| __timestamp | China Eastern Airlines Corporation Limited | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 4120000000 | 324539000 |

| Thursday, January 1, 2015 | 3651000000 | 319173000 |

| Friday, January 1, 2016 | 3133000000 | 327505000 |

| Sunday, January 1, 2017 | 3294000000 | 482852000 |

| Monday, January 1, 2018 | 3807000000 | 573644000 |

| Tuesday, January 1, 2019 | 4134000000 | 936600000 |

| Wednesday, January 1, 2020 | 1570000000 | 877100000 |

| Friday, January 1, 2021 | 1128000000 | 1005000000 |

| Saturday, January 1, 2022 | 2933000000 | 1020000000 |

| Sunday, January 1, 2023 | 7254000000 | 1139000000 |

| Monday, January 1, 2024 | 1248000000 |

Cracking the code

In the competitive world of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. This analysis compares two industry titans: Westinghouse Air Brake Technologies Corporation and China Eastern Airlines Corporation Limited, over a decade from 2014 to 2023.

Westinghouse Air Brake Technologies, a leader in rail technology, consistently maintained lower SG&A expenses, averaging around 700 million annually. This reflects a disciplined approach to cost management, with expenses peaking at 1.14 billion in 2023, a 75% increase from 2014.

Conversely, China Eastern Airlines, a major player in the aviation sector, faced more volatile SG&A costs, averaging 3.5 billion annually. Their expenses surged to 7.25 billion in 2023, a staggering 76% rise from the previous year, highlighting the challenges in the airline industry.

This comparison underscores the importance of strategic cost management in different sectors, with Westinghouse demonstrating more consistent control over SG&A expenses.

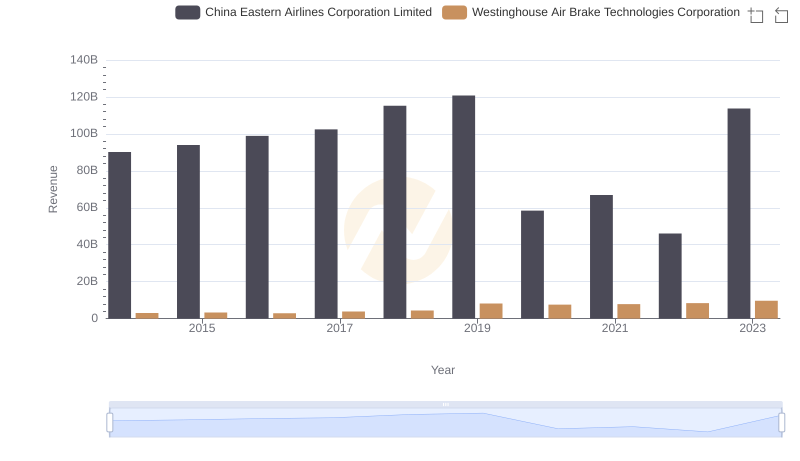

Revenue Insights: Westinghouse Air Brake Technologies Corporation and China Eastern Airlines Corporation Limited Performance Compared

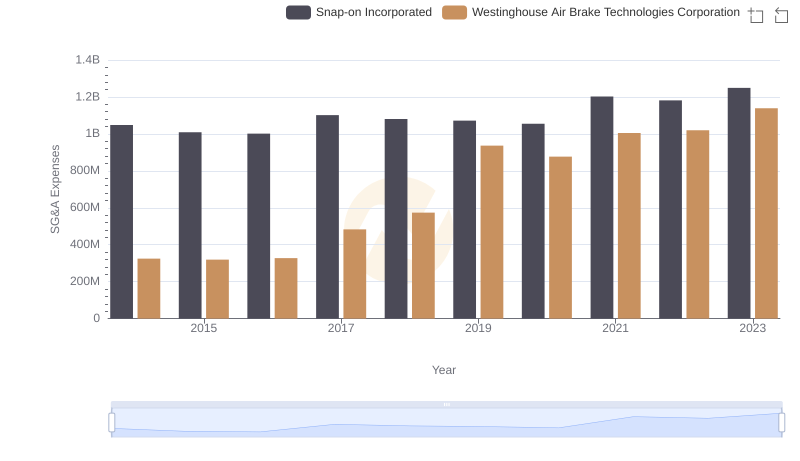

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Booz Allen Hamilton Holding Corporation

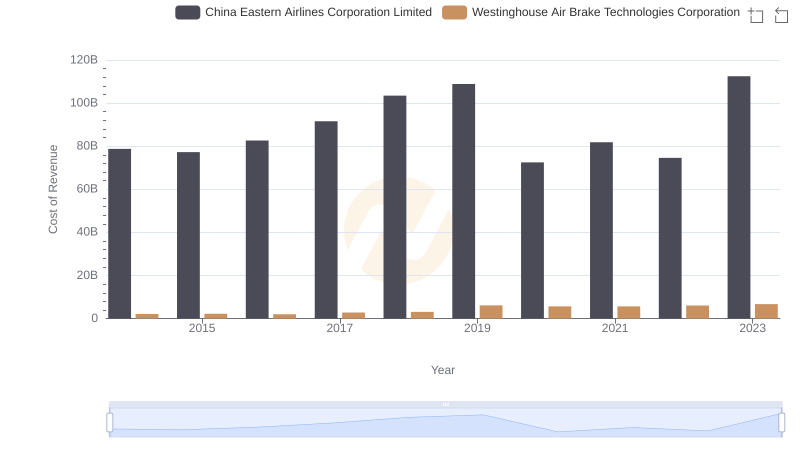

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs China Eastern Airlines Corporation Limited

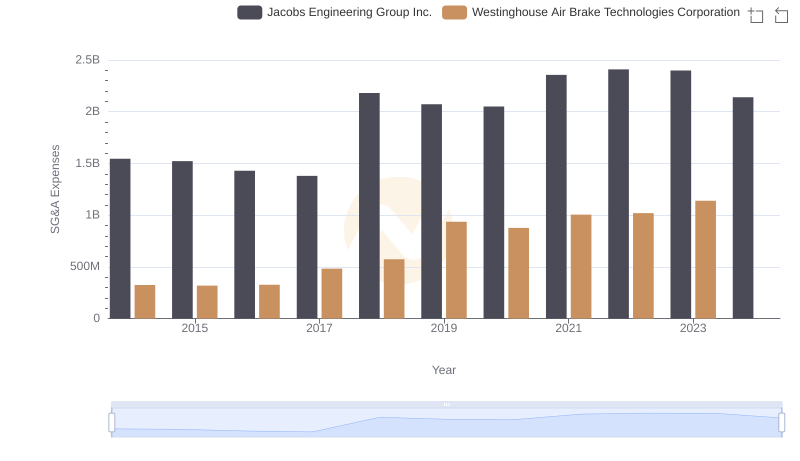

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs Jacobs Engineering Group Inc. Trends and Insights

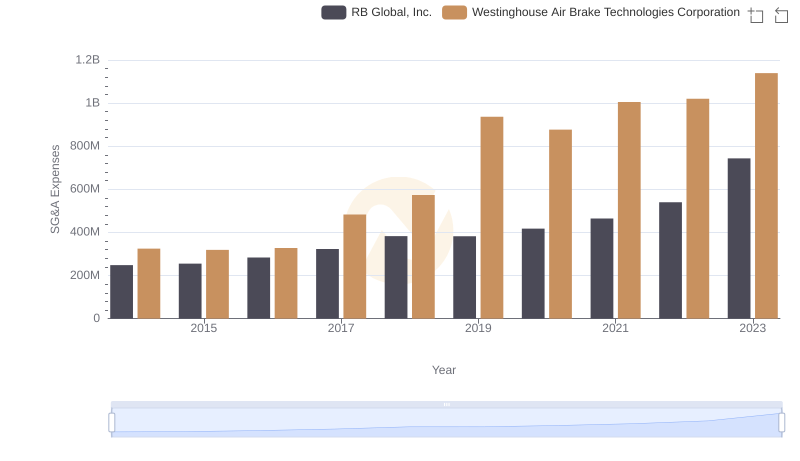

Westinghouse Air Brake Technologies Corporation and RB Global, Inc.: SG&A Spending Patterns Compared

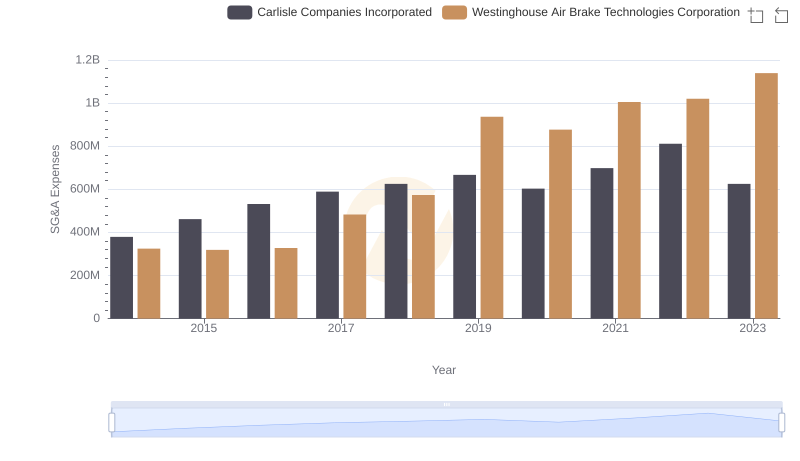

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Carlisle Companies Incorporated

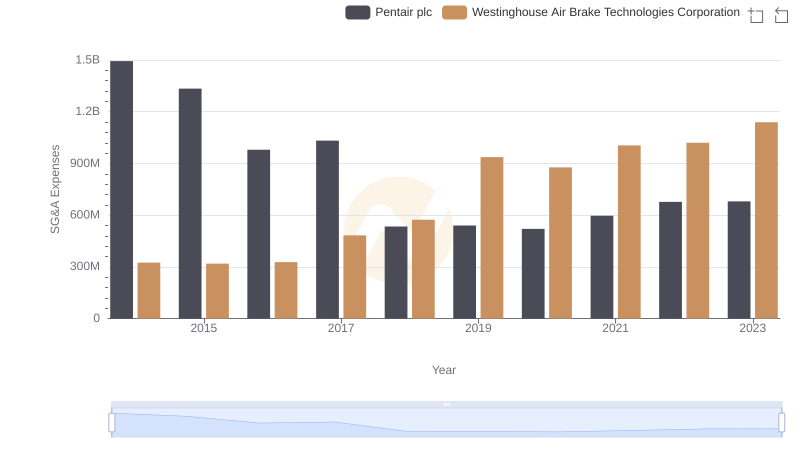

Westinghouse Air Brake Technologies Corporation or Pentair plc: Who Manages SG&A Costs Better?

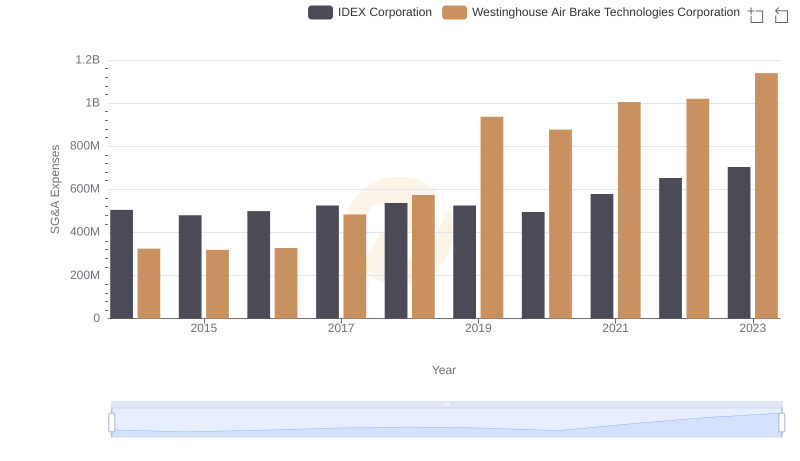

Cost Management Insights: SG&A Expenses for Westinghouse Air Brake Technologies Corporation and IDEX Corporation

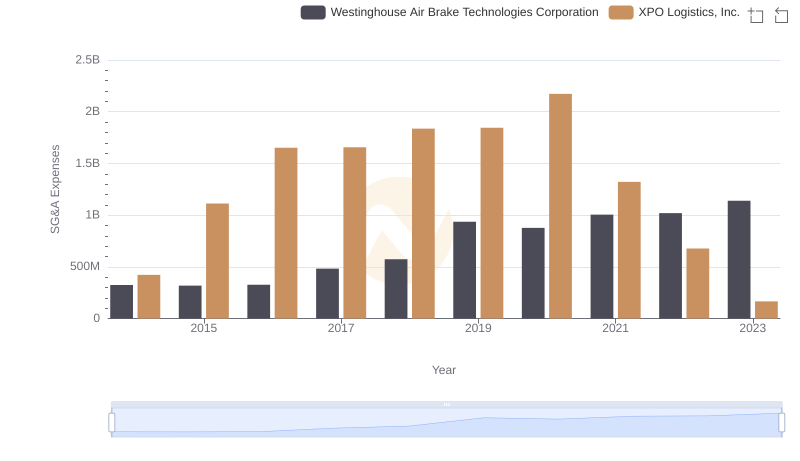

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs XPO Logistics, Inc.

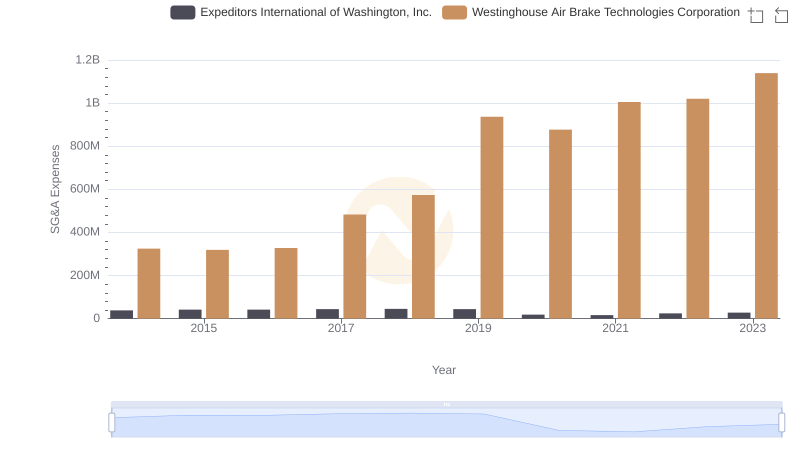

Breaking Down SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs Expeditors International of Washington, Inc.

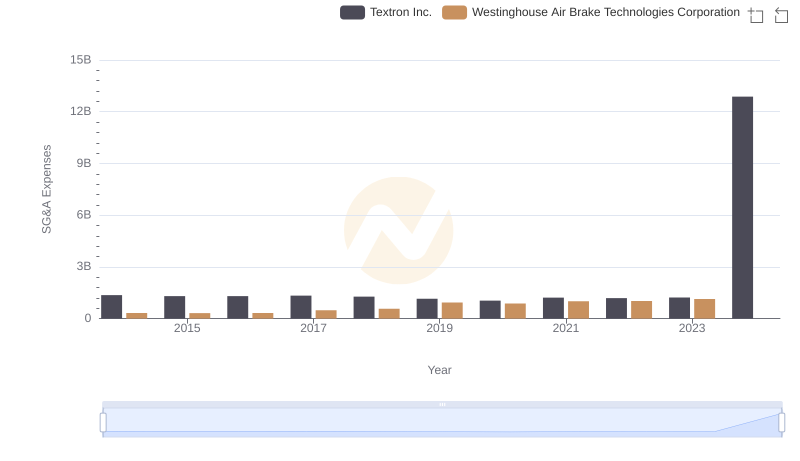

Operational Costs Compared: SG&A Analysis of Westinghouse Air Brake Technologies Corporation and Textron Inc.