| __timestamp | Booz Allen Hamilton Holding Corporation | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 531144000 | 588370000 |

| Thursday, January 1, 2015 | 520410000 | 672301000 |

| Friday, January 1, 2016 | 506120000 | 535893000 |

| Sunday, January 1, 2017 | 561524000 | 532795000 |

| Monday, January 1, 2018 | 577061000 | 584199000 |

| Tuesday, January 1, 2019 | 663731000 | 1067300000 |

| Wednesday, January 1, 2020 | 745424000 | 1229400000 |

| Friday, January 1, 2021 | 834449000 | 1405000000 |

| Saturday, January 1, 2022 | 826865000 | 1519000000 |

| Sunday, January 1, 2023 | 958150000 | 1787000000 |

| Monday, January 1, 2024 | 1199992000 | 1609000000 |

Unleashing the power of data

In the ever-evolving landscape of corporate finance, the EBITDA performance of Westinghouse Air Brake Technologies Corporation and Booz Allen Hamilton Holding Corporation offers a compelling narrative. From 2014 to 2023, Westinghouse Air Brake Technologies Corporation has seen its EBITDA grow by approximately 204%, peaking in 2023. This growth trajectory underscores the company's robust operational efficiency and strategic market positioning.

Conversely, Booz Allen Hamilton Holding Corporation has demonstrated a steady upward trend, with its EBITDA increasing by around 127% over the same period. This consistent growth reflects the company's resilience and adaptability in a competitive consulting industry.

While Westinghouse Air Brake Technologies Corporation's data for 2024 is missing, Booz Allen Hamilton Holding Corporation projects a promising future with an anticipated EBITDA increase of 25% from 2023. This comparison not only highlights the financial health of these corporations but also provides valuable insights into their strategic directions.

Westinghouse Air Brake Technologies Corporation vs Booz Allen Hamilton Holding Corporation: Annual Revenue Growth Compared

Westinghouse Air Brake Technologies Corporation vs Booz Allen Hamilton Holding Corporation: Efficiency in Cost of Revenue Explored

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and Booz Allen Hamilton Holding Corporation Trends

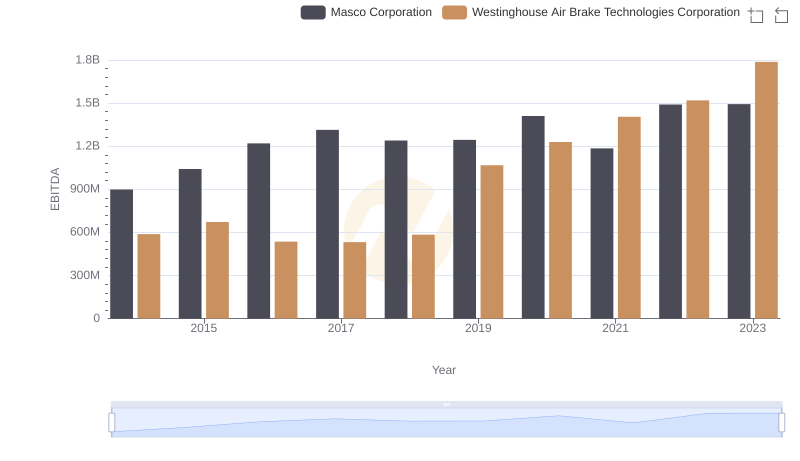

Comparative EBITDA Analysis: Westinghouse Air Brake Technologies Corporation vs Masco Corporation

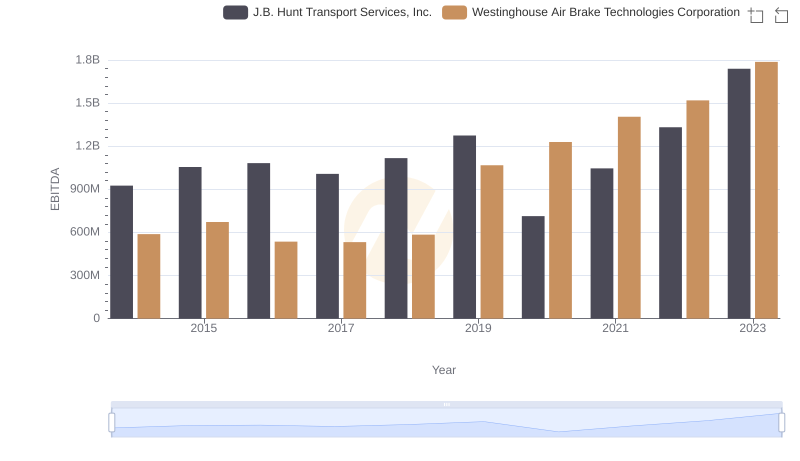

A Professional Review of EBITDA: Westinghouse Air Brake Technologies Corporation Compared to J.B. Hunt Transport Services, Inc.

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Booz Allen Hamilton Holding Corporation

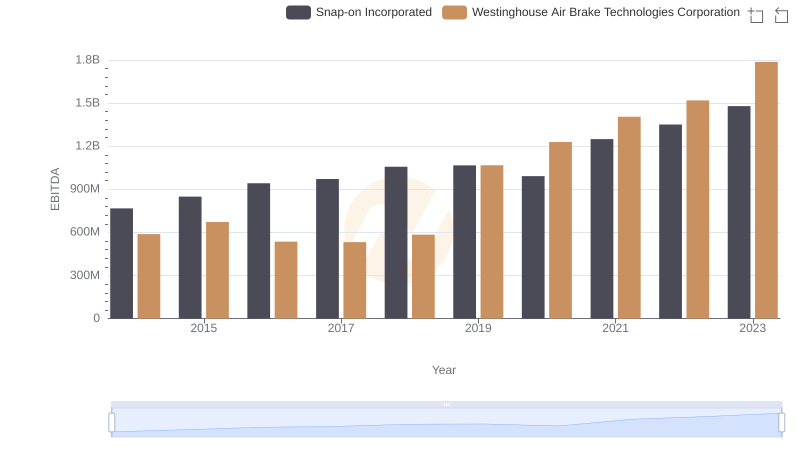

EBITDA Analysis: Evaluating Westinghouse Air Brake Technologies Corporation Against Snap-on Incorporated

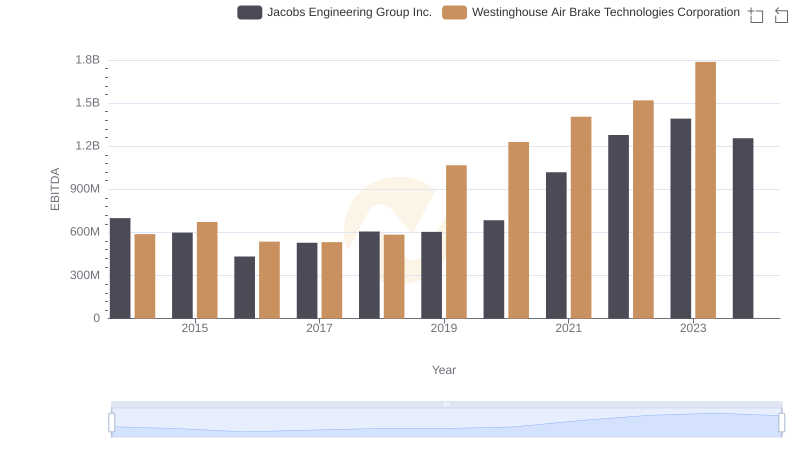

EBITDA Performance Review: Westinghouse Air Brake Technologies Corporation vs Jacobs Engineering Group Inc.

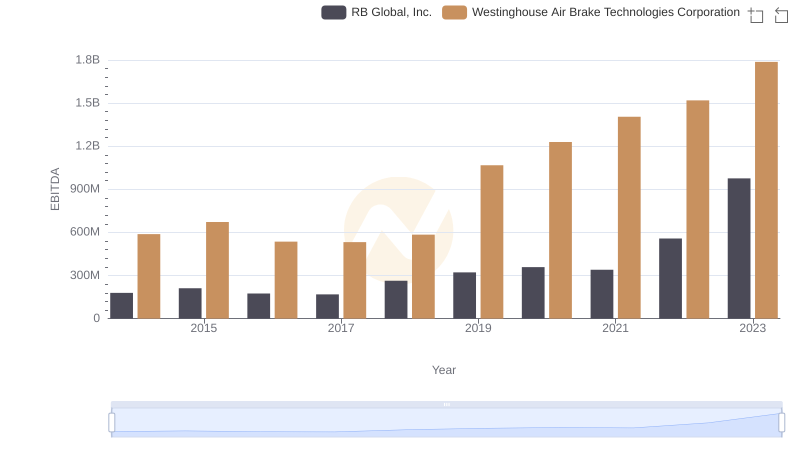

EBITDA Analysis: Evaluating Westinghouse Air Brake Technologies Corporation Against RB Global, Inc.

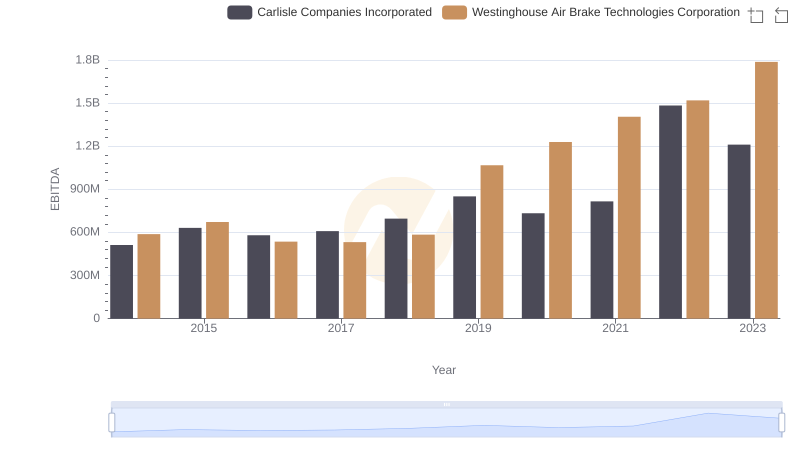

A Side-by-Side Analysis of EBITDA: Westinghouse Air Brake Technologies Corporation and Carlisle Companies Incorporated

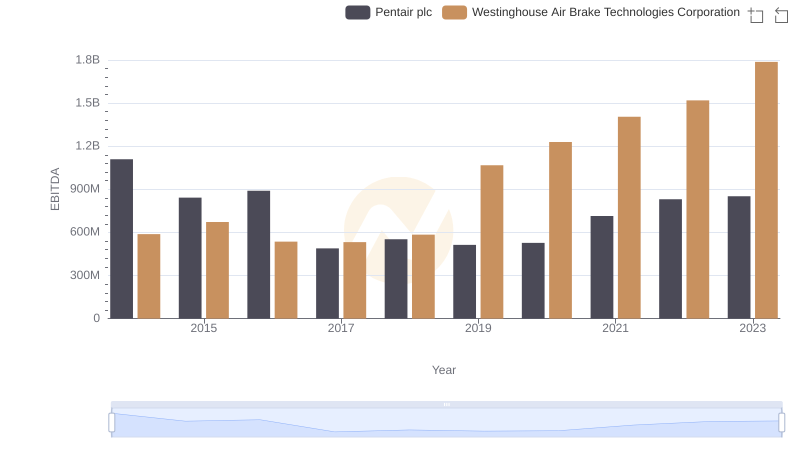

EBITDA Metrics Evaluated: Westinghouse Air Brake Technologies Corporation vs Pentair plc

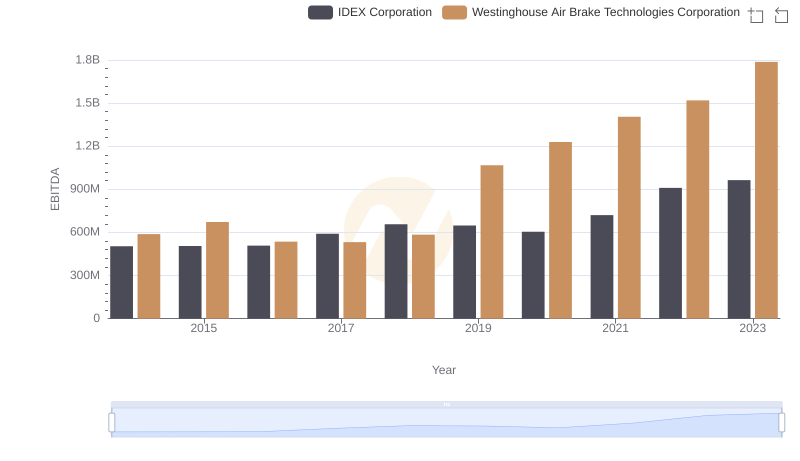

A Professional Review of EBITDA: Westinghouse Air Brake Technologies Corporation Compared to IDEX Corporation