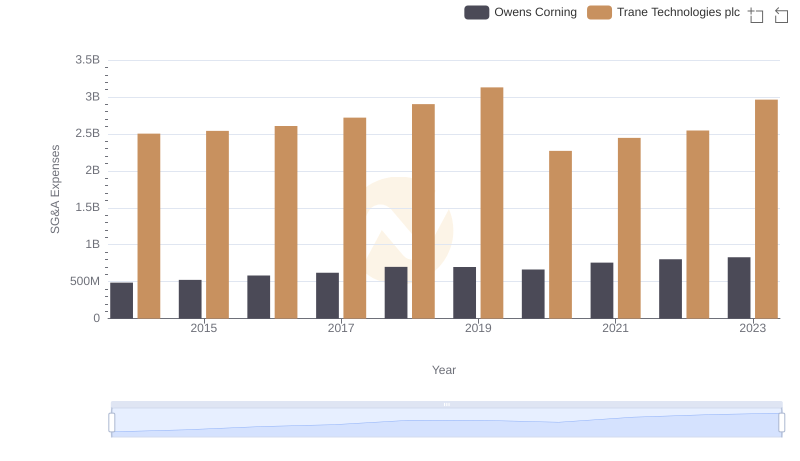

| __timestamp | Owens Corning | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 650000000 | 1757000000 |

| Thursday, January 1, 2015 | 853000000 | 1835000000 |

| Friday, January 1, 2016 | 1041000000 | 2311000000 |

| Sunday, January 1, 2017 | 1134000000 | 1982500000 |

| Monday, January 1, 2018 | 1266000000 | 2242400000 |

| Tuesday, January 1, 2019 | 1178000000 | 1931200000 |

| Wednesday, January 1, 2020 | 341000000 | 1831900000 |

| Friday, January 1, 2021 | 1909000000 | 2319200000 |

| Saturday, January 1, 2022 | 2200000000 | 2715500000 |

| Sunday, January 1, 2023 | 2166000000 | 3149900000 |

| Monday, January 1, 2024 | 3859600000 |

Unlocking the unknown

In the ever-evolving landscape of industrial giants, Trane Technologies plc and Owens Corning have showcased remarkable financial trajectories over the past decade. From 2014 to 2023, Trane Technologies consistently outperformed Owens Corning in EBITDA, with a notable peak in 2023, reaching approximately 3.15 billion, a 79% increase from 2014. Meanwhile, Owens Corning demonstrated a robust growth trajectory, achieving a 233% increase in EBITDA from 2014 to 2022, before slightly declining in 2023.

This comparative analysis not only highlights the financial health of these companies but also offers insights into their strategic maneuvers in a competitive market.

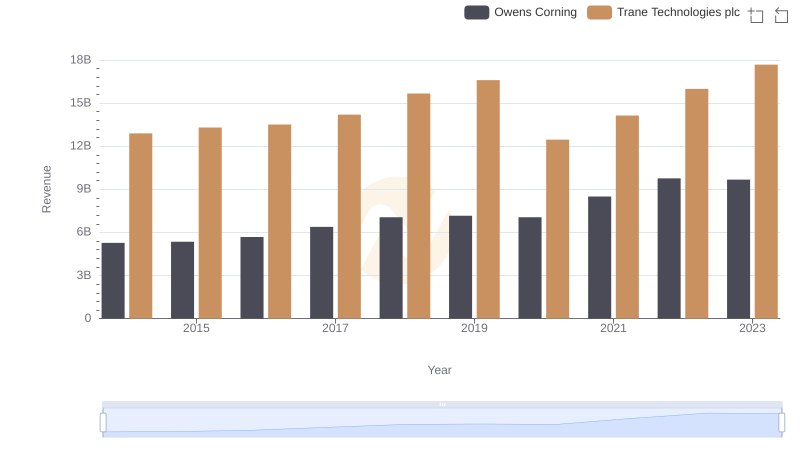

Trane Technologies plc vs Owens Corning: Annual Revenue Growth Compared

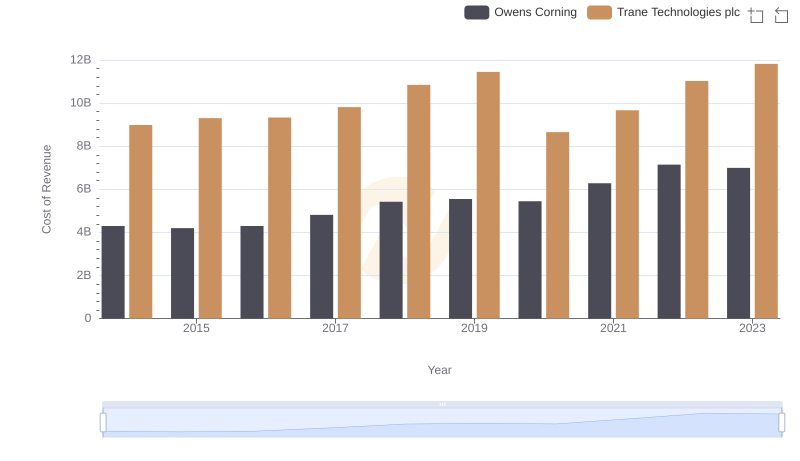

Cost Insights: Breaking Down Trane Technologies plc and Owens Corning's Expenses

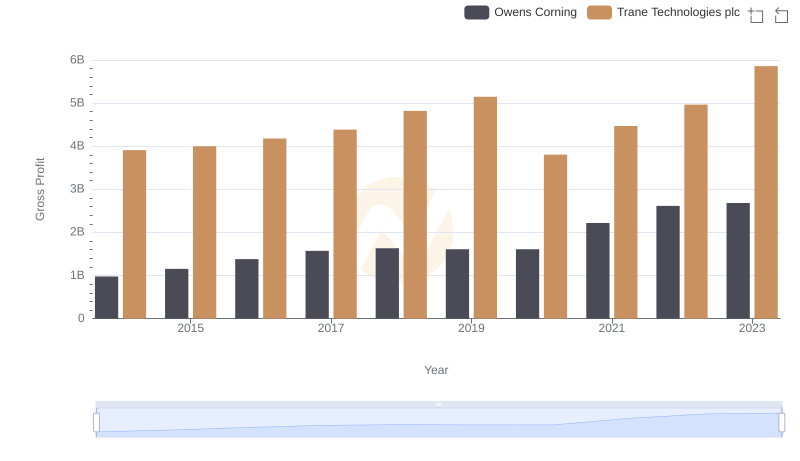

Gross Profit Analysis: Comparing Trane Technologies plc and Owens Corning

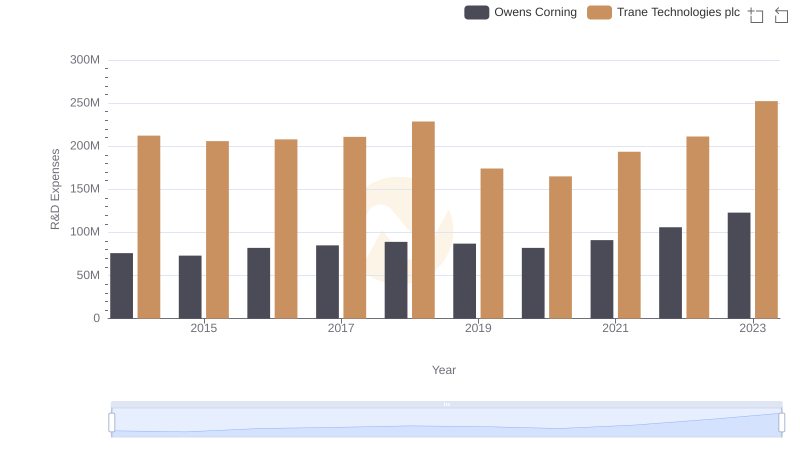

Trane Technologies plc vs Owens Corning: Strategic Focus on R&D Spending

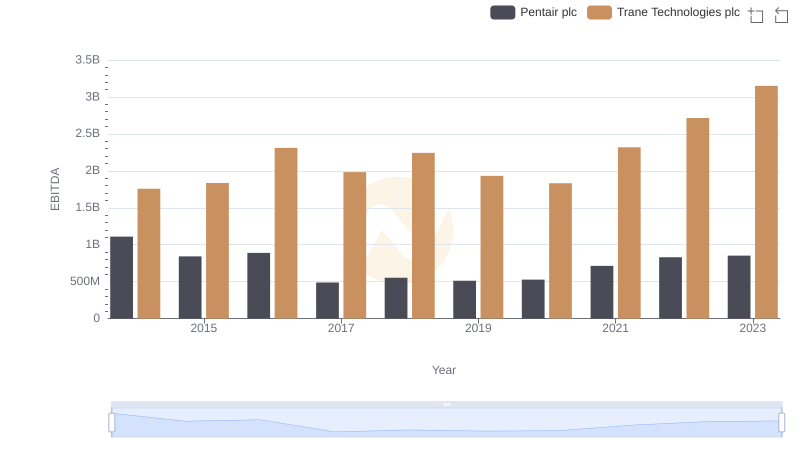

EBITDA Performance Review: Trane Technologies plc vs Pentair plc

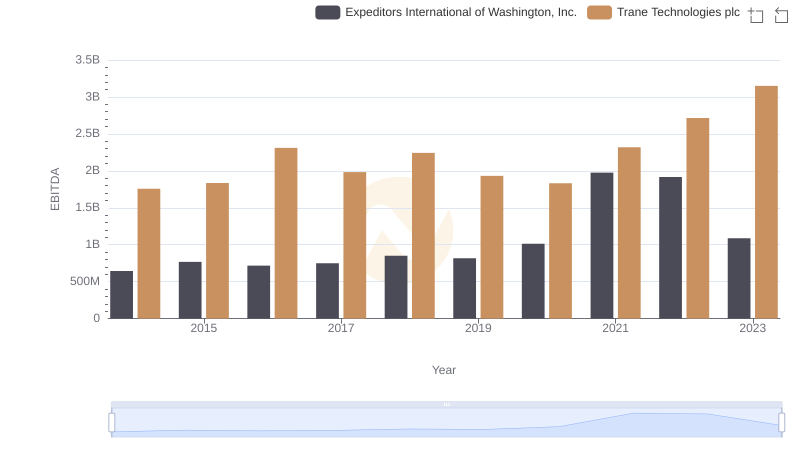

Trane Technologies plc vs Expeditors International of Washington, Inc.: In-Depth EBITDA Performance Comparison

Trane Technologies plc or Owens Corning: Who Manages SG&A Costs Better?

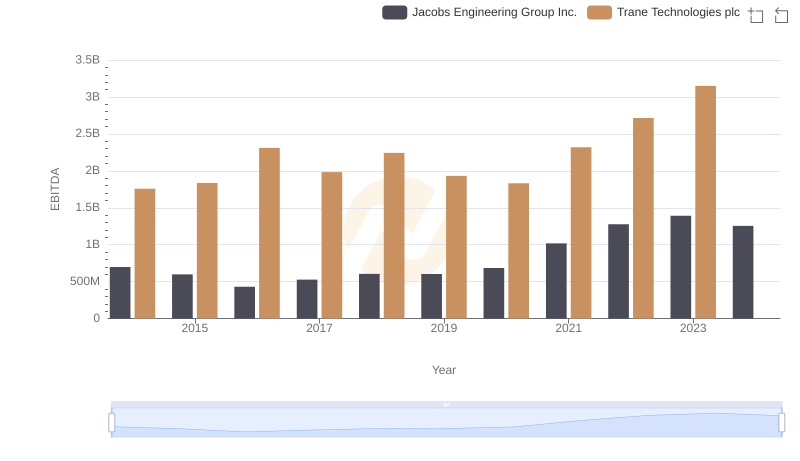

EBITDA Analysis: Evaluating Trane Technologies plc Against Jacobs Engineering Group Inc.

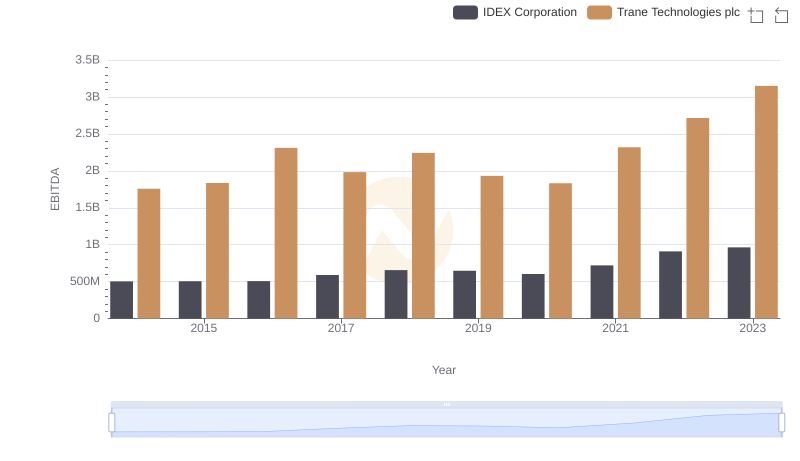

Professional EBITDA Benchmarking: Trane Technologies plc vs IDEX Corporation

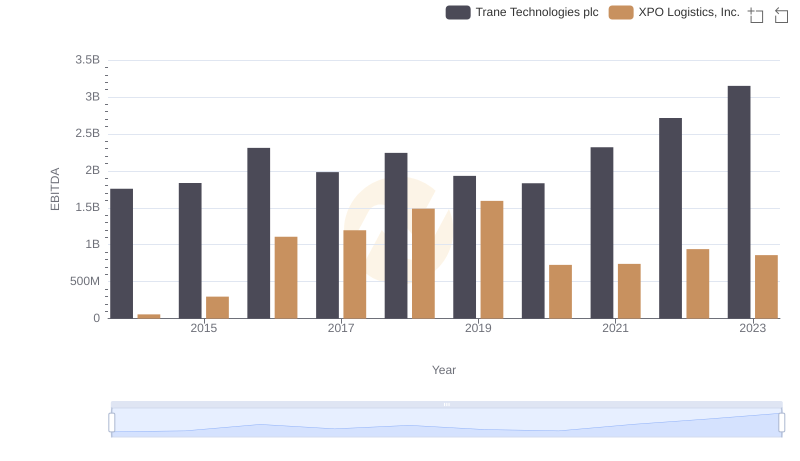

A Professional Review of EBITDA: Trane Technologies plc Compared to XPO Logistics, Inc.

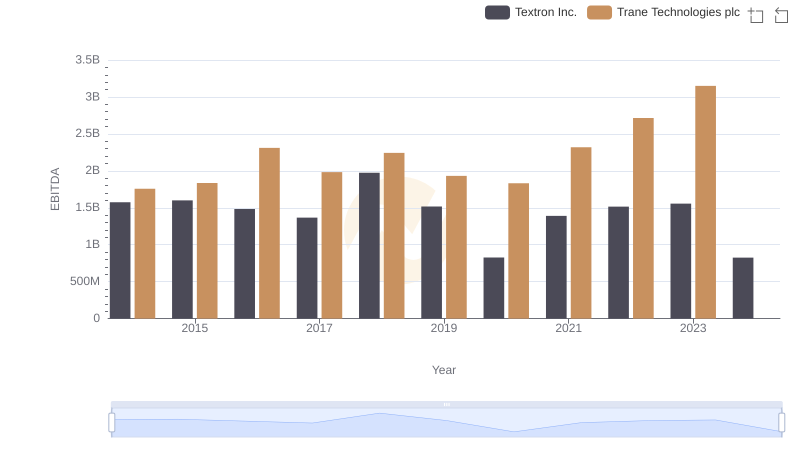

A Professional Review of EBITDA: Trane Technologies plc Compared to Textron Inc.

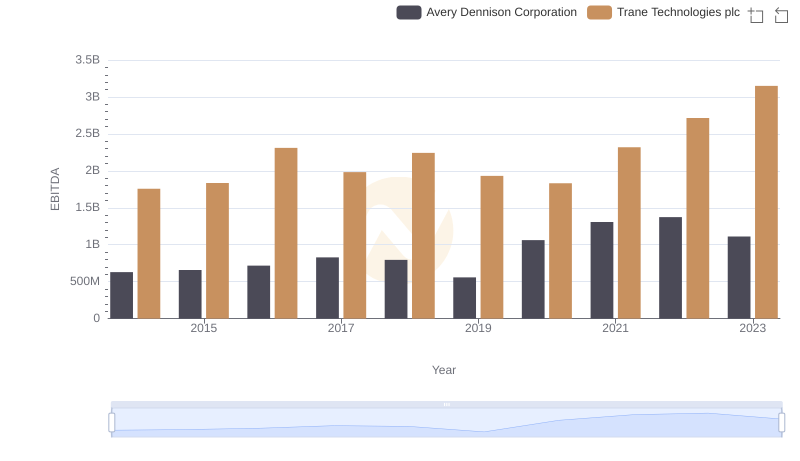

EBITDA Analysis: Evaluating Trane Technologies plc Against Avery Dennison Corporation