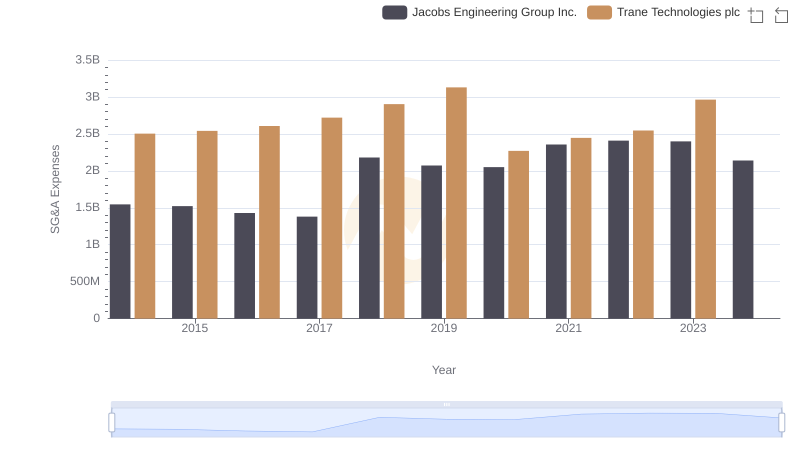

Breaking Down SG&A Expenses: Trane Technologies plc vs Jacobs Engineering Group Inc.

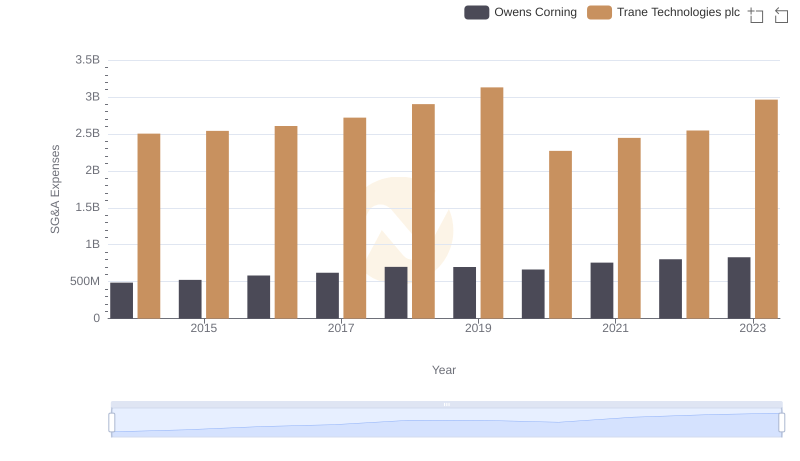

Trane Technologies plc or Owens Corning: Who Manages SG&A Costs Better?

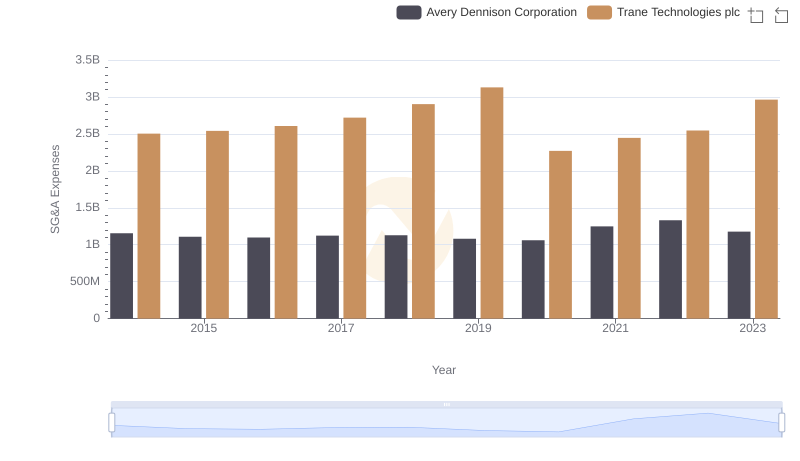

Operational Costs Compared: SG&A Analysis of Trane Technologies plc and Avery Dennison Corporation

A Professional Review of EBITDA: Trane Technologies plc Compared to XPO Logistics, Inc.