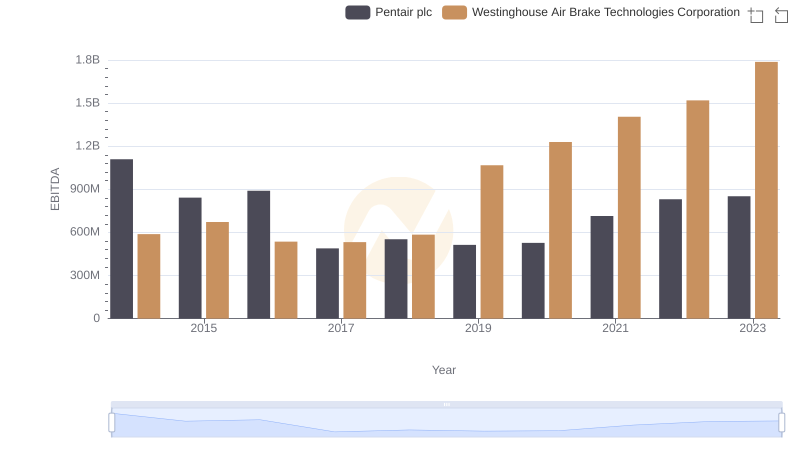

| __timestamp | Pentair plc | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1493800000 | 324539000 |

| Thursday, January 1, 2015 | 1334300000 | 319173000 |

| Friday, January 1, 2016 | 979300000 | 327505000 |

| Sunday, January 1, 2017 | 1032500000 | 482852000 |

| Monday, January 1, 2018 | 534300000 | 573644000 |

| Tuesday, January 1, 2019 | 540100000 | 936600000 |

| Wednesday, January 1, 2020 | 520500000 | 877100000 |

| Friday, January 1, 2021 | 596400000 | 1005000000 |

| Saturday, January 1, 2022 | 677100000 | 1020000000 |

| Sunday, January 1, 2023 | 680200000 | 1139000000 |

| Monday, January 1, 2024 | 701400000 | 1248000000 |

Data in motion

In the competitive landscape of industrial manufacturing, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, Pentair plc and Westinghouse Air Brake Technologies Corporation have showcased contrasting strategies in this domain. From 2014 to 2023, Pentair's SG&A expenses have seen a significant reduction, dropping by approximately 54%, from $1.49 billion to $680 million. This reflects a strategic shift towards leaner operations. In contrast, Westinghouse Air Brake Technologies Corporation has experienced a 250% increase in SG&A costs, rising from $324 million to $1.14 billion. This surge could indicate aggressive expansion or increased operational complexity. As businesses navigate the post-pandemic economy, understanding these trends offers valuable insights into corporate strategy and financial health.

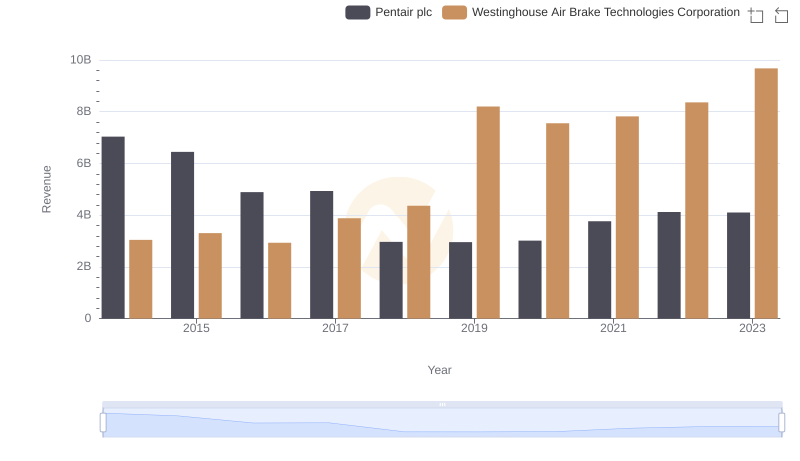

Revenue Showdown: Westinghouse Air Brake Technologies Corporation vs Pentair plc

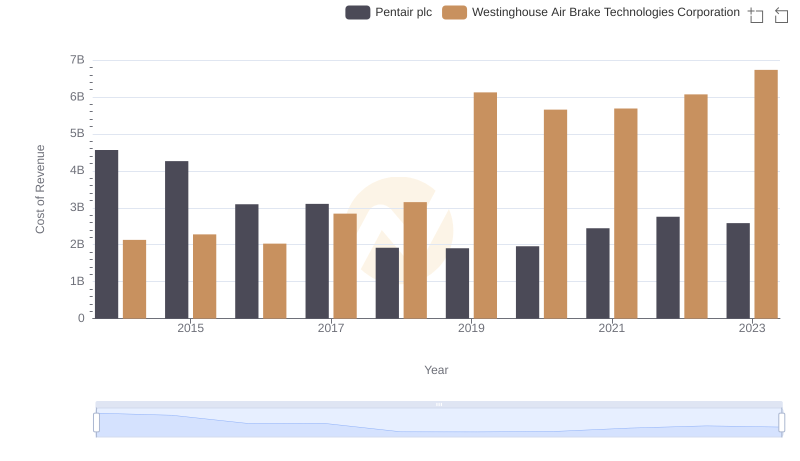

Analyzing Cost of Revenue: Westinghouse Air Brake Technologies Corporation and Pentair plc

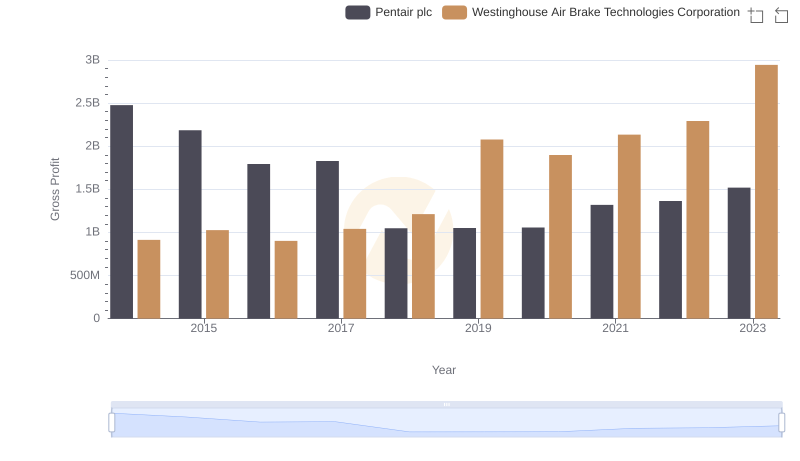

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and Pentair plc Trends

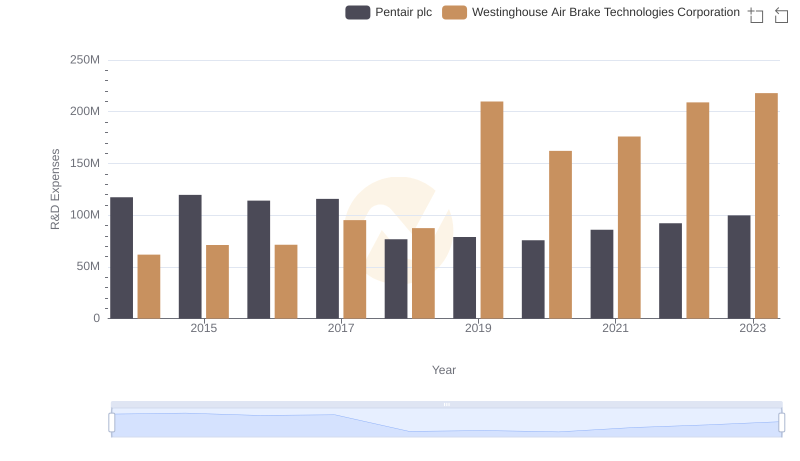

Comparing Innovation Spending: Westinghouse Air Brake Technologies Corporation and Pentair plc

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Booz Allen Hamilton Holding Corporation

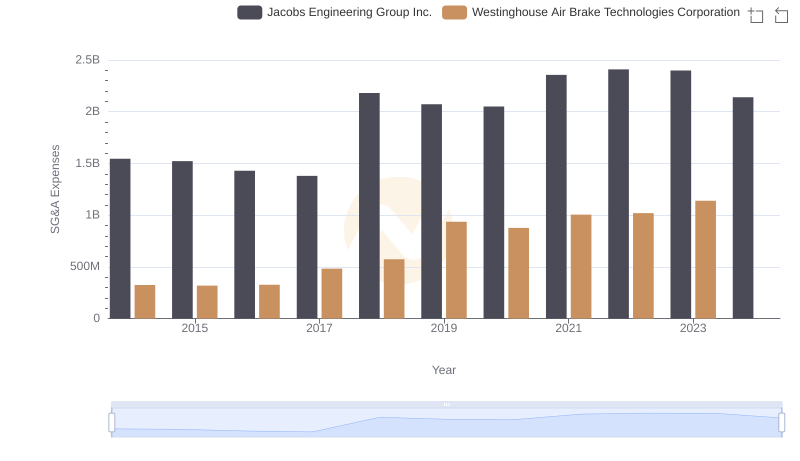

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs Jacobs Engineering Group Inc. Trends and Insights

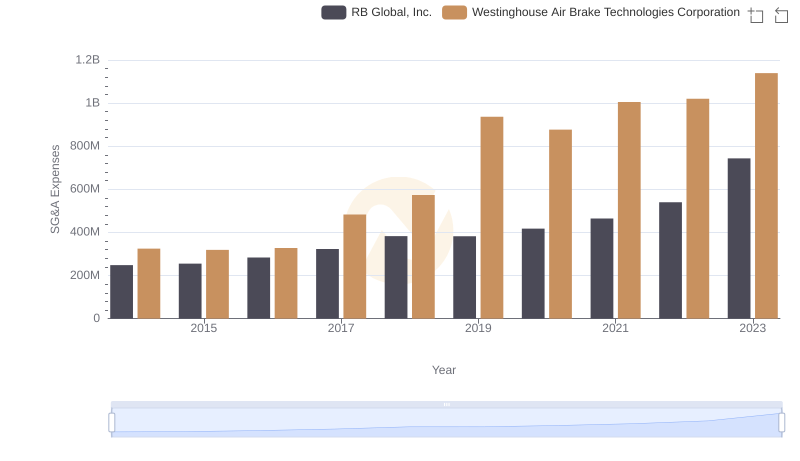

Westinghouse Air Brake Technologies Corporation and RB Global, Inc.: SG&A Spending Patterns Compared

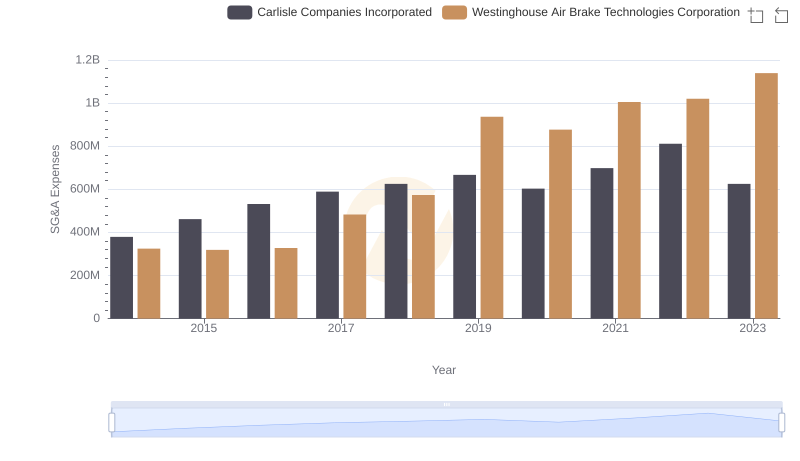

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Carlisle Companies Incorporated

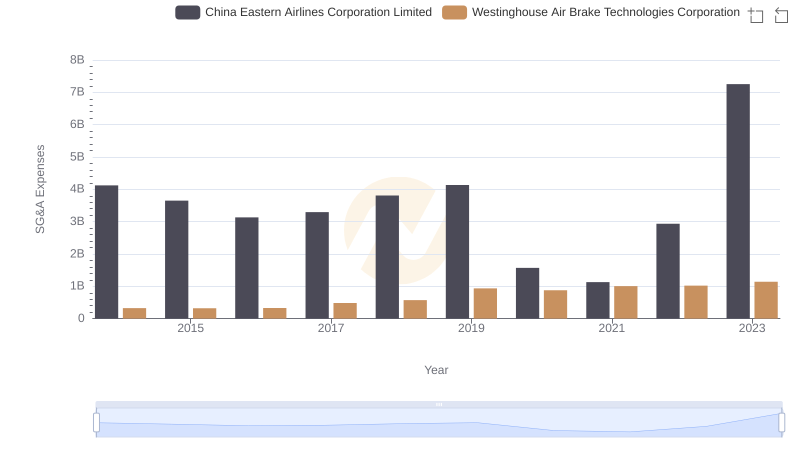

Westinghouse Air Brake Technologies Corporation or China Eastern Airlines Corporation Limited: Who Manages SG&A Costs Better?

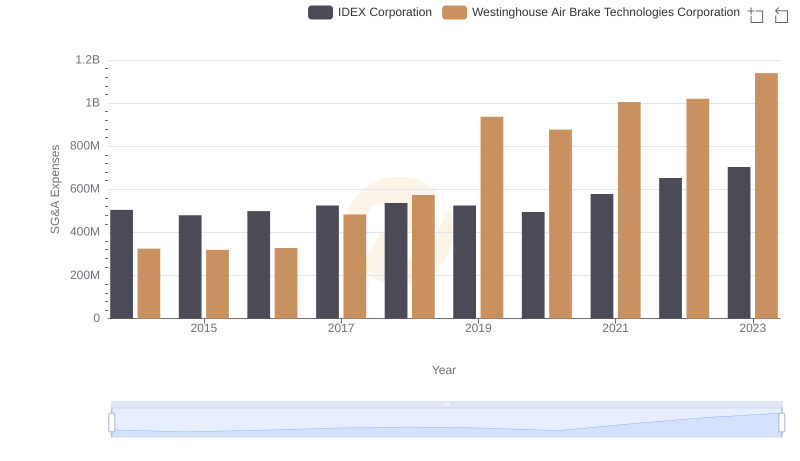

Cost Management Insights: SG&A Expenses for Westinghouse Air Brake Technologies Corporation and IDEX Corporation

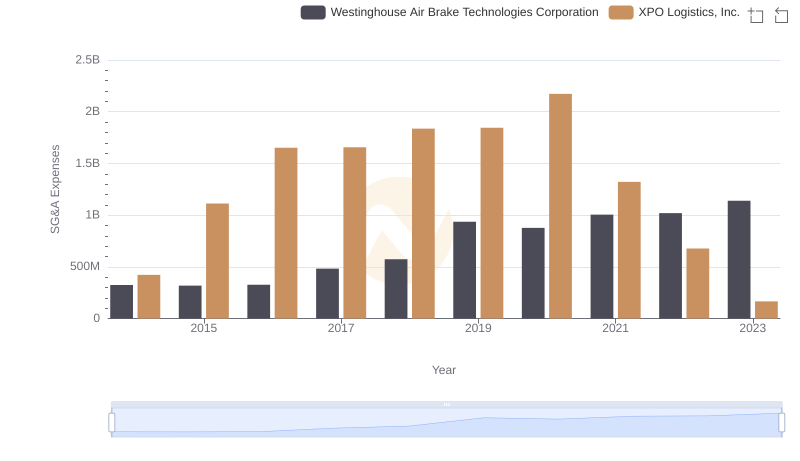

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs XPO Logistics, Inc.

EBITDA Metrics Evaluated: Westinghouse Air Brake Technologies Corporation vs Pentair plc