| __timestamp | General Dynamics Corporation | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 4401000000 | 1757000000 |

| Thursday, January 1, 2015 | 4682000000 | 1835000000 |

| Friday, January 1, 2016 | 4208000000 | 2311000000 |

| Sunday, January 1, 2017 | 4635000000 | 1982500000 |

| Monday, January 1, 2018 | 5222000000 | 2242400000 |

| Tuesday, January 1, 2019 | 5503000000 | 1931200000 |

| Wednesday, January 1, 2020 | 5105000000 | 1831900000 |

| Friday, January 1, 2021 | 5194000000 | 2319200000 |

| Saturday, January 1, 2022 | 5311000000 | 2715500000 |

| Sunday, January 1, 2023 | 5246000000 | 3149900000 |

| Monday, January 1, 2024 | 5819000000 | 3859600000 |

Cracking the code

In the ever-evolving landscape of industrial giants, Trane Technologies plc and General Dynamics Corporation stand as titans in their respective fields. Over the past decade, from 2014 to 2023, these companies have showcased their financial prowess through EBITDA performance. General Dynamics consistently outperformed, with an average EBITDA of approximately $4.9 billion, peaking in 2019. Trane Technologies, while trailing, demonstrated impressive growth, with a notable 79% increase from 2014 to 2023, reaching its zenith in 2023. This growth trajectory highlights Trane's strategic advancements in the industrial sector. However, data for 2024 remains incomplete, leaving room for speculation on future trends. This analysis not only underscores the financial health of these corporations but also provides insights into their strategic maneuvers in a competitive market.

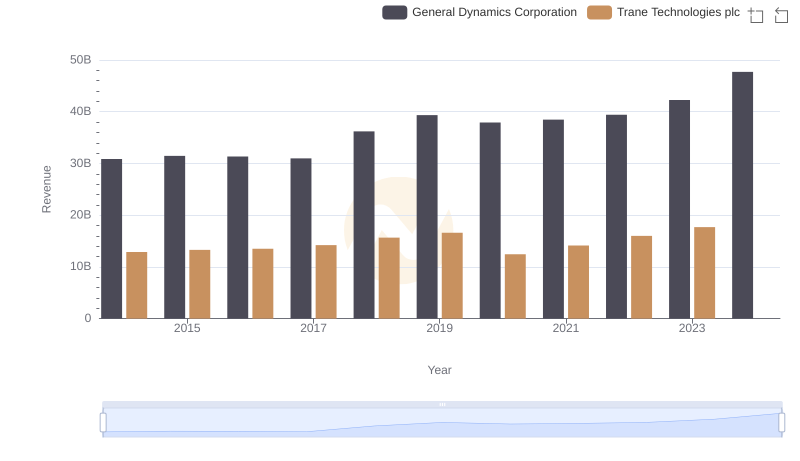

Trane Technologies plc vs General Dynamics Corporation: Annual Revenue Growth Compared

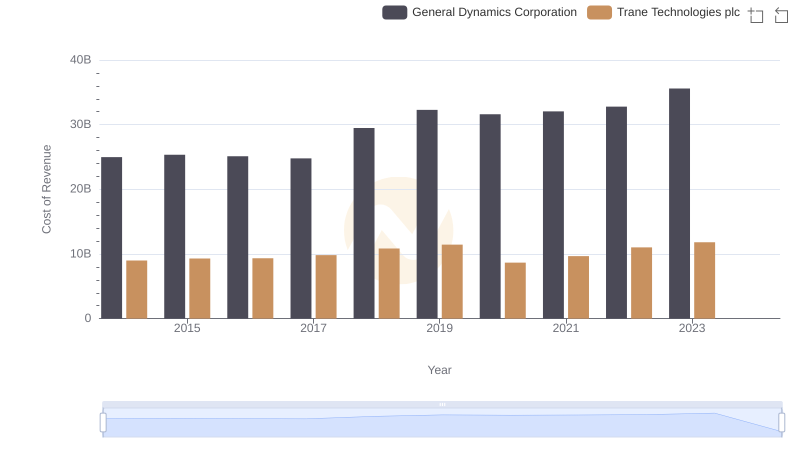

Cost of Revenue Trends: Trane Technologies plc vs General Dynamics Corporation

Trane Technologies plc vs General Dynamics Corporation: A Gross Profit Performance Breakdown

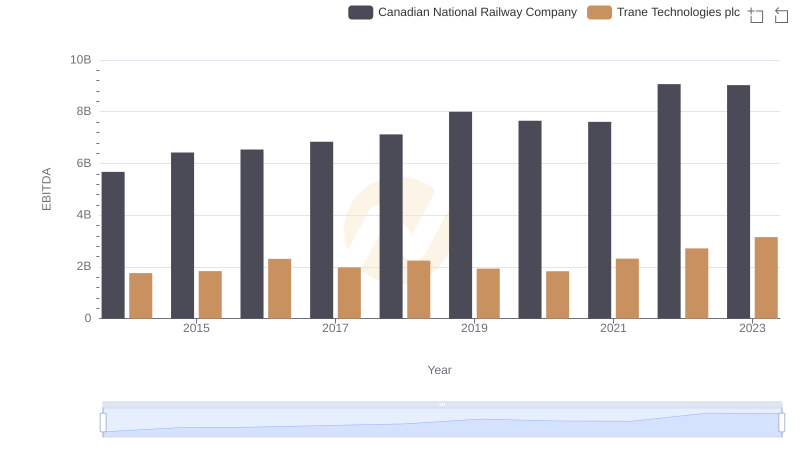

A Professional Review of EBITDA: Trane Technologies plc Compared to Canadian National Railway Company

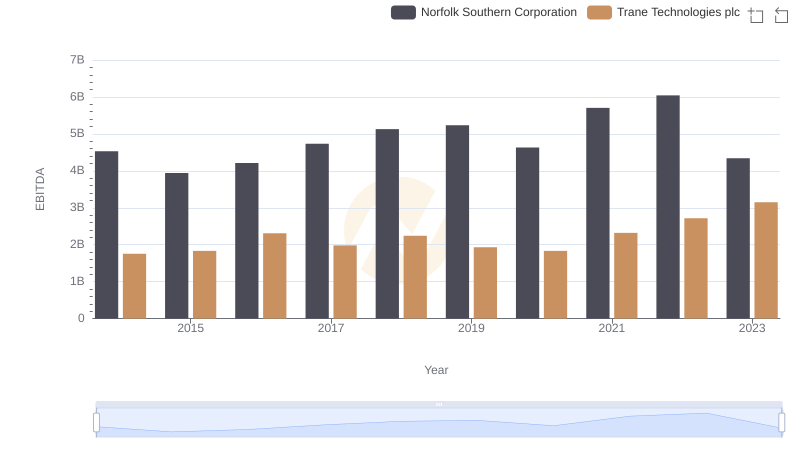

EBITDA Analysis: Evaluating Trane Technologies plc Against Norfolk Southern Corporation

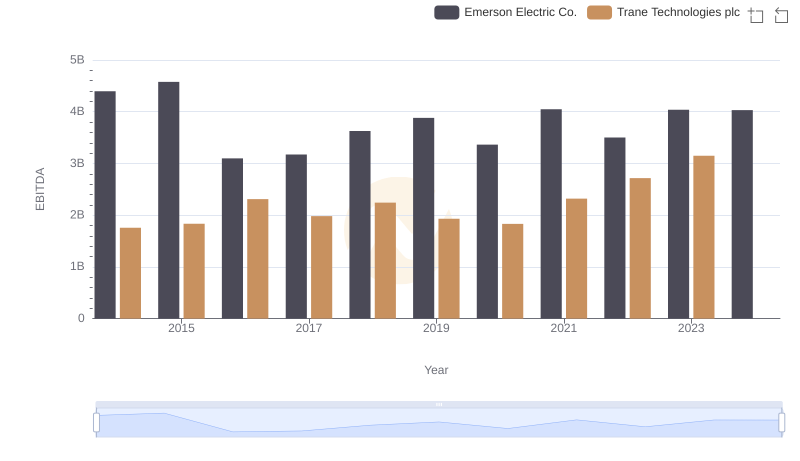

Comparative EBITDA Analysis: Trane Technologies plc vs Emerson Electric Co.

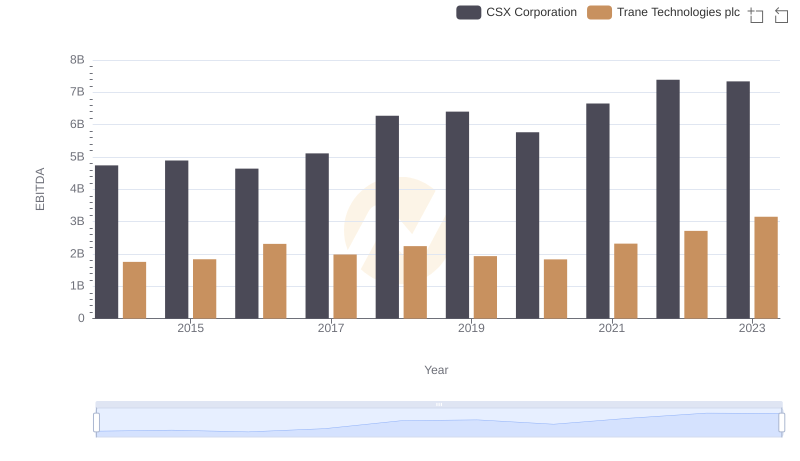

EBITDA Performance Review: Trane Technologies plc vs CSX Corporation

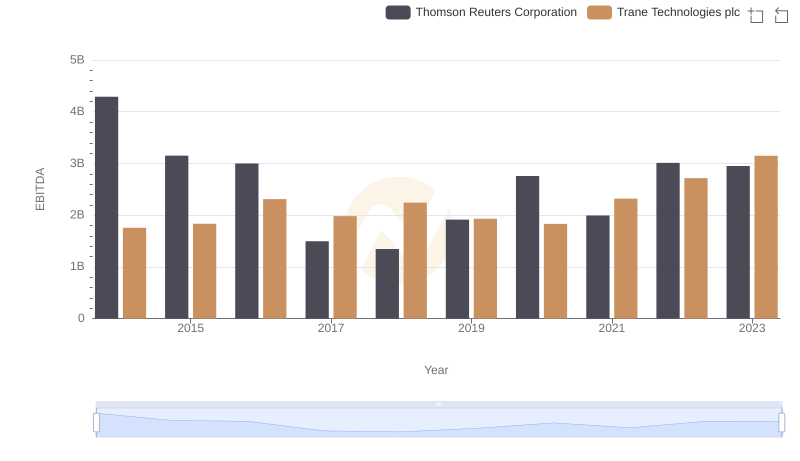

A Side-by-Side Analysis of EBITDA: Trane Technologies plc and Thomson Reuters Corporation

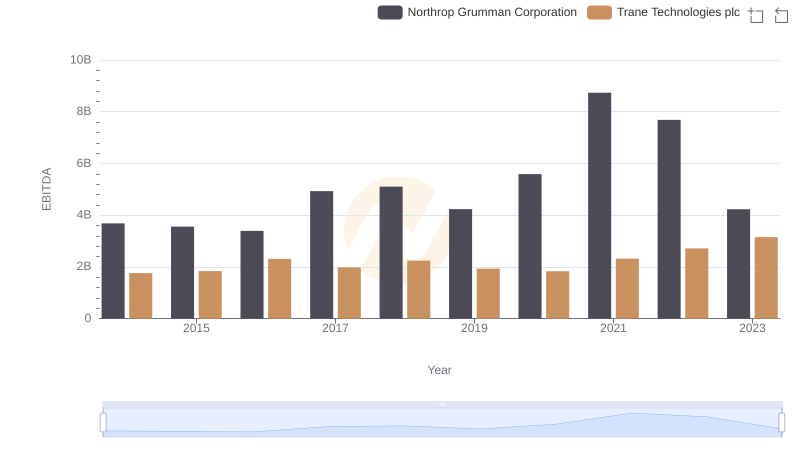

Trane Technologies plc and Northrop Grumman Corporation: A Detailed Examination of EBITDA Performance